PeopleImages

A few weeks ago, I wrote cautious articles on the PIMCO Dynamic Income Fund (NYSE:PDI) here, and here. My main argument was that while the 12%+ current yield is attractive, investors were at risk of losing more in ‘price’ than what they earn from ‘yield’.

So far, that thesis seems to be playing out as the PDI has returned -7.4% in price despite continuing to pay it’s $0.2205 monthly dividend, for a total return of -6.4%.

Simply put, I remain cautious on the PIMCO Dynamic Income Fund in the near-term because the Fed is expected to continue raising interest rates and putting the screws on the economy for several more months/quarters. I recommend investors stay on the sidelines and wait for either an unsustainable level of junk bond yields (~8%, which would correspond with a weak economy and a Fed pivot) or the Fed signals an end to the current rate hike cycle because they have achieved a ‘soft-landing’.

Quick Fund Overview

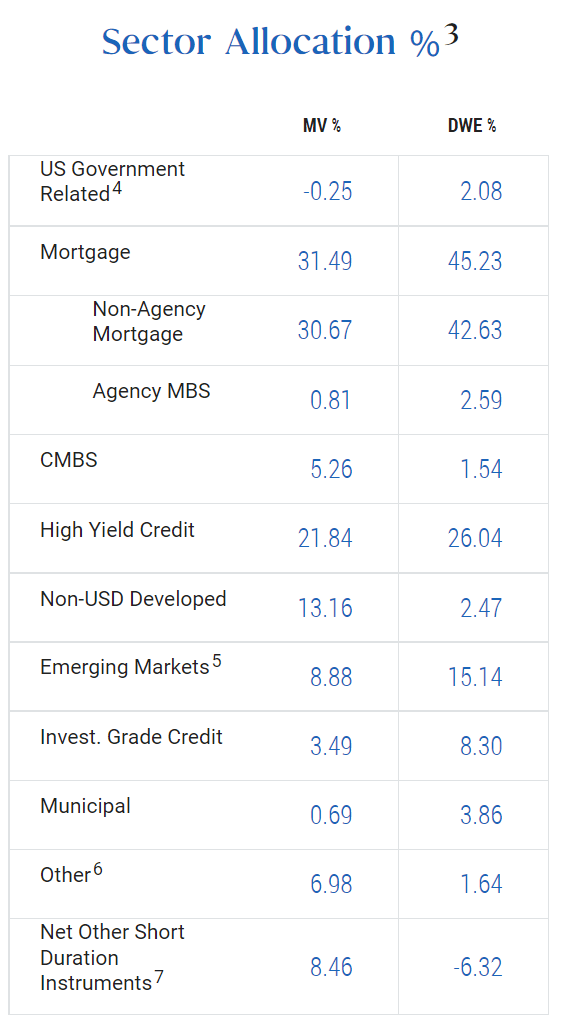

For those not familiar, PDI is a closed-end (“CEF”) levered credit fund that borrows short-term and invests in high yield junk bonds, MBS, emerging market bonds and other credit instruments. From the PIMCO website, we can see that the fund currently has 31% of net assets invested in MBS, 22% in high yield (“junk”) credit, 13% in developed market credit, 9% in Emerging markets, and other assets (Figure 1).

Figure 1 – PDI Sector Allocation (pimco.com)

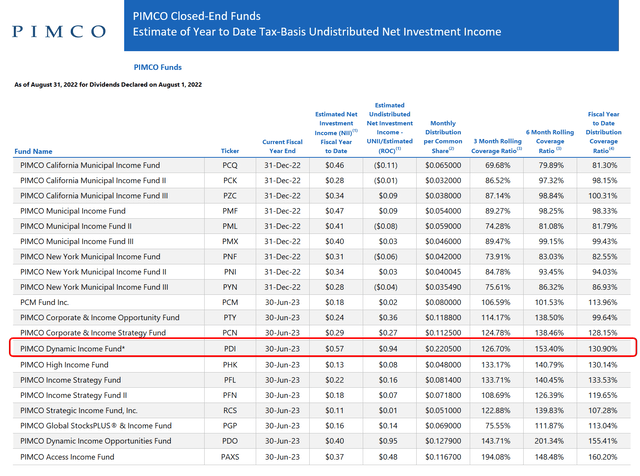

Distribution Coverage Ratio Still Solid

Looking at PDI’s latest Undistributed Net Investment Income (“UNII”) report, we can see that PDI’s current distribution remains well covered, with 3 and 6 month rolling coverage ratio of 127% and 153% respectively.

Figure 2 – PDI UNII report shows the distribution is still well covered (pimco.com)

More Short-Term Pain Ahead

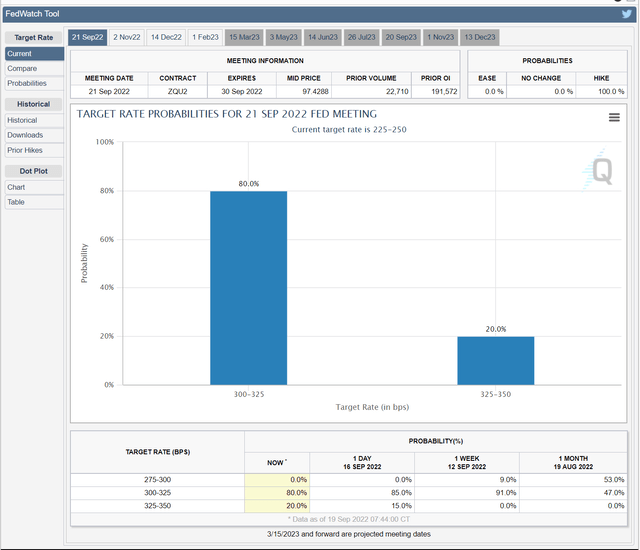

As I see it, the problem with PDI is that short-term interest rates continue to ratchet higher, with the Federal Reserve expected to raise the Fed Funds rate by another 75 bps this coming Wednesday (Figure 3).

Figure 3 – Market implied Fed Funds expectation for September FOMC (cmegroup.com)

Increasing interest rates hurt PDI in two ways: first, its cost of debt rises, hurting net investment income; second, rising interest rates cause PDI’s fixed income assets to decline in market value (fixed income assets trade inversely to yields), hurting the NAV.

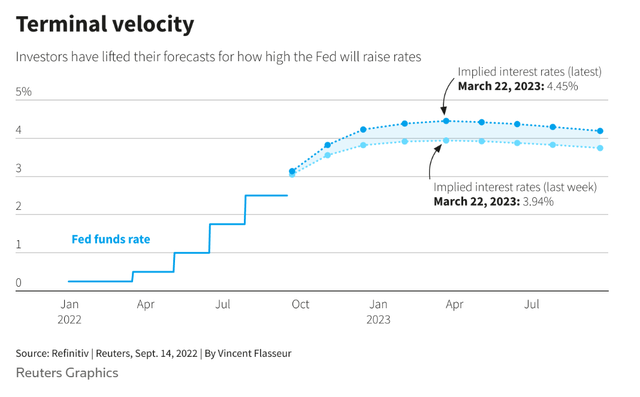

The Fed’s interest rate hikes are not expected to stop until Q1/2023, so there’s potentially several months of pain ahead (Figure 4).

Figure 4 – Fed Funds terminal rate at ~4.5% (reuters.com)

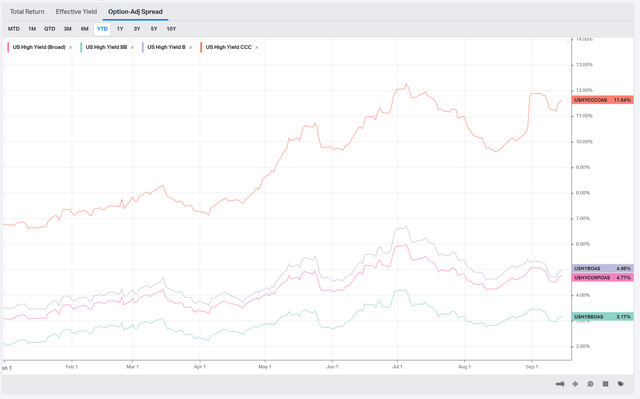

Another headwind for PDI is that with the economy heading into an economic slowdown (FedEx’s (FDX) profit warning last week highlighted the global weakness), credit spreads have been on a widening trend. This is especially pronounced in the lower quality credits, like CCC, which is approaching YTD highs.

Figure 5 – HY credit spreads widening (koyfin.com)

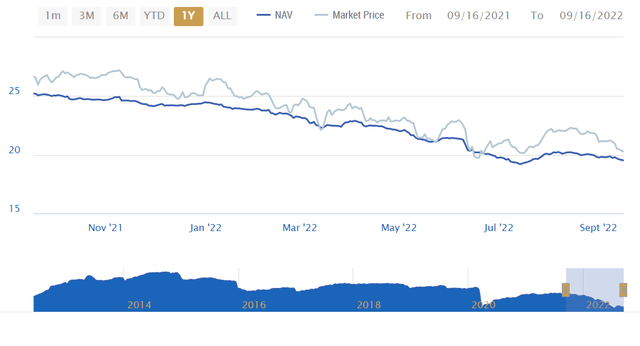

Therefore, it’s no surprise that PDI’s NAV and market price continue to grind lower, with its NAV declining 12.3% YTD (wiping out a full year’s worth of distributions).

Figure 6 – PDI NAV and market price declining (pimco.com)

When Will I Turn Bullish On PDI?

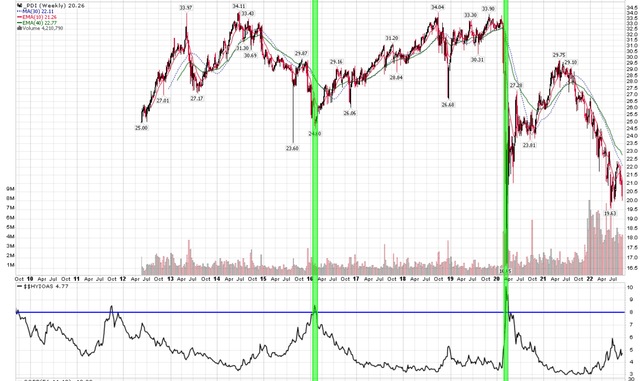

With the headwinds listed above, I remain cautious on PDI’s near-term prospects. Historically, when HY spreads spike past 8% it has been a good long-term entry point for PDI and other levered credit instruments. While I’m not predicting a COVID pandemic level crash in the markets, we see that every few years, credit markets do give investors good entry points (2009, 2011, 2016, 2020). Hence I would recommend patience for investors on the sidelines.

Figure 7 – HY spreads > 8% have been good LT entries (Author created with price chart from stockcharts.com)

Risk To My Call

The most obvious risk to my call is if the Federal Reserve suddenly announces it is finished with rate increases or is slowing down the pace of rate hikes. In which case, I expect all risk assets will stage significant rallies. If that indeed happens, it would be a safe entry point, since from that point forward, the Federal Reserve will be acting as a tailwind and not a headwind.

However, in my opinion, this risk is low, as the Fed has clearly stated it wants to reduce aggregate demand and inflation. With core inflation now running at over 6% and unemployment at 3.7%, I think the economy is simply too tight and overheated for the Fed to ‘pivot’. If anything, there is a risk the Fed’s terminal rate may be higher than the ~4.5% currently expected by the market (from figure 4) and the rate hike cycle lasts beyond Q1/23, in my opinion.

Conclusion

In summary, I remain cautious on the PIMCO Dynamic Income Fund in the near-term. While the 13% current distribution yield is attractive, I worry that NAV and price declines will more than offset the yield, as has been the case so far this year. I recommend investors exhibit patience and wait for either an unsustainable level of junk bond yields (~8%) which would cause the Fed to pivot, or the Fed finishes its rate hike cycle and achieves a ‘soft landing’.

Be the first to comment