JHVEPhoto

Dear readers,

It was close to half a year ago that I wrote about Parker-Hannifin Corporation (NYSE:PH), a great dividend stock with a stellar history and superb products. While we since then experienced a drop-down that should have seen us seriously consider the company as an investment, I myself was investing in other businesses at the time, and completely missed writing an article on the business.

I will try to make up for that lack today, hopefully not too-little-too-late.

Let’s get going.

Revisiting Parker-Hannifin Corporation And Its upside

Now, remember Parker-Hannifin? It’s a company where I initially managed to deliver triple-digit profit due to investing at some incredible undervaluation during COVID-19. In fact, it was one of my Coronavirus discount articles back in 2020.

The business specializes in motion and control technologies. With a 104-year history, the company is old and has been publicly traded since the ’60s. Without exaggerating, Parker-Hannifin is one of the largest companies in the world specializing in these areas.

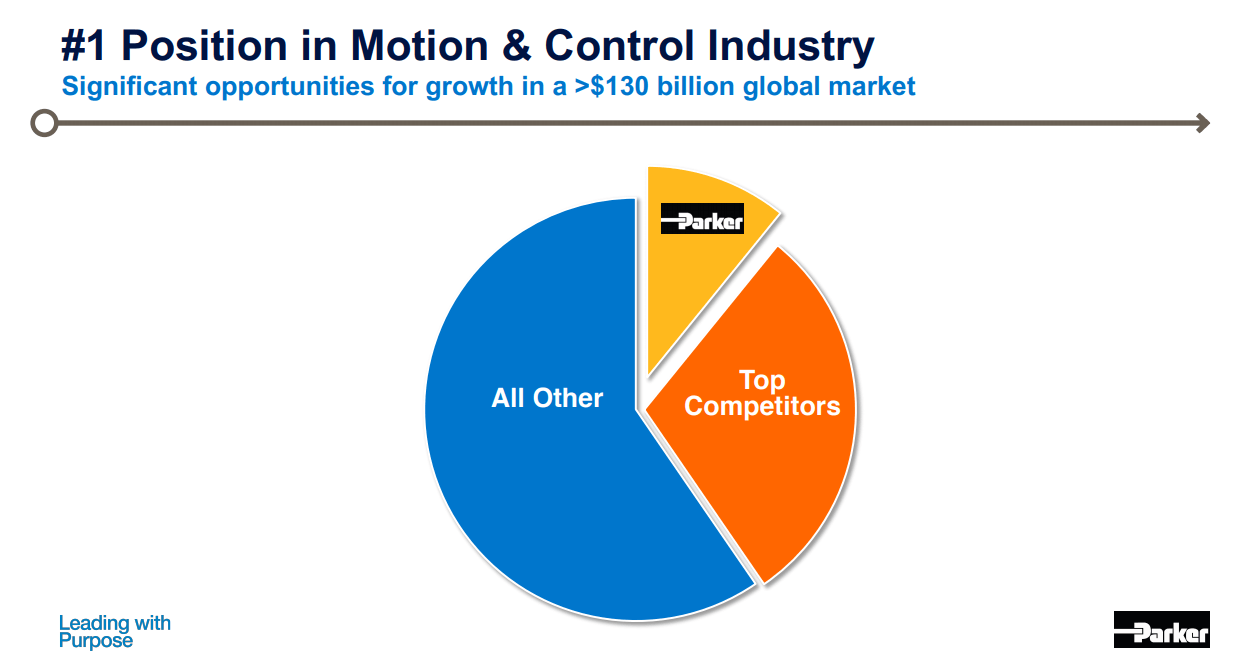

PH IR (PH IR)

This is a global market valued at $130B market, and Parker is the number one company here in terms of market share. Parker splits its operations first into “technologies,” with products found in a variety of different markets and reportable segments, which are contained in diversified industrial segments and aerospace systems, finding peers and competitors across the industrial and aviation sector, including giants such as Airbus (OTCPK:EADSF), Rolls-Royce (OTCPK:RYCEF) and COMAC.

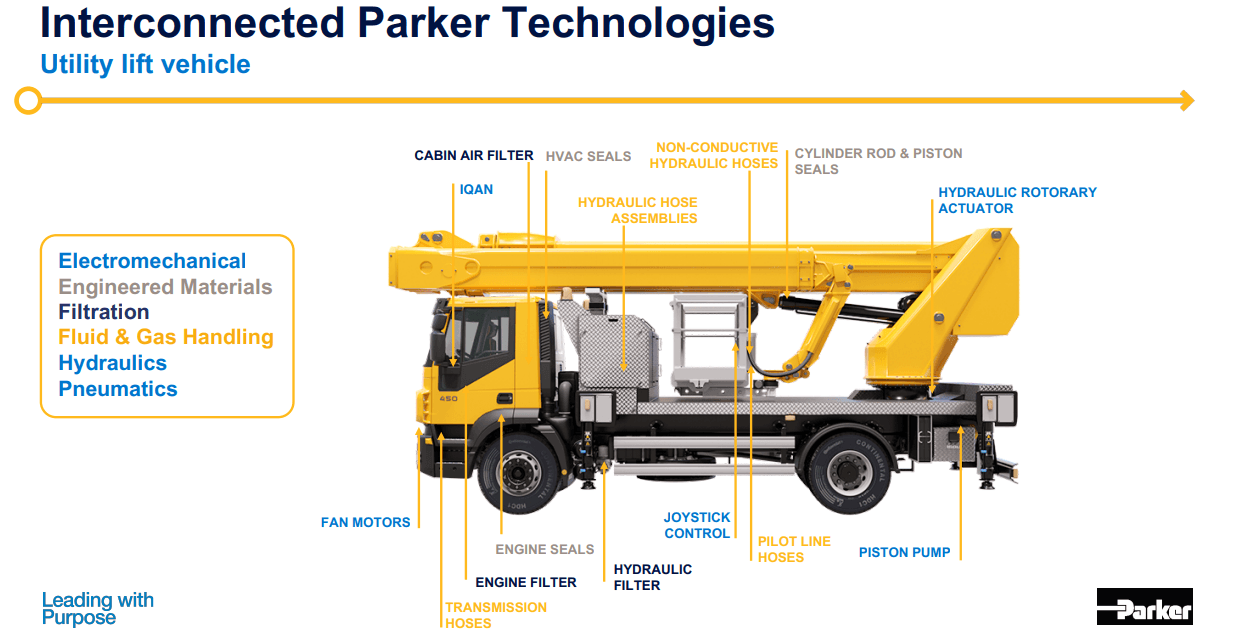

For those of you still wondering what PH does, here’s a bit of an infographic of a vehicle and the company’s role in what the vehicle does, and the corporation’s role in those operations.

PH IR (PH IR)

In its operations, the company employs nearly 60,000 people all over the world and is headquartered in Ohio.

So, Parker-Hannifin makes money by researching, developing, and manufacturing motion control technologies for mobile, industrial and aerospace systems across the world. This can involve everything from a simple pneumatic connector to an entire hydraulic system, wheels, brakes, or thermal management systems.

Even at just a surface level, this sort of business is appealing, and that’s why I invested in it in the first place. The company’s recent results are the 4Q22, and fiscal 2022 results – published only yesterday – and this quarter and year give us the following set of results.

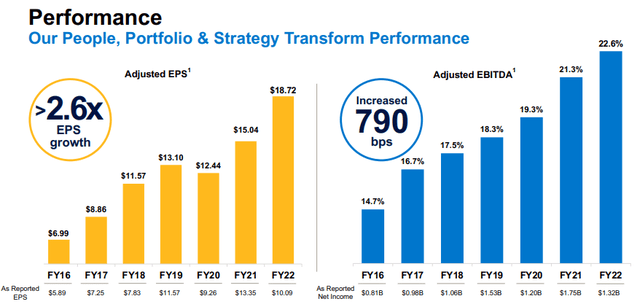

PH continued its superb track record with almost $16B in sales, and a 12% YoY organic sales growth since the past year. Despite all the headwinds, the company saw operating margin records over 20%, or 22.3% on an adjusted basis, representing a 120 bps YoY margin growth, and an operating cash flow margin of 15.4% of sales revenue.

The company’s performance over the past few years has been nothing short of spectacular, justifying much of the premium we’ve been seeing for Parker-Hannifin.

And the growth isn’t over. The company expects future sales to grow even further due to the company reinvesting more in the company, replenishing inventory levels, de-risking the supply chain, keeping M&A’ing strong companies like Meggit, Exotic, CLARCOR, and LORD, and riding the tailwind of the secular growth in:

- Clean technologies

- Electrification

- Digital

- Aerospace

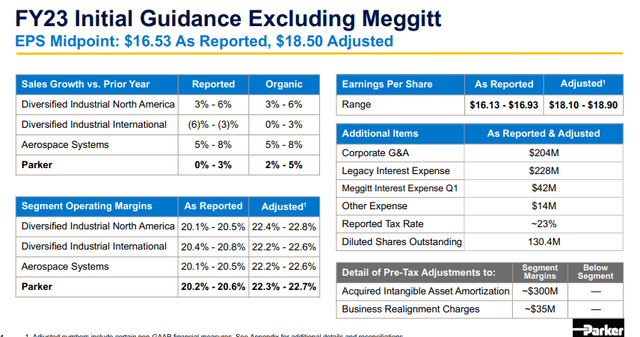

The company has also given us guidance for Fiscal 2023 – and that guidance comes around 3-6% organic growth compared to 2022, based on some of the aforementioned tailwinds.

The company has conservative debt, has a great track record of delivering actual growth in margins and earnings, and more than that has a superb history of managing high-class M&As which have been, without fail, accretive to both growth and margins for the company.

While not having worked personally with the company’s products in any direct way, I know of people even in Sweden who work with Parker, and their anecdotal evidence/opinion on the company is that the company’s thinking works – and results in higher sales and customer preference. Parker’s goal is to make “must-have” products of high value while at the same time improving margins and customer experience. This can only be done if the customer accepts the higher price point for Parker products – and so far, judging by results, customers do this.

Parker’s finances still look damn good. With a constantly growing EPS trend, the company sports a BBB+ credit rating and a conservative current leverage that does not in any way endanger the company’s overall fundamentals.

Managing a record 2022 in a very challenging environment is impressive enough, and the company fully expects to perform extremely well in 2022 as well.

PH is also doing an ongoing portfolio transformation, with the aim of turning the company into a longer-cycle and more resilient business. Meggitt is only the latest step toward this, and PH is expecting this merger to close in the next quarter.

The combination of this growth in trends and the company improving its operations calls for continued positivity on Parker-Hannifin. It’s hard to fault anyone for investing in the company, even at a slightly more expensive valuation, because the quality of Parker-Hannifin is just so high.

It’s hard to forecast exact trends, but it’s again, hard to fault the company’s forecasts, which are the natural way of development and the current industrial trends.

Based on this, I call the company’s expectations correct, and the forecasts likely.

Let’s look at how exactly this flows to the company’s valuation.

Parker-Hannifin Valuation

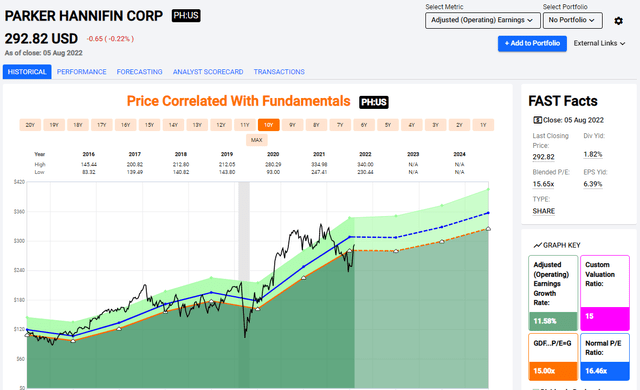

As mentioned, Parker-Hannifin typically trades at quite of a bit of premium between 15-20x P/E. During the crisis, as high as 22-23x. Obviously, we have no plans to invest even into such a great company at such multiples. The yield and the return potential are too low to interest us here.

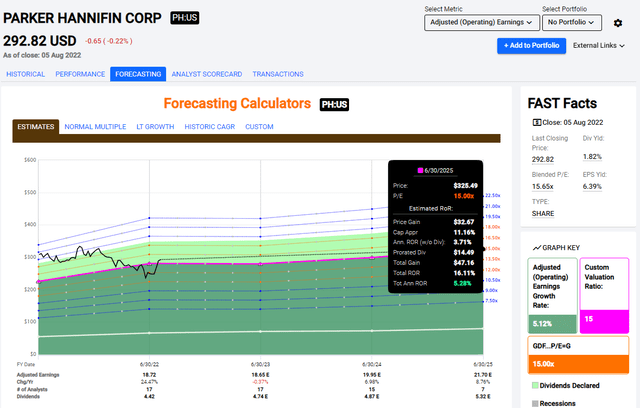

The company had a fairly recent dip which caused the share to trade at around 13-14x P/E, which would have been a great time to invest in PH at a double-digit potential RoR until 2024-2025.

Parker-Hannifin Valuation (F.A.S.T graphs)

In my article, when I rotated Parker-Hannifin, I wrote the following.

Given company earnings forecasts, it is indeed justified that company valuation increase somewhat to levels above 15X to 2021E, given expected EPS growth of 15% annually until 2024. However, when pushing the company to multiples such as these, we also need to take a much closer look at the accuracies and potential rates of return until such time.

When doing so, a few flaws start to appear in the thesis. Flaws that I consider serious enough to rotate profits here, and move on from Parker-Hannifin for the time being.

First, forecast earnings accuracy. Almost 50% of the time with a 10% margin of error, FactSet analysts miss the company’s estimate on a negative basis.

(Source: Seeking Alpha PH Article)

This decision proved to be entirely the right choice at the time because I was able to invest my triple-digit returns into many better-valued companies at the time. The analyst forecast accuracy is better today – the statistics only call for analysts missing around 29% of the time on a 20-year basis or 36% of the time on a 1-year basis.

In the end, it’s all about valuation. Investing in Parker-Hannifin at current levels can be done, but would give you returns of around 5.28% on a 15x P/E ratio on a forward basis.

As I see it, the company has traded close to, or around this valuation for enough periods of time that this is a real danger. Because investing at a 5% annual RoR isn’t enough, at this time, to potentially beat inflation.

At the premium of close to 16-17x, that upside grows to around 8-9% annually, or around 27% RoR until 2025. In one way, the company may seem appealing here based on just how fundamentally sound PH is. But at a sub-2% yield, the upside and returns here are simply pretty low compared to what else is available on the market today.

I consider a long-term fair value price target of P/E 15X to be the best bet here. That means that I won’t pay more than $270/share for Parker-Hannifin, which represents its premium of 15X seen in the average forecasted earnings.

When considering the company in such a fashion, the overvaluation is clear, and it should be clear why at least I consider this business to currently be a “HOLD”.

I also still do not consider options trading to be a particularly good idea here. Cash-secured puts that generate any sort of income are at prices that still fail to reach fair value, meaning it’s not a good buy. The capital outlay is also nearly $29,000, which I consider too much at this time.

S&P Global gives PH the following targets at this time. 16 analysts give the company an average range of $245 up to $494 per share, with an average target of $331/share. 9 out of the 16 analysts have a “BUY” at this time. This expresses the market’s confidence that PH may actually deliver a premium here. I don’t disagree that it might be a possibility. I just don’t want to bet on it at this particular time. S&P Global’s upside is around 13% on average. I consider it slightly overvalued and would stay my hand at the time and invest in other businesses instead.

Thesis

My thesis for Parker-Hannifin is as follows:

- Parker-Hannifin is a market leader in certain technologies, and a company that over the years has proven its ability to generate excellent earnings, as well as deliver on superb mergers and acquisitions. Its market sectors are through-cyclical, and secular growth trends should deliver continued upside here.

- However, the valuation at current times remains prohibitive for a market-beating upside. Only by assuming premiums of 16-18x do we see alpha, and this is not something I would want to invest in.

- Because of this, I remain at a “HOLD” here for the time being, and my PT for the company is $270.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (bolded).

This company is overall qualitative. This company is fundamentally safe/conservative & well-run. This company pays a well-covered dividend. This company is currently cheap. This company has realistic upside based on earnings growth or multiple expansion/reversion.

Thank you for reading.

Be the first to comment