DancingMan/iStock via Getty Images

Introduction

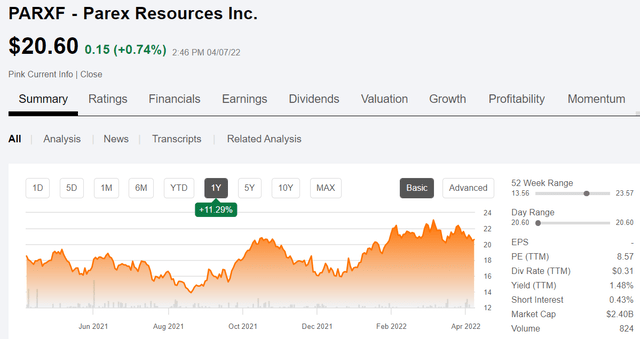

Part of the fun of writing these articles, is discovering companies like Parex Resources Inc. (OTCPK:PARXF) to present to you. Parex shares have rebounded about 25% from the December, 2021 lows, but their Q-4/2021 report did not seem to inspire investors. The stock has largely treaded water in the last couple of months, and is currently selling at a 10% discount to recent highs.

Price graph for Parex (Seeking Alpha.com)

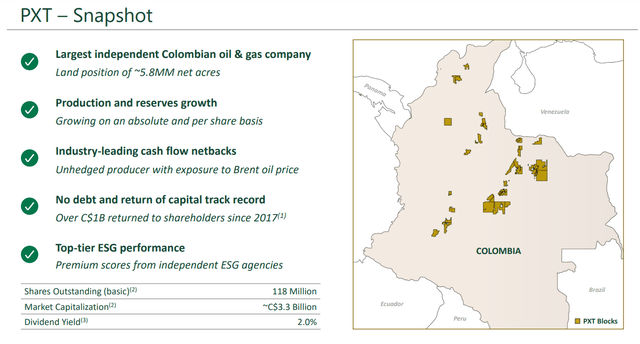

The company is the largest international oil operator in Colombia with over a 5 mm acre leasehold, with years of development potential ahead of it. They have recently increased their dividend and have a plan to reward shareholders with additional increases and share repurchases. Parex can do this in part thanks to their debt-free, “fortress balance sheet.” They are growing production, and have a capital program funded through cash flow, and entirely unhedged in this supportive environment.

Snapshot of Parex (Parexresources.com)

What’s not to like?

Analysts are bullish on the company, with 9 of 10 covering it, rating it a buy. The price targets range from CAD$27.19 to CAD$43.19, and imply a 20-80% upside to the shares. We will make our own estimate later in this article.

The Thesis For Parex

With its focus in Colombia, it is appropriate to review the political environment as regards oil and gas development. Latin American countries are notorious for political upheaval and for targeting foreign oil operators. This doesn’t seem to be the case for Colombia, which, given its 2040 Plan to add 3 BOE (barrels of oil equivalent) by 2040, seems remarkably clear-eyed with regard to resource development. One could only wish for this clarity of vision in oil producing countries a few thousand miles northward.

A Reuters article included a bullish quote from Armando Zamora, President of the national hydrocarbons agency (ANH) in regard to this development:

The addition of these reserves will guarantee Colombia’s energy self-sufficiency, said Zamora, who spoke during the final day of a virtual forum hosted by the Colombian Petroleum Association (ACP).

“We hope to strongly replace the current reserves by more or less 150%, which would add 3 billion barrels on the next 20 years,” Zamora said.

This is not to say that risks operating in Colombia aren’t present. They are. Colombia has political insurgency risks, as we have discussed in previous articles. The advantage for Colombian operators is that the government, at least, isn’t fighting them tooth and claw.

Colombia certainly realizes that national security begins with energy security.

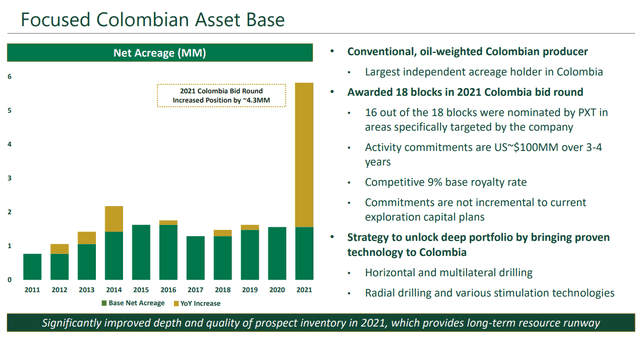

On to Parex then. Against this beneficent backdrop, we find a company with a huge land holding on which to build their base. As noted in prior articles, the Magdalena, Castilla, and Vasconia crude grades fit largely into the 18-30 API gravity category, that we’ve also noted is in high demand in El Norte. The company was the successful bidder in Colombia’s 2021 leasing round that saw Parex’s acreage quadruple.

Their long experience working in these basins gives them a leg up in evaluating this acreage for development. From their comments in the slide below it appears, they have some thick, tight intervals that lend themselves to long horizontals and multi-lateral wells. Radial drilling -jetting tunnels into the reservoir and stimulation techniques – suggest water flood-type or perhaps miscible-flood operations in an EOR operation for heavy crude.

Focus of Parex (Parexresources.com)

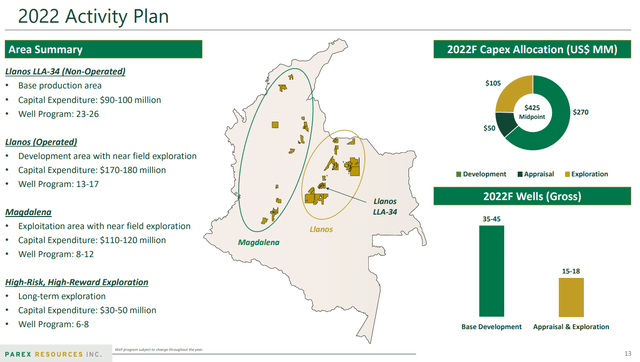

They grew production ~12% in 2021 to 51K BOEPD and have plans to aggressively pursue development of the new acreage picked up in the 2021 leasing round. In particular, the company called out plans to further leverage its 2021 alliance with Ecopetrol S.A. (EC), in the northern Llanos basin, where they expect to tap mid-to-light gravity crude.

Activity of Parex (Parexresources.com)

Parex CEO Imad Mohsen commented in the Q-4 call regarding the acreage pickup and the Ecopetrol alliance:

During the year, I’m pleased to say that we materially improved the depth and the quality of our land inventory. We acquired 18 new blocks in 2021, Colombia Bid Round, as well as expanded our strategic partnership with Ecopetrol in the Northern Llanos, which combined represent a nearly 4 times increase in our total acreage in Colombia.

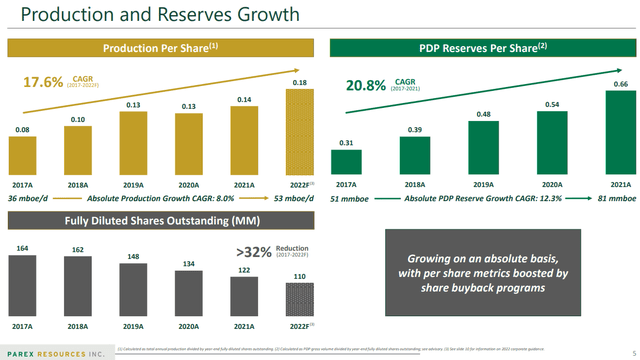

One final point in what I see as a fairly compelling case for Parex is its ability and definite plans to return capital to shareholders. With the increase cash flow its seen over the last year of prices above $60 for Brent, the company has been aggressively buying back shares, and reducing the share count 32% since 2017. As the slide below shows, production has grown at CAGR of 17.6% and 1P resources are up 20.8% CAGR, while at the same time the share count has been reduced by 32%. That’s wealth creation for investors!

CAGR for oil and Share count (Parexresources.com)

Parex CEO Imad Mohsen comments on capital allocation plans for 2022:

Building on our track record of returning meaningful capital to shareholders, moving forward we want to be clear that we are targeting to return at least one-third of free flow from operations to shareholders through share repurchases and dividends. With this philosophy at current strip prices, Parex expects to return approximately 40% of 2022 annual FFO to shareholders. The remaining free flow from operations will be invested to grow the company and replenish development inventory to support future return of capital activities.

Q-4/2021

Parex generated record funds flow from operations of $168 million in Q-4, up 200% quarter-over-quarter, $568 mm for the year. Quarterly net income was $96 million. Over the full year 2021, it generated over $300 million of free funds flow and continued adding to its return of capital track record, as previously noted. For 2022, the company is forecasting FFO of $760 mm, driven by both Brent prices up 20% over 2021 averages and increased production.

Parex has a solid balance sheet ending the year with no debt and working capital of $326 million. They also have, undrawn, a $200 million credit facility.

Their 2021 capital budget of $277 mm has been increased to $425 mm for 2022, reflecting their optimism about ROIC metrics with Brent prices above $100 per barrel.

Risks

The key risks for Parex lie in political shifts that are common in Latin America. For now, the government’s plan for 2040 gives assurance that the company will be able to pursue its operational objectives.

Catalysts

The company has done a good job of looking ahead and tying up logistical requirements, such that it may avoid some of the supply chain delays that are impacting some operators. CEO Mohsen comments in this regard:

We have secured rates under long-term contracts to have equipment in place to cater for our capital investment program for years to come. It is — it does give you some feeling of warm heart to see when the last rigs in Colombia are under contract.

We have increased critical organizational capabilities hiring significant staff was in Calgary and Bogota. I would recall around 30% in Calgary in 2021 increase to help us ramp up our programs.

And lastly, we have placed orders for long lead items for the foreseeable future. That includes casings, wellhead, steel, compressors, turbines you name it. In order to provide installation from supply chain short — and disruptions and the relative head against cost inflation going forward.

We have all seen the impact that supply chain having across the industrial arena. It hasn’t spared oil operators, and Parex’s proactive stance could be a catalyst for their planned growth.

Your Takeaway

The company is trading at <4X projected 2022 operating cash flow (OCF). On a flowing barrel basis, it clocks in (giving them credit for 15% growth this year) at $41K per barrel. That is not too extreme with Brent at $104ish today.

I like that Colombia is providing as secure an underpinning for petroleum development as you will find in the world today. Having a goal that includes energy independence gives operators some assurance about making investments in their country.

I rate the company a buy at current prices and took a small position recently for growth and eventual income.

Be the first to comment