R.M. Nunes

Note: The image above shows Quebec city. This article first appeared on Trend Investing on November 17, 2022, when TSXV:PMET was at CAD 4.93; however, it has been updated for this article.

Patriot Battery Metals 5-year price chart – Price = CAD 7.05, USD 5.17 (source)

Yahoo Finance![Patriot Battery Metals 5 year price chart [TSXV:PMET]](https://static.seekingalpha.com/uploads/2022/12/15/37628986-16711626953515542.png)

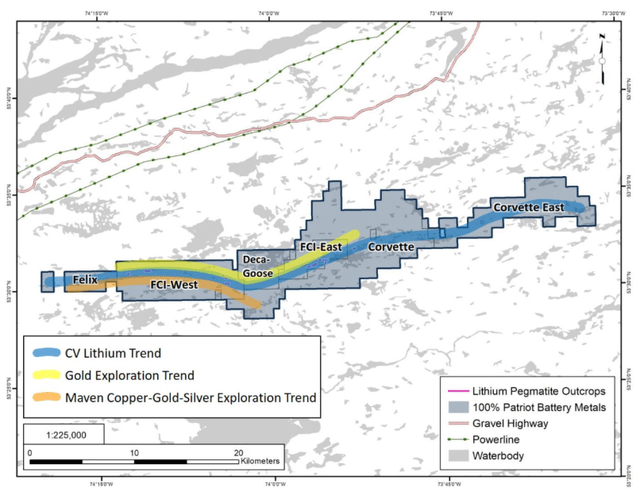

Patriot Battery Metals Inc. (OTCQX:PMETF, TSXV:PMET:CA) (“Patriot”) is a Canadian company focused on their 100% owned Corvette Lithium Project in James Bay, Quebec, Canada. The Corvette Project is spread over a 214 km2 tenement package (in the La Grande Greenstone Belt), with in excess of 70 lithium-bearing pegmatite outcrops discovered over 20+ km trend (plus an additional 20+ km of trend remaining to be assessed by the Company). The project is still at a very early stage but shows very good drill results to date.

Other projects

Patriot also has many other early-stage projects and interests, as you can read here. For lithium in Quebec they also have Pontax (lithium and gold), Lac du Beryl (lithium and gold), Eastmain (lithium, located proximal to the James Bay Deposit held by Allkem). In the NWT, they own a 40% share of a JV on the Hidden Lake Lithium Project (lithium 1.6% Li2O over 9.2m). Plus there is the promising Carmen Creek Prospect in Idaho, USA (surface samples of 5.5 g/t Au, 159 g/t Ag, and 9.75% Cu) and the Golden Silica Project in British Columbia, Canada (high purity silica prospect).

Today we are focusing only on the Corvette Lithium Project.

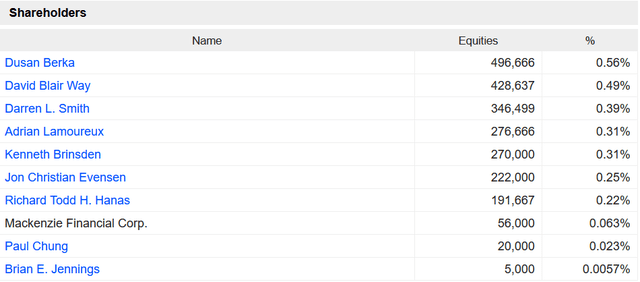

Corvette Lithium Project

Location map of the Corvette Lithium Project in Quebec, Canada

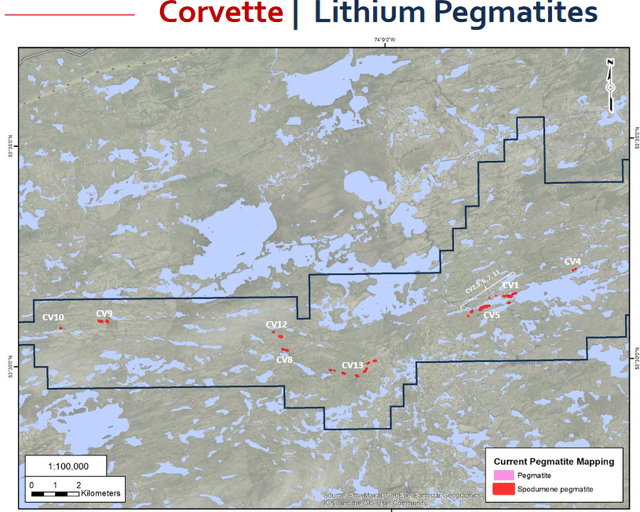

The Corvette Project does not yet have a resource; however, drill results have been very good. Patriot has defined its various pegmatite deposits naming them “CV1” and “CV2,” etc. As shown below in red most deposits are associated with spodumene, a very promising sign.

Patriot’s Corvette Lithium Project tenement showing the CV pegmatite discoveries to date

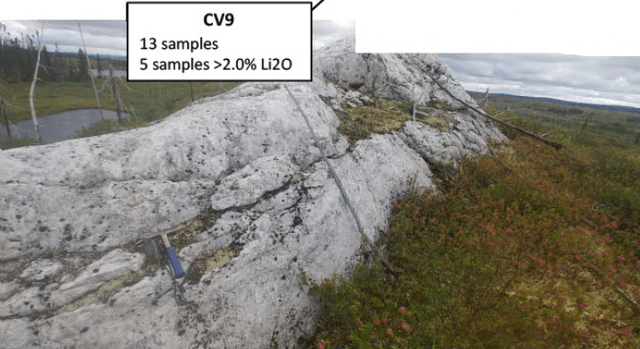

CV9 shows another outcropping of pegmatite (source)

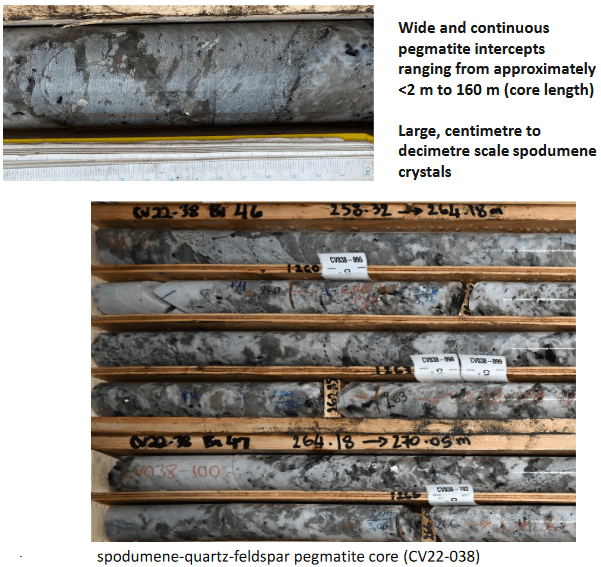

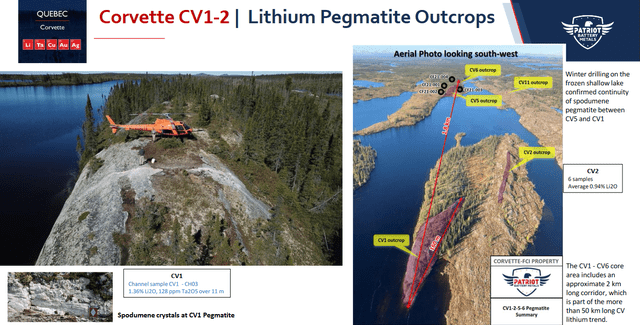

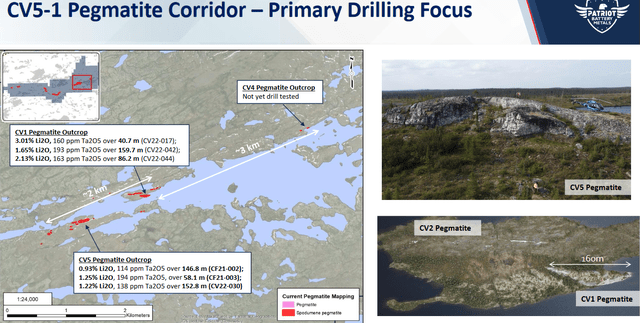

Drilling to date indicates a strike length of at least 2.0 km for the principal pegmatite body (CV1-CV6) with drill intercepts ranging from <2 to 160 m (core length) at good grades. CV5 is currently the largest outcropping deposit and was discovered in Sept. 2021 with a drill result of 0.93% Li2O and 114 ppm Ta2O5 over 146.8m.

The CV5 outcropping pegmatite measures 220m x 40m

Winter drilling on the frozen shallow lake confirmed the continuity of spodumene pegmatite between CV1 and CV5.

Images showing the CV1 to CV6 pegmatite corridor separated by a shallow lake

Sample drill results (at CV5)

- CF21-001: 0.93% Li2O and 114 ppm Ta2O5 over 146.8m.

- CF21-002: 0.94% Li2O, 117ppm Ta2O5 over 155.1m.

- CF21-003: 1.25% Li2O, 194ppm Ta2O5 over 58.1m

- CF21-004: 1.13% Li2O and 180 ppm Ta2O5 over 30m.

(Source: Patriot Battery Metals).

- CV22-052: 0.97% Li2O over 104.5 m (124.7 m to 229.3m)

- CV22-040: 1.42% Li2O over 61.9 m (214.0 m to 275.9m)

- CV22-048: 1.42% Li2O over 47.4 m (181.3 m to 228.7m)

(source).

- CV22-042: 1.65% Li2O and 193 ppm Ta2O5 over 159.7 m (from 131.8 m downhole)

(source).

Drill cores have been seeing large, centimeter to decimeter scale spodumene crystals

Company presentation

Huge exploration upside

The main 2.2km pegmatite strike from CV1-CV6 remains open along strike at both ends and at depth. Spodumene-bearing pegmatite has been encountered down to a vertical depth of approximately 315m.

Drilling to date has mostly been confined to the CV5 pegmatite. A third drill rig has been active at the CV13 pegmatite cluster for initial drill testing since early Sept. 2022.

As of October 5th, 2022, a total of approximately 23,497m over 80 holes have now been completed over the 2022 drill campaign, with 37 drill cores currently en route to or in process at the analytical lab.

The 2022 drill program plans to continue to step out to expand knowledge of the pegmatite corridor.

Patriot states (regarding the 2.2km strike length):

The high number of well-mineralized pegmatites in this core area of the trend indicates a strong potential for a series of relatively closely spaced/stacked, sub-parallel, and sizable spodumene-bearing pegmatite bodies, with significant lateral and depth extent, to be present.

Regarding the potential resource size just at the 2.1km (later updated to 2.2km) strike length corridor CEO Blair Way comments (from 30:45 min mark in the CEO video):

With a 2.1km corridor even around 100m thick and 300m deep…it appears to be well and truly into the three digits…I think we will easily be over the 1.0, 1.2%….

Our interpretation of the above comment is CEO Blair Way is saying the target resource (just in the 2.1km strike zone) is 100 million tonnes of spodumene at 1.0-1.2% Li2O.

Minerology is favorable at Corvette

The Corvette Project appears to have excellent minerology with lithium found predominantly as spodumene and also some tantalum (useful for by-product credits).

Patriot states:

Spodumene is the dominant lithium-bearing mineral present – of the samples probed grading >0.4% Li2O, spodumene accounts for 86-99% of the lithium deportment…. Columbite/tantalite are the dominant tantalum bearing minerals present….Preliminary Heavy Liquid Separation (“HLS”) tests on drill core from the CV5 Pegmatite (CF21-001 and 002) at two different crush sizes support a potential flowsheet using Dense Media Separation (“DMS”) followed by magnetic separation to produce a 6+% Li2O spodumene concentrate…. Spodumene in the metallurgical samples from the CV5 Pegmatite is very coarse grained and liberates effectively at -6.5 mm and -9.5 mm crush sizes which has the potential to reduce the power intensity of the flowsheet due to less grinding.”

Note: Overall lithium recovery rate exceeded 70% from the above testing.

Access and infrastructure

Access is via an all-weather road located 15kms from the Project.

Infrastructure is limited at the site however it is only 15km to the high-voltage power lines powered by green “hydro” electricity.

Road and power access are 15km away from the Corvette Project. The Project may also be prospective for copper and gold

Next steps/catalysts

The next steps and near-term catalysts are further assay results from the 20,000m three rig 2022 drill program, then a large drilling program in 2023.

Beyond that investors can expect a maiden resource to be announced perhaps later in 2023 or 2024, followed by a Scoping Study/PEA/PFS shortly thereafter.

CEO Blair Way thinks permitting won’t be a problem.

Longer term, Patriot plan to become a spodumene concentrate producer, perhaps by 2026, all going well.

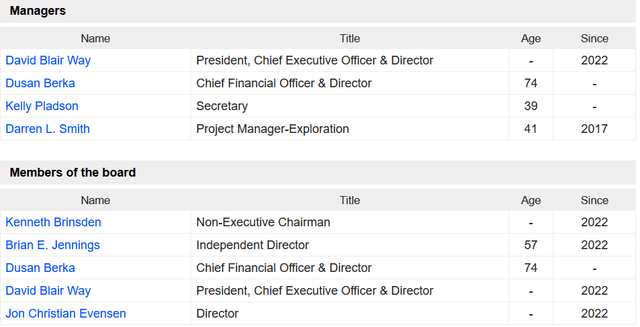

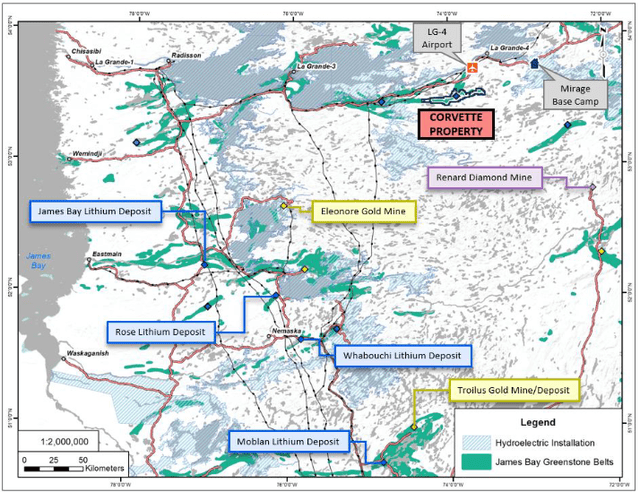

Management, Board and top shareholders

Patriot President & CEO is Blair Way with over 30 years of management experience within the resources and construction industry throughout Australasia, Canada, the United States, and Europe.

Of particular interest is new Board member Ken Brinsden, who was the very successful CEO at Pilbara Minerals. His choice to join Patriot rather than to retire gives a hint of the potential for the company.

Details on the Board and Management are here.

Insider ownership looks to be low at <3% (see chart below).

Managers, Board, & largest Shareholders (source)

Market Screener Market Screener

Valuation

Patriot’s current market cap is C$638m (US$468m), with no debt and C$20m recently raised in cash, plus C$7m as of Sept. 2022.

Yahoo Finance shows an analyst’s price target of C$8.76. Market Screener also shows the analyst’s consensus price target is C$8.76, representing 24% potential upside.

Risks

- Falling lithium prices.

- The usual mining risks – Exploration, permitting, production, partner, environmental, sovereign risks.

- Business risks – Management, liquidity, debt, and currency risk.

- Sovereign risk – Low in Canada.

- Stock market risks – Dilution, lack of liquidity (best to buy on local exchange), market sentiment, volatility.

- In the case of Patriot Battery Metals the main risks relate to the early stage and the fact that the stock price has already run up a lot due to the potential of the Corvette Project.

Recent news

- Dec. 13, 2022 – Patriot Drills 113.4 m of 1.61% Li2O, including 2.0 m of 6.41% Li2O, at the CV5 Pegmatite, Corvette Property, Quebec

- Dec. 6, 2022 – PATRIOT BATTERY METALS COMMENCES TRADING ON THE ASX

- Nov. 9, 2022 – Patriot Battery Metals Lodges ASX Prospectus

- Nov. 2, 2022 – Patriot Battery Metals Provides Exploration and Corporate Update

- Oct. 12, 2022 – Patriot Drills 104.5 m of 0.97% Li2O and 61.9 m of 1.42% Li2O, and Extends Strike Length of Mineralization to 2.2 km at the CV5 Pegmatite, Corvette Property, Quebec

- Oct. 6, 2022 – Patriot Announces Closing of $20M Flow-Through Financing

- Sept. 8, 2022 – Patriot Acquires the Pontois West Lithium Property, Expanding its Land Position in the La Grande Greenstone Belt, James Bay, Quebec

- Aug. 31, 2022 – Patriot Announces Best Drill Intercept to Date – 1.65% Li2O over 159.7 m, including 4.12% Li2O over 9.0 m – at the Corvette Property, Quebec

- Aug. 23, 2022 – Patriot Battery Metals Appoints Former Pilbara Managing Director and CEO Ken Brinsden as Non-Executive Chairman and Director

Further reading

About Patriot Battery Metals (source)

Conclusion

Patriot Battery Metals is still in the early stage of exploring and drilling their 100% owned Corvette Project, in northern Quebec Canada. Most drilling to date has been done at the CV5 pegmatite (and CV1, CV13) which has resulted in very good drill results and strong spodumene showings. The project has a huge exploration upside and drilling is ongoing. Certainly, the potential is there for a large-scale spodumene project. Mineralogy looks very positive (helped by coarse grades spodumene crystals) in preliminary testing producing a 6+% Li2O spodumene concentrate. Access and infrastructure are limited at site, however, all-weather road access and hydro power lines are only 15 kms away.

Next steps are further drilling (multiple assay results are due soon) leading towards a possible maiden resource announcement perhaps later in 2023 or 2024, followed soon after by a Scoping Study/PEA/PFS.

Valuation is hard to say due to the early stage and no resource yet, but on a market cap of C$638m (US$468m) looks to be fully valued for now. Ultimately it will depend on how big the resource grows and how Patriot progresses to production. Analysts’ consensus price target is C$8.76, representing 24% potential upside. The fact that Patriot has numerous other projects is also a nice positive.

Risks are the usual mining risks, especially for companies at the exploration stage. Please read the risks section.

Certainly, there is enormous potential for Patriot Battery Metals and we rate them in our top 5 Canadian lithium companies at this time.

We rate Patriot Battery Metals as a speculative accumulate on dips for investors with a 5-year plus time frame.

As usual, all comments are welcome.

Be the first to comment