Evkaz

Despite poor inflation data yesterday, the market surged, with the Dow Jones Industrial Average rising more than 800 points. Nonetheless, there are opportunities to be found in a market that is becoming increasingly difficult to understand.

Ladder Capital Corporation (NYSE:LADR) is one such company, and despite the fact that commercial mortgage real estate investment trusts have taken a beating recently, I believe there is a long-term investment opportunity for income investors to purchase the stock.

In the second quarter, Ladder Capital benefited from strong originations and continued to cover its dividend with distributable earnings.

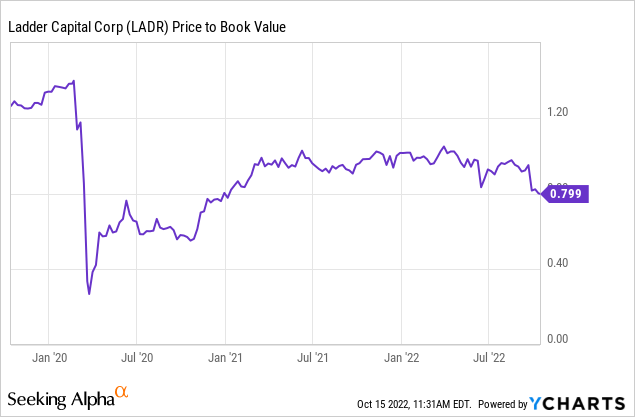

I believe the market is overpricing LADR at 0.8x book value, and the margin of safety here is excessive.

Would You Want To Buy A Stock That Just Raised Its Dividend?

Ladder Capital increased its quarterly dividend by $0.01 per share in September, bringing the total annual dividend payout to $0.23 per share per quarter and $0.92 per share per year.

Even though the $0.01 per share dividend increase is small (but not insignificant), the commercial mortgage real estate investment trust has sent a strong signal to the market. It believes its earnings will be sufficient to pay income investors a stable dividend even in a more choppy and volatile market.

Since the stock fell precipitously in 2022, income investors seeking passive income now have the opportunity to purchase Ladder Capital at a 9.5% stock yield and a 20% discount to book value.

Ladder Capital’s book value multiple is nonsense, and it cannot be justified based on the trust’s portfolio or distributable income performance, in my opinion.

While mortgage trusts have been under pressure recently as a result of the central bank aggressively raising interest rates and driving up mortgage rates, the discount to book value for Ladder Capital appears excessive and difficult to justify.

Ladder Capital’s stock is presently valued at 0.8x book value.

With that said, I believe Ladder Capital represents excellent value for passive income investors, at least at this price. Of course, the large discount to book value provides a significant margin of safety for income investors as well, so even if mortgage originations fall as interest rates rise, Ladder Capital’s low valuation provides a layer of protection that investors rarely have access to.

Why Higher Interest Rates Might Actually Help Ladder Capital

Too many investors are only concerned with the cost side of the mortgage origination business, which means that when interest rates rise, mortgage costs rise as well, making it more difficult for companies to find profitable investment projects in the commercial real estate market.

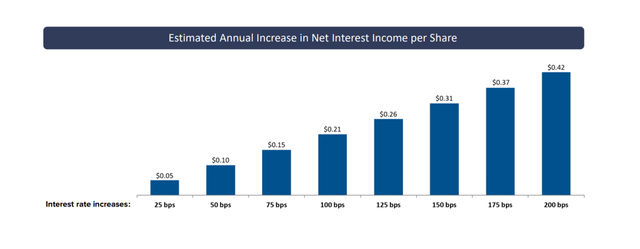

Ladder Capital’s loan investments are made up of 90% floating rate loans, which are expected to boost net interest income in a rising-rate interest market. According to Ladder Capital, a 100-basis-point increase in interest rates will benefit the trust handsomely.

Interest Rate Increases (Ladder Capital Corp)

Ladder Capital’s Dividend Is Covered

The 20% discount to book value implies that Ladder Capital’s dividend is risky, despite the fact that it is not.

To begin, Ladder Capital recently increased its quarterly dividend by $0.01 per share, and trusts typically do not increase their payouts if they expect to have to reduce their dividends in the near future.

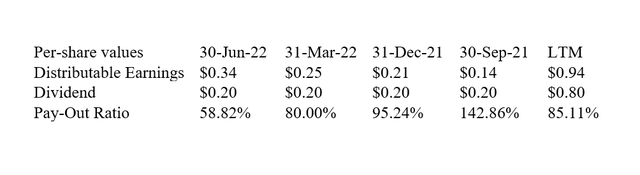

Second, Ladder Capital has consistently covered its dividend pay-out with distributable earnings over the last year, as evidenced by a pay-out ratio of 85% over the last twelve months.

Dividend And Pay-Out Ratio (Author Created Table Using Trust Information)

Why Ladder Capital Might See A Lower Valuation

Inflation in September was 8.2%, which was higher than expected and only slightly lower than the 8.3% rate in August. Despite yesterday’s unexpected market surge, this provides yet another compelling case for the central bank to raise interest rates significantly in the coming months.

Higher borrowing costs, which are linked to higher interest rates, could cast the same shadow on Ladder Capital’s mortgage origination business in 2023.

On the other hand, fading inflation (and a lower risk of further rate hikes) would be beneficial to Ladder Capital and the commercial real estate sector.

My Conclusion

Ladder Capital’s 20% discount to net asset value reflects an opportunity to double down on a well-managed commercial mortgage real estate investment trust that could assist passive income investors in planning for retirement and financial independence.

Given that the trust recently increased its dividend and that the company continued to cover its dividend pay-out with distributable earnings in the second quarter, the discount appears exaggerated.

So far, 2022 origins have remained strong. Even though rising inflation and interest rates may cause a slowdown in commercial mortgage origination, I believe investors can secure a significant margin of safety here.

Be the first to comment