guvendemir

In each monthly portfolio review we discuss how the stocks and portfolio as a whole are positioned for the forward environment. This month’s update will focus more on portfolio strategy and the process of stock selection. For a more stock specific focus please check out the September portfolio review available on Portfolio Income Solutions.

A dark 6 years for REITs

2CHYP, 2nd Market Capital’s High Yield Portfolio, began trading on 7/1/16 and its 6.25 years of operation have been in one of the roughest REIT markets of all time.

They say to make hay when the sun is shining, but what are you supposed to do when it’s not?

I think you just make hay anyway.

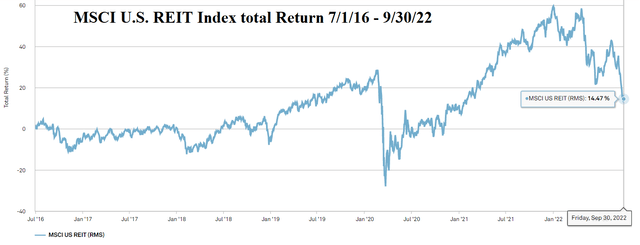

Over 6.25 years the REIT index returned only 14.47%.

S&P Global Market Intelligence

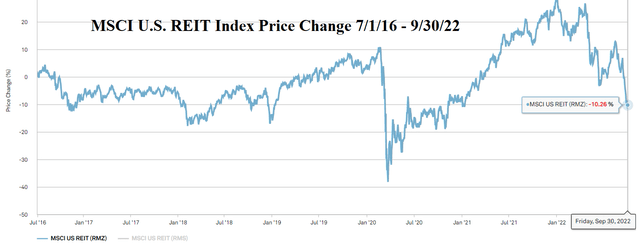

If we were to look at price alone, the REIT index is down 10.26%.

S&P Global Market Intelligence

More than 100% of the return came from dividends.

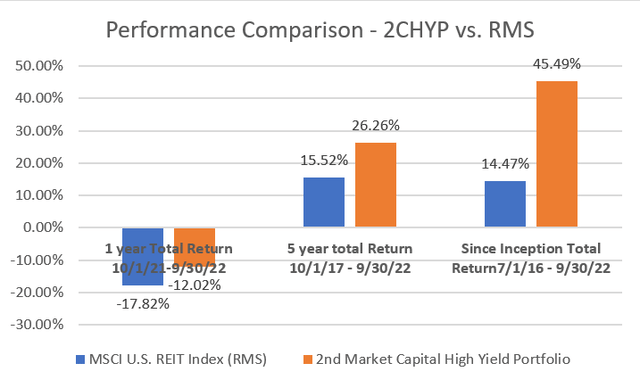

Even in this dark period there were opportunities to outperform the index. Certain portions of the REIT market were overhyped and had bloated valuations. Simply avoiding these names helped substantially. There were other pockets of the market that despite excellent fundamental setups were unpopular, affording us an opportunistic entry point.

Over this same time period, 7/1/16 – 9/30/22, we managed to capture a total return of 45.49%. That is far less than we would normally like to get in 6.25 years, but given that it was one of the worst 6.25 years in REIT history I am proud of the result.

Interactive Brokers and S&P Global Market Intelligence. See accompanying notes and disclosures

Our active management is a continuous process of repositioning into high quality undervalued REITs. Each trade individually is a small advantage, but they summed up to a total return that was a bit more than triple the index return.

The success was not without bumps in the road, and I believe in learning from mistakes, so I want to take a minute to discuss some of the positions that did not go our way. Two stand out to me as mitigating our alpha.

- Significant position size in high leverage mall REITs heading into COVID.

- Taking gains far too early

In assessing a suboptimal choice and learning from it, it is crucial to separate the result from the expected value at the time of the decision.

Consider a coin flip where you pay $1 to enter, heads nets $3 ($2 profit) and tails nets $0 (1$ loss). This is a great expected value with an average return of $0.50 and it is correct to play it every time, including the times it comes up tails. Thus, not every position that resulted in a loss was a mistake and not every position that resulted in a gain was a good trade.

The above decisions were suboptimal upon further reflection because they were negative expected value at the time the decision was made.

I of course did not know it at the time, or I would not have made these decisions, but I think there were enough data points that one could have known they were incorrect even without the benefit of hindsight.

With the mall REITs, for example, I don’t believe it was possible to see COVID coming, but the companies were high leverage and in a somewhat volatile sector. That combination of volatility and leverage makes any number of factors potentially risky. It ended up being COVID that was the nail in the coffin, but perhaps a regular recession would have done the same. There is a place for high-risk, high-reward stocks in a portfolio, it just should have been a much lower concentration.

The other thing I could have done better was allowing winners to play out. I ended up selling winners too early. As a young and still green analyst I was eager to take gains as a sort of proof of concept of the process so I ended up trimming a dozen or so securities over the years at a 10%-20% gain.

Selling when a stock reaches fair value is proper, but selling while a stock is still far undervalued is probably not correct.

With exception to tax considerations, existing gains or losses on a position should not be factored into the sell or hold decision. I have since amended the portfolio’s sell discipline to be a matter of opportunity cost.

I sell a stock if and when a different stock becomes relatively better. The raw opportunity is then weighed against the diversification benefits to determine if the new position better suits the portfolio.

Goal and process of 2CHYP portfolio

We do not chase exciting stocks or speculate. It is a simple matter of fundamental analysis informing stock selection. We are guided by an underlying philosophy that a diversified portfolio of stocks with a superior combination of quality and value will outperform over time.

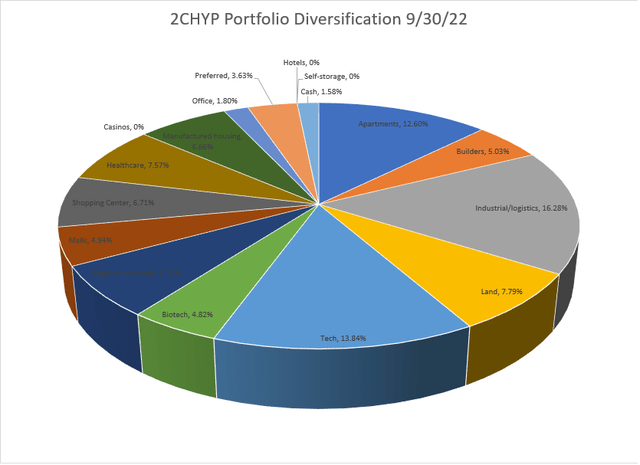

As of 9/30/22 here is the diversification by economic exposure:

2nd Market Capital

Superior quality and value are partially a matter of top down sector selection. You may note in the pie chart above that we have zero exposure to hotels, self-storage and casinos. Hotels are fundamentally disadvantaged in their vertical with travel agencies and brands perpetually eating up too high a percentage of profits. Self-storage and casinos are perfectly fine sectors fundamentally, but are getting a bit expensive on valuation.

We also have a massive underweight relative to the index in office as I think the sector is oversupplied with new construction still coming in despite high national vacancy rates.

In contrast, we are intentionally overweight sectors that have more growth and are undersupplied.

- Farmland

- Housing (apartments, homebuilding and manufactured housing)

- Hospitals

- Labs

- Manufacturing facilities

- Fiberoptic cable

We also like towers and have a full position in American Tower (AMT), but that is not an overweight because the tower REITs are so large that they are a massive portion of the index.

Superior quality and value also come from individual stock selection within the 21 REIT property sectors.

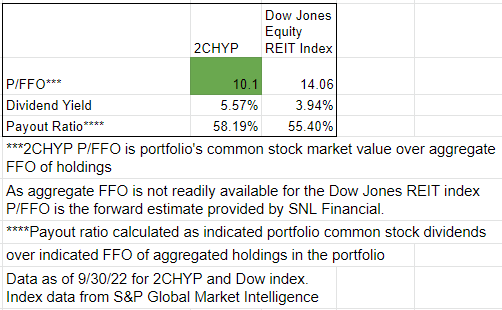

The REIT index has an FFO multiple of 14.06X while our portfolio has a multiple of 10.1X

Portfolio Income Solutions

That extra value means we have a cashflow yield of 9.9% while the index has a cashflow yield of 7.1%. More cashflows means a bigger dividend yield at 5.57% while maintaining a reasonable payout ratio of 58% such that there is plenty of capital left over for growth.

Going forward – Spring-loaded portfolio

Having survived the dark times with a moderate return I look forward to working in a more favorable environment.

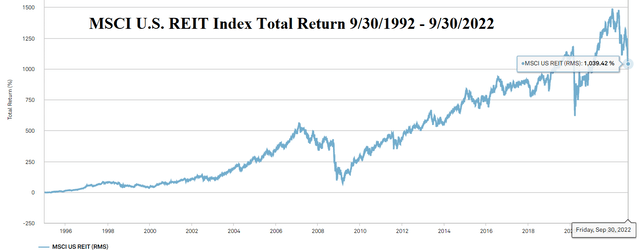

It is worth noting that this dark period is quite unusual for REITs as they have typically outperformed the market and delivered a CAGR of somewhere in the 9%-11% range depending on the time period. The 30-year chart, for example shows a 1039% return.

S&P Global Market Intelligence

This sharp contrast between recent REIT performance and long term REIT performance lends itself to the question: Has something fundamentally changed that REITs are no longer a high return sector?

Market sentiment on real estate is so low right now that they seem to think this is the case, but there are two factors that we think suggest the good times will return

- Valuation

- Growth

While REIT prices have been down for 6.25 years, FFO/share has grown. REITs have also upped their quality with lower debt levels and have transitioned their portfolios to better asset types.

In combination this makes REITs spring-loaded to bounce out of this dip.

The REIT index FFO multiple is now 14.06X as of 9/30/22. That is the cheapest it has been in quite some time.

When you have an investing universe that is both higher quality/growth than normal and trading at a lower multiple than normal, that is a recipe for much higher returns. I can’t predict exactly when sentiment will rebound or when the market pricing bottom will be, but the sheer fundamental strength relative to the price is phenomenal right now.

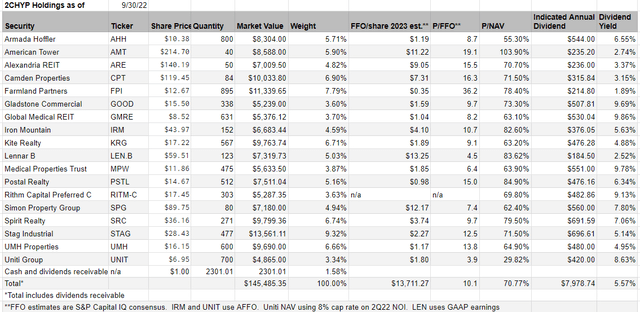

So, without further ado, here is how we are positioning heading into the fourth quarter:

Portfolio Income Solutions

In lieu of the usual stock by stock elevator pitch, I want to discuss our process of how we find undervalued stocks.

Derivative extrapolation – CPT, STAG, ARE, AMT and IRM

Allow me to take a step back and discuss growth from a mathematical perspective particularly looking at three layers.

- Earnings – the current amount of earnings

- Growth is the derivative of earnings

- Acceleration or deceleration of growth is the second derivative of earnings.

If you were to graph these, the earnings would dominate in the short term, growth would dominate in the intermediate term and acceleration or deceleration dominates in the long term.

I wanted to establish this background because it is particularly relevant to five of our companies due to their being in the multifamily, industrial, tower and life science sectors.

In all four sectors, current earnings are great, the highest they have ever been. Earnings growth is also great with all four sectors posting double-digit rental rate growth in 2022 (as much as 40%).

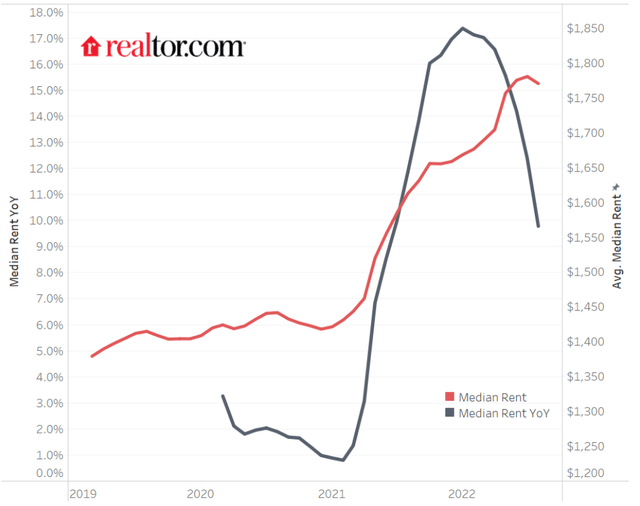

It is the second derivative that has caused markets to sell these names into the ground. The graph below is for multifamily, but you would see similar charts with respect to the derivatives for the other sectors.

Realtor.com

See rent is still growing at 10% for multifamily year over year, but the pace has slowed from over 17%. As such, the second derivative is negative.

If one extrapolates this for a very long duration, the negative derivative would eventually dominate causing growth to turn negative and earnings to turn negative.

That seems to be what the market is doing.

The second derivative only matters, however, if it is reasonable to extrapolate it. I find such extrapolation to be dubious at best given how rapidly changing the environment is. When growth was accelerating I did not extrapolate that to infinity and now that it is decelerating I still see no reason to extrapolate it.

A much better way to get a read on the long-term growth rate is to look at the actual fundamentals.

- Multifamily is still undersupplied with steady demand growth.

- Industrial is slightly undersupplied and has rapid demand growth.

- Life science is undersupplied and the market is dominated by a few critical campuses where ARE has dominant market share.

- Towers are underbuilt in most of Asia and emerging markets

The growth will accelerate and decelerate in patterns that I cannot predict, but the fundamental setup suggests it will be strong long term.

Bringing this back to the specific REITs, Alexandria (ARE), Camden (CPT), Iron Mountain (IRM), and STAG Industrial (STAG) are priced at low FFO multiples and growing at a pace that fluctuates between moderate and rapid. The growth is not priced in and as FFO/share rises they are poised to deliver strong total return. The low FFO multiples only make sense if one extrapolates the second derivative far further into the future than one can reasonably see.

American Tower is priced under 20X FFO for the first time in a very long time.

Iron Mountain’s price fell drastically after its investor day when they put out a projection to grow AFFO/share at an 8% CAGR through 2026. The market was apparently upset because this is slightly slower than Iron Mountain had been growing (a negative second derivative).

I see it as excellent growth for a company trading at about 10X AFFO. All four of these companies are freshly cheap due to the market’s myopic focus on extrapolation. The market might not be aware that they are straight lining a volatile factor for multiple years. They might just see scary words like “decelerating” and hit the sell button.

Wrongfully accused – UNIT, MPW, GMRE, AHH, GOOD

One of the most reliable sources of undervaluation is a stock being wrongly accused of something, whether it is wrongdoing or some sort of risk factor that is blown out of proportion.

The challenge with situations like this is that it takes a massive amount of work to dig through accusations and figure out if the company is innocent. Therefore, anyone who does not have the time to independently do the deep research might be inclined to sell.

Quite often when a company is accused they are actually in the wrong so it is entirely understandable for investors to err on the side of safety and sell, especially given how much work it takes to look into it.

Well, as REIT dedicated investors, we have a relatively small universe of stocks. There are only about 180 equity REITs and we as a company have been studying them for about 30 years. I have personally been studying them for about 11 years. This makes the workload of looking into accused companies much less daunting.

In fact, one of our best trades came from a wrongfully accused company as Farmland Partners (FPI) was insinuated to have done in-dealing of loans to related parties. The stock fell off a cliff and that allowed us to get shares at a ridiculously cheap price. The cost basis of FPI shares in 2CHYP is a weighted average of $7.15

It took many years for FPI’s innocence to be proven in court, but through doing the work we were able to get in on it early.

We make it a point to establish relationships with as many REIT CEOs as possible. We talk to everyone we can in the entire spectrum from slime-balls to saints. I speak openly and publicly about my opinions of REIT management teams, calling out those who abuse shareholders such as RMR, Ashford, and Nick Schorsch. I also discuss those who operate with integrity, putting shareholders first.

Over the years, and hundreds of meetings I believe I have gotten fairly good at deciphering the honest from the dishonest. Occasionally I do get fooled, but actually talking to people is a heck of a lot more accurate than merely guessing.

So, when the FPI news hit and the stock dropped 40%+ I reviewed the loans in question and determined that they were clearly beneficial to FPI. If the loans performed, FPI was getting a roughly 8% stream of interest income, and if they failed, FPI got about double their money back in farmland that collateralized the loans. With that information and a pre-existing relationship with Pittman in which I believed him to be trustworthy, it was a fairly easy choice to pick up the freshly cheap shares.

With that background out of the way, there are five stocks I see as opportunistic presently due to being “wrongfully accused” by the market.

- Gladstone Commercial (GOOD)

- Uniti Group (UNIT)

- Armada Hoffler (AHH)

- Global Medical REIT (GMRE)

- Medical Properties Trust (MPW)

GOOD is a triple net REIT that consistently trades at a discount to peer triple net REITs based on it being externally managed. The market associates external management with misalignment and while it is true that there have been a disproportionate amount of misaligned external managers, guilt by association is fallacious. Gladstone Commercial is the only REIT I know to have voluntarily not taken its management fee so as to preserve capital for shareholders. Following the great financial crisis, GOOD was temporarily not covering its dividend. In order to make up the difference, its external manager waived a significant portion of its fee so as to not have to cut the dividend. It was one of only a handful of companies to not cut dividends during the difficult time and it was because of management’s integrity. Thus, the external management discount is a wrongful accusation and GOOD is opportunistically cheap

Not every wrongful accusation is directly at management. It could also be a risk factor blown out of proportion or a mischaracterization of assets. For Uniti, it is a matter of a risk factor being priced in more than 100% of its potential damage.

Uniti and Windstream have a weird relationship and the contract between them is just as unusual. The big risk that the market is worried about is that when the contract comes up for renewal in 2030 the pre-existing terms of the contract might allow Windstream to lease the fiber assets at a below market rate for the next period.

I don’t think that is going to happen. I think it will end up being re-leased by Windstream or someone else at a market rate, but even if that bad scenario plays out the price discount attributed is beyond the damage it would cause.

Uniti is trading at 3.9X forward AFFO. That is a level that implies disaster, but even in the bad case of Windstream getting to lease below market what is essentially happening is UNIT getting full cashflows from 2022 through 2030, low cashflows from 2030 to 2040 and then full market rent cashflows again after that.

So years 0-8 look good and years 18 and beyond look good. That just strikes me as not justifying a 3.9X AFFO multiple.

Medical Properties Trust has a somewhat large concentration with Steward as its biggest tenant. The exact revenue percentage bounces around but it is somewhere in the mid-teens. A writer for the Wall Street Journal has suggested Steward is going to go bankrupt and MPW’s stock has been cut in half.

The reaction is completely overblown for three reasons:

- Steward’s weak financials are based on COVID era numbers which were likely worse than normal due to COVID blocking hospital revenues.

- The price reaction greatly exceeds the harm of a failed tenant. MPW has replaced big tenants before with minimal loss to revenues (see Adeptus)

- MPW does not have significant exposure to its operators. It owns the real estate and the hospitals themselves are well located. It is good real estate with a potentially bad tenant. MPW owns the real estate.

GMRE and AHH have gotten clobbered due to being clumped in with office. Office fundamentals are indeed troubled, but medical office has completely different fundamentals. Vacancy at medical office is fairly low and occupancy is rising.

Similarly, Armada Hofflers office consists of trophy locations and long term leases to reliable tenants. In the most recent quarter, AHH’s office rents were resigned at significantly higher rates.

Cyclical bottom SRC, KRG, SPG. LEN.B

Homebuilding has taken a turn for the worse with mortgage rates shooting up. Retail has long been afflicted by e-commerce and has recently been harmed by COVID.

Each of these is at a cyclical bottom in terms of sentiment and the stocks are trading as if the situational declines are secular trends. I am of the belief that COVID will get less bad as time goes on and that mortgage rates will stop shooting upward. They might stay at this level, but if mortgage rates have been 7% for years it is not as shocking as if they were just recently at 4%.

As such, I am valuing Spirit Realty (SRC), Kite Realty (KRG), Simon Property (SPG) and Lennar (LEN.B) based on long run averages for their fundamentals. The deathly earnings multiples imply something much more dire

Too small to be understood – RITM-C, PSTL, UMH

Most institutions have a minimum market cap before they can even consider investing in a stock. Companies smaller than that threshold often fly under the radar and are particularly misunderstood by the market when they have unusual business models.

Postal Realty (PSTL) epitomizes this lack of market awareness as it is a microcap with a unique business. I think people hear about the post office being unprofitable and assume it makes PSTL risky, but I consider this to be my lowest risk position. The government has paid their rent for hundreds of years without fail and I don’t see that stopping anytime soon.

Rithm Capital Preferred C (RITM-C) has a yield that converts to floating rate, but the issue is so tiny that I don’t think it has yet been noticed that it is a variable rate security. Its market price has gone down by almost the exact amount one would anticipate a fixed income security to go down as interest rates rose.

Due to its variable conversion, however, it gets better with higher interest rates, not worse. The variable rate yield on it is up to 12.4%, but the market is only seeing the current fixed 9.16% (from the 6.375% coupon).

UMH Properties (UMH) is often left out of the discussion due to its small size even when the market gets excited about manufactured housing. Fundamentally, UMH consistently outperforms its large cap peers in same store NOI growth, but it still trades at a significantly discounted multiple.

Wrapping it up

Real estate fundamentals look strong to me. Inflation has increased construction cost which means the standing buildings are more expensive to replace. Potential tenants have to decide between renting or building their own, so the high construction cost directly increases REIT negotiating power for rental rates. COVID substantially reduced construction pipelines leaving many types of real estate undersupplied. The overall supply and demand picture looks quite favorable for real estate owners.

These strong fundamentals happen to coincide with a time when publicly traded REITs are at extremely low multiples.

This combination of value and operational strength has REITs spring-loaded for high returns going forward. Through careful selection of the best REITs, I intend to do even better than that.

Be the first to comment