Bank OZK

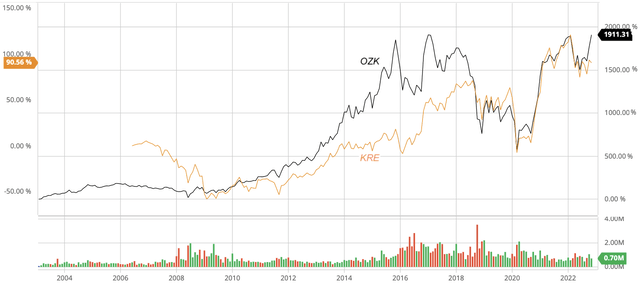

Banking stocks have been torn between rising interest rates, which is seen as a bullish factor for the sector, and worries over a global recession amid the rate hikes by the central banks. Such a confusion can be seen in the SPDR S&P Regional Banking ETF (KRE) (Fig. 1).

Fig. 1. Stock chart of SPDR S&P Regional Banking ETF (KRE), as compared with Bank OZK (NASDAQ:OZK), dividend back-adjusted (modified from Barchart and Seeking Alpha)

In this article, I intend to analyze Bank OZK (OZK), a Little Rock, Arkansas-headquartered commercial bank. Bank OZK is one of the 23 regional banking stocks in the elite group of dividend champions.

From Jasper to Little Rock and beyond

Bank OZK traces its origin to 1903 in Jasper, Arkansas. It would have been just another community bank in the small town, had George G. Gleason II – an Arkansas lawyer – not bought the control of it, with $10,000 in cash, a $3.6 million loan, and the family farm and family trust as collateral.

In 1979, when Gleason acquired the bank at the age of 25, it only had $28 million in assets. He slowly grew the bank to five branches. By 1995, Gleason seems to have been ready for bigger things; he changed the name of the bank to “Bank of the Ozarks” and moved the headquarters to Little Rock. Two years later, the bank went public with $300 million in assets. With growth capital from the public listing, the bank expanded to North Carolina and Texas, respectively, in 2001 and 2003.

The global finance crisis provided a golden opportunity for Gleason to expand. Taking advantage of an FDIC program that was designed to assist sound banks to take over failing peers, Gleason bought seven banks by 2011. Six more banks were acquired over the next five years.

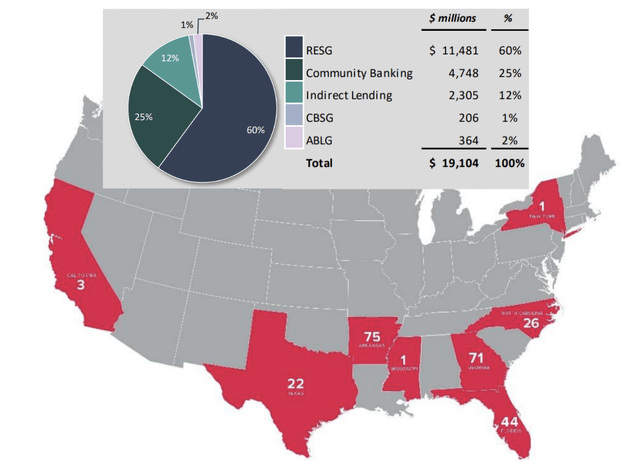

By 2020, when the bank moved into a new 225,000 sq-ft office building in West Little Rock, it had $27.2 billion in assets, operating in 8 states with 243 offices (Fig. 2).

Fig. 2. The footprint of Bank OZK, shown with non-purchased loans by lending group as of September 30, 2022 (modified from Bank OZK)

Profitable growth

As a commercial bank, OZK takes money from trusting depositors in its network of 231 branches, and loans the money out mainly to commercial clients in real estate development (60% of non-purchased Loans), and small businesses and consumers (25%). OZK pays the depositors at a specific rate of interest but collects from debtors a higher rate than what is paid to depositors, thus pocketing the spread between the interest rates and generating huge returns on its tangible capital.

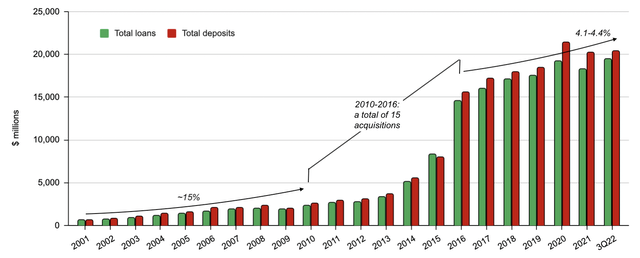

From 2001 to 3Q2022, Bank OZK grew deposits from $678 million to $20.4 billion at a CAGR of 16.9%, and expanded loans from $616 million to $19.5 billion at a CAGR of 17.2% (Fig. 3).

- It is worth pointing out that much of the growth was accomplished in the 7 years immediately following the global financial crisis when OZK made 15 acquisitions.

- Since 2016, deposits and loans have been growing at moderate annual rates of 4.1% and 4.4%, respectively. Now a much bigger business, OZK apparently was no longer able to post ~15% per-year organic growth as it had done in 2001-2009.

Fig. 3. Total deposits and loans of Bank OZK at period end from 2001 to 3Q2022 (Compiled by Laurentian Research for The Natural Resources Hub based on financial filings of Bank OZK and Seeking Alpha)

Profitability

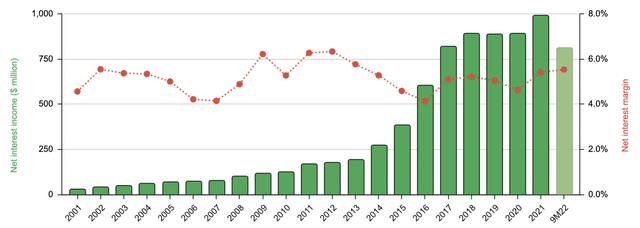

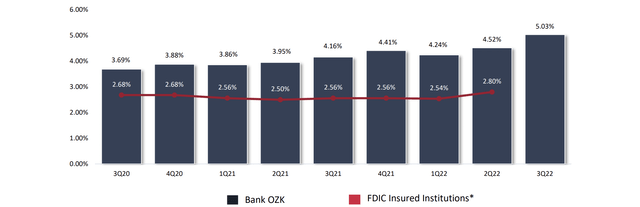

OZK was able to achieve a net interest margin – i.e., the spread between the interest rates of the loans and the deposits – between 4.0% and 6.3% (Fig. 4). Such high net interest margins left the industry average in the dust (Fig. 5).

Fig. 4. Net interest income (lhs) and net interest margin (RHS) of Bank OZK (compiled by Laurentian Research for The Natural Resources Hub based on financial filings of Bank OZK and Seeking Alpha) Fig. 5. Bank OZK compared with the industry in terms of net interest margin (Bank OZK)

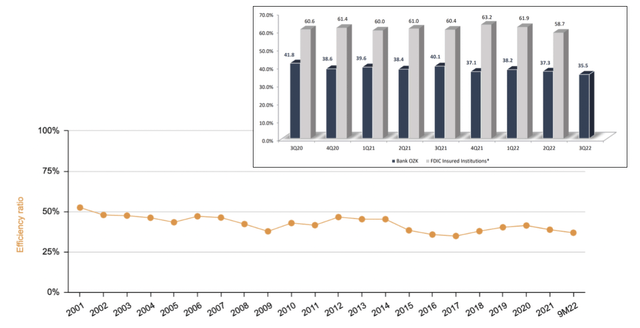

While the net interest margin highlights how a bank is doing in attracting low-cost deposits and lending out money to debtors who are willing to pay higher interest rates, the efficiency ratio is used by financial analysts to measure how efficiently a bank runs its operations. The efficiency ratio is derived by dividing non-interest expenses, including G&A, with revenue so the lower it is, the more efficiently the bank is being operated.

- Bank OZK averages 38.0% in efficiency ratio since 2016; in other words, it costs OZK only 38 cents to pull in every dollar of revenue. OZK again compares favorably with the banking industry average, which has an efficiency ratio around 60% (Fig. 6).

- Better yet, the efficiency ratio has been declining over the past 22 years, thanks to economies of scale and an expanding customer base.

Fig. 6. The efficiency ratio of Bank OZK, as compared with that of the industry (inset) (compiled by Laurentian Research for The Natural Resources Hub based on financial filings of Bank OZK and Seeking Alpha, with the inset from Bank OZK)

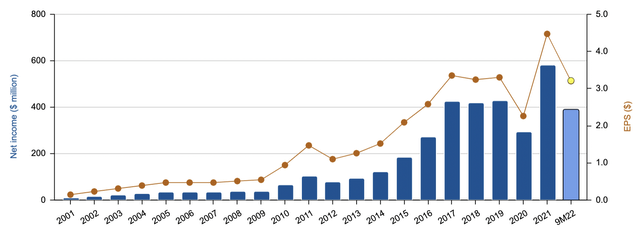

Interest income accounts for ~80% of the total revenue of Bank OZK. Between the high net interest margin (Fig. 4), low efficiency ratio (Fig. 6) and expanding business (Fig. 3), OZK was able to post rising net income and earnings per share (or EPS), as illustrated in Fig. 7.

Fig. 7. Net income and EPS of Bank OZK for 2001-2021 and the first 9 months of 2022 (compiled by Laurentian Research for The Natural resources Hub based on financial filings of Bank OZK and Seeking Alpha)

Dividends

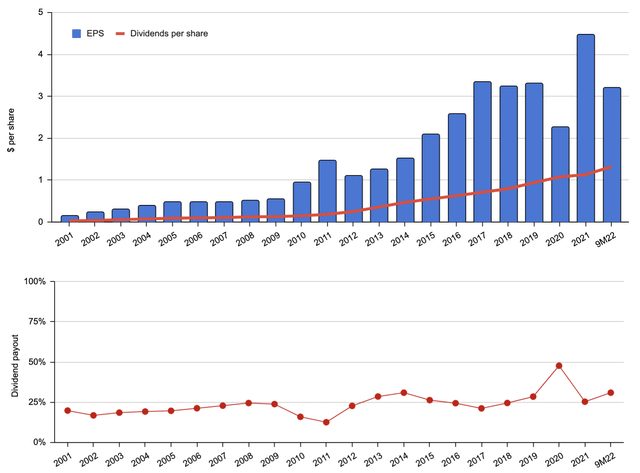

Bank OZK has been raising dividends for 25 consecutive years and is a member of the dividend champions, as I discussed previously. From 2001 to date, OZK has been raising dividends at a CAGR of 19.2%; since 2016, however, the dividend growth rate moderated to a CAGR of 11.6% (Fig. 8). At the 11.6% dividend growth rate, the 2.85% forward yield will compound to 8.53% in 10 years.

- It is worth emphasizing that the dividends of OZK are likely safe, not only because of the high-quality assets but also thanks to the low payout. Over the last six years, the payout ratio averages only 29%. Even in 2020, an especially tough year, dividend payments were more than adequately covered by the earnings.

Fig. 8. Bank OZK earnings and dividends per diluted common share (upper) and dividend payout (lower) (compiled by Laurentian Research for The Natural Resources Hub based on financial filings of Bank OZK and Seeking Alpha)

Valuation

Bank OZK is valued at 1.30X of book value, 1.54X of tangible book value, and 10.58X of earnings. Over the last 13 years, however, the P/B of OZK was between 0.49X and 3.87X with a median at 1.89X; the P/Tangible book value was between 0.63X and 4.89X with a median at 2.36X; and the P/E was from 6.12X to 27.90X with a median at 14.86X. Therefore, OZK appears to be undervalued relative to the median historical multiples. Despite it being a higher-quality business with an ROE of 12.11%, OZK is valued at similar multiples to its peers.

Assuming an annual dividend growth rate of 11.6% for additional 10 years followed by a terminal period of zero growth, I arrived at an intrinsic value estimate of ~$71 per share, which implies the current share price carries a 35% discount.

Risks

Warren Buffett said,

“In the end, banking is a very good business unless you do dumb things. You get your money extraordinarily cheap and you don’t have to do dumb things. But periodically banks do it, and they do it as a flock, like international loans in the 1980s. You don’t have to be a rocket scientist when your raw material cost is less than 1.5%.”

According to Buffett, for banks the greatest risk lies in that they may follow other bankers into making popular loans that will eventually turn out to be bad.

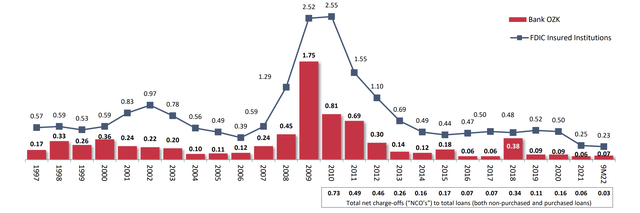

That seems not to be the case for Bank OZK. Since 1997, its annual net charge-off ratio has averaged only ~1/3 of that of the industry, outperforming the industry average in every single year (Fig. 9).

Fig. 9. The annual net charge-off ratio for Bank OZK, as compared with industry average (Bank OZK)

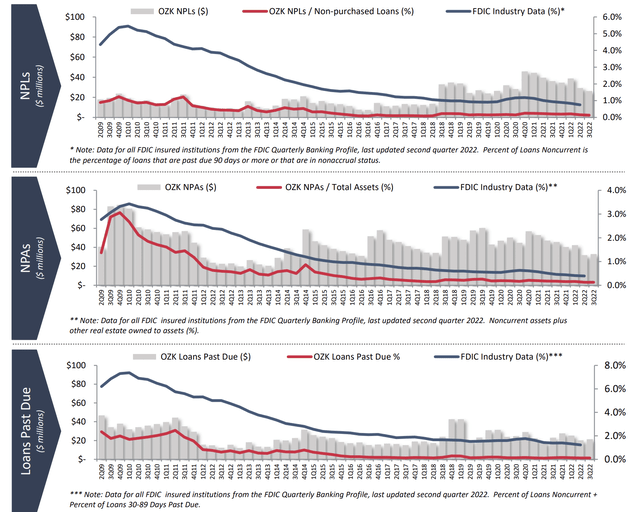

The industry-leading net charge-off ratio resulted from OZK’s prudent lending practice. Its ratios for non-performing non-purchased loans, non-performing assets (excluding purchased loans), and non-purchased loans past due 30+ days (including non-accrual non-purchased loans) all outperformed industry averages (Fig. 10).

Fig. 10. The NPLs/Non-purchased loans, NPAs/Total assets, and Loans past due ratios of Bank OZK, as compared with industry averages (Bank OZK)

Chairman and CEO Gleason has been on the job for 45 years; however, he seems to be getting yet better, as can be seen by OZK’s industry-leading net interest margin, declining efficiency ratio, and asset quality. Gleason runs a tight ship, maintaining the efficiency ratio at ~38.0%. For example, OZK closed its retail banking branch in New York City in August 2021. A hard worker since boyhood, Gleason said,

“I tell the people who work closely with me every day, if you want to work for the Bank of the Ozarks, you need to be willing to come to the office and run up Mount Everest every day. However well we did something yesterday, we want to try to do it better today and even better tomorrow. It is a constant quest for improvement.”

It is great to have an owner-CEO running the show. The insiders own some 6.3% of the shares outstanding, which partly explains why the company has been so faithfully raising dividends year in, year out for some 25 years. On November 14, 2022, OZK announced it would repurchase an additional up to $300 million of its outstanding shares.

Investor takeaways

From its impressive asset quality, profitability and organic growth track record, I believe that Bank OZK is one of the best-run regional banks in America.

With forward dividends of $1.32 per share and a dividend yield of 2.85%, OZK may seem not to be so interesting to high-yield income investors. However, as a banking stock with an ROE of 12.11%, it may attract dividend growth investors under the following condition.

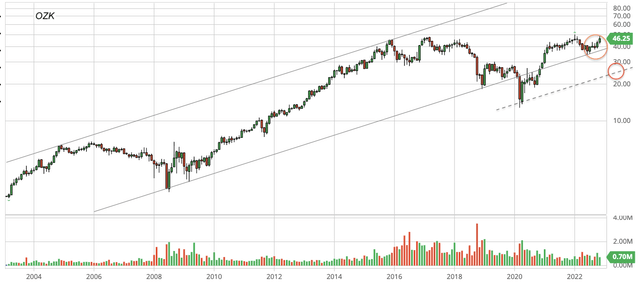

To fortress-like OZK, a recession will probably hand Gleason another M&A opportunity. Should a recession indeed occur, I am prepared to pick up shares of OZK in the $20s neighborhood, where the forward yield will be ~6% and the margin of safety will be in my opinion, huge (Fig. 11).

Fig. 11. Stock chart of Bank OZK, dividend back-adjusted (modified after Barchart and Seeking Alpha)

Be the first to comment