FatCamera

Intro

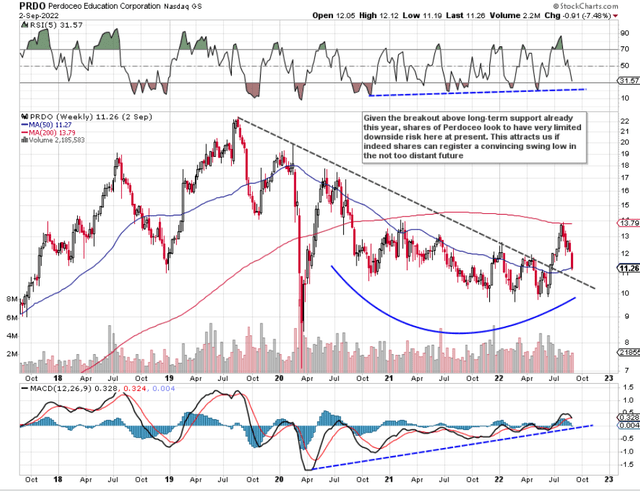

If we first look at the long-term technical chart of Perdoceo Education Corporation (NASDAQ:PRDO), we can see that shares of the Education & Training company have already broken out above the multiyear downcycle trendline depicted below. Suffice it to say, it will be interesting if this trendline will now convert into long-term support. If indeed this turns out to be the case, shares at least from a technical standpoint look to have very limited downside risk at this point.

As we see below, shares are presently fighting to remain above their 50-week moving average (200 Day moving average), but even if this support level fails, Perdoceo shares both have that multiyear trend-line as well as strong underside support at approximately the $10 level.

Technical Chart Of PRDO (Stockcharts.com)

Suffice it to say, the bullish technicals alluded to above needs to be put in perspective when digesting the fact that shares of Perdoceo have lost approximately $2.60 in value, or 19%, over the last five weeks or so. Longer-term charts enable us to digest far more information, and as far as we can see, despite Perdoceo’s recent volatility, no long-term technical damage has been inflicted thus far.

Therefore, let’s see if the stock’s other areas coincide with what we are seeing on the chart. If indeed our aim is to buy here if support levels can hold, we need to be seeing bullish trends in the company’s profitability and balance sheet. Furthermore, although consensus estimates are subjective, they can give insights into how analysts believe a stock is changing for the better.

Profitability

Perdoceo recently reported its second quarter earnings numbers where both a top-line beat ($167.68 million) and a bottom-line beat (EPS of $0.42) were recorded. The top and bottom-line beats were buoyed by strong student engagement in the quarter. Furthermore, when you see a net profit tally of almost $26 million for the second quarter on sales of almost $166 million, the profitability of this company really stands out.

For example, student enrollments at CTU as well as at AIU System declined by a higher percentage compared to sales in each segment. Student enrollments declined by 2.3% at CTU, but sales only dropped by 1.5%. Moreover, AIU´s student enrollments came in 14.5% lower compared to the same period of 12 months prior, but yet sales in the segment decreased by 8.6%. These trends demonstrate efficiencies and although top-end sales are expected to be slightly lower in the latter part of the year, management continues to work hard on the costs side whilst also on the marketing side to keep the income statement ticking over.

This is essentially what investors need to understand. Although the pandemic and external conditions, in general, have affected the numbers, internal changes to marketing processes also have temporarily skewed student enrollments to the downside. Suffice it to say, when these changes annualize on the income statement, negative growth in student enrollments should begin to bottom out. The market is most likely pricing in this bullish trend already.

Balance Sheet

Cash & Short-Term investments came in at approximately $516 million at the end of the company´s second quarter which means this key line item increased by approximately $39 million over the past four quarters alone. This really is a substantial number when we view Perdoceo’s market cap ($762 million) and shows how cheaply Perdoceo is priced at present. Many times, in our commentary, we state that growth is an overstudied metric in investing and this premise is particularly evident in Perdoceo’s financials. Although sales for example came in 4.5% down over the same period of 12 months prior, strong cash flow generation (operating cash flow of $32.6 million in Q2) is enabling management to increase cash, reward shareholders through share buybacks and keep CapEx investment elevated. The amount of shares outstanding now comes in under 68 million and shareholder equity is now at almost $693 million.

Guidance

Although student enrollments will come in lower this year, management bumped its expectation for adjusted operating profit for the year to approximately $145 million which is roughly a $1.5 million increase over the previously guided number. Consensus has followed suit with increases of both 3.5% & 4.3% in earnings per share for both the third and fourth quarters this year. Suffice it to say, given present trends concerning profitability and how alterations to marketing processes should now being to impact the income statement, this coincides with our recurring premise that downside risk remains limited in this play. Shares as we see below are currently wrestling with their 200-day moving average. This support level could very well put a stop to the steep decline we have seen in recent weeks.

Conclusion

Perdoceo’s technicals certainly line up with its fundamentals in that profitability remain very strong as the company continues to generate strong cash flow. Furthermore, forward-looking earnings estimates continue to rise as negative growth in student enrollment continues to slow down. Let´s see if we can time a long entry here. We look forward to continued coverage.

Be the first to comment