AntonioSolano/iStock via Getty Images

Shares of the Packaging Corporation of America (NYSE:PKG) have been hit in recent weeks over fears that containerboard prices are declining amid normalizing consumer demand for goods. Packaging’s business proved to be resilient in Q3, and shares continue to price in a meaningful decline in earnings that is yet to materialize. I would be a buyer here.

In the company’s third quarter, it earned $2.83 excluding special items, which beat consensus by $0.02 and its own guidance by $0.03. This was up 5% from last year. These results were driven primarily by higher prices, which offset lower production and increased operating costs. Sales rose 6% from last year to $2.1 billion.

Given higher energy costs, gross margins were 24.4% from 25.5%, but management did an excellent job controlling the costs it can. Selling, general, and administrative expenses rose less than 1% to $145 million, which is especially impressive considering the level of inflation in the economy. PKG has a superior management team in my view, and that paid dividends during the quarter.

Its packaging segment is the real driver of the company’s results. Packaging income was down about 2.5% to $362 million. Packaging volumes per day fell by 6% from last year. Containerboard inventories rose 22,000 tons from last quarter and 11,000 from last year, modest increases relative to the 1.16 million quarterly production rate. Management is being disciplined in running production to demand, which is minimizing the buildup of excess inventory and should help PKG maintain sufficient pricing power. Its paper unit saw segment income more than double to $27 million.

Now, management is seeing demand for packaging products soften, though the company has been able to implement price increases with little issue. The company will reduce output as needed to meet demand and avoid holding excess inventory. Packaging Corp is also taking advantage of weaker demand to do scheduled maintenance on its Alabama mill. Given lower production (the holidays mean there are four fewer shipping days in Q4 than Q3) and some export pricing pressure, it expects to earn about $2.22 in Q4.

A slowdown from Q3 to Q4 is normal given the shorter calendar. In recent years, the sequential earnings decline has been 12-15%. That would imply, based on Q3 results, that in stable market conditions, PKG “should” earn about $2.43 in Q4, so we are seeing $0.21 of deterioration from the softening demand as consumers buy less goods, lessening the need for cardboard boxes.

Given this guidance, PKG will generate about $11 in EPS, so the stock is trading just 10.5x earnings. Assuming current market conditions persist for a year, it would have an earnings run rate over the next twelve months of about $10.25-$10.40. Even then, the stock is trading just 11.3x earnings. I view that as fairly cheap for a disciplined operator, which also has $794 million in cash on the balance sheet and just $2.5 billion in debt. This fortress balance sheet has positioned PKG well for any downturn and gives it the capacity to do roll-up M&A if assets come onto the market at cheap valuations.

Plus, Packaging Corp is a strong returner of capital. It pays a $1.25 dividend for a 4.3% yield. The company has increased its dividend for 11 years with a 12% five-year growth rate and a 25% increase this past June. I would expect a smaller increase next year, but still likely high-single digits given it pays less than half of profits to fund this dividend.

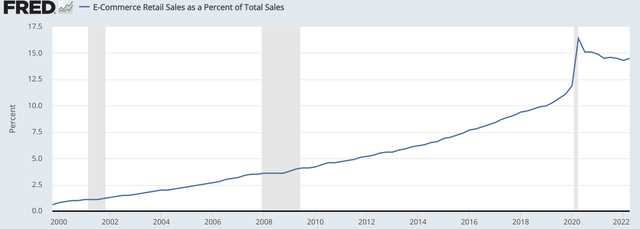

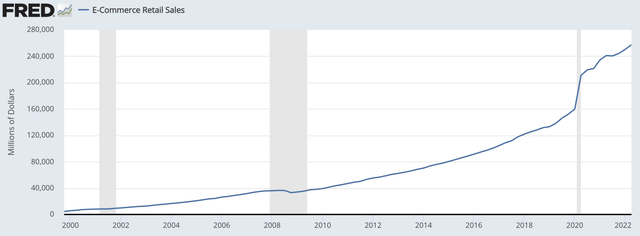

Ultimately, the containerboard business is a commodity business, but this is a commodity that is in my view enjoying a secular bull market, and bouts of cyclical weakness provide buying opportunities. I am sure we have all seen our houses overflow with card boxes from Amazon (AMZN) as the holiday season approaches, and e-commerce sales have been in a secular uptrend for over twenty years. Admittedly, its share has come down since the peak of COVID, in part because physical stores that were closed have since reopened.

Indeed, when you look at total e-commerce sales, it’s clear that while COVID caused a step change, the sales growth has since continued at a steady pace. More e-commerce business should mean more demand for PKG’s boxes.

There is also an environmental push to replace plastic packaging with more sustainable paper offerings, which can provide further growth for Packaging Corp’s business. While consumers may be cutting back their purchases of goods as they spend more on services and inflation constrains budgets, PKG is managing through this soft patch with disciplined production, cost, and inventory management. Plus, it still has over $10 in earnings power unless the market deteriorates further. Between e-commerce growth and a movement away from plastic, I view the containerboard industry as offering long-term attractive growth attributes. At 11x earnings, investors should accumulate shares of PKG, enjoy a solid and slowly growing dividend, and ultimately share price appreciation back to at least $130 as earnings prove more resilient than some fear.

Be the first to comment