kali9

Peloton (NASDAQ:PTON) is one of the more polarizing companies we have come across. The two investing camps are of the opinion that PTON is either: a) a $2k coat rack or b) the best thing since sliced bread and will make all gyms obsolete. We find polarization to be a signal into the potential strength of a brand, it is not hate/love but indifference that kills a brand. Other polarizing brands are Tesla, Apple, etc. If nothing else it contributes to share of mind. The fitness industry has seen a myriad of popular fads hit the market, with their rapid ascension matched only by their subsequent descent. Fitness fads started out in the 80s with Jane Fondas aerobic work outs, followed by Tae Bo in the 90s etc. Billy Blanks sold nearly 500mm Tae Bo tapes! This was then followed by the treadmill (there are currently 35mm treadmills in U.S. homes) and various home equipment brands such as Bowflex. The continued resurgence and decline of these fads points to underlying secular trends such as the want to be healthier along with the convenience of working out at home. However, none of these fads have shown the ability to evolve into a trend.

Although we are hesitant to say this time is different, we do believe Peloton is closer to a trend than a fad. We wrote in a previous article that a trend is a phenomenon that exerts an irreversible pressure on penetration rates for a good or service. We believe the at-home-connected fitness trend is in its infancy and that more people will be working out using PTON than they are today. At home fitness hardware has seen little change over the last twenty years, however technological progression of connected fitness is the next evolutionary step in merging the software and hardware worlds. The hardware solutions have already been built out and are in every gym in America. Fitness equipment has seen little progress in the last 100 years — treadmills have been around for the last 500 years and were first aptly used as a torture device. What is different today is the ability to have more personalized workouts (instructors, curated classes, music), better feedback loops due to biometric wearables, being able to track progress conveniently, and to close the loop the ability to share real-time progress with the world via social media. Fitness software will only continue to become more personalized and feedback oriented. Normally PTON would be a highflyer stock with otherworldly valuations, however, the abrupt slack in demand post COVID coupled with macro headwinds and operational mishaps have driven PTON to more earthly levels.

Production of PTON session (Peloton 2020 10K)

The shooting of each studio session is meticulously prepared and shot with video edits and added curated music to create an engaging workout for users.

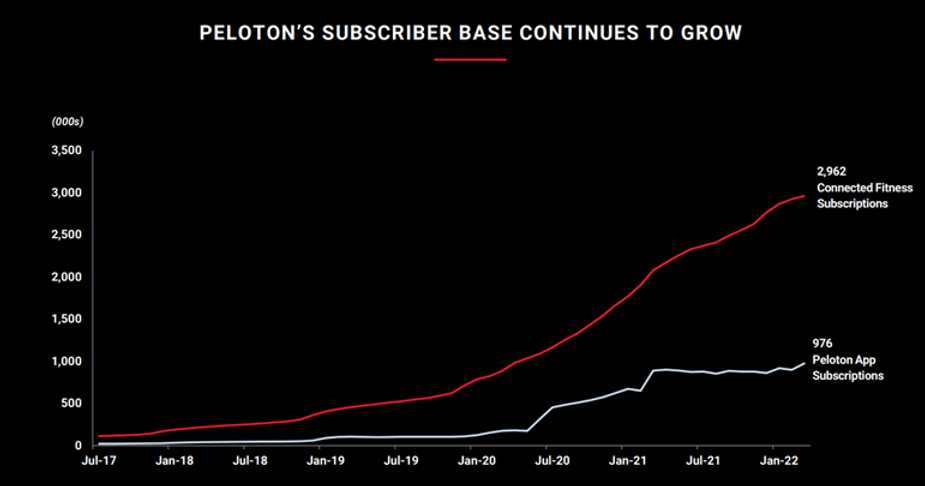

Subscriber Growth (Lender Presentation 2022)

Although hardware sales have fallen, subscriber growth has continued with little change to churn Lender Presentation 2022

The appeals of PTON are convenience, personalization, motivation, and in some instances even cost. Compared to spin classes that can cost $50 per class, PTON is a less costly substitute. Here is what a customer said about PTON:

” Why would I want to go back to not only paying $50 for 6 classes when I pay $40 for a monthly subscription with unlimited classes?! Not only the monetary cost but there the cost of time used for public transportation just getting to the gym and coming home. For me, that’s almost two hours round trip for a one-hour class! Hell, I now use that “transportation” time to relax as soon as I come home!”

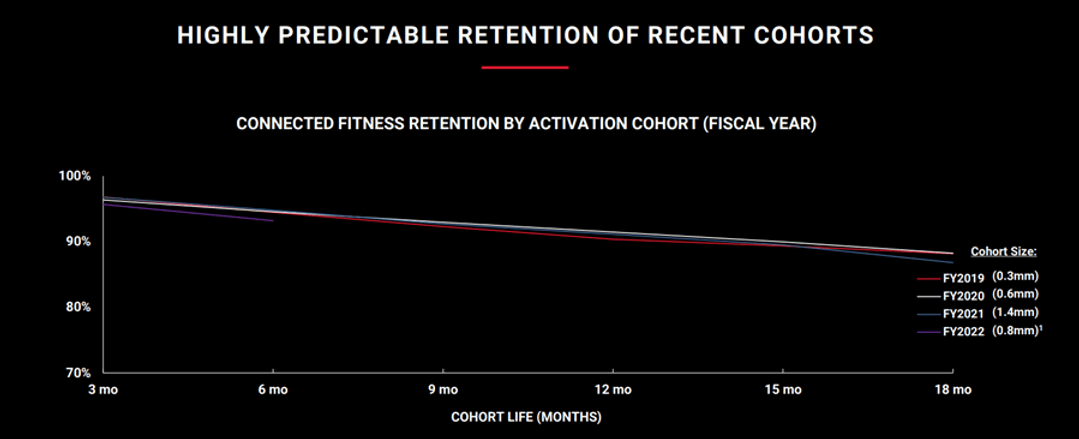

PTON Cohorts (Lender Presentation 2022)

PTON was a COVID darling as it saw unprecedented demand for its products while the world was stuck at home. A better product-market fit couldn’t have been imagined, equipment that provided a functional workout along with a quasi-social interaction at a time when everyone was in quarantine and gyms were closed. COVID launched PTON into stardom and it quickly gained worldwide recognition.

“Covid was the marketing campaign the company could never have afforded” Barry McCarthy, PTON CEO

PTON revenues more than doubled, and likely would have gone up significantly more had they not been bottlenecked by manufacturing and supply chain issues. PTON management became exuberant and heavily invested in becoming vertically integrated. Becoming vertically integrated comes at a heavy cost and is only worth it with enough demand. PTON acquired manufacturers, started to build out its own manufacturing plant in the USA, and invested heavily in last-mile delivery. In aggregate, PTON spent about $1B on becoming vertically integrated. However, the surge in demand under COVID was short-lived and the large investments PTON had made became abruptly unnecessary and led to a bloated fixed cost structure. PTON went from being profitable to losing money, ultimately leading to a massive $750mm loss in q3 2022. PTON’s share price went from a peak of $165/share to about $10/share today, a decline of 94%. Subsequently, a new CEO was bought in to replace the former CEO and founder of Peloton.

Barry McCarthy is the former CFO of Netflix and Spotify and has an intimate understanding of subscription models. He expressed the sentiment that finding product market fit is one of the hardest things for a business to find and is the main reason he joined PTON as it exhibited this characteristic. Although PTON has some operational mishaps, we believe the brand fundamentals have not changed. Net Promoter scores for PTON still hover in the 80s, churn rates remain the same, and workouts per subscriber per month number hover around 20!

McCarthy is looking to execute on two things: 1) return PTON to profitability by implementing $800mm in savings by mid -FY23 and 2) transition PTON to primarily a subscription-based business. The $800mm in savings will be achieved by divesting in-house manufacturing/distribution and outsourcing manufacturing to Taiwanese firms. PTON has also begun headcount reductions which will cut PTON’s workforce by almost 50%. While these cost savings are straightforward to implement, the business model change will be less clear. By decreasing the price of the bike, PTON lowers the activation energy for new customers and can reach a wider TAM. McCarthy addressed this demand curve in the Q3 2022 letter: “The price cuts on hardware have increased our daily unit sales by 69% and increased our revenue by more than $25 million per month.” However other questions then surface such as can the increase in revenue from subscriptions offset the profit lost by lowering the hardware price point, and what will the churn rate look like with these different cohorts of customers?

Prior to these changes, PTON had about 50% gross margins on hardware sales which generally made up the lion’s share of the bottom line. The gross profit generated from these sales went towards marketing and acquiring new customers which isn’t really a strategy but sounds reasonable. The diligence around the price point also seems to have been facile. However, with a new CEO who has extensive experience with subscription models, PTON is exploring other levers. McCarthy has been clear that it will take time as variables that make up customer LTV such as selling price, gross margin, CAC, and churn, etc. are dependent on one another. Figuring out the optimally profitable blend is a work in progress, but is not an insurmountable hurdle given the underlying brand strength.

McCarthy is approaching these changes to the business model in a sensible manner and running pilot tests that are statistically significant before rolling out the changes across the broader market. Given the product market fit of PTON, we believe that tweaking the business model will have minimal impact on the brand. It is important to note that PTON was originally transitioning to this business model before COVID however the reason PTON postponed these plans was due to the surge in demand due to COVID. Here are some quotes from the prior CEO.

“We are absolutely 100% committed to having the best treadmill at a lower price”

Over the last five years, we’ve been able to realize significant production and scale efficiencies. We’re excited to pass those sick cost savings to prospective members

Here are some other changes McCarthy has done in his first six months as CEO.

1. Replaced CFO

From an optics perspective, the previous CFO Jill Woodworth made a huge blunder by saying that PTON (below quote) was not going to raise additional capital due to PTON managing their operating expenses. Fast forward two weeks and PTON raises $1B via a public offering. This 180-degree pivot by the company showed a lack of competence and needed to be addressed.

“I think just cutting to the chase we don’t see the need for any additional capital raise based on our current outlook. As we mentioned, we’re taking significant steps to adjust our expenses across COGS and OpEx with this revised revenue guidance. And we have a lot of levers to pull. So why is this not getting done?” CFO Jill Woodworth Q1 2022

2. Putting more of an emphasis on PTONs digital app to act as a funnel to become a connected fitness member.

PTON’s Digital Fitness segment represents customers paying $12/month for the app whereas a Connected Fitness member has both PTON equipment and pays $44/month for classes.

3. Introducing One Peloton Club

This is a new initiative to allow potential customers to rent a Peloton bike/treadmill for a higher price per month and a one-time delivery charge. This allows potential customers to try out the product (generally a refurbished model) without having to buy it or be locked into a 39-month contract. The bet PTON is making is that people will stay for the service even if they do not end up acquiring the bike/tread. The pricing dynamics below show how sensitive these factors can be.

“When we first launched it (OnePeloton Club) in the control market in like 9 retail markets, we kind of had 39%, 41% incremental growth, which was not nearly as strong as we were hoping for. And then, we adjusted the price points a little bit, and we increased the size of the test market and broadened it to our inside sales group. And last week, our incremental growth was 189%.”

On Turnarounds

Turnarounds Seldom Turn. Although we agree with Buffett’s adage that most turnarounds are a money losing proposition, it is important to make the distinction between a company that is facing a legitimate turnaround versus dealing with a one-time setback. A turnaround would constitute a much-needed change to the business model and culture of the company, a multivariate, complicated, and risky proposition. Examples that come to mind are Nokia, Borders, GoPro etc. A onetime setback on the other hand is much easier to deal with. PTON suffered from the classic victim of its own success and overinvested in its manufacturing and distribution capacity at a time when demand was peaking. The timing could not have been worse although if COVID had continued these would have been great decisions.

However, what remains is that PTONs’ products still have some of the highest NPS scores on the planet, instructors on the Peloton platform have cult followings, and PTON Connected Fitness has a 93% retention rate and has grown every quarter. The PTON brand is intact and its main problems can be navigated. An interesting aside is that much of Buffett’s early success was attributed to “turnarounds” namely: Geico, Washington Post, and American Express. We believe PTON falls in this similar category.

Valuation

The crux of the thesis is whether PTON is a fad or the beginning of a larger trend. We believe it falls in the latter camp. Peloton is riding several waves that we believe will continue to grow . Fitness software will only continue to become more personalized and feedback oriented. PTON has a massive lead on the competition with their connected fitness subscriber base (currently number about 3mm) and its platform. This is important as at-home-fitness will likely exhibit winner take all dynamics due to the available at-home real estate and the costs (will be cheaper for just one service per family as costs are diluted per person). Aside from fitness, the economies of scope for PTON are far reaching. Given the platform and the instructors, PTON can expand into adjacent markets such as nutrition, diet, and apparel. Mimetics is a fascinating field that is based on the premise that people have a basic need for “models” to learn from on how to act, what to desire etc. This was one of the main reasons Peter Thiel invested in Facebook as it provided people with infinitely more “models” than in their regular life. What better model to be healthy and fit than an instructor with whom one spends a workout with almost 20 times per month? PTON can leverage their high engagement platform and celebrity instructors to expand into these adjacent markets.

PTON has enough cash to weather about a year at the current burn rate (roughly $300mm per quarter). However, they will likely not need the entire runway as PTON is well on its way to being cash flow neutral with almost 50% headcount reductions and outsourcing of its manufacturing and distribution. The steps already taken have significantly derisk PTON. Although predicting near term solvency is somewhat straightforward, forecasting PTONs normalized cash flow past a couple of years is much more of an artistic exercise given the company positions and macro landscape. However we have a moderate degree of certainty in the cost cutting initiatives and the underlying growth of the PTON user base. With reduced hardware gross margins of 20%, sustained subscription growth of about 25%, SAAS gross margins of 75%, and costs growing at about half the rate as revenues, PTON should be throwing off about $1000mm in FCF by end of 2025. We ascribe a 12x FCF to PTON’s valuation due to its strong subscription model, industry dynamics, and long runway. Subtracting out net debt of $1.5B and factoring in share dilution of about 20% yields a market cap of about $10B, almost 3x PTONs market capitalization. Because of the nature of some of PTONs costs being run related and likely bumps in the road the next couple of quarters, PTON is a smaller weighting and we will look to add given sustained subscriber growth.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk and all investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that research, analysis and forward looking price targets (including the research allcapbros does) will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.

Be the first to comment