FilippoBacci

Investment Thesis: While the Johnny Was acquisition has resulted in a temporary reduction in cash flow – I take the view that continued growth in sales and earnings should mean an improvement in the company’s cash position, leading to longer-term upside.

In a previous article last month, I made the argument that Oxford Industries, Inc. (NYSE:OXM) could see further potential upside ahead. This was on the basis of continued earnings growth, along with the acquisition of the Johnny Was brand and Tommy Bahama’s new partnership with Lowe allowing the brand to expand across the hotel industry.

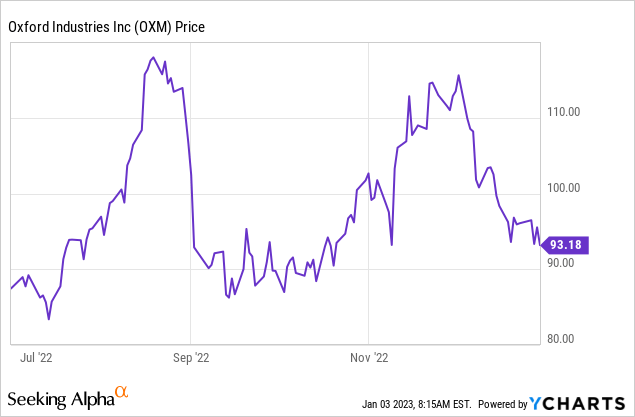

In spite of these assertions, the stock is down by nearly 10% since my last article:

ycharts.com

The purpose of this article is to assess whether the prior case for upside that I made in my last article still holds, and the trajectory for the stock from here.

Performance

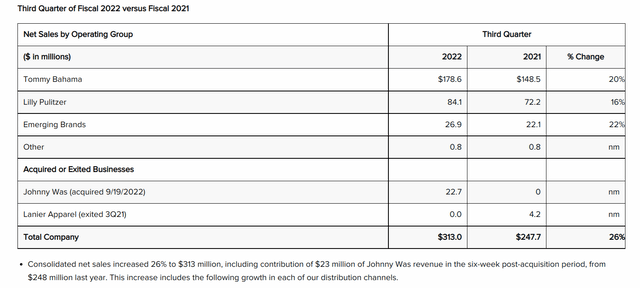

When looking at sales performance for Oxford Industries as compared to the same quarter last year, we can see that total company sales are up by 26% – with all operating groups showing double-digit growth and the Tommy Bahama brand up by 20%.

Oxford Industries: Third Quarter 2022 Press Release

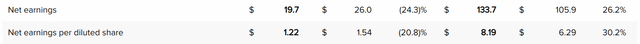

We can see that while net earnings per diluted share were down by over 20% on a quarterly basis – the same was up by over 30% on a nine-month ended basis.

Oxford Industries: Third Quarter 2022 Press Release

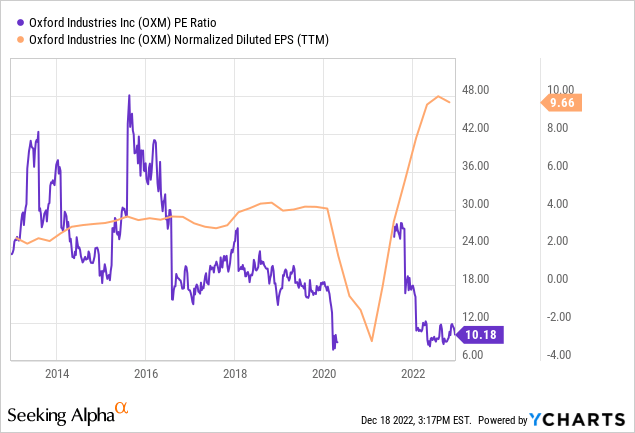

Additionally, when we look at the company’s P/E ratio on a 10-year basis, the ratio is trailing at a 10-year low – while earnings on a normalized diluted basis remain near a 10-year high – in spite of the recent quarterly decline.

ycharts.com

However, a look at Oxford Industries’ balance sheet metrics illustrate that the quick ratio has fallen significantly below 1, which puts the company in a less favorable position to be able to meet its current liabilities using existing liquid assets:

| Jul 2021 | Oct 2021 | Jul 2022 | Oct 2022 | |

| Total current assets | 349046 | 366953 | 421248 | 299495 |

| Inventories, net | 77330 | 90981 | 135483 | 171639 |

| Prepaid expenses and other current assets | 24720 | 23609 | 29242 | 28643 |

| Total current liabilities | 220184 | 207172 | 222640 | 230395 |

| Quick ratio | 1.12 | 1.22 | 1.15 | 0.43 |

Source: Figures (except quick ratio) sourced from Oxford Industries Second and Third Quarter 2022 Earnings Results. Figures provided in USD thousands. Quick ratio calculated by author as total current assets less inventories less prepaid expenses and other current assets all over total current liabilities.

Long-term debt now stands at just over $130 million, and the company’s long-term debt to total assets ratio stands at just over 11%.

With that being said, the company reports that the Johnny Was acquisition is the main cause of the rise in debt and decrease in cash flow – with Oxford Industries reporting an increase in inventory of $25 million as a result of the acquisition, with the debt of $130 million resulting from its revolving credit agreement at the end of Q3 2022.

As we have seen from net sales performance above – the acquisition of Johnny Was resulted in an increase of $22.7 million in net sales for Q3 2022 and the company expects fourth quarter sales to see further growth which should allow for inventory levels to come back down to a more normal range.

Looking Forward

Going forward, I expect that the company’s expectation of continued sales growth is plausible. In an environment of inflationary pressures and supply chain concerns – Oxford Industries has continued to see strong growth in net sales.

As we have seen, the company has seen a decrease in cash and higher debt levels as a result of the Johnny Was acquisition. However, I take the view that we should see these metrics approach normal levels once again given that sales performance continued to remain strong in spite of inflationary pressures.

One risk at this point is whether Oxford Industries might cut its dividend in light of the reduction in cash flow.

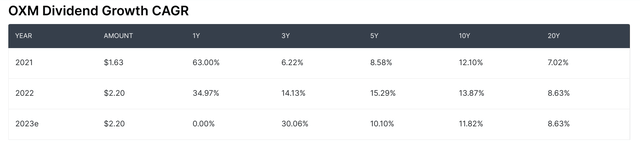

As we can see, Oxford Industries has had two consecutive years of dividend increases – while the dividend payout for 2023 is expected to remain at the current level. Should we see net sales growth come in lower than expected in the upcoming quarter, then the risk of a dividend reduction might increase. However, I take the view that this is an unlikely scenario given the strong growth that we have seen in net sales.

Conclusion

To conclude, Oxford Industries has demonstrated strong sales growth over the past quarter – and earnings growth on a nine-month ended basis has also remained strong.

The stock has seen some consolidation of late given broader macroeconomic pressures. However, I take the view that business performance remains strong and continued strong performance in net sales would mean that the company’s cash position would be expected to strengthen once again. Taking these factors into consideration, I expect that Oxford Industries, Inc. will see a rebound in longer-term upside. Thus, I maintain my bullish view on Oxford Industries, Inc. stock.

Be the first to comment