DebbiSmirnoff/E+ via Getty Images

Pactiv Evergreen Inc. (NASDAQ:PTVE) is a leading manufacturer of food packaging products. It IPO’d in late 2020. Although the company has shown improving financial results in recent quarters, I am concerned that recent outperformance has come from price increases at the expense of volume declines. Furthermore, the company has a heavy debt burden, with more than half paying floating rate interest. I think this is a stock that investors should avoid in the current rate-hiking environment.

Company Overview

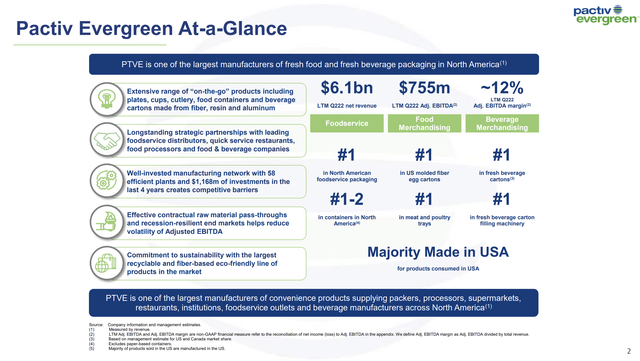

Pactiv Evergreen is a leading manufacturer and distributor of food packaging products for the Foodservice, Food Merchandising, and Beverage Merchandising industries.

Pactiv Evergreen is majority controlled by New Zealand billionaire, Graeme Hart, who owns 78% of the shares of PTVE. Mr. Hart assembled the assets within Pactiv Evergreen over two decades, beginning with the acquisition of International Paper’s (IP) drinks packaging business, Evergreen Packaging, in 2006.

Today, Pactiv Evergreen is one of the largest packaging companies in the U.S. with $6.1 billion in LTM revenues, regularly ranking #1 or #2 in the segments it serves (Figure 1).

Figure 1 – PTVE Overview (PTVE Investor Presentation)

2020 IPO Was Not Well Received

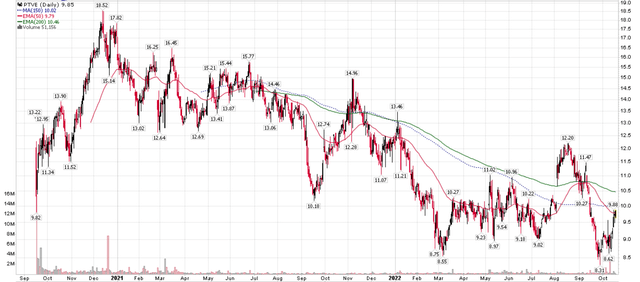

Pactiv Evergreen came to the markets in an IPO transaction in late 2020 that was not well received. The stock debuted at $14, far below the initial range of $18-21, and traded down to $10.93 on day 1 (Figure 2). However, the company did recover and traded as high as $18 by December 2020.

Figure 2 – PTVE Price Chart (StockCharts.com)

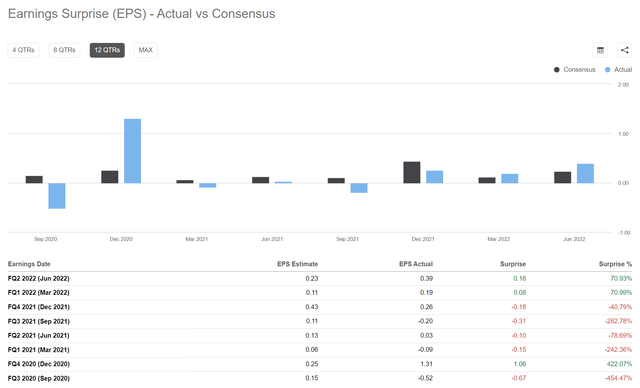

PTVE’s 2021 results were marred by a string of negative earnings surprises (Figure 3), as the company faced inflationary margin pressures from rising input costs and $50 million in additional costs related to Winter Storm Uri. A CEO change mere months after the IPO did not help matters. PTVE’s stock continued to see selling pressure throughout 2021 and 2022, trading at a recent all-time low of $8.31 per share in September 2022.

Figure 3 – PTVE Earnings Surprises (Seeking Alpha)

Financials Seem To Have Turned The Corner

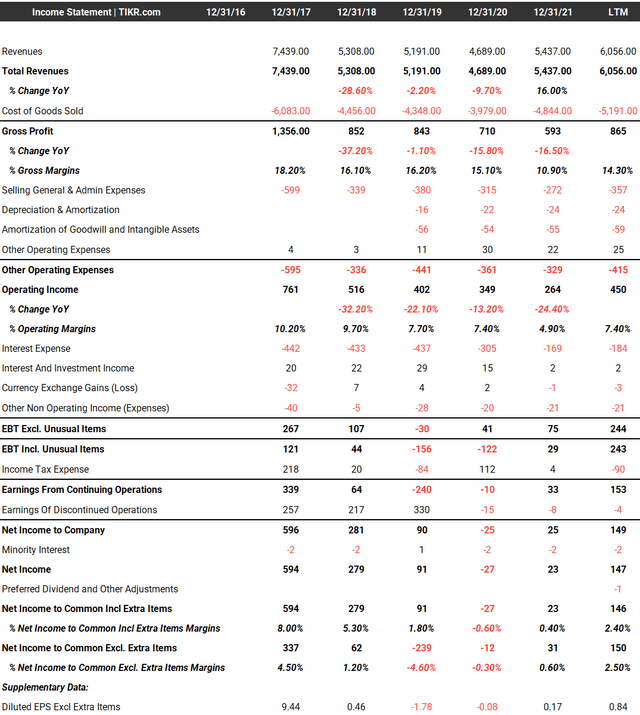

In recent quarters, PTVE’s financial results seem to have turned around, with revenues back in growth mode and operating margins stabilizing (Figure 4).

Figure 4 – PTVE Financials Stabilizing (TIKR.com)

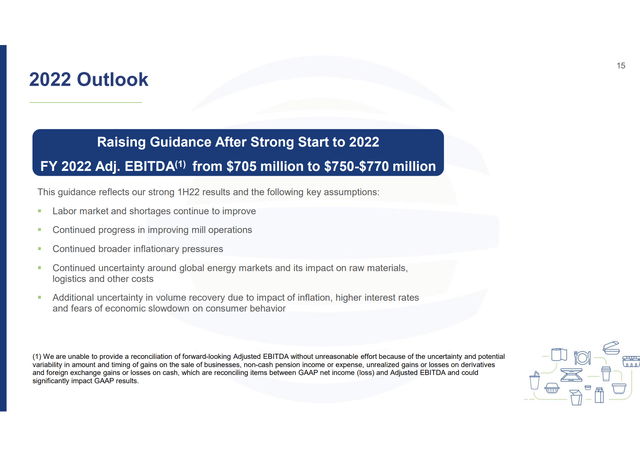

Encouragingly, the company raised its 2022 guidance after the strong YTD start, taking Adjusted EBITDA forecasts from $705 million to $750-770 million (Figure 5). The positive earnings surprise saw the stock price jump more than 10% on the announcement. However, the positive momentum was short-lived, and PTVE has since made new lows in September.

Figure 5 – PTVE Raised 2022 Guidance (PTVE Investor Presentation)

PTVE Has Taken Price In Exchange For Volume

Although the Q2 earnings were a welcome surprise, I see several issues with PTVE’s business that could explain investors’ hesitancy to embrace the positive fundamentals.

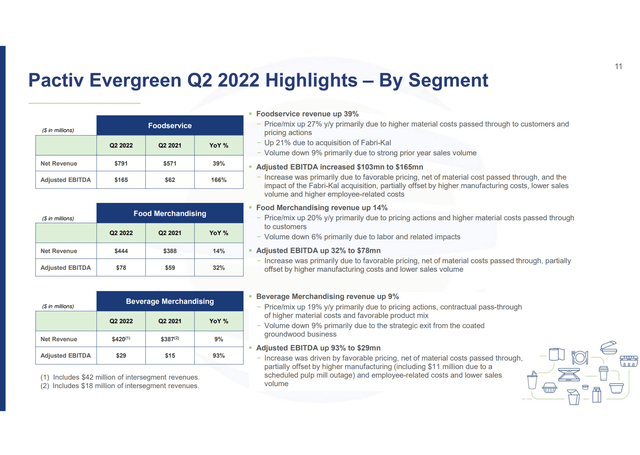

First, if we look at the second quarter highlights, we can see that PTVE took a lot of price action in order to drive the revenue and earnings surprise. Foodservice revenues were up 39% YoY on the back of an acquisition and a 27% increase in price/mix, but volumes were down 9% YoY. Similarly, Food Merchandising price/mix was up 20%, but volumes were down 6%. Beverage price/mix was up 19% but volumes were down 9% (Figure 6). While price actions are necessary to maintain profit margins, they may be coming at the expense of volumes, as customers could be seeking out alternative suppliers.

Figure 6 – PTVE Q2/2022 Segment Highlights (PTVE Investor Presentation)

Too Much Debt

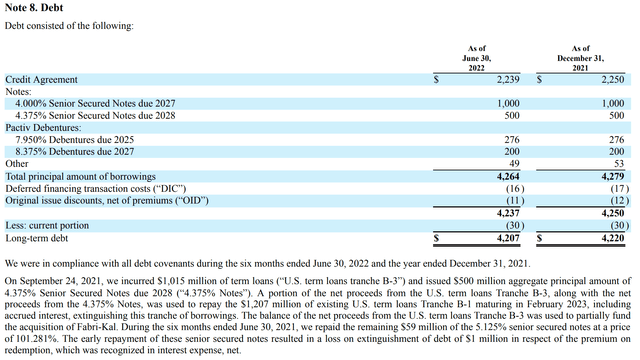

Another issue I have with PTVE is that the company is carrying too high a debt burden, with $4.2 billion of long-term debt on a business that does $750 million in LTM EBITDA (Figure 7).

Figure 7 – PTVE has $4.2 Billion in Debt (PTVE Q2/2022 10Q Report)

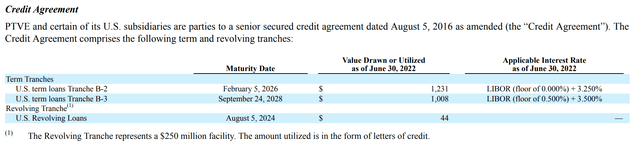

The Net Debt to Adj. EBITDA ratio sits at an eye-watering 5.3x, with $2.2 billion of the debt being term loans that pay floating rate interest at LIBOR plus (Figure 8).

Figure 8 – PTVE Floating Rate Debt (PTVE Q2/2022 10Q Report)

Simply put, I think the company’s capital structure is too debt-heavy heading into a global rate hiking cycle.

Valuation Looks Rich With The Debt

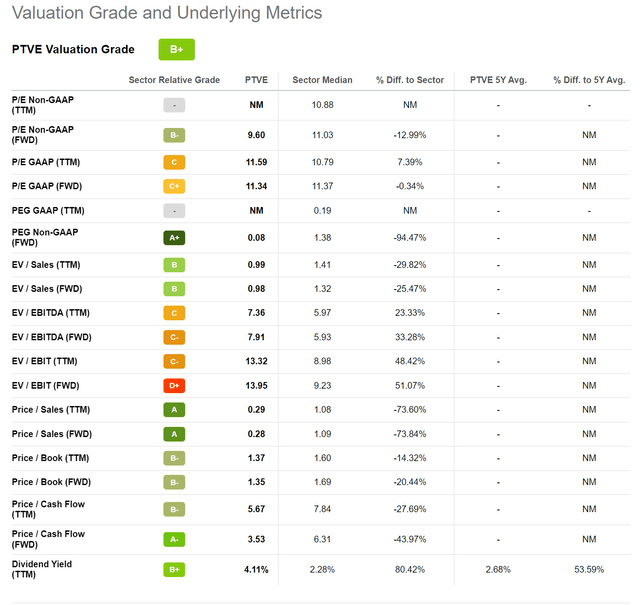

Based on a simple Fwd non-GAAP P/E, PTVE does screen attractive, at 9.6x compared to the materials sector median of 11.0x. However, this valuation ignores the heavy debt load of the company. A more appropriate metric to look at is Fwd EV/EBITDA, which factors in the debt. On this metric, PTVE trades at 7.9x, significantly above the sector median of 5.9x (Figure 9).

Figure 9 – PTVE Valuation (Seeking Alpha)

On the positive side, PTVE pays a quarterly dividend of $0.10 that equates to a 4.1% yield. However, as an investor, I would rather the company save the ~$70 million in annual dividend payments and use it to pay down its debt to a more manageable 3-4x EV/EBITDA.

Conclusion

In conclusion, while Pactiv Evergreen has shown improvement in its financial performance since the string of earnings misses in 2021, I am concerned that recent outperformance has come from price increases at the expense of volume declines. If customers switch to alternative suppliers as a result, then PTVE’s future business may suffer. Furthermore, I am concerned with PTVE’s heavy debt load in the midst of a rate hiking cycle. Although PTVE does not have any near-term debt maturities, it does have over $2.2 billion in term loans that pay floating-rate interest.

Be the first to comment