Andreas Rentz

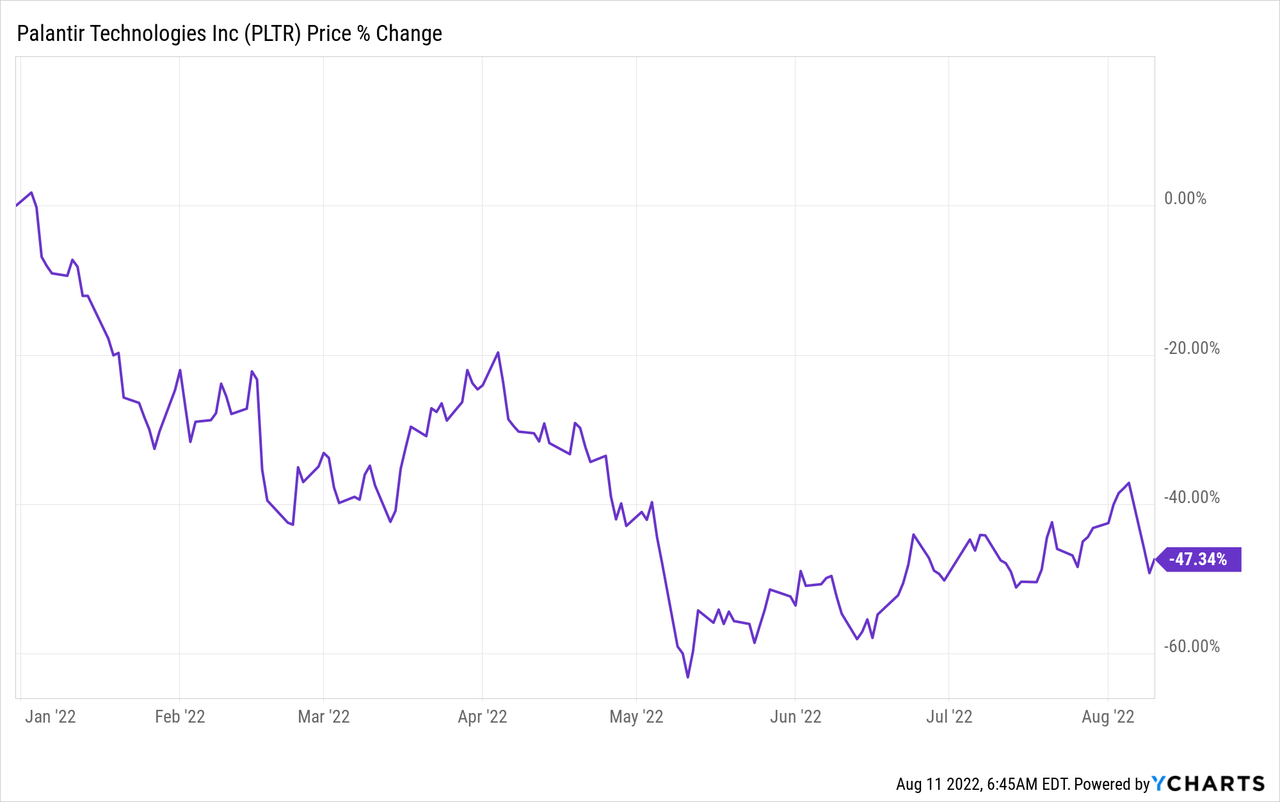

Palantir Technologies Inc. (NYSE:PLTR) is down around 47% year-to-date and it’s getting to a point where it seems quite attractive to me. I’m primarily a special-situation and value investor, and it’s unusual I venture into growth stocks.

I happened to buy a little bit of Palantir at its IPO (and we’re currently revisiting that price level) for three chief reasons: 1) I can see their products and business model resulting in revenue flows that will ultimately be very, very stick and quite profitable; 2) The company has a very strong culture that’s differentiated and likely inspiring to insiders; 3) Leadership seems unconventional but thoughtful in the right ways; and 4) Unconventional IPO method meant the stock was underpromoted and it was actually easy to buy in around the IPO price. That was impossible with another attractive competitor like Snowflake (SNOW). Year-to-date, the stock got smashed. It IPO’ed at $10 and currently trades below that level even.

Owning the stock also lets me sell (out-of-the-money) covered calls on this name. I also like to sell long-term puts on it from time to time. I gravitate towards that options chain because, on longer time horizons, the implied volatility often seems higher than it should be.

I’m not super concerned about the quarter-to-quarter performance of Palantir. The company just lowered guidance. I buy into the story as-so-far Palantir’s key products are essentially operating systems for governmental and/or private organizations. It makes a lot of sense to me that adoption and revenue growth will be a very lumpy affair until Palantir’s total revenue base has grown substantially (this is one of the reasons I’m inclined to believe long-term implied volatility may be too high).

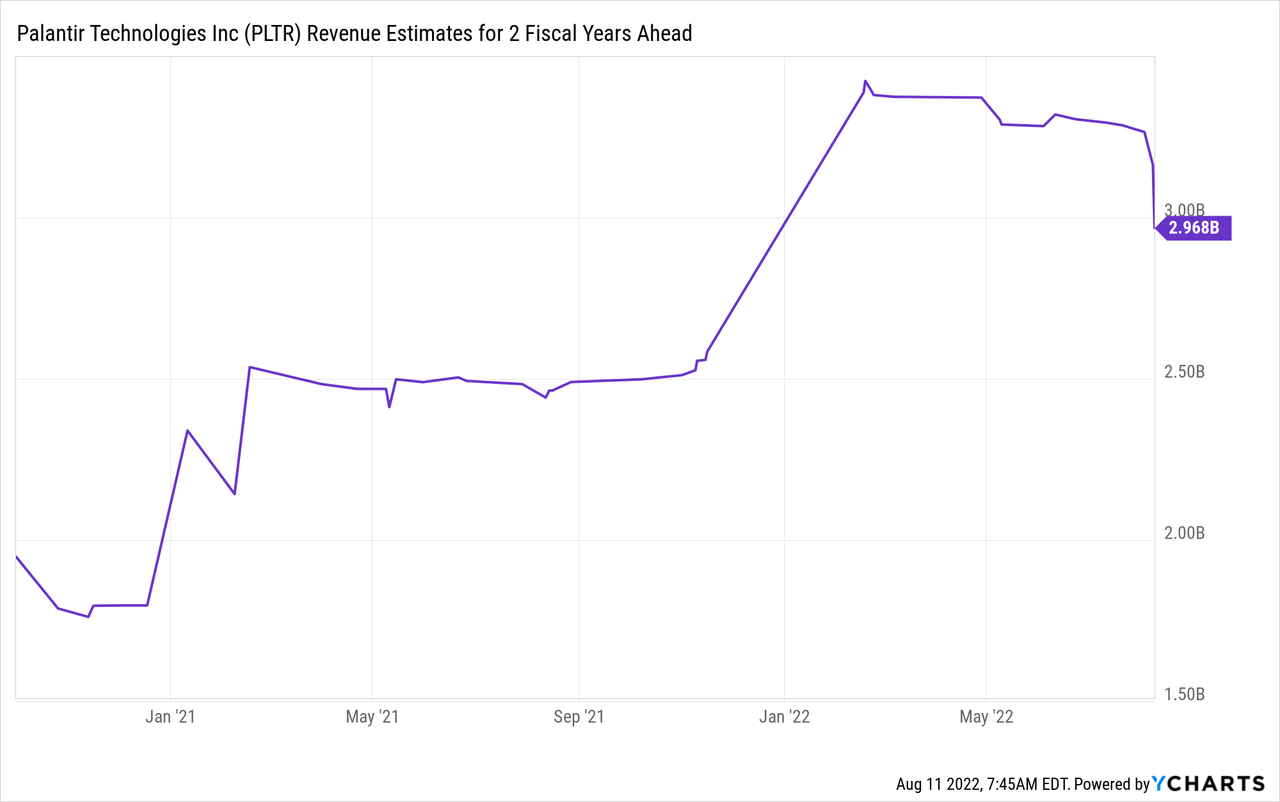

Analysts have revised revenue estimates sharply downwards, but most of that is likely already reflected in the stock price:

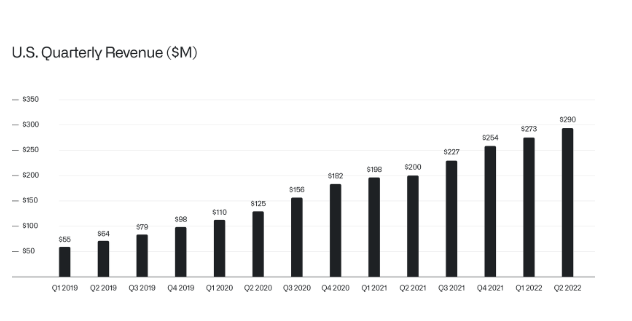

Big picture: the company is still on the right trajectory:

Palantir quarterly revenue growth (Palantir)

There were two things that concerned me a little bit in the August 8 shareholder letter and the earnings call.

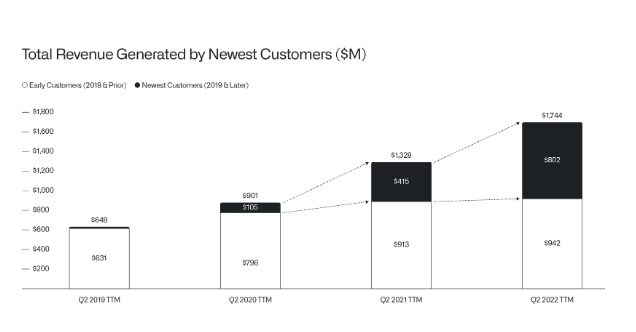

The positive spin put on revenue generated by newest customers:

Palantir revenue growth by early customers (Palantir)

I get how that’s potentially positive. New customers tend to have the most trepidation around spending and are likely to merely put a toe in the water. That suggests a bright future for Palantir. Unfortunately, we’re not seeing that reflected in existing customer growth.

Second, I perceive it as a positive spin when you’re trumpeting U.S. growth. I get why U.S. growth is slightly more attractive compared to global revenue growth. However, a homegrown dollar isn’t that much more attractive I’ll be cheering for low global growth. Why pursue it at all, then? There are also repercussions to a realistic analysis of total addressable market. Does a large total addressable market (“TAM”) get less realistic if goings are tough outside the U.S.? I’d think so. Definitely, a concern here that I’ll keep an eye on.

But there were also things I liked in the recent communications. CEO Alex Karp is claiming customers are coming back to them after having tried to create their own or competitors’ solutions:

A related development is that we are seeing former customers, including some of the world’s largest transportation, banking, and retail enterprises, return to our platforms in increasing numbers after periods of experimentation with other data integration and analytical platforms and approaches.

These customers are returning because they have tried other options and those options have failed. The product has brought them back.

Karp also commented on the global macro backdrop that’s definitely been in focus due to Russia’s invasion of Ukraine (emphasis mine):

Let me give you a different riff on this. So a number that — I don’t know, I think we shared in one of our earnings calls was that our government U.S. business has a CAGR over a decade or more of 35%. During that time, we’ve had a number of years that were flat, and this is frustrating. Believe me, it’s more frustrating for us than anyone else because we would prefer an even lower CAGR, but having more certainty.

And so nevertheless, you can ask yourself the question, does it appear that the last 10 years were less dangerous or the next 10 years are going to be more or less dangerous than the last 10 years? So it’s just a very basic view that we have. The next 10 years, the next 2 years are clearly more dangerous. America’s engaged on multiple fronts. And then there’s a question, does Palantir have the product market fit and access to the market?

Our product, we’re looking at the U.S. business that’s going to cross the $1 billion mark next year as well. This is like so you have a $1 billion software business as of next year with positioning that has never been as good. So both our micro positioning and obviously, the macro position, it’s so sublime. It’s hard to talk about without sounding like we’re kind of warmongering.

And that’s why I am positing internally and externally the growth in U.S. government over a multiyear period will be at least as good in the future as it was in the past. However, that 35% CAGR included a number of years where it was flat or even negative, and that’s just the frustrating part about contracting at our level. The contracts are so big and meaty that you got to kind of wait.

I believe China is often portrayed and/or perceived by Western media commentators as warranted by facts, history, and culture. But that’s my personal read, and don’t mistake me for a China expert. At the same time, the perception of China/Russia as a threat is unlikely to diminish any time soon. I’m very bullish on global military budgets.

Palantir is likely one beneficiary of that increased spending. The open-source intelligence community has been a big story around the war in Ukraine and may influence how conflicts are planned and waged in the future. Great software tools for the interpretation of data should be very useful. The nature of AI technology (highly useful to make sense of large datasets within short timeframes) is that the largest players within the competitive landscape develop an advantage. More data (generally) means better interpretation, leading to more data, meaning better interpretation.

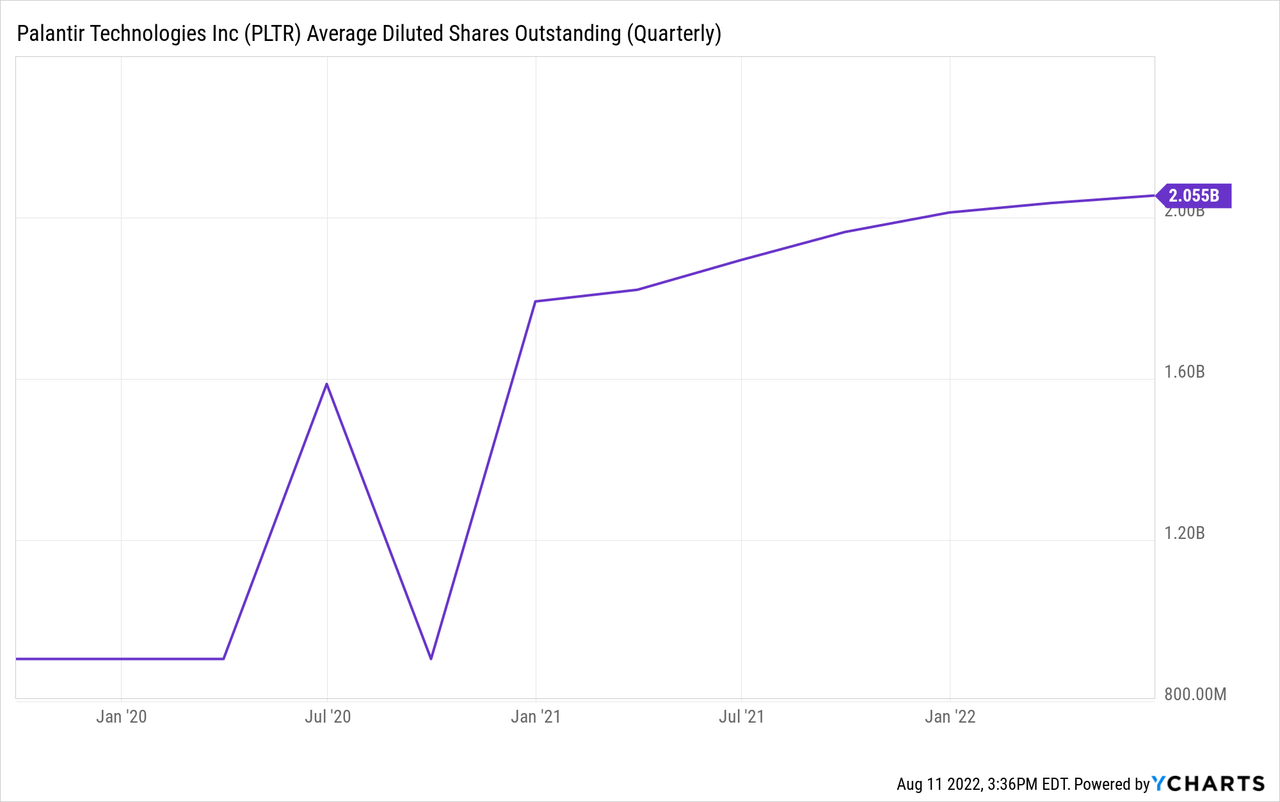

Finally, Palantir’s share-based compensation has always been a valid point made by bears. It seems to be leveling off much faster than revenue growth, so I perceive that as a positive.

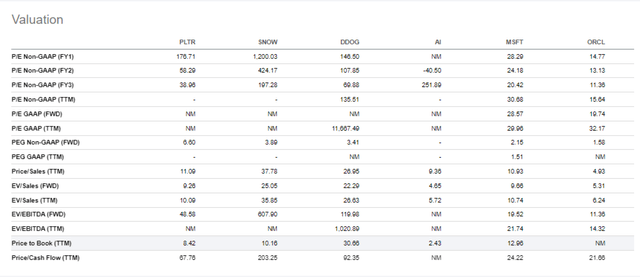

Valuation wise Palantir trades at around 9x EV/Sales. Snowflake trades at an EV/Sales level of around 35x, Datadog (DDOG) at around 22x, and C3.ai (AI) at an EV/Sales of 6x. I’ve included a dataset of software company valuations on Seeking Alpha:

Data companies valuations (Seeking Alpha)

More mature software companies like Microsoft (MSFT) or Oracle (ORCL) trade at around 10x and 6x EV/Sales, respectively. Although both are mature, I would characterize both as software companies that provide mission-critical software that’s very hard for customers to remove from their organizations. They are also companies that are very involved with data and/or operating systems which is why I picked these.

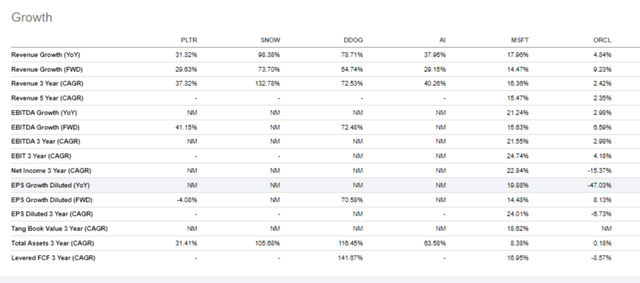

Snowflake and DDOG are growing quite a bit faster, but I’d argue the quality and stickiness of Palantir’s revenue, over the long term, is likely of a higher level. I also expect Palantir’s revenue growth to be a bit lumpier compared to competitors. Sure, that’s a negative in principle, but if we just hit a rough patch, it means the growth could easily accelerate as a few big contracts land in 2024 or whenever. Overall, I think a few of these are trading at quite attractive levels given their strong propositions. However, I like where Palantir is within the continuum.

Growth rate data AI companies (Seeking Alpha)

As a value/special-situations investor, I rarely buy companies at 9x EV/Sales. But with the business model, high margins, growing competitive advantages, strong, differentiated culture, high growth, attractive customer base, macro tailwinds to its industry, and attractive customer niches, I’m interested in making an exception here. A secondary consideration to me is that Palantir is a great addition to my portfolio in terms of diversification (as I own a few high-growth companies).

A third and final consideration is how Palantir tends to benefit from events like Covid-19 and the invasion of Ukraine because that’s when the capabilities of its products shine in the context of current events. Investments that benefit from chaos (dubbed anti-fragile by Taleb) are hard to find and, in my mind, extra valuable.

Be the first to comment