marc chesneau/iStock via Getty Images

After Russia fully invaded Ukraine in late February, the importance of Palantir’s (NYSE:PLTR) proprietary software solutions to the defense efforts of western nations has exponentially increased. While Palantir already has close ties with various defense agencies of western democracies, the new war in Europe shows that the free world needs to step up and increase its defense spending even more, as the global stability that all of us enjoyed in the last three decades since the end of the Cold War is over. As democracies are looking at ways to expand their defense budgets, Palantir has a unique opportunity to penetrate new markets and help western democracies, which are its main clients, protect the current rules-based order.

If Palantir seizes those opportunities, it’ll significantly improve its top and bottom-line performances and will be able to greatly reward its shareholders in the long run. Considering this, I continue to be bullish about the company’s stock and have no plans to unwind Palantir shares from my portfolio anytime soon.

Welcome To The Brave New World

My latest article on Palantir, which was published in mid-February, focused on the company’s ability to efficiently provide AI-based software solutions to its defense clients to tackle any foreign threats. As I was preparing to write another article on Palantir about its solutions for the private sector, the unimaginable has happened. In the early morning of the 24th of February, I woke up to the sounds of an air raid siren in my hometown in Ukraine, which meant that the worst has happened and a major war has returned to Europe once again. After more than a month of volunteering, I have once again some free time to update my thesis on Palantir, reiterate its importance to the defense sector, and highlight how the company could use the ongoing war to its advantage.

The letter that Palantir’s CEO Alex Karp published a month ago mirrors my belief that the world has changed, whether we like it or not, and the sooner we realize this – the better. As Karp perfectly pointed up:

The fantasy of an instinctively peaceful world may be comforting. But it is again coming to an end.

The good news is that European democracies have finally begun to wake up and realize that in order to defend their way of life and tackle any threats from the authoritarian regimes, they can’t afford to remain complacent much longer. Germany has already completely changed its foreign policy and started to send weapons to Ukraine, where the war is still ongoing, while the European Union first time in its history adopted a strategic compass, which is a document that outlines the threats and challenges that the union is facing and ways to combat them.

Considering this, investors will be able to benefit from this strategic policy shift of democracies by owning stocks in companies from the military-industrial complex, which already showed great returns in the last month. Also, as the war in Ukraine is showing, in addition to ammunition and military hardware, software matters as well, and will matter even more as we enter this brave new world, previously unknown to us. As a result, Palantir now has unique opportunities to penetrate new markets and expand its customer list by providing its custom software solutions to democracies around the globe.

New Opportunities Await

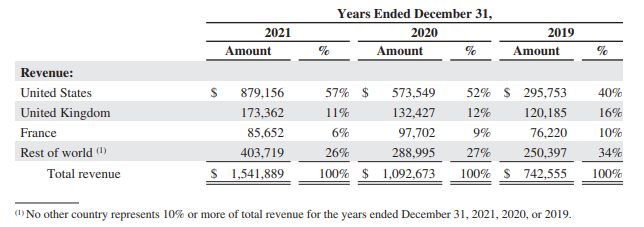

Palantir initially has been created as a big data analytics company that provides proprietary services to defense agencies. While later it evolved and started to work with clients from the private sector, its revenues that are generated through defense contracts continue to account for the majority of overall revenues to this day. In the latest earnings report for FY21, Palantir reported that it generated $1.54 billion in total revenues, up 41% Y/Y, out of which $897 million was generated through its defense contracts.

In addition, the major upside of Palantir is the fact that it works only with organizations that are located in democratic countries and are part of the western world. Thanks to this, Palantir has eliminated all security risks that come from collaborating with organizations, which are located in countries such as China and Russia that are ruled by authoritarian regimes.

Palantir clients by markets (Palantir)

As I already mentioned in my previous article on the company, Palantir’s proprietary platform, Gotham, is used to solve various data-related challenges that its clients from the government face. One of Palantir’s major customers that use it is the United States Army. Just less than a year ago, Palantir won an $823 million DCGS contract to support the army with real-time battlefield intelligence. Its AI-driven software is able to collect various data from the battlefield via different sources such as satellite images, report any suspicious activity to the general staff, and provide real-time solutions to particular problems on the field, making it more efficient to navigate through the fog of war. How important is all of this? The Russian-Ukrainian war shows that it’s more important than anyone could’ve imagined.

It’s safe to say that the real-time intelligence that Ukrainian General Staff receives from its western partners is one of the main reasons why the Ukrainian army managed to survive the initial phase of the war, push the enemy away from the Kyiv region, and engage in numerous successful counterattacks across the front. The DoD’s security assistance fact sheet shows that commercial satellite imagery services continue to be one of the services that are provided to Ukraine to this day. Unfortunately, Ukraine is not working with Palantir, so it has no access to its AI-based software solutions, which could’ve helped it to efficiently analyze satellite imagery in real-time. Instead, Ukraine relies on its elite drone unit, which scouts the area that was targeted by satellites and helps the commanding officers plan their next moves. Nevertheless, such a tactic without any major AI-driven software is still pretty efficient, as it helps Ukrainians find out the enemy’s weak spots, harass its supply convoys, and prevent its offensive actions.

It also seems that Palantir understands how important it is to better navigate through the fog of war in comparison to your enemy and that’s likely one of the main reasons why it decided to launch its first satellite into orbit last week. This will help the company to increase the speed at which data is gathered and improve its quality, which will make it easier for Palantir’s clients, such as the U.S. Army, to efficiently deal with their challenges on the battlefield in real-time.

Going forward, it’s safe to say that Palantir is poised to benefit from the current chaos that has erupted in Europe and will be felt all around the globe. The latest developments show that democratic countries are beginning to increase their defense spending to counter threats that come from authoritarian regimes. The U.S. Department of Defense recently requested a record $773 billion budget for FY23, while Germany recently announced that it will commit €100 billion to defense spending.

In addition, the defense IT spending market is expected to grow at a CAGR of 6.1% by 2030 and worth $137.65 billion by the end of this decade. Also, out of the $773 billion that the DoD requested, a record $130.1 billion is expected to be spent on R&D, which includes the improvement of the government’s current cyber and AI capabilities. Thanks to such an increase in defense spending, Palantir will be able to penetrate new markets and likely sign new defense contracts in the future simply due to the fact that it’s already one of the most reliable partners of defense agencies from democratic countries. The table above shows that in recent years the company has been systemically growing its revenues across various western states, and in the current environment, it’s hard to see how it will learn less in months and years ahead.

Considering all of this, Palantir has everything going for it to accelerate the growth of its business in the following years. The company so far has been successful in achieving its goal of growing its top line by 30% Y/Y and above, and in this new reality, it shouldn’t be a problem for it to continue to achieve this goal in the future. While for some Palantir could be an expensive stock to own, considering that it trades at 13 times its sales, let’s not ignore the fact that it also grows more aggressively than most other stocks. While the average sales growth rate for the companies from the S&P 500 index is ~11%, Palantir managed to grow its revenues in FY21 by 41% Y/Y and is expected to continue to grow at a similar aggressive rate in the following years. Thereby, I believe that its premium price is justifiable, as the stock has more room for growth given the current opportunities.

Risk

There’s one major risk, which could undermine my bullish thesis. The current instability in the world is likely going to increase inflation and lead to an economic crisis, which itself will lead to the depreciation of most asset classes, which could possibly hurt Palantir’s shares in the short term. In addition, governments could also slash the current defense budgets in order to battle the possible recession. However, even if that’s going to be the case, it’s hard to see how defense budgets are going to be significantly slashed given the rising threat from authoritarian regimes to democratic states.

The Bottom Line

The war in Ukraine has implications for the whole world. Not only is it the biggest war in Europe since World War 2, but it’s also the one where the current international rules-based system that was established with the foundation of the United Nations in 1945 is under a threat. Palantir at its core is a company that aims at helping western governments help to defend this international system by providing AI-based software solutions, which protect democracies from foreign threats. As democracies are finally realizing that autocratic regimes pose significant threats to their way of life and are increasing their defense spending, Palantir will be able to help them face the upcoming challenges more efficiently, which in the end should lead to the creation of additional shareholder value in the long run. For that reason, I’m bullish on Palantir and continue to hold its stock in my portfolio.

Be the first to comment