JHVEPhoto/iStock Editorial via Getty Images

Peloton Interactive (NASDAQ:PTON) was one of the hottest stocks of the past two years. The company’s connected fitness products filled a niche perfectly during the stay-at-home period.

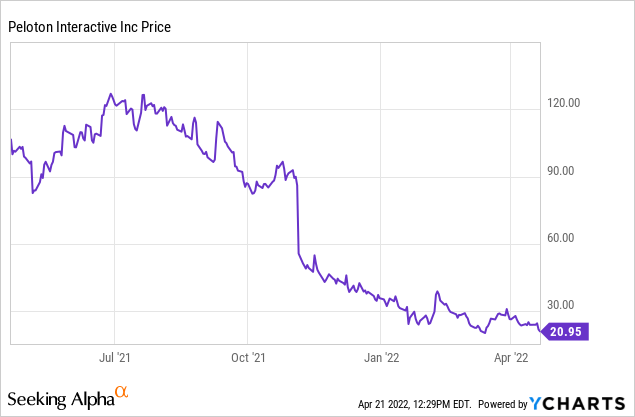

However, the company has struggled to move into the next era of economic activity. As demand has slumped, the company has cut production, laid off employees, and changed its management team. It hasn’t been an easy transition process, however. Additionally, activist investors have taken aim at the company. Despite all the efforts, PTON stock continues to sink, and it’s now approaching fresh 52-week lows:

Some traders might be tempted to buy the dip, thinking shares are already down so dramatically that it can’t get much worse. Unfortunately, there’s unlikely to be any speedy recovery for the fitness company.

Soaring Inventories

It’s easy to point at the lack of top-line revenue growth as the reason why Peloton has plunged. And that’s a totally logical explanation for the firm’s problems.

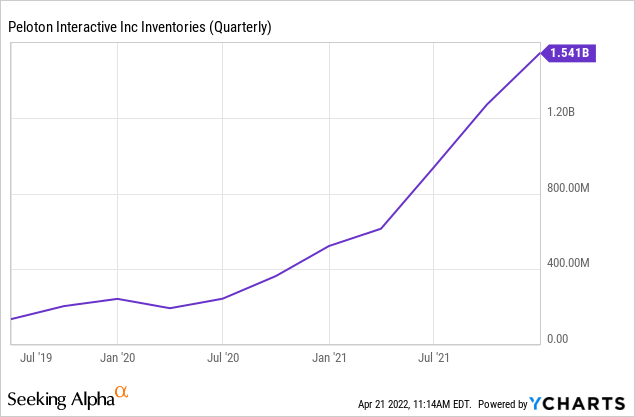

However, there’s another issue I’d highlight which has gotten less press. Peloton has an absolutely gargantuan build-up of inventories now.

Heading into the start of Covid-19, Peloton kept around $200 million of inventories on its balance sheet at any given time. This rose to around $500 million in early 2021, which was a logical and understandable build given its rapid revenue growth. Generally, the more product you sell, the more inventory you have to hold to meet demand. Indeed, we heard reports of waiting lists for Peloton deliveries as the company struggled to keep up with demand. So the company’s inventory picture looked totally reasonable for a growth firm.

Now, however, Peloton’s inventories have tripled just over the past year even as revenue growth has disappeared. The company has a market cap of around $8 billion as of this writing, meaning that close to 20% of the company’s current valuation is tied up in inventories.

For anyone that follows consumer discretionary companies, this is a most dangerous trend. Often, when companies build way too much product relative to demand, they end up having to dump their excess goods at greatly reduced prices.

And, indeed, Peloton is starting down that path. Earlier this month, Peloton cut the cost of its original bike from $1,495 to $1,195. The Bike+ dropped from $2,495 to $1,995. The company also cut the price of its treadmill product.

Subscriptions Won’t Save The Day

Already, Peloton was earning thin margins on its hardware sales with the goal of making it back on the subscription offering. With such steep price cuts to the bikes, it’s worth asking whether there will be any profits on hardware at all at current pricing levels. Given the company’s drastic build-up of inventory, however, a big clearance sale might be necessary simply to avoid having the products sit in warehouses and generate no return on investment.

In any case, the goal now is to sell the bikes at reduced prices and earn back the lost revenue by raising subscription fees. The monthly U.S. subscription offering will rise from $39 to $44 per month. This is a market share play; sell the hardware cheaper, try to attract a broader audience.

From a business strategy sense, there’s some appeal to the idea. However, the timing for this is unlikely to work.

At the same time Peloton is trying to reach a wider audience for subscriptions, we just saw Netflix (NFLX) stock collapse due to subscription fatigue. After a boom in stay-at-home subscriptions for products such as video streaming, consumers are now cutting back on what they’re willing to pay for. With the economy reopening, there’s less need for activities which solely take place at home.

If Netflix can’t even maintain a flat subscription base at the moment, it’s hard to imagine Peloton prospering in the current environment.

Peloton was always going to have more difficult comps in 2022 as other fitness options such as gyms and public parks reopened. Now, it is trying to jam through a price increase at the same time that even leading subscription services are struggling with rising churn. To put it simply, if NFLX stock is an undesirable asset in this environment despite its massive audience and healthy profitability metrics, it’s hard to imagine buying Peloton here.

Valuation: Big Risks To The Downside

There’s a common bullish argument that Peloton is cheap now based on its recurring subscription revenue. If the company simply cuts costs, it can shrink its way to profitability.

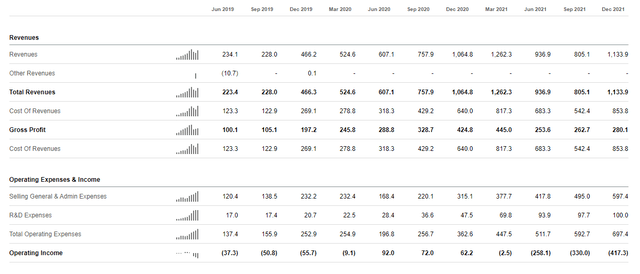

Is that true? Based on what we see on the income statement, I’m skeptical:

Peloton Income Statement (Seeking Alpha)

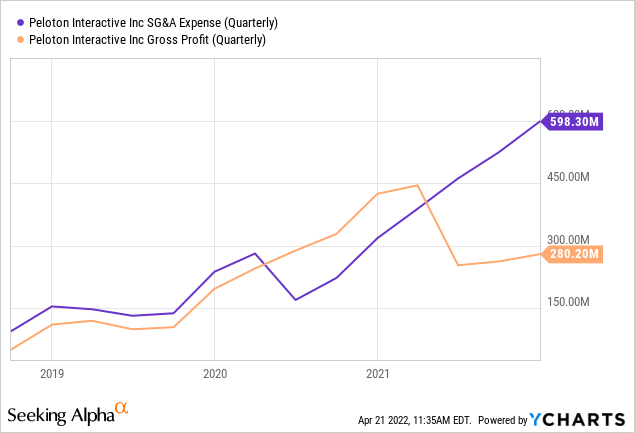

As you can see, the company’s SG&A is now up to $600 million per quarter, and has absolutely exploded; it’s up roughly 3x since the pandemic started. Peloton has been one of those unfortunate companies whose operating losses soared even during a period of rapid top-line growth. Now that the growth is winding down, the company faces a precarious situation.

Even as operating costs exploded, the company’s gross profit moved up less than 50% since the Dec. 2019 quarter. Here’s a chart to show the massive gap that has developed:

Even if the company slashed its SG&A by half – which might be difficult to achieve – it still would be spending more on that line item alone than it is earning in gross profit. This doesn’t seem to be a sustainable business model.

And don’t forget, the company used to earn a gross profit selling hardware as well. That may flip to an outright loss depending on how heavily the company has to discount its bikes to clear out its inventory glut.

During one of the best possible macroeconomic environments for a stay-at-home fitness company, Peloton was not able to reach consistent profitability. Meanwhile, it let its costs run dramatically out of control, and will now face a major headache in terms of shrinking its operating budget without destroying company culture or causing increased customer churn.

PTON Stock Bottom Line: Way Too Early To Buy

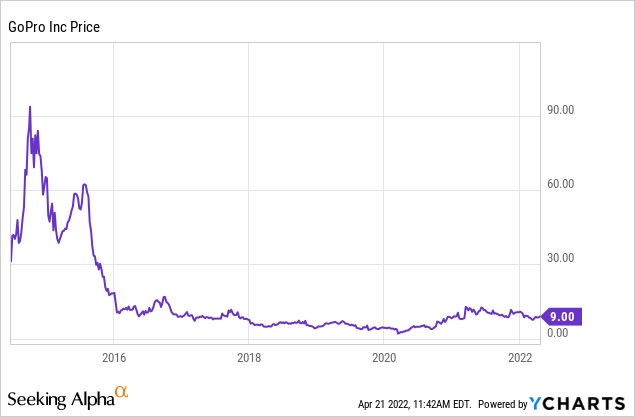

The closest analog I see to Peloton is GoPro (GPRO). GoPro was once a hot consumer products company. Wall Street analysts viewed it as a technology platform and gave it a massive multiple for what was ultimately a minimal moat hardware business. GoPro remains in business today and in fact is still publicly traded but has faded from relevancy:

I suspect we’re in about December of 2015 if you use GoPro’s chart history as a prediction of Peloton’s future. Peloton stock has already collapsed, sure. But what’s the reason to pay $21 for it today?

The company is losing tons of money. To reduce its losses, it will have to slash marketing, which will cause more erosion of top-line revenues. Meanwhile, the company is sitting on a massive pile of hard-to-move inventory, further complicating the situation. Oh, and the economy continues to reopen, presenting an additional headwind to indoor bike adoption. And, if that weren’t enough, Netflix just warned us that tech-driven subscription services are not an attractive investment theme in 2022.

How quickly will Peloton stock continue to decline? That probably depends on its cash burn and how quickly it can stem its operating losses. Fellow contributor Michael Wiggins De Oliveira sees potential dilution coming, and the math checks out on that. The broader point I’d make is that given the large operating losses and strong industry headwinds, there’s little reason to think of trying to play Peloton as a turnaround situation yet.

There are plenty of tech stocks that have crashed over the past year which have more resilient business models. That’s where I’d take my swings at turnarounds. Peloton, like GoPro, may just slowly fade from view as consumers move on to some other newer more interesting piece of tech hardware.

Be the first to comment