JHVEPhoto

PepsiCo, Inc. (NASDAQ:PEP) is an iconic beverage and convenient food company with a portfolio of some of the most well-known brands, including Lays, Doritos, Cheetos, and Gatorade, to name a few among a host of other notable names. Their operations are organized into seven reportable segments, structured between their foods and beverages divisions across their North American and International business units.

The broad portfolio of relatively low-cost foods provides customers across a wide income spectrum a variety of choices to fulfill their individual tastes and preferences. In the most recent period, PEP reported stronger than expected results and increased their full-year guidance. Despite the inflationary pressures plaguing household budgets, individuals have not cut back on their indulgences.

Shares in PEP have natural defensive characteristics, such as a low beta and a steadily growing dividend, supported in part by a time-tested business model. YTD, shares are down just under 2%, compared with a decline of more than 19% for the broader S&P. Despite a strong earnings release, however, shares have exhibited little change. A price point near the top end of their 52-week range and a high forward P/E could be a few reasons for investor hesitancy. But for buy-and-hold investors, Pepsi, regardless, is a great portfolio hedge against broader market volatility and a dependable dividend grower with a long track record of success.

Resilient Revenue Growth

In the period ended June 11, 2022, PEP reported total revenues of +$20.2B, which was 5.2% greater than the same period last year and +$720M better than expected. The increase in revenues were aided in part by higher prices and strong sales of snacks and packaged foods. On average, prices were up 12% for the period. This is on top of a YOY increase in the 1st quarter of 10% and 7% in the fourth quarter of last year.

Despite the price hikes, consumers still appear willing to bear the higher costs to treat themselves to relatively affordable snacks and beverages. PEP’s broad portfolio of products also provides customers with options ranging from premium brands, such as Frappuccino, to more value-driven products like Santitas. In fact, CFO Hugh Johnston mentioned in his earnings presentation that the company is beginning to stock stores in some low-income communities with more value-oriented products, such as the Santitas tortilla chips. This should enable continuing sales growth, even during poor business cycles.

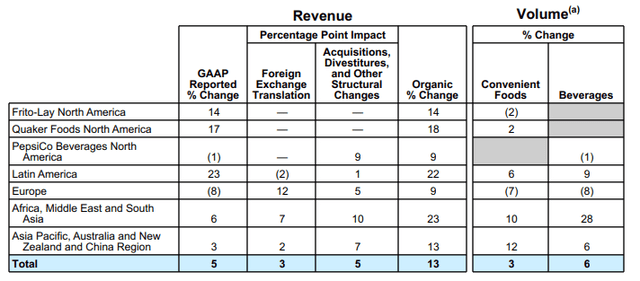

In North America, the Frito-Lay snacks unit was up 14%, driven by favorable net pricing. Volume, however, was down 2% due to a double-digit decline in their Sabra joint venture products, stemming from lost production related to quality-control issues. Growth was higher in their Quaker Foods unit at 17%. In addition, volume was also up 2% as consumers stocked up on bars and rice/pasta choices.

Q2FY22 Earnings Release – Revenue Growth by Division

PEP’s International business also performed strongly, exhibiting 15% organic growth, with accelerating 20% organic growth reported in their International convenient foods business.

Overall, PEP reported second quarter net income of +$1.4B versus +$2.4B last year. Adjusted for the effects from the ongoing conflict in Europe, PEP had EPS of $1.86/share, which was better than the $1.74/share consensus estimates.

Looking ahead, PEP provided favorable revisions to guidance. Full-year organic revenue growth is now expected to be 10% versus 8% previously. In addition, the company expects their portfolio to remain resilient despite domestic and international uncertainties, though the company does expect losses resulting from the effects of foreign exchange translation. Overall, core EPS is expected to be $6.63/share, which is a 6% increase from 2021.

Strong Balance Sheet With Ample Liquidity

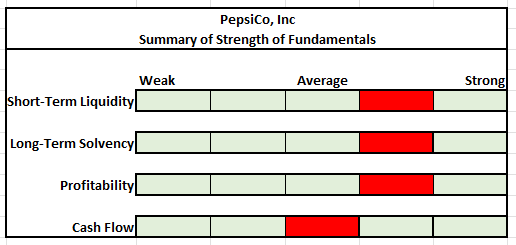

Author’s Summary of Strength of Fundamentals

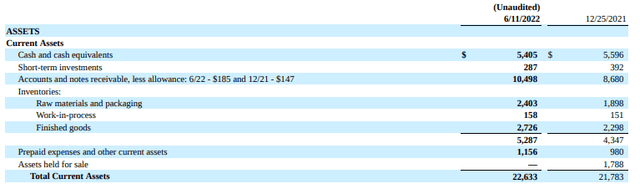

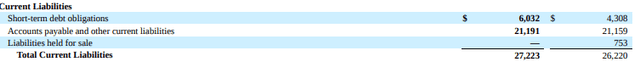

As of the most recent filing period, PEP reported total current assets of +$22.6B and total current liabilities of +$27.2B, representing a current ratio of 0.83, which is comparable to the figures reported at the end of FY2021. Though a ratio of 1x or greater is preferable, it’s worth noting the outsized impact of the effects of the inventory balance, which is stated at cost on the balance sheet.

At period end, PEP’s COGS/Sales ratio was 0.47. This suggests the company’s selling price of their inventory is 2.1x greater than their cost reported on the balance sheet. In truing up the balance sheet to reflect the estimated selling prices, one would obtain an adjusted current ratio of 1.05x, which suggests an adequate ability of PEP to meet their short-term obligations.

Q2FY22 Form 10-Q – Partial Balance Sheet Q2FY22 Form 10-Q – Partial Balance Sheet

Inventories were up about 20% sequentially on higher purchases. TTM turnover, though, appears in-line, albeit up slightly from the 45 days to sale reported in 2021. In addition, collections on A/R also appear to be in-line with no notable increase in allowances.

In addition to cash and equivalents of +$5.4B, PEP has access to +$7.6B on their revolving credit facilities, which were unused at period end. As a multiple of EBITDA, net debt stood at approximately 2.3x, which is manageable given the extended maturities of the obligations. With most of their term debt due after 2026, the company faces no near-term repayment risks.

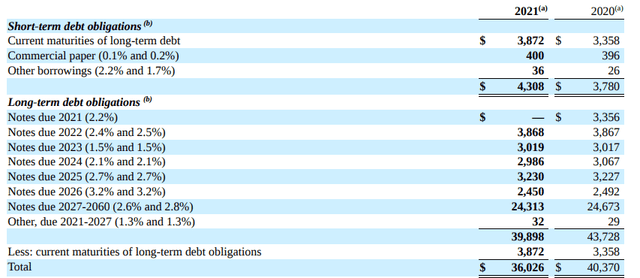

FY2021 Form 10-K – Summary of Debt Maturities

In addition to sizeable liquidity, PEP continues to generate positive cash from operations. For the most recent 24-week period, however, operating cash flows are trending lower due in part to lower net income when factoring out the gain on the sale of their juice brands to PAI Partners. Furthermore, favorable operating profit performance was offset by unfavorable working capital comparisons.

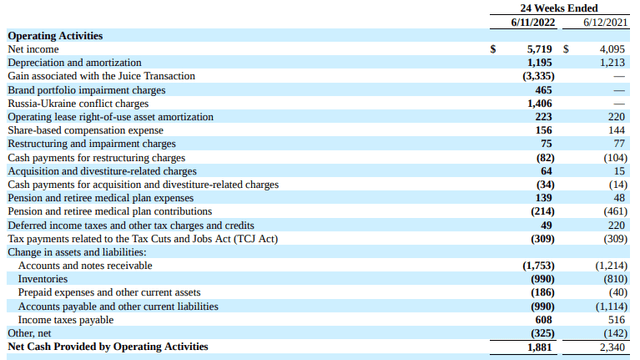

Q2FY22 Form 10-Q – Partial Cash Flow Statement

Still, free cash flow is holding up at about +$600M. While this is lower than the prior year, improvement is likely in future periods as total revenues continue to track higher on favorable pricing. Declining CAPEX should also contribute meaningfully to future free cash flows.

For income-focused investors, PEP’s strong liquidity position enables them to continuously increase their dividend payouts. In 2022, for example, they increased their dividend for the 50th consecutive year, bringing their annual payout to $4.60/share, representing a yield of 2.7% at current pricing. At just over 50% of total YTD net income, coverage is clearly adequate, and the payout appears safe for the foreseeable future.

Some Risks to Consider

Demand for PEP’s products is dependent on the ability of the company to effectively respond to shifts in consumer trends and preferences. Changing demographics and consumption patterns, in addition to concerns regarding the nutritional profile and health effects of certain products are a few factors that could affect individual consumer preferences. A failure of the company to market products that are compatible with most of their addressable market could result in lost future sales. Additionally, any externality that damages their reputation could impair their brand image and could lead consumers to reduce or publicly boycott the purchase or consumption of their products.

The possibility of product recalls is ever-present in the industry. This could be due to product quality or safety issues, including spoilage, undeclared allergens, or actual/alleged mislabeling. If PEP were forced into recalling one of their products, they could be adversely affected if losses resulting from the destruction of inventory or product unavailability are material to the company’s operating results.

Continued disruption in the supply chain and inflationary pressures in commodities could weigh on future earnings if the company is unable to recover their costs through higher prices. With consumers already facing some of the highest prices in decades, there have been some signs of behavioral changes in other consumer goods, with some consumers trading down to private-label brands. If input prices continue to rise in future periods, PEP may be unwilling or unable to increase their product prices due to the expected pushback from consumers.

Aside from other notable raw materials, such as petroleum-based materials, water is one of the most essential inputs into the company’s products. Water scarcity, therefore, could have an adverse effect on the company’s operations. Water could become scarce due to deterioration in quality and/or government pressure to conserve and replenish water in areas of stress. This could result in higher compliance costs and capital expenditures in technologies that enhance water efficiency and reduce efficiencies.

Conclusion

PepsiCo is an iconic company with a large portfolio of household brands across prepared foods, snacks, and beverages. Their resilient business model was supported by their most recent earnings release, which demonstrated continued growth in the face of unprecedented inflation that continues to weigh on household budgets. Despite spending a higher share of their incomes on fuel during the period, consumers still indulged themselves in the company’s products on their more frequent trips to the gas station.

Volume was indeed lower in their snacks division, but this was primarily related to production disruptions. These setbacks were offset by higher volumes in prepared foods, as consumers stocked up on relatively lower cost items, such as rice and pasta. Still, favorable net pricing contributed to overall organic revenue growth of 13%. The strong momentum ultimately led to favorable revisions to the full-year outlook.

At almost 26x forward earnings, PEP trades at about the same multiple as The Coca-Cola Company (KO). While the multiple is high compared to the broader S&P, shares in the stock offer investors critical protection against market volatility. Shares are down just 2% YTD, for example, compared to the nearly 20% decline suffered by the broader S&P. Additionally, investors are provided with a 2.7% yielding dividend that has been steadily growing for the past 50 years. Over the past five years, alone, the payout has grown at a CAGR of 7%. Shares in PEP do trade at a premium to the market, but an investment, nevertheless, comes with a high degree of safety and resilience.

Be the first to comment