maeroris/iStock via Getty Images

Another Update

Here’s what I wrote about Palantir (NYSE:PLTR) at the end of March 2022:

We’re stuck right now because of valuation, stock price, SBC, missing Wall Street expectations in Q4 2021, and the macro environment. The big picture is that PLTR is rightfully suppressed. But, digging into the details, it’s also true that PLTR is a growth machine with a bright future.

Summing it all up, I can say this: I’m not selling PLTR. I’ll continue to hold. Or, said differently, I’m neutral about PLTR in the short run, but bullish in the long run. Now is not a bad time to accumulate, or to start a position. Dollar-cost averaging, or dripping, is equally rational for some investors.

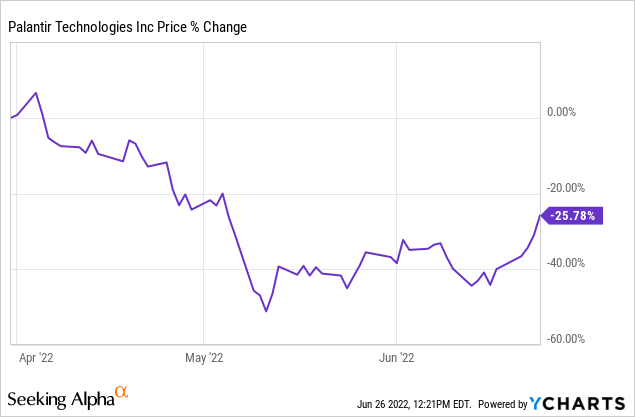

Cutting to the chase, we are still in a tough spot. In fact, since publishing that article, PLTR has dropped another 26%, so buying would have been a rather big mistake.

Perhaps the only good news is that PLTR is only down 26% in Q2. Not long ago, it was down about 50%. As the chart above shows, PLTR has come up from the bottom recently.

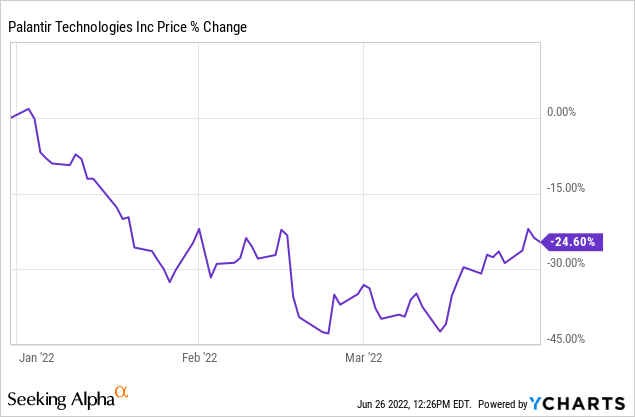

As a brief aside, I think it’s eerie how PLTR was down about 24% in Q1. Specifically, look at the chart, because you’ll see how PLTR was down about 45%. The pattern is almost exactly the same.

But, that’s just an aside. The human mind often sees what it wants to see. We see patterns when probably none are there; think Rorschach test.

In any event, in this article we’ll take a look at PLTR to see if there are any signs of life, or if we are still in the dark days.

Quantitative View Plus Analyst View

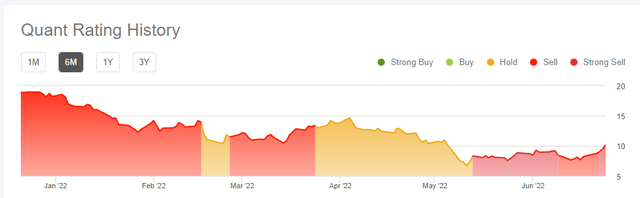

It’s still ugly.

Palantir Quant Ratings (Seeking Alpha)

In Q1 2022 there was a shift from Sell turn to Hold. Specifically, the ratings shifted from Sell and Strong Sell to Hold. But now, clearly PLTR is in the red. It’s officially a Sell. That’s even with a recent turn up in price to above $10. Perhaps the only good news is that it’s merely a Sell and not a Strong Sell right now. That’s not especially comforting.

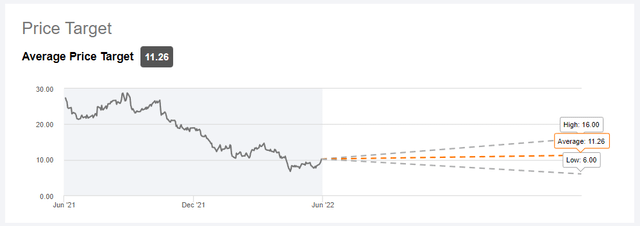

On a related topic, Wall Street isn’t expecting much. Price targets have collapsed this year from well above $20 down to just above $11 right now. Here’s how the range looks, if you’re curious:

Wall Street Price Targets for Palantir (Seeking Alpha)

That’s a low of $6 up to a high of $16, with an average just above $11. In some other modestly bright news, analyst ratings scores have risen from about 2.5 to above 3.25, indicating a pretty sold Hold rating.

Adding it together, and keeping it very simple, the Quants say Sell, and the Analysts say Hold. There is little optimism, and zero exuberance right now.

Another Instructive Comparison

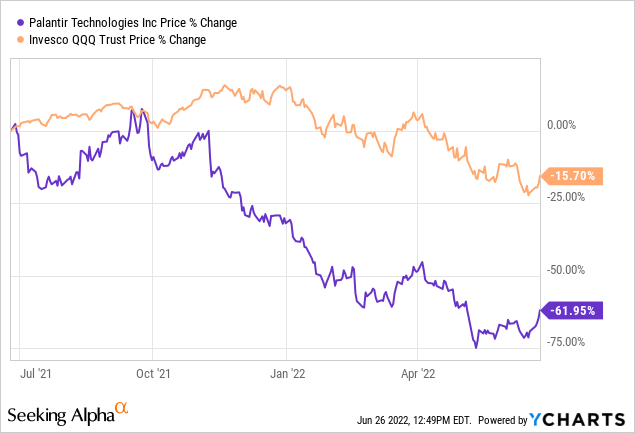

I previously indicated that PLTR was down about 37% from the end of Q1 2021 to Q1 2022, and the Nasdaq (QQQ) was down about 17% over the same 1-year period of time. In other words, QQQ did twice as well as PLTR. That’s not saying much given their poor performances. So, let’s catch up, and see if PLTR has gained ground, or not.

What a train wreck. In a one year period, PLTR has done four times worse than the QQQ. Again, we see that PLTR hasn’t maintained any relative strength or parity to the market as a whole.

The Pressure Is Still On

Although PLTR has a market cap of just under $30 billion, it’s still relatively small, and more prone to violent moves up and down. But, the real kicker is that PLTR is an aggressive growth stock. That’s what investors wanted, and that’s what it delivered. But, the macro environment changed and what I’ll call the “Growth Leverage” is now working strongly against PLTR.

This is still all true, except that PLTR now has a market cap of about $21 billion. That’s already been explained, per the charts and analysis above.

Furthermore, I discussed that when you add everything up, the short-term and medium-term outlook has been negative. Specifically, I wrote:

Dare I say that I’m bearish in Q2 2022? That doesn’t mean I’m screaming “SELL” from the top of my lungs.

So, Q1 2022 and Q2 2022 were ugly, at least in terms of price action. While I didn’t think “SELL” made sense, I was not buying. And, bluntly, I’m still not buying. I’m not seeing any great catalyst, or catalysts.

More On Wall Street

Bank of America (BAC) recently had this to say:

“Palantir’s dominant position in the AI-powered software market, differentiated end-to-end & highly-secure solutions and first mover advantages should support more than 30% annual revenue expansion and improving profits in the midterm,” the analysts wrote, adding that “increased urgency” to modernize military and intelligence capabilities should give the company “significant opportunities.”

While that’s positive news, it’s simply not new. It’s the same story I’ve been providing for a long time. I think most PLTR investors know that PLTR should have no problem hitting 30% revenue growth. But, can it reach 40-50%? And, what would be the driver for that extra 10-20% of growth. There are no catalysts on the horizon. More on this shortly.

Of course, there is urgency. That’s because there is always urgency. There’s always a crisis or emergency, where PLTR offers up strong positive solutions. But, I’m afraid this isn’t enough. Putting it differently, the “significant opportunities” that BoA sees are par-for-the-course. It’s a big reason why we’re getting 30%, instead of let’s say 15-20%.

Meanwhile, Goldman Sachs (GS) took a different view:

“We view Palantir as uniquely positioned in an ecosystem of data analytics vendors, given its holistic solutions encompassing data preparation, data modeling, and forward-deployed engineers,” Borges wrote in a note to clients, adding that Goldman is constructive on Palantir’s long-term opportunity to succeed in the enterprise as it grows its sales force and continues updating its products.

What’s obvious is that GS is looking at the big picture and long-term for PLTR. We come back to the issue I’ve highlighted, namely that there aren’t any obviously wonderful near-term catalysts. There’s nothing extraordinary. And, that’s exactly what’s needed as I’ll now explore.

Sentiment Versus Fundamentals

PLTR is locked into a negative sentiment channel. While I generally want to spend my time on fundamental analysis to find the truth, and to plan, we are currently in a place where feelings and emotions are extra strong.

Before PLTR can gain significantly, here’s what needs to happen. First, PLTR needs to “surprise and delight” the market with 40-50% growth, or something that alters the fundamental picture. It cannot be good performance. It must be great performance to be meaningful. Plus, it should have legs to run, versus just being one single pop. We need more than one great contract, and more than one great new customer.

Second, sentiment needs to change. With high inflation, expanding interest rates, and the threat of a recession, PLTR is behind the proverbial 8-ball. More than anything, it’s a growth stock, so it needs to outperform substantially at the fundamental level to overcome the current negative sentiment.

As I’ve indicated, along with BAC and GS, there are no near-term catalysts. Well, there’s nothing big enough in public view to give us the 40-50% growth that would overcome the sentiment. Sparklers and firecrackers aren’t enough.

Quick Wrap Up

Right now, I’m frustrated to report that PLTR is at the mercy of sentiment. While I was perhaps hoping to turn optimistic about PLTR in H2 2022, I’m afraid I’m still stuck in neutral. Specifically, PLTR is still just a Hold.

That might even be too optimistic. After all, guidance in early May was lame:

For the second quarter, Palantir said it expects $470 million in sales, compared to estimates of $483.76 million. The company caveated that figure, noting that “there is a wide range of potential upside to our guidance, including those driven by our role in responding to developing geopolitical events.”

Yuck.

So, fundamentally, we’re not great shape at the top line. In fact, I was hoping to see $485 million to $490 million. Therefore, we’re $15-20 million short of my estimates. It’s no wonder PLTR has been drifting down. Fundamentals aren’t even close to amazing, and sentiment is negative.

I sincerely believe PLTR has a great future but the timing does matter. It could still be many more quarters before we get that strong leg up, with a shift in sentiment plus a fundamental blast upward. Again, PLTR is a Hold right now.

Be the first to comment