Spencer Platt

NEW YORK (October 11) – Nothing is more important for a business than its reputation. Lose that, and you have lost virtually everything.

Nowhere is that more true than with companies in the financial services sector. It’s why we regulate banks. And brokerages. And mutual funds.

But in the modern morass of “social justice,” “equity,” and “ESG” (i.e., environmental, social and governance) objectives, and the nebulous, subjective, definitions of those terms, financial services companies that attempt to address those objectives in a sharply divided national electorate do so at their peril.

That was never more apparent than with PayPal Holdings, Inc.’s (NASDAQ:PYPL) misadventures last week when a revision to its Acceptable Use Policy (“AUD”) had, by Saturday night, triggered a tidal wave of objections on social media. By the wee hours of Sunday morning, “#bankruptPayPal” was trending, with many people purporting to cancel their accounts.

While the timing is unclear, widespread reportage of the AUD came about on a website called “The Daily Wire,” and soon was picked up by Fox News. But by Saturday night, a spokesperson for Pay Pal had walked back the policy with Fox News:

“An AUP notice recently went out in error that included incorrect information,” the spokesperson said. “PayPal is not fining people for misinformation and this language was never intended to be inserted in our policy. Our teams are working to correct our policy pages. We’re sorry for the confusion this has caused.”

The full text of the leaked revised and withdrawn AUP appears to be this document, which includes, among other violations this sentence in paragraph (5) (emphasis added):

…involve the sending, posting or publication of any messages, content or materials that, in PayPal’s sole discretion, (A) are harmful, obscene, harassing or objectionable, (B) depict or appear to depict nudity, sexual or other intimate activities, (C) depict or promote illegal drug use, (D) depict or promote violence, criminal activity, cruelty or self harm (E) depict, promote or incite hatred or discrimination of protected groups or of individuals or groups based on protected characteristics (e.g. race, religion, gender or gender identity, sexual orientation etc.) (F) presents a risk to consumer safety or (financial) wellbeing, (G) are fraudulent, promote misinformation or are unlawful, (H) infringes the intellectual property rights or other proprietary rights of any party or ((i)) are otherwise unfit for publication.

PayPal’s users would be entirely fair in asking, “misinformation” in whose view? “Promoting and inciting hatred or discrimination of protected groups” in whose estimate?

Would PayPal consider a parent not-for-profit group that seeks to remove books the parents believe inappropriate for children, like “Gender Queer” or that objects to “Drag Queen Story Hour,” to “promote…discrimination of protected groups…based on protected characteristics (e.g., gender or gender identity, sexual orientation)”?

Well, PayPal removes any doubt as to whose view or whose estimate will be considered in this section of its agreement, under:

Actions We May Take if You Engage in Any Restricted Activities

If we believe that you’ve engaged in any of these activities, we may take a number of actions to protect PayPal, its customers and others at any time in our sole discretion. The actions we may take include, but are not limited to, the following:

- If you’ve violated our Acceptable Use Policy, then you’re also responsible for damages to PayPal caused by your violation of this policy; or

- If you are a seller and receive funds for transactions that violate the Acceptable Use Policy, then in addition to being subject to the above actions you will be liable to PayPal for the amount of PayPal’s damages caused by your violation of the Acceptable Use Policy. You acknowledge and agree that $2,500.00 U.S. dollars per violation of the Acceptable Use Policy is presently a reasonable minimum estimate of PayPal’s actual damages – including, but not limited to, internal administrative costs… [Emphasis mine]

Moreover, “misinformation” still seemingly draws the ire of Pay Pal and could draw the $2,500 fine:

Restricted Activities

In connection with your use of our websites, your PayPal account, the PayPal services, or in the course of your interactions with PayPal, other PayPal customers, or third parties, you must not:

- Violate any law, statute, ordinance, or regulation (for example, those governing financial services, consumer protections, unfair competition, anti-discrimination or false advertising…

- Provide false, inaccurate or misleading information…[Emphasis is mine.]

Question: what is the difference between “promoting misinformation,” which was withdrawn from the policy, and providing “misleading information,” which can still draw sanction?

Notably, those quotes of the user agreement come not from the policy that PayPal said Saturday night “went out in error,” but from the policy on PayPal’s website as it still exists at 10:30AM EDT on October 11th!

PayPal Needs an Intervention

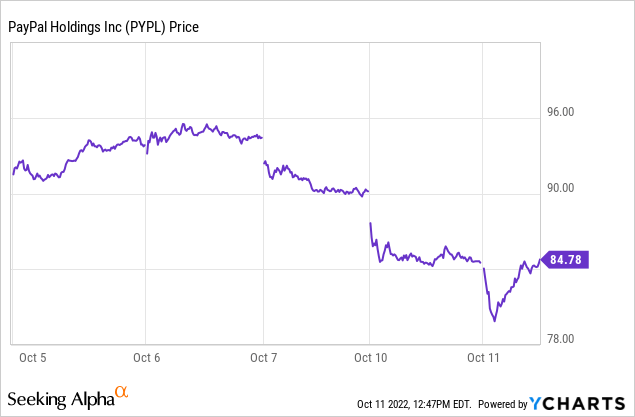

While markets were open yesterday, Columbus Day, trading was thin. This morning, however, as markets opened, PayPal took the full brunt of user and investor outrage as expressed over the holiday weekend on Twitter. PayPal plunged from October 7th, and again at the open this morning, as seen below, before being “rescued” somewhat. The rescue makes sense because PayPal shares are owned mostly by institutions, and mutual funds like BlackRock who, likely, hope to avoid losses.

PayPal Holdings (and its associated entities, including Venmo) are in a crisis of confidence. Reading the company’s investor relations news site, it does not appear they seem aware of that. They seemed quiet over the weekend, save for that single notice that they were dropping the AUP. They shouldn’t have been.

While self-inflicted, and far less important because no lives are at stake, this is not unlike the 1982 Tylenol Crisis that became a textbook example of how to manage a crisis of consumer confidence. Unlike Johnson & Johnson (JNJ) in the Tylenol situation, PayPal has been late to pick up on the importance of media relations in this time of crisis.

Pay Pal’s president, Dan Schulman, should be out-in-front in the financial press — particularly Fox Business and the Wall Street Journal — on an “apology” tour to right the damage done over the weekend.

These are the steps I would advise PayPal to take to rescue its business model from a public that is rightfully circumspect:

1. Add a high-profile conservative to its board. Retiring Pennsylvania Senator Pat Toomey, who serves on the Banking, Budget, and Finance committees. would be a perfect fit.

2. Entirely abandon the notion of requiring users to agree to “liquidated damages” of any amount.

3. Instead, require only that users submit to arbitration of disputes, as with most other financial institutions.

4. Provide some limited period, say 90 days, for anyone whose accounts were suspended or whose funds were taken as damages, to apply for reinstatement and refund of any “liquidated damages” that may have been claimed.

5. Name a respected, unassailable, independent and bipartisan board to review any future updates of PayPal’s user agreements.

Investment Thesis

There’s no way of telling whether Schulman and his team will awaken to their crisis. It doesn’t seem they will and may, perhaps, dismiss the controversy as existing only in what they believe to be a small corner of Right-wing media and conservative users of its site. That would be foolish, because fixing things is a low-cost, high-impact, strategy to restore confidence.

They may be right, of course; this is all Right-wing paranoia. But even unaligned vendors must acknowledge that PayPal’s policies — nebulous and subjective — are inherently risky to their businesses and accounts and may be having second thoughts.

The stock has already suffered significantly, but it seems unlikely it will be hurt more. Since there is no way to tell how PayPal management will react in this crisis, it is advisable for current owners to hold their position, maybe with a stop-loss or put.

At the first sign the PayPal executive team starts executing on the kind of crisis management I suggest, one might buy call options at a range about 20% higher than the then-current price. Retail investors might do well to keep PayPal in their news feed and jump in at that trigger point.

____________________________

Note: Our commentaries most often tend to be event-driven. They are mostly written from a public policy, economic, or political/geopolitical perspective. Some are written from a management consulting perspective for companies that we believe to be under-performing and include strategies that we would recommend were the companies our clients. Others discuss new management strategies we believe will fail. This approach lends special value to contrarian investors to uncover potential opportunities in companies that are otherwise in a downturn. (Opinions with respect to such companies here, however, assume the company will not change).

Be the first to comment