Paul Kane/Getty Images News

It’s been a rough couple of months for the Gold Miners Index (GDX), with the index reversing from a gain early in the year to a (-) 20% year-to-date decline, underperforming the S&P 500 (SPY). This can be attributed to rising costs and a falling gold price which have pinched margins, but even inflation-protected companies have participated in the violent sell-off. In my view, this is a case of the babies being thrown out with the water, and Osisko Gold Royalties (NYSE:OR) is one of those companies. So, for investors looking for precious metals exposure at a dirt-cheap valuation, I see Osisko Gold Royalties as a name worthy of consideration as we sit below $10.00 per share.

Canadian Malartic Mine – Osisko GR (3-5% NSR) (Company Website)

Earlier this month, I wrote on Osisko Gold Royalties, noting that the stock was too cheap to ignore. The reason for this view was that it was trading at 0.80x P/NAV despite having an industry-leading organic growth profile. Since then, the stock has struggled to make upside progress amid even worse sentiment for the sector, but its Q2 results were solid, and it continues to see positive recent developments across its portfolio. In my view, the fact that the stock has not moved on this news is a gift, and the stock should be trading at least 10% higher based on these recent developments and record Q2 GEO volume. Let’s take a closer look below:

Q2 Preliminary Results

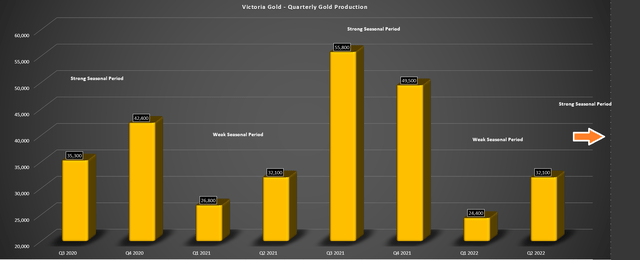

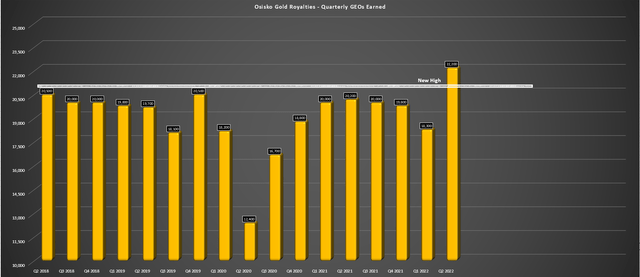

Osisko Gold Royalties (“Osisko”) released its preliminary Q2 results last week, reporting quarterly attributable GEOs of ~22,200, a record for the company since its inception in 2014. This record was helped by the return to receiving payments from the Renard Diamond Mine following the stream’s reactivation on April 30th, partially offset by the Eagle Mine being in its slow seasonal period. Given that the company will start enjoying full quarterly contributions from Renard in Q3 2022 and Eagle will ramp up closer to its normal seasonal rate (50,000+ ounces per quarter), I would not be surprised to see another new volume record in the back half of the year for Osisko.

Eagle Mine – Quarterly Gold Production (Victoria Gold Filings, Author’s Chart) Osisko Gold Royalties – Quarterly GEO Volume (Company Filings, Author’s Chart)

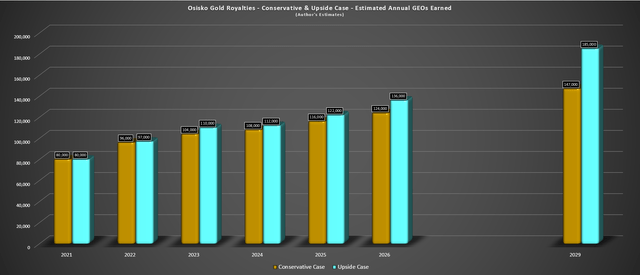

While the Q2 quarterly volume was solid and has set Osisko up to deliver into its FY2022 guidance of 90,000 to 95,000 GEOs (~40,500 year-to-date) with deliveries being back-end weighted, the developments across the portfolio were just as exciting, and there were several. These developments de-risk what’s already an industry-leading organic growth profile for Osisko, with a path towards 130,000 GEOs at the mid-point by 2026, translating to a ~10.2% compound annual growth rate. Osisko has guided for a mid-point of 135,000 GEOs in 2026 or ~11% CAGR, but I have chosen to be more conservative.

Osisko GR – Long-Term Growth Profile (Company Filings, Author’s Chart & Estimates)

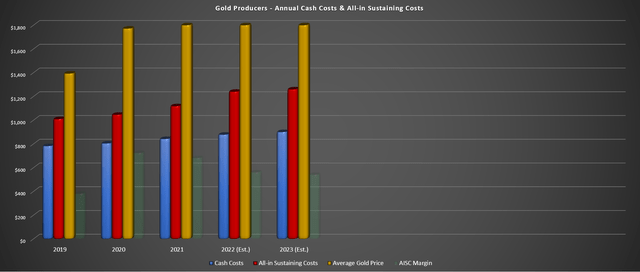

This growth profile makes Osisko stand out among its peer group, with a top-10 growth profile sector-wide and one of the only double-digit compound annual growth rates in the royalty/streaming sector. Based on this growth, Osisko is in a unique position that it will be able to grow cash flow, dividends, and earnings per share regardless of the gold price volatility. The reason is that even if the gold price were to find itself at $1,600/oz in 2024/2025, which is arguably near the floor given the rising cost of production on an all-in cost basis, Osisko’s production volume growth would more than offset any decline in margins (50% production growth vs. 2021 vs. a potential 8% – 10% decline in gold price).

Costs, Gold Price, Margins + Forward Estimates (Company Filings, Author’s Chart & Estimates)

Before moving on to recent developments, it’s important to note that this growth profile does not account for any new producing royalties/streams acquired by the company between now and 2025, suggesting that the above estimates are likely conservative. It’s also worth noting that in a period where producers struggle to hold the line on margins, evidenced by the Newmont (NEM) Q2 report, royalty/streaming companies should be a staple for any portfolio looking for precious metals exposure to diversify. Just as importantly, their exposure should be concentrated in safer jurisdictions, an area where Osisko excels.

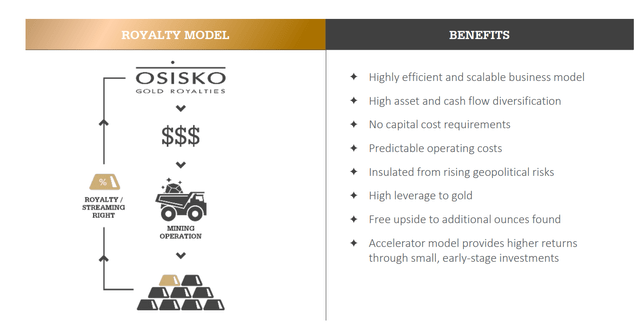

Osisko Gold Royalties – Business Model (Company Presentation)

Osisko wears the crown as not only a top-10 growth story sector-wide (2021-2026) but a highly liquid name in the royalty/streaming space (1.0+ million shares traded on average), making it an attractive option for funds looking to increase exposure to the sector. Hence, I expect it to be a beneficiary of what should be a stampede back into the sector as sentiment begins to improve after a major washout over the past few months. However, it should get extra points due to its growth and inflation-protected business model, a key differentiator relative to most other names in the sector. Let’s take a look at recent developments below:

Recent Developments

Tocantinzinho

G Mining Ventures recently secured its financing, and its goal is for the first gold pour at the Brazilian mine by Q4 2024, and potentially earlier, given the strong team at the helm. Although Osisko GR’s 2.75% NSR royalty is subject to a buy-down (it will be 0.75% post-buy-down), this would still translate to a contribution of ~1,300 GEOs per annum between 2025-2029, adding more than $2.0 million in revenue per annum. Although G Mining is a very small company, it is led by a phenomenal team responsible for the construction of the following projects over the past decade:

- Essakane

- Fruta del Norte

- Process plant automation in Nunavut at Meliadine

- Merian Project in Suriname, where GMS did a DFS/Project Optimization, Engineering/Construction for Stage 2 at Merian

Given the team’s experience, this reduces the risk of the project going over budget or behind schedule, making this another key asset that will pad Osisko’s attractive growth profile over the next couple of years.

Mantos Blancos

Capstone Copper (OTCPK:CSCCF) is progressing well on its ramp-up of the Mantos Blancos expansion to 7.3 million tonnes per annum, expected to push Osisko’s annual attributable GEOs to more than 16,000 GEOs per annum over the next few years depending on copper prices. This is a significant boost from the ~9,000 GEOs earned in 2021, translating to an additional $10+ million in revenue per annum attributable to Osisko. However, the company noted in its Q1 results that it’s analyzing the potential for a further expansion to 10 million tonnes per annum using the existing ball mills and process equipment. At these levels, Osisko’s attributable GEOs would come in above 20,000+ GEOs, doubling from FY2021 levels. So, while no start date or confirmation is clear yet, investors should watch for the Feasibility Study in Q4 2022.

Amalgamated Kirkland & Akasaba West

Those familiar with Osisko will know that it owns many royalties on Agnico’s ground, including its massive 3-5% NSR royalty on Canadian Malartic. However, among smaller assets that sometimes get missed by investors, there are a couple of small boosts to future attributable production that look to be in play short term.

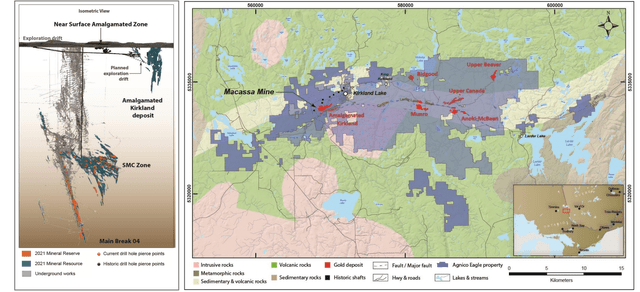

The first is Amalgamated Kirkland [AK] and the rest of Kirkland Lake Camp, where Osisko Gold Royalties holds a 2.0% NSR royalty. Before the KL/AEM merger, this was an orphaned deposit lying east of Kirkland’s high-grade Macassa Mine. Given the invisible border between Macassa and the AK deposit, it wasn’t exploited. The reason? AEM had the resource (600,000+ ounces) but didn’t have the infrastructure, and a deposit of this size didn’t justify a mine. However, with the boundaries removed, Agnico is considering using this as a satellite deposit for Macassa, given that it can drift across from the Macassa infrastructure.

Macassa & AK – Kirkland Lake Camp (Agnico Presentation)

The opportunity is not that significant, with the potential for just 40,000 GEOs per annum starting in 2024. However, this would translate to an additional 800 GEOs to Osisko or more than $1.4 million in additional revenue. Perhaps the most exciting opportunity, though, is a potential extension of the South Mine Complex onto Agnico’s land. The South Mine Complex at Macassa carries phenomenal grades (half an ounce per tonne of gold). It could also complement Macassa’s production profile (like AK), but on Agnico Eagle land, benefiting Osisko, who has a royalty east of the South Mine Complex. Finally, it holds a 2.0% NSR on 25,000 hectares of land in the camp, suggesting long-term royalty upside, including Upper Beaver post-2026, which I estimate will contribute 3,500 GEOs per annum.

Meanwhile, Agnico noted in its most recent results that it plans to start processing Akasaba West ore at Goldex, which has additional processing capacity. The low-grade Akasaba West deposit, which has copper credits, should contribute close to 40,000 GEOs per annum, depending on copper prices. This would translate to up to 1,000 GEOs per annum for Osisko Gold Royalties or a total contribution from AK and Akasaba West of close to 1,800 GEOs. So, while Upper Beaver (3,000+ GEOs) and Hammond Reef (4,500+ GEOs) are long-term opportunities held by the #3 producer globally, these are short-term opportunities that should augment Osisko’s attributable production.

Before moving on, it’s worth pointing out that Agnico Eagle is arguably the most aggressive explorer sector-wide among the producers. So, the benefit of having royalties on projects it owns cannot be overstated, especially when weaker producers are being forced to cut back spending a little as margins get pinched. Besides, if Agnico is successful, it hopes to build a mining complex in the Kirkland Lake Camp, similar to what Nevada Gold Mines has done at Carlin/Cortez, and the lucky owner of royalty land in the area (2% NSR on the camp) post-amalgamation is Osisko. Therefore, long term, I would not rule out 6,000+ GEOs per annum from this camp alone (AK, Upper Beaver, Upper Canada) separate from Malartic, Akasaba West, and Hammond Reef.

Eagle Project 250

Finally, while there have been no new major developments from the Eagle Gold Mine on Project 250, and it could be delayed with ~230,000 ounces in 2023 followed by 250,000 ounces in 2024 per my estimates, this is another major growth opportunity. This is because Osisko has a massive 5.0% net [NSR] royalty on the asset, and a 90,000-ounce increase in production would translate to an additional 4,500 GEOs coming Osisko’s way per annum. So, while this is already a solid contributor (~9,000+ GEOs in FY2022), I would expect 12,000+ GEOs in 2024 through 2028, translating to an additional ~$5.3 million in annual revenue attributable to Osisko ($1,775/oz gold price assumption).

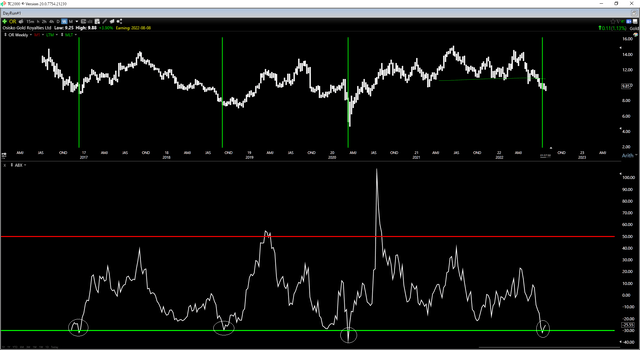

Technical Picture

Looking at the technical picture, Osisko Gold Royalties has only been this oversold on its long-term indicators on three other occasions, and they were as follows:

- December 16th, 2016

- September 14th, 2018

- March 13th, 2020

In all of these cases, the stock made a key low within less than ten weeks and saw an average forward 6-month return of ~76%, with an average 6-month drawdown (pullback from signal date) of less than 8%. Even if we exclude the unusual March 2020 signal date due to the sharp recovery in global markets, the average forward 6-month return comes in at ~43%, with an average forward 6-month drawdown of less than 6%. This translates to a very attractive reward/risk ratio of ~7.1 to 1.0, suggesting this is a rare opportunity to accumulate a position in this growth story with limited downside risk.

Obviously, past performance is not indicative of future results, and while history rhymes, it does not always repeat itself, and sometimes it doesn’t do anything remotely similar. Still, all we can operate in when it comes to trading/investing are probabilities. With the odds stacked in favor of higher prices between now and February, I have continued to increase my position in OR into weakness under $10.00 per share.

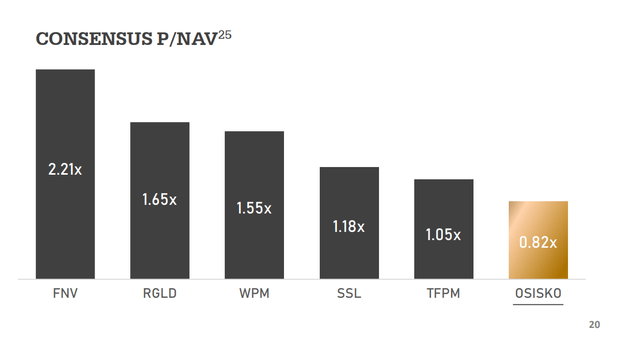

Osisko – Valuation vs. Peers (Company Presentation)

The reason is that even if the probabilities don’t work out in my favor, this is a business that I am more than happy to own over the long run, recession or not, given that it’s insulated from inflation, enjoying considerable growth, and trading at a massive discount to its peer group. In fact, I would argue that OR could easily command a valuation of 1.4x P/NAV with its current growth profile, with an upside to 1.70x P/NAV to 1.80x P/NAV as its partners reach key milestones toward construction/organic growth, and its portfolio becomes more attractive through increased diversification and the addition of new high-margin royalty/streaming assets.

Summary

There are few sectors as prone to emotional overreaction as the gold mining sector. When the going is good you can’t buy shares in ‘businesses’ for reasonable valuations, given that the majority are paying for growth at any price, convinced that gold is heading 50% higher in short order. However, when the going is bad every limit order is hit, no matter how attractive the business model of the stock one is purchasing, because even if some investors think they can stomach a 40% – 60% drawdown, most of them can’t, and they end up puking up their positions.

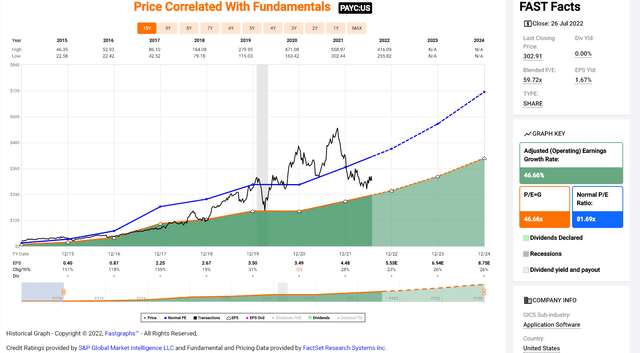

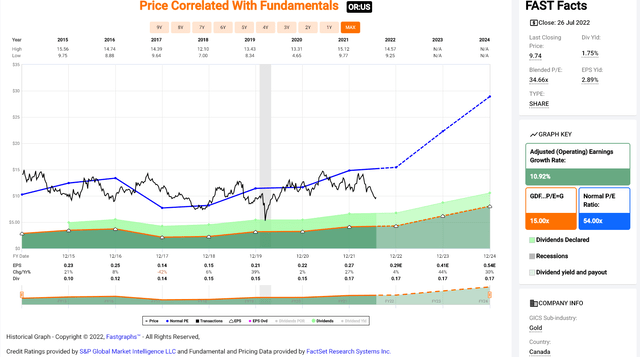

The latter is the case for Osisko Gold Royalties currently, with the extreme selling pressure pushing the stock to a valuation typically reserved for a producer despite limited inflation risk and 93% cash margins. These margins are better than most SaaS companies that trade for 40-60x forward earnings in their high growth phases, yet OR (shown below) in a high growth phase trades for less than 25x FY2023 earnings estimates ($0.42).

Paycom – Historical Earnings Multiple (FASTGraphs.com) Osisko Gold Royalties – Historical Earnings Multiple (FASTGraphs.com)

Obviously, banking on mining partners to deliver is less certain than collecting subscription revenue. Still, royalty/streaming companies are a different breed than producers. Osisko Gold Royalties could easily trade at 40x earnings ($0.42 x 40 = $16.80) and $18.00+ on a P/NAV basis. Beside. In contrast, while some subscription revenue might pull back in a recession, there’s no shortage of buying from miners, so even though miners are price takers, there’s always a taker for their product. And this pullback in the stock has left it at its most attractive buy point since going public. For this reason, I continue to see this pullback in the stock as a gift, with this being one of the best values I’ve seen in the sector since 2017, when I was fortunate to have built a position in Kirkland Lake Gold under US$7.00 per share.

Be the first to comment