Philip Rozenski/iStock Editorial via Getty Images

Investment thesis

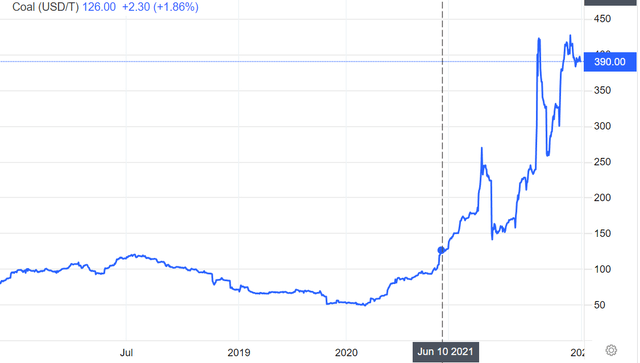

Contrary to expectations, the current coal price rally is shaping up to be more than just a dead cat bounce, and with it so is the recent positive stock performance of Peabody Energy (NYSE:BTU). There is still some ways to go on its financial performance, with the latest quarterly report not fully reflecting the positive coal price environment. Looking at full-year 2021 returns, however, it does seem like Peabody is turning a corner and prospects are looking increasingly good, as the global coal market looks more and more favorable. Peabody’s hedging situation should also improve going forward, with time being on its side, given that coal prices seem to remain high for a long time, as part of a broader global bull market in commodities. Even though Peabody stock already put in a stellar performance so far this year, all indications are that there is room for further improvement going forward, based on fundamentals. When even the EU’s green leaders are embracing a return to using coal, we can no longer dismiss the recent coal price rally as just a temporary blip.

A decent financial performance in 2021 is followed by some more disappointment for the first quarter of the year

One of the catalysts that turned Peabody stock into a star performer this year, aside from the dramatic increase we saw in coal prices recently, was the decent annual report for 2021. It went from a $1.87 billion loss in 2020 to a net income of $360 million in 2021. For the first quarter of this year, it managed to put in yet another loss of $120 million, which was in fact worse than the $80 million loss it incurred in the first quarter of 2021. On the bright side, Peabody’s long-term debt remained more or less steady compared with the end of last year, increasing by less than a million dollars, to $1.08 billion.

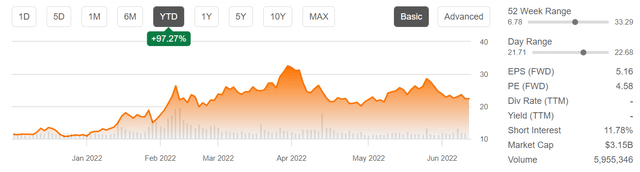

The reason I see the long-term debt situation as a bright spot in the last quarterly report, even though there was no decline in its debt level is that the next few quarters are likely to see an improvement in terms of financial returns, and with it, there should be an improved trend in terms of Peabody’s overall debt reduction efforts. Seeking Alpha has Peabody trading at an estimated forward P/E ratio of 4.6 currently.

Peabody financial metrics (Seeking Alpha)

The estimated forward P/E suggests that even though the stock is currently up almost 100% YTD, there is still plenty of room for improvement in its stock value, given that it is by no means an expensive stock. Despite the weak financial performance for the first quarter of this year, we should see a significant improvement on last year’s performance in terms of net earnings when full-year financial results will be in. It goes without saying that an estimate is one thing, while actual results might come in different from expectations. We will have to wait and see. If actual financial returns will prove current expectations to have been overly optimistic, there could be some downside to Peabody’s stock performance in the next 12 months or so. Even if that will be the case, longer-term prospects might beat all current expectations, given the resurgence we are seeing in coal demand prospects.

The curious case of green politicians turning brown and black

If anyone would have suggested just a year ago that we will see green politicians in the EU advocating for more coal use, most people would have reacted by expecting some punchline to a joke at the end of the conversation. Germany’s green party member and Economy Minister, Robert Habeck is by no means looking for a good laugh when he is advocating for more coal use, in order to make up for a widening gap between natural gas supplies and demand. Before advocating for more coal use in electricity generation, he pleaded with households to cut back on energy use, by showering for shorter durations and cutting back on air conditioning in the summer and heating in the winter. He is claiming that he cut back his own duration in the shower to 5 minutes. None of that seems to be nearly enough, therefore more and more EU countries are advocating for a temporary return to burning more coal for the purpose of electricity generation, including Germany’s green Economy Minister, Robert Habeck, as well as other green politicians across the EU.

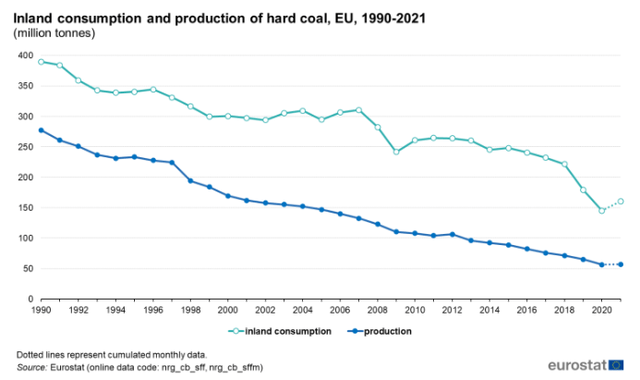

This of course does not mean that the EU’s green politicians are no longer advocating for their ultimate goal of getting rid of all fossil fuel use, especially coal, which is the most polluting by far. In order to safeguard the temporary nature of the supposedly stop-gap measure meant to deal with a shortfall in natural gas supplies this year, the EU is apparently opposed to reopening coal mines within the EU, many of which have been abandoned in the past few decades. The President of the EU commission, Ursula von der Leyen recently stated that the EU does not want to see investments in coal in the EU in response to the gas crisis. It is not entirely clear what that means in practice, but some interpretations I read on a Romanian news site are that it is meant to discourage the re-opening of mines in the EU.

What this means for a company like Peabody is that an entire continent is seeing robust and entirely unexpected coal demand growth, even as it continues to discourage domestic supply growth. Demand for exports of coal from places like the US and Australia where Peabody has its mining operations is set to see a boost, whether directly from Europe or indirectly, due to other coal exporters re-directing supplies to Europe, leaving gaps in export supplies elsewhere. Just to put into perspective the magnitude of potential coal demand growth in the EU, last year it consumed 155 Bcm of Russian gas. If they will be forced to replace a quarter of that with coal, it would amount to roughly 72 million tons of extra coal demand per year. It remains to be seen how much actual coal demand will grow in the EU this year, but it is clear that there is a significant rise in demand underway.

It is widely believed that this bump in coal demand will be only temporary. New supplies of natural gas, growing reliance on wind & solar, as well as measures meant to reduce demand, are all thought to make this bump in coal demand in the EU and globally, just a bump in the road. The ultimate path will take us to EU independence from Russian energy and eventual complete decarbonization of the EU economy. It is therefore argued that the current change in fortunes that Peabody experienced is not set to last very long. At most, the EU might increase coal demand this year, followed by a return to its long-term path of cutting coal use.

EU coal demand & productions (Eurostat)

It may indeed be the case that this will be just a blip on the chart, but objectively speaking, for that to happen, Russia-EU economic relations would have to return to normal, which I do not see happening. Russia is set to pivot its exports towards the Asian market, with China and India becoming its main export markets. Russia’s net energy exports will see a decline in the process. With Russian energy exports seeing a downturn in volume, it is hard to see how it will be possible for the EU to resume its long-term plan to phase out coal in the coming months and years. This is not a global buyers’ market in terms of most commodities and alternatives are scarce. Whatever bump in EU coal demand we are seeing this year, and perhaps next year, if the rupture with Russia worsens significantly, will probably have far more staying power than most EU leaders would like to admit at the moment.

Even before the Russian invasion of Ukraine, most forecasts put global coal demand at an all-time high for this year. With the stunning shift of Europe’s green political elites, many of which are now calling for a temporary increase in coal consumption in the EU, it seems that global coal demand is set to reach new records, not just this year but also next year and perhaps beyond. With the increase in demand, global coal prices are set to continue hovering around current levels for the foreseeable future, with more upside potential than downside risk to prices.

Asia coal spot price (Trading Economics)

Investment implications

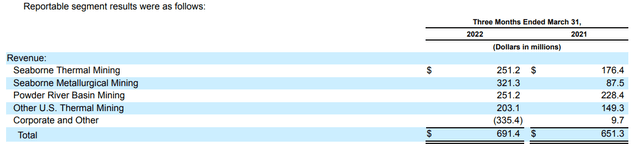

For the short-term Peabody is not likely to fully benefit financially from the near four-fold increase in coal prices, compared with the average prices we experienced before the COVID recovery gave rise to a new commodities price boom. Peabody took a loss of over $300 million on its hedging position in the first quarter of the year, which is in large part what caused the overall financial loss.

As we can see, even though Peabody brought in $642 million from its mining sales in the first quarter of 2021, and $1.03 billion in the first quarter of this year, resulting in a 60% increase, the increase in revenue, once factoring in its other dealings was only about 8% million.

Peabody will probably continue to hedge its sales going forward, but given the much higher coal prices we are seeing, it will likely be able to hedge at much better price levels, meaning that its financial results should improve going forward, no matter what the longer-term outcome for coal prices will be, beyond the immediate crisis. Expectations, or better said hopes, especially among the ranks of green EU politicians are that this will be very temporary. Having said that, few people expected to see them advocating for more coal use, just a few months ago.

A prolonged period of growing global reliance on coal consumption may still be an unexpected, and definitely unwelcome scenario at the moment. Yet, it does seem that along with the overall sustained global commodities price boom, coal will continue to benefit as well. Perhaps not as much as many other commodities, but it will nevertheless. With that, Peabody will continue to be a solid long-term investment choice. After locking in some stock price gains when it was trading at recent highs, I am now considering buying some more Peabody stock, if it drops below $20/share in the next few quarters. If it will not, I will be content riding out the gains on my remaining shares.

Be the first to comment