DIGIcal

Introduction

In February, I wrote a bullish article on SA about Canadian death care company Park Lawn Corp (TSX:PLC:CA) (OTCPK:PRRWF) in which I said that it has a bright future and that its objective of reaching $150 million adjusted EBITDA and EPS of $2.00 by 2026 is achievable.

The company released its Q4 2022 financial results in early March and while they looked underwhelming at first glance as revenue growth dropped to single digits and operating margins deteriorated, it’s worth noting that Q4 2021 financials received a strong boost from Covid-19 as death rates across North America were elevated. Park Lawn has announced two significant acquisitions over the past two months, and I continue to think that it’s likely to achieve its 2026 goals. In my view, the decline in the market valuation of the company over the past week opens a good window of opportunity to open a position and I feel comfortable upgrading my rating on the stock to a strong buy. Let’s review.

Overview of the recent developments

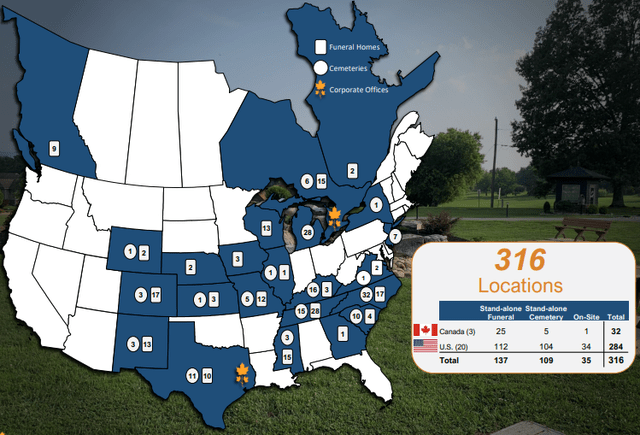

In case you’re not familiar with Park Lawn or my earlier coverage, here’s a brief description of the business. The company specializes in the operation of cemeteries, crematoriums, and funeral homes in Canada, and the USA and is Canada’s only listed death care company. Yet, 284 out of its 316 locations are located in the USA and about 90% of its revenues come from the latter.

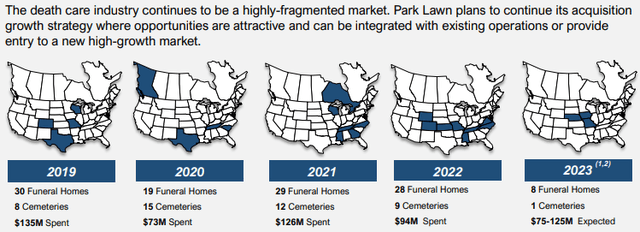

The number of the company’s locations has almost quadrupled since 2017 and the main reason behind this is an aggressive M&A strategy. In 2022 alone, Park Lawn made a total of 11 acquisitions for $94 million and it plans to invest another $75 million to $125 million into M&A during 2023.

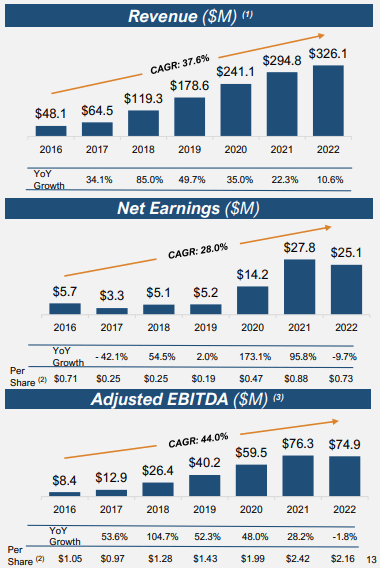

Considering the death care industry in North America generates annual revenues of about $22 billion and some 80% of the funeral home and cemetery locations in the USA and Canada are independently owned and operated, the company is unlikely to run out of acquisition targets anytime soon. Since my previous article, Park Lawn has announced two significant acquisitions (Speaks, and Meyer) which are expected to add a total of nine locations and boost adjusted EBITDA by around $4.09 million per year. Turning our attention to the financial performance of the business, we can see that revenue growth slowed significantly in 2022 while adjusted EBITDA dropped by 1.8% following years of double-digit growth. The reason for this included a return to normal following two years that benefitted from high demand for death care services in the USA due to Covid-19.

Park Lawn

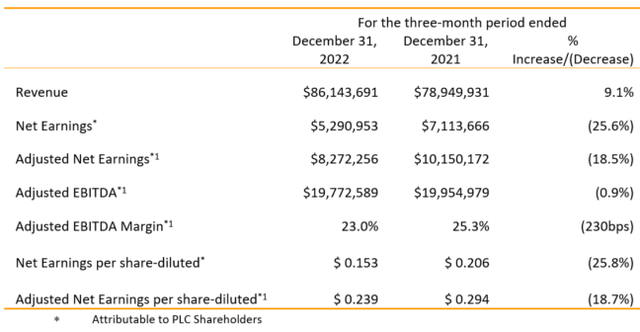

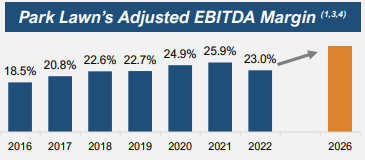

The effect of the end of the boost to the financial results from Covid-19 is most noticeable for Q4 2022 as revenues rose by just 9.1% to $86.1 million while adjusted EBITDA slumped by 18.5% to $8.3 million. Revenue from comparable operations (ex-M&A) decreased by 2% year on year. Considering the adjusted EBITDA margin is now close to 2019 levels, I expect revenues and EBITDA to start growing again by double digits over the course of 2023.

Turning our attention to the balance sheet, net debt increased by $73.3 million year on year to $253.3 million in December 2022 while the gearing ratio jumped from 37.2% to 51.4% but I think that Park Lawn is in a strong position to fund its growth in 2023 without significant stock dilution. The company has a quarterly dividend of C$0.114 (0.083) per share, which translates into an annual dividend yield of 1.74%. In my view, the size of the dividend is unlikely to be increased over the coming months due to the weaker state of the balance sheet compared to 2021.

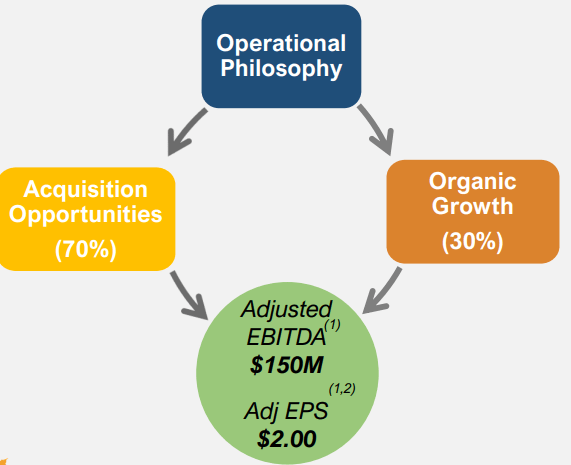

Looking at what to expect for the future, Park Lawn aims to reach annual adjusted EBITDA of $150 million and EPS of $2.00 by 2026 and I think this goal is likely to be achieved as I expect revenue and net income growth rates to surpass 20% by the end of 2023. Considering the company plans to achieve 70% of this growth through acquisitions, the objective should be fairly easy to complete in this timeframe.

Park Lawn

Valuation

Looking at the valuation of Park Lawn, the enterprise value stands at $910.7 million as of the time of writing and the company is trading at an adjusted EV/EBITDA multiple of 12.1x. This might seem high at first glance but the multiple drops to just 6.1x if Park Lawn achieves its 2026 growth targets without significant stock dilution. In addition, the company is trading far below its average 5-year price/cash flow, EV/EBITDA, and P/E ratios as the market valuation has declined by 8.7% since April 18. In my view, the recent decline in the share price seems unjustified and this could be a good time to open a long position.

Seeking Alpha Seeking Alpha Seeking Alpha

The latest U.S. Federal Reserve minutes show that there could be a recession in 2023, and considering that this is a business that should be unaffected by macroeconomic headwinds, I think that Park Lawn should be valued at above 15x EV/EBITDA. This multiple translates into a share price of around C$35 ($25.70) which represents an upside potential of 32.9% as of the time of writing.

Risks

Looking at the risks for the bull case, I think there are three major ones. First, it’s possible that the financials of Park Lawn are still receiving a small boost from Covid-19 and that this leads to underwhelming comparable revenue growth over the next few quarters. Second, I could be overestimating the strength of the company’s balance sheet, and acquisitions over the coming years could result in significant stock dilution, thus putting EPS growth under pressure. Third, it’s possible that I’m over-optimistic about Park Lawn’s chances of achieving its 2026 EBITDA and EPS targets.

Investor takeaway

Park Lawn expanded its network from just 6 locations in Toronto in 2012 to more than 300 locations today and I expect the company to resume EBITDA and EPS growth during 2023. In my view, Park Lawn is undervalued at the moment considering that it has often traded above 15x EV/EBITDA over the past several years. And if a recession is coming in the next few months, I think that this could be a good investment as the business shouldn’t be affected by the economic cycle to a significant extent. Note that Park Lawn’s main listing is on the TSX and that volume on the US OTC market is thin.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment