We Are

Owl Rock Capital Corporation (NYSE:ORCC) announced an increase in dividend rate to $0.33 per share per quarter after easily covering its dividend pay-out in the third quarter with net investment income.

The business development firm also announced that it will distribute excess portfolio income in the form of a supplementary dividend of $0.03 per share in the fourth quarter.

I am confident in Owl Rock’s net asset value because of the BDC’s strong portfolio performance and low non-accruals.

Because the stock is still trading at a discount to NAV, I continue to recommend ORCC to passive income investors.

Portfolio And Credit Quality

Owl Rock’s credit quality remained strong in the third quarter. It added one new investment to its non-accruals, but the overall exposure to troubled loans is small in comparison to the total portfolio value of the company.

Owl Rock had two non-accrual investments at the end of the September quarter, accounting for 0.6% of the business development company’s investments based on fair value. The total investment value of Owl Rock’s investment portfolio was $12.84 billion, a $188 million increase QoQ.

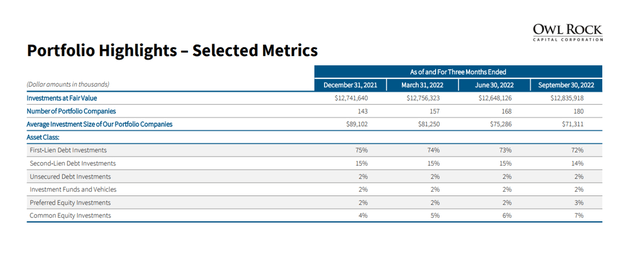

In the third quarter, high quality first and second liens accounted for 86% of the BDC’s investments. Other investments included unsecured debt, funds/investment vehicles, and equity, accounting for 14% of Owl Rock’s total investments.

Portfolio Highlights (Owl Rock Capital Corp)

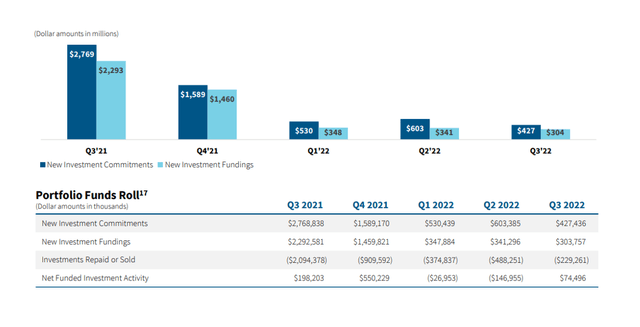

Owl Rock’s new investment fundings totaled $304 million in the third quarter, roughly the same as in the first and second quarters. Demand for new investment funding is not as strong as it was in 2021, but Owl Rock’s portfolio continues to grow, and the BDC appears to have no trouble finding new investment opportunities.

New Investment Fundings (Owl Rock Capital Corp)

Dividend Is Covered, Owl Rock Increased Distribution

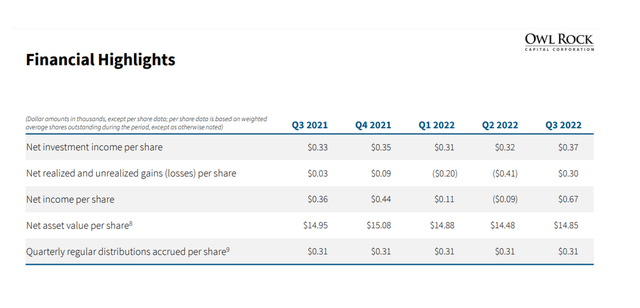

In the third quarter, Owl Rock earned $0.37 per share in net investment income, outperforming the business development company’s running quarterly dividend pay-out by 6 cents.

Owl Rock’s pay-out ratio in Q3’22 was 84%, indicating that the regular dividend pay-out was easily covered by net investment income. In the previous twelve months, Owl Rock’s dividend pay-out ratio was 92%.

Financial Highlights (Owl Rock Capital Corp)

Owl Rock announced an increase in its quarterly dividend due to its strong portfolio performance, high credit quality, and confidence in its net investment income.

The new quarterly (regular) dividend will be $0.33 per share, with the first payment made in the fourth quarter. Owl Rock also announced the payment of a $0.03 per share supplemental dividend for the third quarter, bringing the total payout in the fourth quarter to $0.36 per share.

Owl Rock now provides a covered 9.9% dividend yield to passive income investors as a result of the increase in the regular dividend rate.

Owl Rock Is Still Available In The Market At A Discount

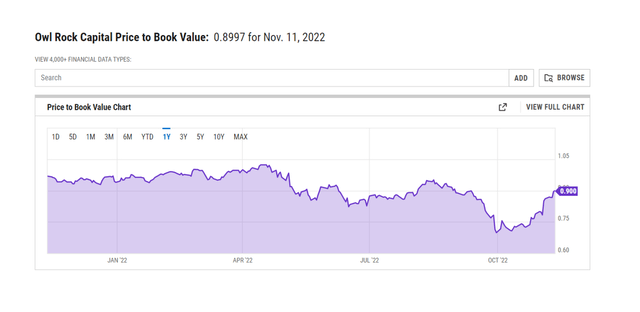

Despite a strong recovery in its stock price in October, Owl Rock is still valued below its net asset value of $14.85 in the third quarter of 2012.

With a current stock price of $13.36, the valuation represents a 10% discount to net asset value.

Owl Rock, in my opinion, is undervalued and should trade at or near book value, if not at a premium, due to the high quality of the BDC’s investment portfolio.

Why Owl Rock Might See A Lower/Higher Valuation

Owl Rock’s distinct selling point is the safety of its portfolio, which is focused on First Liens and has a low number of non-accruals. Increased non-accruals would almost certainly result in a lower net asset value and possibly a higher discount to net asset value.

I believe the BDC is well-managed, and given the quality of the portfolio, I believe the discount to net asset value will narrow rather than widen in the future.

My Conclusion

The second-most important takeaway from the BDC’s earnings release in early November was that Owl Rock covered its dividend with net investment income.

The most important takeaway was that the BDC increased its regular distribution by $0.02 per share to $0.33 per share and will pay a $0.03 per share supplemental dividend in Q4’22.

Owl Rock offers passive income investors a 9.9% dividend based on the regular dividend payout, while the stock is still trading at a 10% discount to net asset value. ORCC is a good investment.

Be the first to comment