EtiAmmos

The bears were buried in green for a fourth day in a row, as the latest rally in the major market averages is reminiscent of the one we had off the June bear-market low. Whether we continue to see gains in the short term depends on this morning’s inflation report. Investors are clearly anticipating good news in terms of more evidence that the peak rate of inflation is behind us. I have no doubt about that, which is the basis for my bullish narrative. As Jim Paulson at The Leuthold Group noted yesterday, during each of the past seven inflation cycles, the stock market bottomed once the rate of inflation had peaked.

Finviz

The bond market is telling investors what I’ve been espousing for months, which is that the rate of inflation is likely to fall over the coming year as fast as it rose over the past year. Breakeven rates for Treasury Inflation Protected Securities, which is what the market expects inflation to be over different time periods, are all approaching new lows for the year. Every maturity is gravitating to the Fed’s target of 2%, with the most pronounced decline coming in the 2-year. This explains investors’ renewed appetite for risk assets. It should allow the Fed to tighten less aggressively than the consensus now expects, which should alleviate concerns about recession and increase odds that a soft landing prolongs the expansion.

Bloomberg

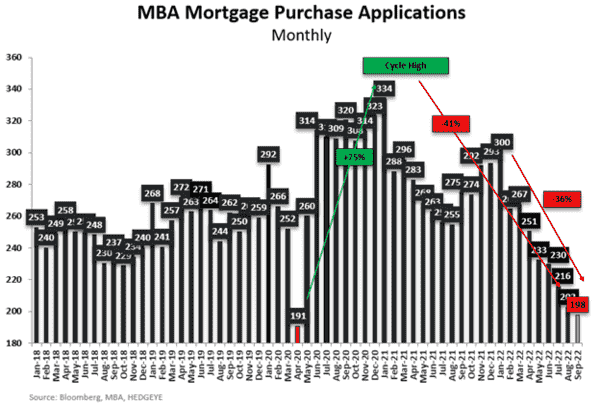

This morning’s Consumer Price Index report should show continued progress in reining in price increases from the post-pandemic period, but I am still looking for more leading indicators that expectations are on track. The stickiest of all price increases is the cost to rent, which is derived, in part, from what homeowners think they can obtain by renting their own homes. That number is largely derived from what the residence is thought to be worth. Monetary policy tightening to date has had a stifling impact on home sales with the near doubling on mortgage rates over a very short period of time, and this is manifesting into a collapse in mortgage purchase applications to levels last seen at the depth of the pandemic in 2020.

Hedgeye

I expect the double-digit rate of home price appreciation to fall to negligible gains, if not modest losses, over the coming year. The rate of increase in rents should follow. We do not need to see further tightening by the Federal Reserve to see this play out. Furthermore, yesterday’s New York Fed survey showed that consumer expectations for home price appreciation for the year ahead have cratered from what was 6% in April to just 2.1% today.

The chart for monthly mortgage applications is a precursor to what investors are likely to see in the monthly Consumer Price Index chart below, which had a parabolic run up since the beginning of 2021. There should be a reversion to the mean over the coming year, which the stock market should discount, as it happens. In fact, I think the tremendous rebound off the June bottom, which coincided with the peak rate of inflation, is the beginning of this process.

Stockcharts

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment