Muhammet Camdereli/iStock via Getty Images

The six months leading to October 2022 have seen the price return of Pacific Biosciences of California (NASDAQ:PACB) gain by ⁓14% after trailing in the one-year analysis by -60%. With its Q3 2022 earnings date due on November 3, 2022, investors will be keen to see an enhanced product portfolio including the SMRT Cell 8M, Sequel II/ IIe Systems, and the recent Circulomics and Omniome acquisitions.

Thesis

PacBio unveiled the Tandem Repeat Genotyping Tool also known as TRGT, with the ability to sequence broader sections of DNA. This computational analysis method is seen to give scientists and clinicians a robust advantage in spotting DNA sections linked to disease. Despite having fewer instruments on sale in Q2 2022, PacBio managed to raise the average selling price of instruments realizing an increase in instrument revenue. The company is on a mission to raise the installed base of its Sequel II/IIe placements during the remainder of 2022 due to increased customer demand. However, the supply chain is facing a global shortage of semiconductors and rising inflation that have resulted to cost increases that have adversely affected the margins.

Key Highlights of Q2 2022

PacBio’s instrument revenue increased by 9% (QoQ) to $15.6 million from $14.3 million in Q2 2021. Recent instrument releases such as the Sequel II systems realized higher selling prices including a multi-instrument order with greater consumable service revenue volume. The quarter saw PacBio increase its installed base for Sequel II/IIe to 460 from 282 systems in Q2 2021.

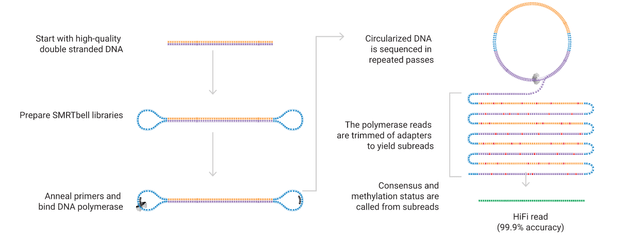

In my view, the company’s strategy has always involved the growth of its Sequel system. After its launch in 2015, PacBio began to phase out the production of the RS II instruments in a move to improve gene computational capacity. Later in April 2019, it launched the Sequel II system which helps customers generate PacBio HiFi reads more efficiently. PacBio has stated that it is the only sequencing technology offering HiFi reads with a 99.9% accuracy since a typical 20,000 bp HiFi read has 8 incorrect bases.

PacBio

In April 2021, PacBio released its new HiFi sequencing workflow that further increased the accuracy of the HiFi reads with a limited sample set. Advanced scientific research in the contemporary world needs sequencing data that is not only accurate but also complete even with limited sample quantities. It did not come as a surprise that the company raised its installed base to 460 Sequel II/ IIe from 282 in Q2 2021. Total revenue in the three months ending on June 30, 2022, was $35.47 million up 15.87% (YoY) from $30.61 million realized in Q2 2021.

These higher revenues were realized from increased product sales. In the 6 months leading to June 30, 2022, product sales alone hit a high of $58.42 million from $51.84 million recorded on June 30, 2021. We note here that PacBio has maintained consistency in the sale of its nucleic acid sequencing products/services considering that it competing against big names in the market. Companies such as Illumina (ILMN), BGI Genomics, Thermo Fisher Scientific (TMO), and Oxford Nanopore Technologies (OTCPK:ONTTF) among others have longer operating histories than PACB.

Market Situation

Gene sequencers from Illumina have been known to power many recent breakthroughs in biology and medicine as far as genome science is concerned. However, the company with a market cap of $34.61 billion has not launched a new product (with full end-to-end workflows) for the past 5 years. It is no wonder that Illumina tried to purchase PacBio in 2018, through a planned merger that was later terminated in January 2020.

By the end of September 2022, Illumina announced that it had scheduled two products for launch in 2023. The two include Novaseq 6000 Dx- an in vitro diagnostic (IVD) high-throughput sequencer that uses long continuous reads to extend completeness of the 30X genome and Illumina Complete Long-reads formerly called Infinity – an enrichment panel that targets the hard map regions of the genome.

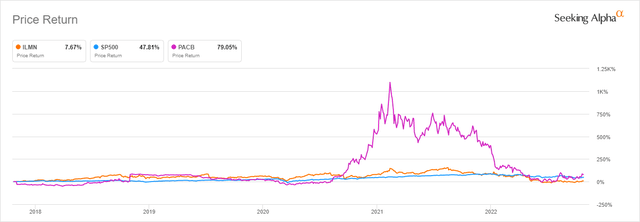

Over the past 5 years, PacBio’s price return has gained 79.05% against Illumina’s +7.67%.

Seeking Alpha

PACB made notable gains particularly in 2021 despite the recent decline by more than 75% from its 52-week high of $31.10.

The CEO, Christian Henry has been at the helm of the company for two years and has promised investors that PacBio will leverage its long-read technology to scale commercialization and drive growth. PACB acquired Omniome and Circulomics in September 2022 to add to its product portfolio and create value for customers. The company’s GAAP operating expenses rose to $84.2 million with non-GAAP operating expenses up 74% (YoY) at $89.6 million in Q2 2022. This increase was primarily driven by the acquisition of Omniome (in September 2021) and increased R&D expenditure at $51.3 million. For Circulomics (acquired in July 2021), PacBio paid $29.5 million in cash for all its outstanding shares of common stock.

PacBio intends to commercialize both Omniome, a short-read platform, and Circulomics a Nanobind technology. To raise the value, Circulomics will be integrated with HiFi to allow for a greater seamless sequencing workflow. While the specifications are impressive considering the increased accuracy in the improved HiFi model, it will be important to consider if the customers will be willing to pay a premium for this product.

Continuous improvement of the Short read and long-read sequencing systems

PacBio also announced Onso, a highly accurate short-read sequencing platform, and Revio a new long-read sequencing system on October 25, 2022. In the announcement, PacBio stated that Revio was designed to give customers the chance to sequence up to 1,300 human whole genomes annually at 30-fold coverage for less than $1,000 per genome. PacBio has not only leveraged scalability but also pricing since it will use HiFi sequencing for conducting large studies including human genetics, cancer research, and agricultural economics.

In his statement about Revio, CEO Christian Henry stated,

We’ve designed an entirely new SMRT Cell with three-fold higher density than our existing SMRT Cell 8M, resulting in 25 million ZMWs. Revio will run up to four SMRT Cells in parallel, which provides up to 100 million ZMWs for sequencing single molecules simultaneously. Combined with significant advances in our computing, Revio will deliver shorter run times and a 15-fold increase in HiFi data. I’m excited to see what researchers can discover using the power of Revio.”

The other product, Onso short-read sequencing system is expected to use PacBio’s sequencing by binding [SBB] technology. PACB expects to commence taking orders for Onso in Q1 2023 and begin shipments in H1 2023 after it completes its external beta program.

Risks to the Downside

PacBio’s management is relatively new considering it has only been in place since September 2020. However, Christian Henry, the CEO worked at Illumina since 2005 where he started as the Chief Financial officer. I believe he brings a wealth of experience, especially in commercialization and product development strategy.

In my view, PacBio is trying to be aggressive on sales since total revenues increased to $35.5 million in Q2 2022 up from $33.2 million in Q1 2022. Additionally, gross profit has almost doubled from the 12 months to September 2020, where it stood at $34.1 million to $63.2 million in the 12 months to June 2022. It represents an increase of 85% (on TTM analysis). However, it is still left to be seen if customers will be willing to pay a premium for the higher accuracy products provided by Omniome and Circulomics technologies into 2023. Further, applications dealing with nucleic acid sequencing are new therefore it may take time for PacBio to establish new customers.

The global shortage of semiconductors and rising inflation may continue to adversely affect PacBio’s business. Cost of revenues grew 1.5% (QoQ) to $19.1 million leading the company to make a net loss of $71.4 million in the quarter. However, this net loss represents a reduction of 12.4% (QoQ) accumulated in Q1 2022 where it stood at $81.5 million.

PacBio’s cash levels have declined 13.9% (QoQ) to $899.2 million in Q2 2022. The company’s total conventional debt stands at $950.2 million. It does not have enough cash to offset the debt as it will remain with a deficit of $51 million. Positively though, in the six months ending on June 30, 2022, PacBio spent a total of $157.82 million in operating activities and capital expenditures. Without considering the risk of offsetting the debt balance (within a year), PacBio has sufficient cash to run its operations well into 2023.

Bottom Line

PacBio’s strategic revolution has been characterized by aggressive investments in product development. The company aims to commercialize its long and short-read technologies while promoting new technologies to improve the accuracy of its Sequel II/IIe platforms. The company had a strong balance sheet with cash at $899.2 million enough to power operations and capital expenditures into Q2 2023.

However, the company’s CEO has been at the helm of the company for 2 years and I believe it will require some time to actualize the turnaround strategy. PacBio is also facing other macroeconomic issues such as inflation and a shortage of semiconductors that may hamper product production. Still, the company is in a greater position to progress its product development with a higher level of automation to not only increase revenue but the average yield in the long term. For these reasons we propose a hold rating for the stock.

Be the first to comment