Max Zolotukhin/iStock via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. A version of this article was originally posted to members of the CEF/ETF Income Laboratory on June 23rd, 2022.

PIMCO Dynamic Income Opportunities Fund (NYSE:PDO) came to market at the beginning of 2021. The fund enjoyed a rather short period of calm before being smacked by the idea of higher interest rates. Then, ultimately, it was pounded even harder when the higher interest rates started to show up.

This probably wasn’t the start that PIMCO wanted to see happen, but the whole fixed-income space has been selling off due to these higher interest rates. It also isn’t as if the equity market was someplace to hide during this tumultuous time. Both asset classes are getting hit hard.

The declines in the underlying bonds aren’t the only thing working against PDO now. It is a double whammy, with the share price falling considerably further than the actual performance of the underlying portfolio. Thus, a deep discount has opened up on shares of this PIMCO offering.

The Basics

- 1-Year Z-score: -0.75

- Discount: 5.74%

- Distribution Yield: 10.63%

- Expense Ratio: 1.93%

- Leverage: 46.81%

- Managed Assets: $3.496 billion

- Structure: Term (anticipated term date January 27th, 2033)

PDO is designed to provide “current income as a primary objective and capital appreciation as a secondary objective.” This is pretty standard for the PIMCO funds and most CEFs. They go on to mention how they will attempt to achieve this;

The fund will normally invest at least 25% of its total assets in mortgage-related assets issued by government agencies or other governmental entities or by private originators or issuers. The fund may invest up to 30% of its total assets in securities and instruments that are economically tied to “emerging market” countries; however, the fund may invest without limitation in short-term investment grade sovereign debt issued by emerging market issuers. The fund may normally invest up to 40% of its total assets in bank loans (including, among others, senior loans, delayed funding loans, covenant-lite obligations, revolving credit facilities and loan participations and assignments). It is expected that the fund normally will have a short to intermediate average portfolio duration (i.e., within a zero to eight year range), although it may be shorter or longer at any time depending on market conditions and other factors.

Essentially, while they remark that the fund will invest at least 25% of total assets in mortgage-related debt, they can invest in quite a flexible way. The managers aren’t necessarily limited to investing where they want, which we generally see in most PIMCO funds. They are basically multisector bond funds with limited restrictions. In this case, they will also normally target a short or intermediate-duration portfolio. That’s an important detail given the interest rates and the impact of higher rates.

The fund is highly leveraged, which is another standard feature for the PIMCO lineup. That’s often why they are among the space’s best-performing funds. Which usually garners some of the highest expense ratios too. You get what you pay for kind of deal.

In this case, a 1.93% expense ratio on a ~$3.5 billion size fund is a bit unusual. When including interest expenses, it comes to 2.61%. When higher rates come, interest expenses will also rise. However, in their portfolios, they typically utilize interest rate swaps and various other derivatives that can negate some of this impact as well.

Due to their high leverage, we must be aware that deleveraging is a risk. It hasn’t taken place for PDO until at least the end of May 31st, 2022. They reported around $1.628 million in reverse repurchase agreements at the end of 2021.

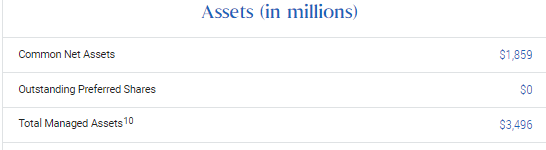

PDO Assets (PIMCO)

In fact, the difference between their total managed assets and common net assets is around $1.637 billion—a small increase from the beginning of the year. Admittedly, I don’t follow the fund every single month, so if there were a decline at some point, I would have missed it. All I can do at this point is follow what is documented.

Performance – Deep Discount

As mentioned at the open, shares of PDO had traded mostly sideways through 2021. When the Fed began to announce they would be raising interest rates sooner to fight off inflation, we began to see a decline. This has only seemed to have accelerated even faster through 2022 as the rate increases were anticipated to increase sharper than originally thought.

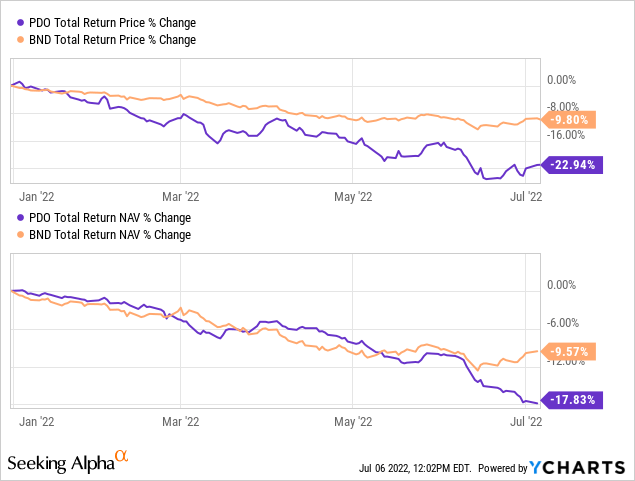

Even though PIMCO has historically pulled off miracles, even they can’t fight the Fed. These declines in the fixed income space (and equities) were seen across the board. Almost no place was safe. In the YTD performance chart below, I’ve also shared the Vanguard Total Bond Market ETF (BND) for some context.

Despite the significant leverage that PDO has utilized, the declines weren’t overly enormous relative to BND. In fact, most of the noticeable differences in performance only came about in the last few weeks. One of the reasons for holding up relatively well is that PDO has a lower duration than BND. BND has a 6.7-year duration, and PDO is at 3.85 years. The divergence can be due to the credit risk when heading into a recession.

On top of this, the biggest shock would have come from the fund’s share price and not the actual performance of the underlying portfolio. A loss is a loss, and that isn’t anything to brag about, but put in context isn’t as bad as one might have expected. This divergence of share price and NAV opens up opportunities in the CEF space as funds can trade at some pretty wild discounts.

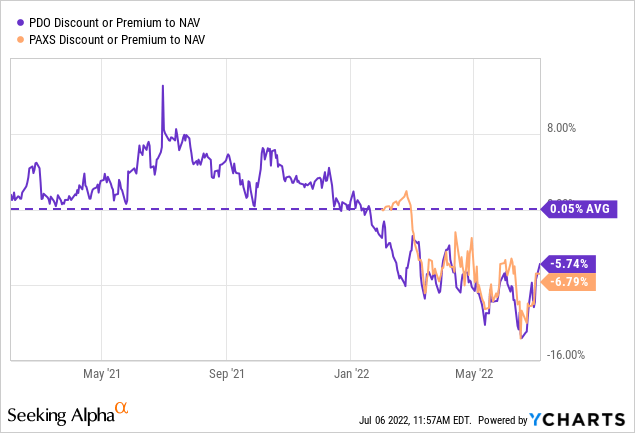

Most of PIMCO’s taxable bond funds are strangers to trading at premiums. PDO is different. It has traded to a sharp discount to its NAV. PIMCO Access Income (PAXS), the newest PIMCO fund, is experiencing the same treatment.

However, the discounts have bounced back significantly in just the last week or so. At one point, PDO was at around a 13.6% discount. When the article was originally written, shares were at a discount of 12.9% and a 1-year z-score of over 2. I still believe the latest discount is still attractive to be initiating a position.

It seems that investors don’t have that built-up trust of longevity that the other PIMCO funds get, which can only come through time. Though, to be fair, a lot of the PIMCO taxable bond funds have lost a lot of their premium or are flirting with slight discounts.

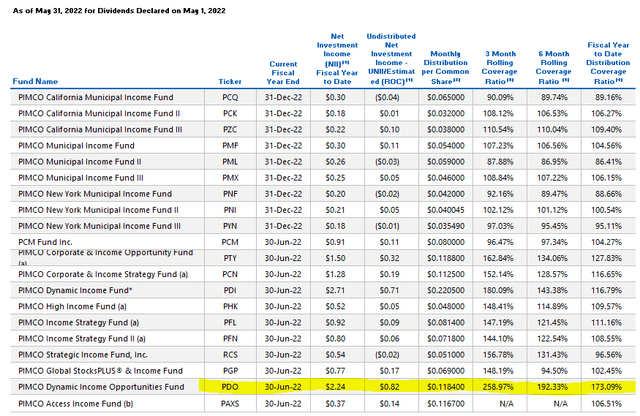

Distribution – High Coverage

Since the original publication of this article, PDO increased its monthly distribution to $0.1279 or by 8.02%. I still believe that a year-end special might be on the table.

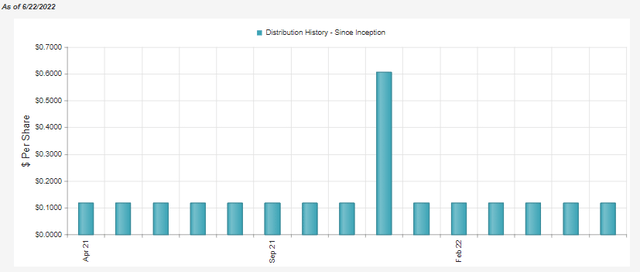

The fund launched with a monthly $0.1184 and paid a special in the first year of $0.49.

PDO Distribution History (PIMCO)

This currently works out to a distribution rate of 10.63% and, on a NAV basis, works out to 9.03%. This is elevated, but the distribution coverage remains solid with the latest monthly UNII report. The fact that they haven’t had to deleverage to this point from the end of the year should also indicate that the coverage can continue to remain strong too.

There is such a cushion here that even if they had to deleverage, the coverage should remain well above what they are currently paying. This is some of the strongest coverage I can recall that I’ve ever seen since following the PIMCO funds. This would indicate that an increase in the distribution might be closer than a cut. At the very least, a special year-end might be required in order to avoid excise taxes as a regulated investment company.

PDO’s Portfolio

One of the most important metrics is the duration of the portfolio. As, as mentioned above, it comes to 3.85 years. That’s actually quite low, thanks to the fund’s high yield credit allocation. It accounts for nearly 30% of the fund at this time. That is the largest single sector allocation of the fund. This is then followed by mortgage assets – both non-agency and agency coming in at 15.50%. Then CMBS makes up a fairly meaningful 15.3% of the portfolio as well.

Higher risk holdings generally cut the length of the maturity in the portfolio. Lenders want their money back faster from riskier companies. The longer a bond is outstanding, the greater the risk of an economic collapse, risking their chance of getting anything back.

That plays another role in the outlook for the fund. If we are expected to potentially be in a recession or enter a recession in 2023, the chances of defaults and bankruptcy also increase. That will put further pressure on the prices of the underlying portfolio. Therefore, it can be blamed for some of the declines on a YTD basis, besides just the impact of higher interest rates.

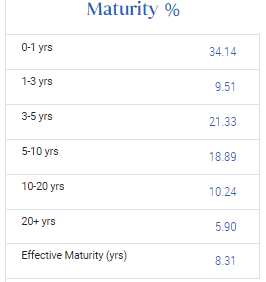

PDO Maturity (PIMCO)

Still, their effective maturity comes to 8.31. That’s once again where interest rate swaps can help out this fund. This would be to help diminish to impacts of higher rates.

Interest Rate Swap Agreements may be entered into to help hedge against interest rate risk exposure and to maintain a Fund’s ability to generate income at prevailing market rates. The value of the fixed rate bonds that the Funds hold may decrease if interest rates rise. To help hedge against this risk and to maintain its ability to generate income at prevailing market rates, a Fund may enter into interest rate swap agreements.

PIMCO funds have a history of using various derivatives that can be more complex to achieve different results. That includes these interest rate swaps and credit default swaps for PDO.

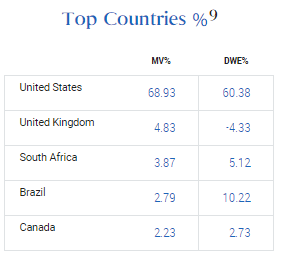

PDO also isn’t limited to investing just in U.S. markets. Around 30% of their portfolio is allocated outside of the U.S.

PDO Country Allocation (PIMCO)

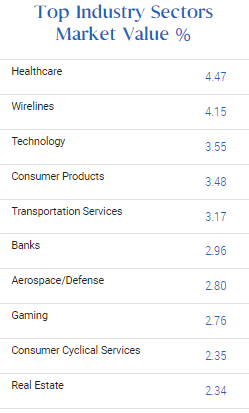

This is one more way that the fund is diversified on top of the industry exposure being limited in any one specific area. When an economic slowdown comes, diversification can help as each sector doesn’t get impacted the same.

PDO Industry Breakdown (PIMCO)

Conclusion

PDO seems to be a great value now with its portfolio being beaten down, but primarily with the fund showing a deep discount, it opens up an even better opportunity. That doesn’t mean it can’t get beaten up more, but the risk of significant discount expansion seems limited at this point. The distribution coverage remains incredibly high. Even if deleveraging becomes an issue, there is enough buffer at this point that the payout shouldn’t be at risk.

Be the first to comment