JasonDoiy/iStock Unreleased via Getty Images

When we last covered PayPal (NASDAQ:PYPL), we did not take the opportunity to buy this fallen angel. While the stock had done a 60% nose dive off its highs, we were less than impressed with the valuation. We were looking for a special number and we said,

Ultimately if the earnings estimates prove out to be correct, we see this bottoming in the $80 range (16X non-GAAP P/E). The good part here is that the falling stock price will make buybacks more effective. After all, you can create a lot more value by buying back at $80 than you can at $300. The bad part is we see a mass exodus of talent that will realize that their stock options are not going to be in the money any time this decade.

Source: What Tops At 16X Sales Will Bottom At 16X Earnings

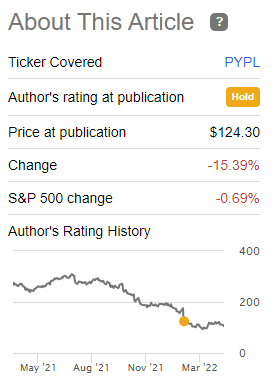

The stock is down 15% since we wrote that vs. just 0.69% for the broader market and S&P 500 index (SPY).

PYPL Returns Since Last Article (What Tops At 16X Sales Will Bottom At 16X Earnings)

So our stance to stay out has been validated, to say the least. We read the tea leaves now as investors prepare for the first quarter results.

Upcoming Results

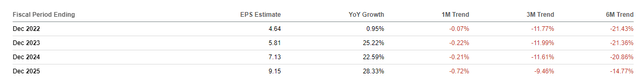

We expect PYPL to disappoint on all fronts. Analysts have been rapidly moving estimates, so one might make the argument that this is getting priced in. Earnings estimates are now down 11.77% in just the last three months.

PYPL Earnings Estimates (Seeking Alpha)

That makes logical sense, but it would be incorrect in our opinion. There are a few reasons for this. The first is that analysts are still pricing in past trends in revenue growth. For example, 2023 shows an acceleration of revenues again, and that on a much larger base.

PYPL Revenue Estimates (Seeking Alpha)

You are not going to get that in a slowing economy with an extreme explosion in Fin-Tech competition. Keep in mind, Q4-2021 grew at 13% vs. Q4-2020, and analysts have funnily priced every single quarter faster than that for 2022.

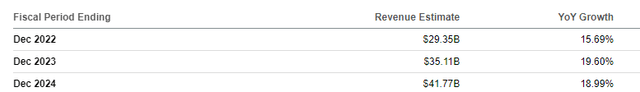

The second is that they have not yet remotely captured the margin compression that is coming. This comes from the same reason as the reason for lack of growth. The competition is coming at PYPL hard. We saw the compression in gross and net margins last year, and this year will be something similar. Publicly traded competitors have far lower margins than PYPL, and you will see this reflected in 2022.

We expect PYPL’s gross margins to drop decisively below 50% in 2022 and stay there. At the end of the day, we think PYPL’s 2022 and 2023 earnings, and we are referring to the Non-GAAP version, will come in below that of 2021. Two years of no growth will require a big mindset change to absorb and we don’t think the stock will make headway with a legion of analysts downgrading it.

The Other Part Of The Bear View

When you have an extreme high-flyer like PYPL that suddenly has a crash landing, there are two other factors you need to consider. The first is that all the people who work there have shattered dreams about getting rich off employee stock options. Those strikes (and dreams) are now not reachable. We will see a mass exodus of talent from PYPL and from each and every “growth” stock over the next few years. The CFO’s departure was just one that made the news.

Walmart Inc. (WMT) announced that John Rainey has been named the retailer’s Executive Vice President and Chief Financial Officer to replace the Brett Biggs, who has held the position since 2015.

Rainey joins Walmart from PayPal where he currently serves as CFO and Executive VP of Global Customer Operations. In that role, Rainey is responsible for all of PayPal’s financial operations. He is also on Nasdaq’s board of directors, where he is a member of the audit committee and chair of the finance committee.

Source: Seeking Alpha

The second aspect is that the ownership takes time to churn. The crowd that owns it today is not looking for a slow-growing deep-value stock that can deliver 7% returns annually. It is primarily a growth mentality investor who largely confused the bubble with investing acumen. So while value investors will start screaming how cheap it is for 7% annual returns, it will take time for the growth investors to puke this out of their portfolios. In the interim, look lower, and bounces should be sold.

Disinfect To Protect

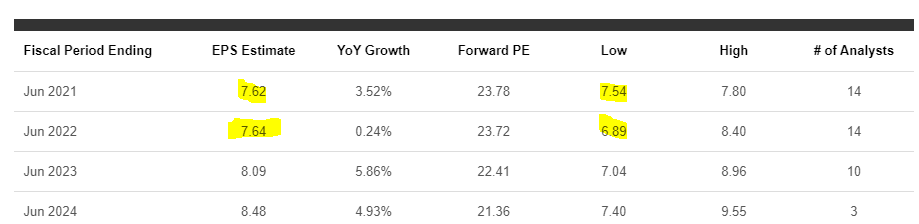

PYPL and The Clorox Company (CLX) might have absolutely nothing in common at first glance. In our coverage, though, we see an identical setup. CLX was headed into tornado of poor revenues and poor margins, and the analyst community was refusing to downgrade estimates. As late as August 2021, analysts still expected a miraculous resurrection and had forecasted $7.64 in earnings for 2022.

CLX Earnings Estimates on August 5, 2021 (Expect An Armada Of Downgrades)

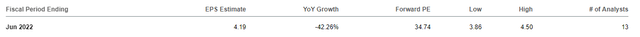

Today, reality has partially set in, and we are looking at $4.19.

CLX Earnings Estimates Today (Seeking Alpha)

PYPL is in the same spot except that those downgrades on revenues and more so on margins, lie ahead. We are sticking with our $80 price target for this (for now) and will reassess post the Q1-2022 results to see if our thesis is playing out as expected.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment