JHVEPhoto

Dear readers,

In this article, we’re going to be taking a look at Pentair (NYSE:PNR). The company’s roots go back to Pentair Inc., incorporated in 1966 in Minnesota. It’s gone through a few iterations, including Pentair Ltd. based in Switzerland, and the Irish public limited company founded in 2014. The company still has management offices in the US.

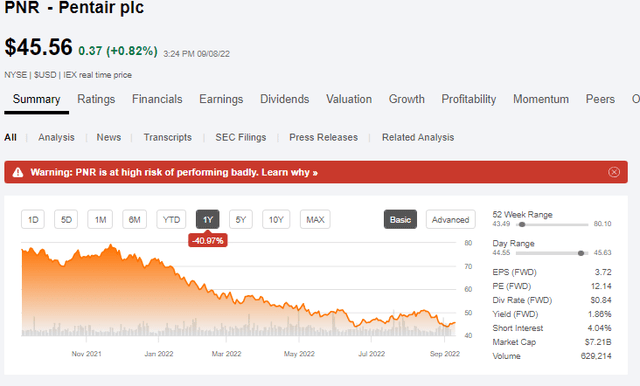

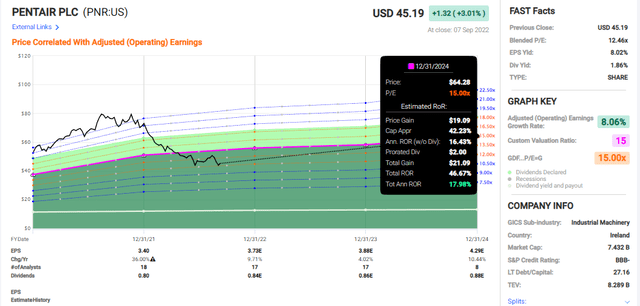

The company has decent fundamentals, a BBB-rating in terms of credit, and a market capitalization of around $7.5B. Since the pandemic, the company’s valuation has seen a significant amount of decline – from a premium of over 20x to a discount now trading at 12.5x.

Let’s look at what we can pay for this business.

Pentair – What does the company do?

Pentair is a company in various types of flow technologies. Two reportable segments make up around $4b in annual sales with around $700-$900M in income per year.

The business is split into Consumer Solutions, which designs, manufactures, and sells commercial pool equipment and related accessories, as well as residential water treatment products. These include things like:

- Pumps

- Filters

- Heaters

- Lights

- Automatic Control Units

- Cleaners

- Maintenance products

- Pressure Tanks

- Control valves

- Filtration products

- PoE-products

Consumer Solutions does B2C business, and 65% of the segment is pool business. It’s an NA market leader, and the primary market is a replacement, not new market products. The company trades under brands like Everpure, Ken’s Beverage, Kreepy Krauly, Pentair Water Solutions, Pleatco, RainSoft, and Sta-Rite. Seasonality exists and demand for the product follows warm weather trends, which tangentially favors the current development.

Aside from Consumer Solutions, we have Industrial & Flow Tech, a segment that focuses on fluid treatment products for industrial and large-scale applications. The products include:

- Membrane filtration

- Separation systems

- Bioreactors

- Pumps

- transfer pumps

- Valves

- Nozzles & Industrial and infrastructure verticals.

The company’s products are used in food and beverage, fluid separation, water, and wastewater treatment. It also has fire impression, and agricultural and crop exposure. This is the B2B segment, within brands like Pentair, Aurora, Berkeley, Codeline, Fairbanks-Nijhuis, Haffmans, Hydromatic, Hypro, Jung Pumpen, Myers, Sta-Rite, Shurflo, Südmo, and X-Flow.

The same trend is true here – weather trends with seasonal highs during 2Q-3Q and it competes with other giants such as Alfa Laval (OTCPK:ALFVF) and others.

Input materials for the business are primarily steel and electronics, as well as plastics and paints.

BBB- isn’t the best credit rating out there – but Pentair doesn’t have the best debt situation either, so that makes sense.

The company sells in the US and 15 foreign countries and operates 35 manufacturing and 35 distribution facilities across the world, as well as 35 service centers.

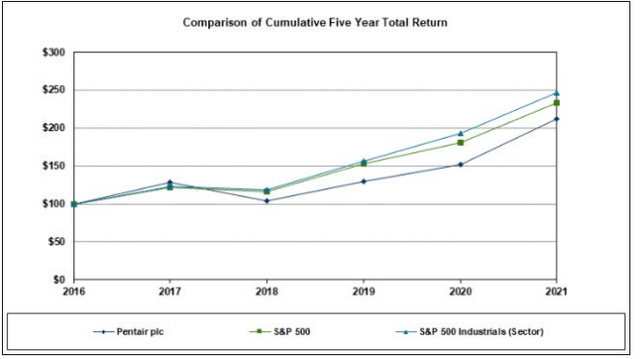

Pentair has underperformed broader indexes.

The company is in a midst of a transformation since 2021. The goals are to drive margin expansion and growth through the reduction of complexity and streamlining. At least 300 bps worth of margin expansion in the next 3 fiscals through a mix of complexity reduction, increasing speed of decision making, developing and modernizing IT. So far, this program is delivering excellent results and EPS growth has not in any way slowed down. 2021 saw 36% of EPS growth, and 10% is expected for 2022 and near-double digits for the next years until 2024E.

Recent results confirm the upside the company is seeing. Sales and income are up, ROS is expanding, and EPS is growing in line with this expected earnings growth.

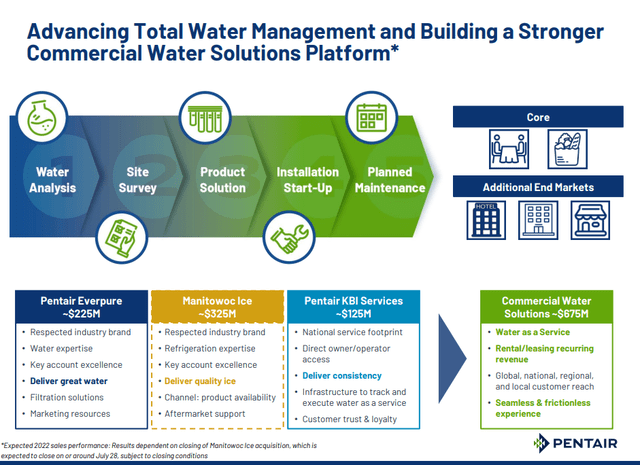

The company is working on M&As – including Manitowoc Ice and has a new segmentation in place for early 2023.

The company also delivered guidance for 2022. The M&As will be complementary to its current segments and targets.

The transformation is ongoing. The combination of appealing pricing, better sourcing and efficiency has caused the company to increase its targets. The fundamentals are…okay.

I’m used to companies having mostly fixed debt – but Pentair’s is around 46% variable, with maturities starting in 2024 at average rates of close to 3%. We’re starting to get into why people are seeing some risks here and why we’re at BBB-. The company’s net debt/EBITDA is within reason though, coming in at around 1x.

And, as I mentioned, we have guidance – and a pretty good one. Double-digit sales increase, double-digit income, double-digit EPS, and corporate expenses up due to transformation and restructuring. The companies target FCF of 100% of net income.

The company does have strong demand, a good backlog and its market position allow it to absorb price increases and inflation by passing costs along to consumers. The recent results is really just a continuation of the positive 1Q22 results.

There are several key main arguments for why this company is a potentially attractive prospect. We have an industry leader with a powerful portfolio, experiencing positive trends, working with a sustainable business model with good growth initiatives. I look forward to seeing more from the transformation program.

Let’s look at the current valuation.

Pentair Valuation

The most positive comes here. As I mentioned, the company has seen a massive valuation and price decline. take a look at some of these recent trends.

We’re talking about a market leader trading at a mixed P/E of 12.5x – which usually trades closer to 20x, and has recently traded at well above 20x. To any estimated valuation of close to 15x P/E, the company’s current forecasts give us 18% per year, to a total of close to 47%. And that’s to a conservative 15x P/E.

If we start including valuations that go toward the historical premium, we’ll see an upside of 32% annually, up to an ROR of nearly 92% in 3 years. In any case, if these forecasts are realistic, and the valuation somewhat normalizes, there is a lot to like about this company.

Other analyst targets are equally positive, following this significant decline. S&P Global sees a price target range of $41 to $77/share, which gives us very limited downside and significant upside. An average target of $58 gives us an average upside of 28%.

Again, the downside isn’t very significant here.

When people talk about specific valuation or company risks on Pentair, we’re usually talking about the very limited yield, which means that investments in bonds or treasuries can yield more appeal – especially as rates start to rise. However, given the very real appreciation potential in this business, I would see Pentair as materially more attractive than any sort of treasury, provided that you have the time to wait for it to normalize.

This company is a market leader. While peers exist, the company’s position in NA and other markets is solid. My thesis for the company is simple – it’s undervalued, and I would put it at the very least at 15x P/E.

This gives us a PT of at least $56/share for the company for the 2022E fiscal.

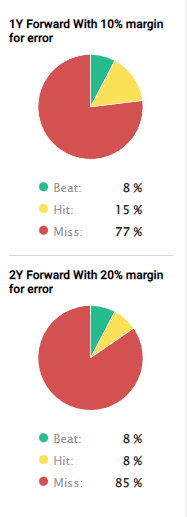

I’m sticking so low and I’m not going further out because the forecast accuracy here, is nearly nonexistent. Take a look.

Pentair Forecast Accuracy (Pentair Forecast Accuracy)

But aside from this, there is plenty to like about this potential investment. Price target established, here is my thesis on Pentair.

Thesis

My thesis on Pentair is as follows:

- Pentair is a quality company in the business of fluid filtering, pool solutions, and other various sorts of water and processing solutions and systems. The company is a market leader in key segments and is in the midst of a transformation. The drawbacks are a low yield, a low credit rating, and forecast uncertainties.

- However, valuation shows us a massive, 18-35% annual upside or a total RoR of up to 92% in less than 4 years.

- Because of that, I’m giving the company a PT of $56 and going for a “BUY” here.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment