Justin Sullivan

We are buy-rated on PayPal Holdings, Inc. (NASDAQ:PYPL). PayPal is one of the leading online payment solutions providers. Our bullish sentiment is based on our belief that the company will see multiple tailwinds, including its recent ability to use the service on Amazon (AMZN) and activist investor Elliott Management’s involvement.

The macroeconomic environment remains harsh as inflationary pressures persist, but we believe PayPal is well-positioned to grow when macroeconomic difficulties ease and consumption picks up. The company maintains the largest market share within the digital payment market. PayPal is a TechStockPro favorite even during market downtrends because of its business model provides relatively safe and straightforward online transactions. We recommend investors buy into the company at current levels.

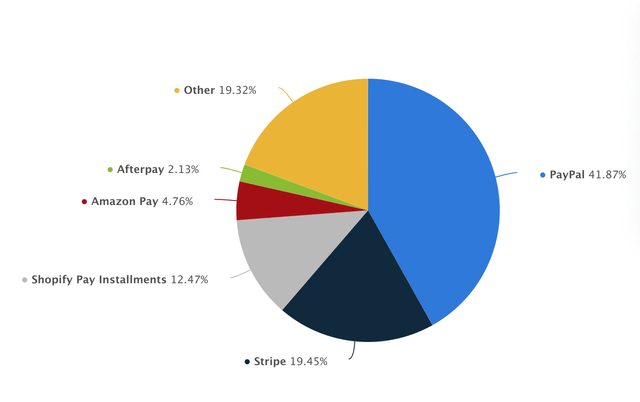

A major slice of the digital payment market

PayPal’s payment solutions retain the largest market share in the digital payment market, accounting for around 42% as of September. The company operates a two-sided network that allows customers to send and receive payments. While near-term macroeconomic challenges and inflationary pressures persist, we expect PayPal’s customer base to enable it to weather the storm. We believe PayPal is well-positioned to grow when the macroeconomic difficulties ease and consumption picks up.

The following graph outlines the market share of online payment processing software technologies worldwide.

PayPal’s platform has around 429M users between active accounts and merchant active accounts across 200 markets. The active accounts account for the company’s main revenue stream and grew 6% Y/Y in its latest quarter. We expect the company’s peer-to-peer payment service, Venmo, will be a major growth catalyst in driving active account adoption going forward.

Activist Elliott’s involvement serves as a tailwind

We’re optimistic about activist investor Elliott Management getting into bed with PayPal. Activist investor Elliott Management has accumulated a $2 billion-plus stake in the company and raised its annual profit guidance. We expect Elliott’s involvement will help the company run its operations better and become more shareholder-friendly with cut costs and the possible return of cash to shareholders.

Rolling out Venmo payment option on Amazon

PayPal users will be able to use the company’s services on Amazon by Black Friday. We expect this will boost the company’s total number of payment transactions. We’re optimistic about the feature, as PayPal generates the bulk of their revenue through charging fees for completed payment transactions for their customers and other payment-related services. The company’s total number of payment transactions achieved 5.5 billion, a 16% increase Y/Y. All Amazon U.S customers will be able to use PayPal services for their payments, and we expect this to boost PayPal’s total number of payment transactions.

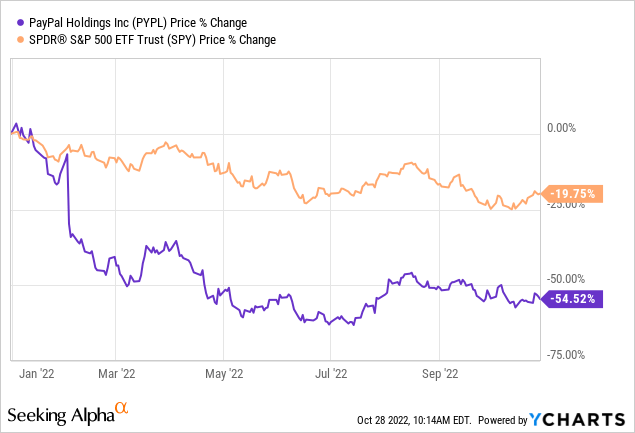

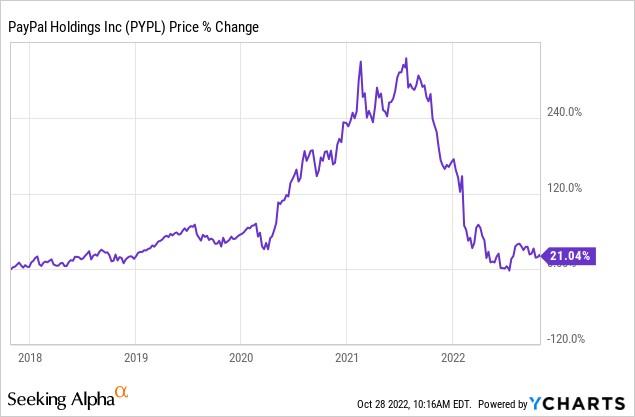

Stock Performance:

PayPal is among the fintech companies that won big during the pandemic, achieving an 81% increase between March 2020 and the end of 2021. The stock, however, has dropped 55% YTD. PayPal increased 21% over the past five years. We are not too concerned about the recent decline, as we believe it’s the result of the macroeconomic challenges and inflationary pressures. We expect the company to rebound now as it expands customer services to include the ability to use PayPal services on Amazon.

The following graphs show PayPal’s performance among the index YTD and its performance over the past five years.

TechStockPros

TechStockPros

Valuation:

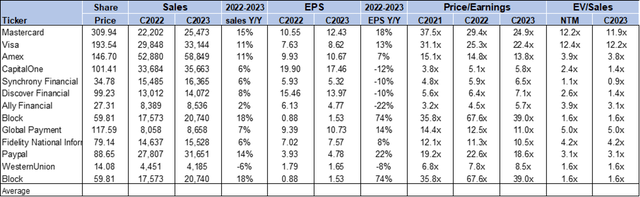

On a P/E basis, PayPal is currently trading at 18.6x C2023 EPS vs the peer group average of 16.4x. On an EV/Sales, PayPal is trading at 3.1x C2023 sales vs the peer group average trading at 4.0x. We recommend investors buy the stock now.

The following chart illustrates PYPL’s valuation relative to its peer group.

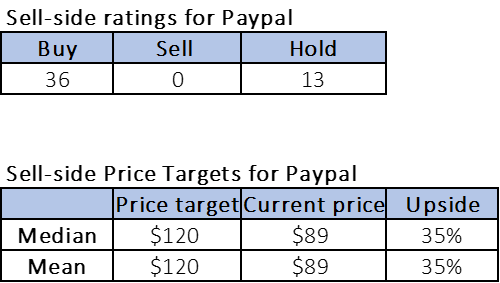

Word on Wall Street:

Wall Street shares our bullish sentiment on the stock. Of the 49 analysts covering the stock, 36 are buy-rated and 13 are hold-rated. PayPal is currently trading at around $89. The median price target and the mean price target are $120, with a potential upside of about 35%. The following chart indicates the sell-side ratings and price targets.

TechStockPros

What to do with the stock:

We are buy-rated on PayPal despite near-term macroeconomic challenges and inflationary pressures. With activist investor Elliott Management’s involvement, we believe the company will focus more on improving its margins, cutting costs and improving profitability. We’re also excited to see how, with Venmo becoming more popular, transaction revenue will increase for the company. We recommend investors buy PayPal stock.

Be the first to comment