bizoo_n/iStock Editorial via Getty Images

Thesis

Warren Buffett mentioned multiple times the secret of picking compounders:

Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.

Indeed, the most important two traits of an ideal compounder are high return on capital employed (“ROCE”) and capital allocation flexibility. As detailed in my earlier article:

These traits mutually enhance each other. High ROCE leads to strong profits, which leads to more flexible capital allocation to fuel further growth, which then leads to more profit, and so on. More quantitatively, the long-term compounding rate of such a business is simply a product of these two traits, i.e.:

Long-term growth rate = ROCE * Reinvestment Rate

And you will see next that PayPal (NASDAQ:PYPL) is a stock that demonstrates both high ROCE and enviable capital allocation flexibility. Its ROCE is competitive even when compared to the overachieving FAAMG group. Also, note that even for such ideal compounders, the grandmaster still cautions us not to leave the question of price aside. The recent market correction has burst the valuation bubble for PYPL and offered a reasonable entry opportunity.

PYPL’s return on capital on par with FAAMG

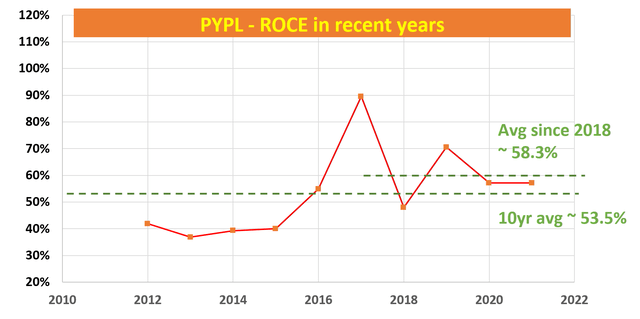

As seen below, PYPL was able to maintain a remarkably high and stable ROCE over the long term (on average 53.5% for the past decade). The ROCE has been even higher in recent years, on average 58.3% since 2018. In this analysis, I considered the following items as capital actually employed 1) Working capital, including payables, receivables, inventory, 2) Gross Property, Plant, and Equipment, and 3) research and development expenses as also capitalized.

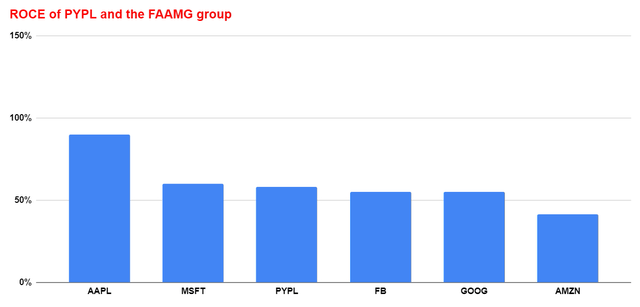

To put things under perspective, the long-term average of 53.5% is already very respectable and competitive profitability even when compared to overachievers like the FAAMG group. The FAAMG group has been maintaining an average ROCE around “only” about 50% to 60%.

PYPL’s ROCE in recent years (58.5%) made it even more competitive among this group of overachievers. It is actually a very close third only after MSFT and AAPL in this group (and AAPL really is in its own category).

Author and Seeking Alpha. Source: author and Seeking Alpha.

PYPL’s capital allocation flexibility

After establishing the superb return on capital, the next important trait to look for is capital allocation flexibility. The reason is straightforward and intuitive as aforementioned. An ideal compounder would be a business that earns a high profit on every $1 of capital employed AND can plow back a healthy fraction of its earnings to fuel further growth.

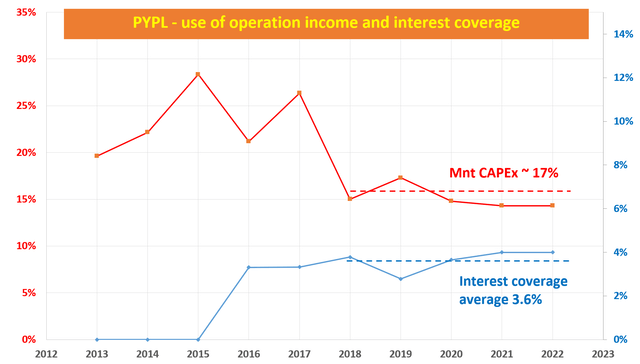

The next chart examines PYPL’s capital allocation and reinvestment rate. How much to reinvest probably is the most important capital allocation decision management has to make. And fortunate to PYPL, its management enjoys enviable capital allocation flexibility. The capital allocation picture is really simple here: PYPL earns a load of cash organically from its operations but does not need to spend much. Its capital allocation flexibility also rivals the FAMMG group.

As seen, to start, PYPL is essentially debt-free. Its interest coverage (defined as EBIT earnings divided by interest expenses) has been on average about 28x. It only takes about 3.6% of its EBIT earnings to service its debt. Second, it has been using on average only ~17% of its OPC (operation cash) as maintenance CAPEX expenses. It does not pay a dividend. So this is it – these are ALL the mandatory expenses for PYPL.

All the remaining cash, more than 80% of its OPC (a whopping $6.3B TTM) can be deployed freely. It can use it for a variety of things: reinvest to fuel further growth, retain it to strengthen the balance sheet, buy back shares, et al.

PYPL has been allocating the remaining earnings heavily toward share repurchases last year, which to me is a sound capital allocation strategy given the recent valuation contraction. PayPal has repurchased 15.4 million shares in the fourth quarter for $3.4 billion alone (about 53% of its 2021 OPC). And according to a Barron’s report, Credit Suisse’s analysis expects stock repurchases to remain at $3.4 billion in 2022 too. After all the share repurchases, there will still be plenty of organic cash remaining for reinvestment and fuel growth. My analysis is that it has been maintaining a reinvestment rate of about 10% to 12.5%.

Source: author based on Seeking Alpha data.

Expected return from PayPal stock

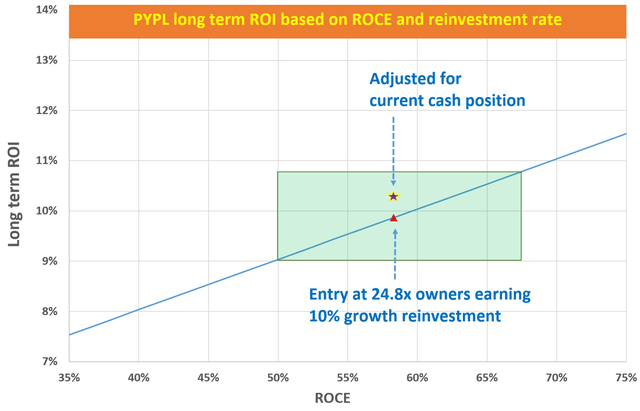

Now with the above discussion of its profitability and capital allocation, we can project the long-term return. The long-term return is simply the summation of the owner’s earning yield (“OEY”) and the long-term growth rate we discussed at the beginning of this article.

At its current price levels, the OEY is estimated to be ~4% (a detailed analysis of its owners’ earnings is provided in my earlier article).

As aforementioned, it has been maintaining a 10% ~ 12.5% reinvestment rate. To be on the conservative side, let’s assume a 10% reinvestment rate. With a 58.3% ROCE, it could maintain a 5.83% long-term growth rate at 10% reinvestment rate (ROCE * reinvestment rate = 58.3% * 10% = 5.83%). So the total return in the long term at the current valuation is almost about 9.8% (4% OEY plus 5.8% perpetual growth rate), a pretty decent long-term return considering the financial strength and the moat of the business.

The above discussions are also summarized in the following chart for more visually oriented readers. And as you can see, the return does not change that much even when the ROCE fluctuates by quite a bit as shown in the green box.

Finally, note that there is about $8.6 of net cash behind each PYPL share (taken as total current assets minus total long-term debt). Adjusted for the net cash position, PYPL’s OEY will be a bit higher, about 4.4%. and this adjustment will push the total long-term return into double-digit range (about 10.2%).

Risks

There are risks involved with PYPL though, specifically:

- Macroscopic risks. The Russian/Ukraine conflict is a big near-term uncertainty. The duration and eventual outcomes of the war (any war) are totally uncertain. It could generate substantial impacts for both the global overall financial markets and PYPL in unpredictable ways. The pace and degree of the post-COVID economy recovery are also uncertain. The pandemic is far from over yet and uncertainties like the delta and omicron variants still exist.

- In the long term, PYPL is in competition with other larger payment companies. With a total payment volume of $1.25 trillion in 2021, PayPal is still substantially smaller than Visa (which has a total payment volume of around $3 trillion per quarter) or Mastercard. At the same time, as aforementioned, the ROCE of Visa is also substantially higher than PYPL. Its role in the ongoing FinTech evolution is uncertain too with ample crises and opportunities. It is possible that banks and other new FinTech solutions can bypass PYPL as a middleman and just perform bank-to-bank transactions.

Conclusion and final thoughts

PYPL is an attractive perpetual compounder. It features an optimal combination of excellent financial safety, high return on capital employed, and enviable capital allocation flexibility. Specifically,

- Its long-term average of around 53% ROCE is already very respectable and competitive profitability even when compared to overachievers like the FAAMG group. Its current 58.3%+ ROCE is actually a very close third only after AAPL and MSFT in this group.

- And a perpetual growth rate of about 6% can be sustained organically considering its ROCE and capital allocation flexibility.

- Furthermore, the recent market correction has offered a rare entry opportunity. An investment here offers very favorable odds for double-digit annual total return in the long term. The risk-adjusted return is even more attractive considering its sizable cash position, financial strength, and aggressive share repurchase plans at these accreditive valuations.

- As a final note, the most valuable insight I learned from studying Buffett is probably this – we do NOT need a business to grow at 10% to achieve a 10% return on our investment. All we need is a few percent of consistent growth (assuming anything more than that is a dangerous assumption to start with anyway) and a reasonable entry valuation. That is all.

Be the first to comment