AsiaVision

Introduction

In 2022, Oscar Health (NYSE:OSCR) has fallen 67 percent due to macroeconomic headwinds, continued unprofitability, and concerns about its +Oscar offering. High-growth companies have underperformed the market this year as the Federal Reserve raises interest rates, causing valuations to contract, especially for companies that aren’t turning a profit.

Despite the macro headwinds and four consecutive misses on earnings, OSCR’s balance sheet is strong, and its key ratios continue to improve. We believe OSCR is a “BUY” as the worst of the macro storm is behind them and they are set to hit the upper end of their re-affirmed FY22 earnings projections. In addition, the sell-off has made the stock extremely attractive from a valuation standpoint.

Company Overview

Oscar Health is a US-based health insurance company that offers a technology platform (+Oscar) that uses personalized data to drive real-time actionable insights and recommendations. The business seeks to simplify the antiquated healthcare process and give customers a more individualized method of locating doctors and receiving healthcare. Formerly Mulberry Health, OSCR IPO’d in March 2021 as the business rapidly grew:

– 2020 Revenue: $391M

– 2021 Revenue: $1.89B

– 2022 Projected Revenue: $5.19B

Oscar offers four plans that cover all doctor visits, preventive care, and generic drugs with no copays or coinsurance. Each tier has an out-of-pocket max, after which the policy covers all additional costs. Called “the future of healthcare”, they aim to modernize how individuals receive healthcare and currently offer plans in 22 states. The +Oscar technology platform is designed to engage, retain and grow membership, reduce administrative costs, and ingest data with actionable value-based care analytics.

OSCR primarily markets its plans and platform to 29M Affordable Care Act (ACA) eligible individuals in the U.S. Over the past five years, the ACA market has grown at a CAGR of 3% as subsidies increased and more affordable options came into the market. Oscar, meanwhile, has posted a CAGR of 60% after having surpassed 1M members in June of 2022. While 1M members only represent 3.5% of the current TAM, OSCR has rapidly acquired that share and is projected to continue growing above market.

Earnings Analysis

On November 8th, Oscar released their 3Q 2022 earnings report. Revenue for the quarter came in 120% higher than a year ago at $978.4M, helping the firm decrease its net loss from -$211.4M in 3Q2021 to -$192.9M this year. EPS improved by 11% YoY to -0.91. CEO Mario Schlosser and management were quite positive in the announcement, stating that they are moving their target date for total company profitability up one whole year to 2024 and updated their FY22 outlook to the higher end of the previous adj. EBITDA range of -$380M to -$480M. Demographical trends and the ongoing wind-down of high net COVID-19 costs continue to power earnings improvement.

Sound Fundamentals

While the 81% YoY membership growth to over 1.075M is impressive, arguably what’s more important for the success of OSCR is their continued improvement of the following key ratios:

– Medical Loss Ratio

– Administrative Expense Ratio

– Combined Ratio

According to the U.S. Centers for Medicare and Medicaid Services, the ACA “requires health insurance issues to submit data on the proportion of premium revenues spent on clinical services and quality improvement”, represented as the Medical Loss Ratio (MLR). If an issuer fails to spend 80-85% of premium revenues on medical care, they may be forced to provide a rebate to payers. Oscar’s MLR improved from 9.8% YoY to 89.9%, which is both impressive and essential in terms of avoiding the rebate penalty.

The company’s Administrative Expense Ratio improved from 2.4% YoY to 20.7%. These ratios combine to define the Combined Ratio, which improved from 10.22% to 110.6%.

A higher MLR and cost efficiency, combined with impressive user growth, drove the positive sentiment among management and significantly contribute to our “BUY” thesis on OSCR equity.

Risk

Macro headwinds continue to plague the global financial markets as the Federal Reserve continues tightening financial conditions. The rate hikes we’ve seen this year have compressed growth stock valuations across the board and it’s challenging to believe that we’ll see rate cuts anytime soon. Further, if the Fed’s war on inflation results in a deep recession, OSCR’s earnings growth could slow or miss projections.

Finally, OSCR announced on August 30th that Florida health insurer Health First Shared Services dropped a services agreement with the firm. Notably, this contract was supposed to prove the value proposition that Oscar is built on: improved cost efficiency and member experience via the +Oscar full-stack tech platform. This move may hang over the company and negatively affect market perception and future client negotiations.

Valuation

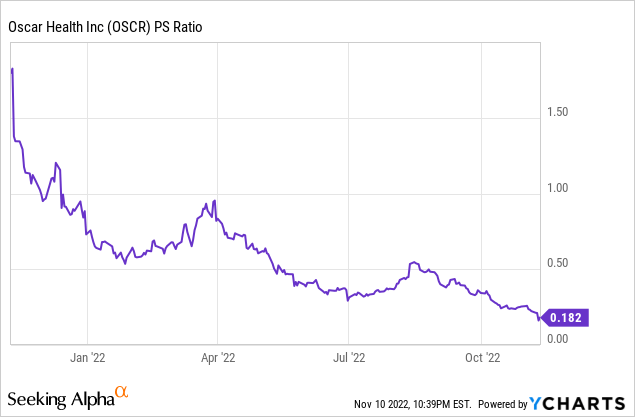

Oscar Health’s stock is deeply undervalued. Compared to its competitors, Oscar has the lowest P/S ratio at just 0.10X.

|

Company |

P/S |

|

OSCR |

0.10x |

|

BHG |

0.13X |

|

MRAI |

0.68x |

|

UNH |

1.47x |

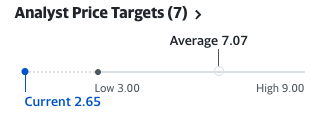

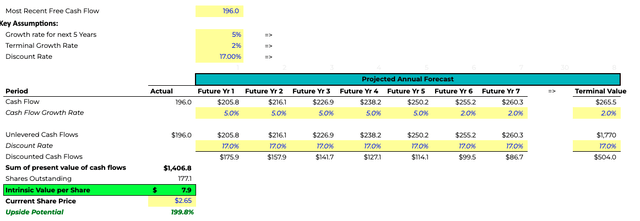

Furthermore, my DCF model yielded a price target of $7.9: assuming a 5% growth rate, a 2% terminal growth rate, and a 17% discount rate.

This is supported by other Wall St analysts, as the average price target is $7.07, a 1.67x increase from current levels.

Yahoo Finance

ESG

Oscar Health was founded in order to address the inequalities of the healthcare system—simplifying and making it more affordable. Oscar Health offers free virtual doctor visits and popular medication at just $3. Ultimately, the CEO believes that better access to drugs and doctors now ensures healthier members in the future — reducing costs in the long term. Oscar Health’s dedication to affordable and quality healthcare has clearly paid off. According to Forrester Research, it has an NPS of 40, compared to 3 for the average health insurer.

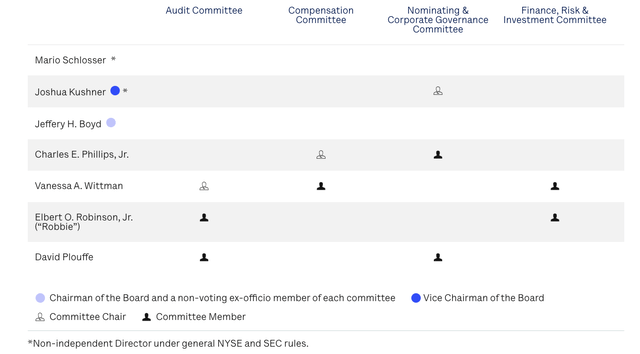

The company is diverse and inclusive, with various support groups for different employees across the company. It has also had a 52% growth in ethnic diversity and 44% growth in diverse leadership hires. On its Board of Directors, 5 out of 7 are independent and are in charge of various risk assessment committees.

Should you buy?

Despite the stock seeing waves of sell-offs, management is confident in its path to profitability. The Federal Reserve will eventually have to slow down, and we believe it’s likely that the loss of the services contract in Florida was more of a cost-savings decision by Health First than a reflection of Oscar’s value-add. Oscar’s attractive valuation, product-market fit, and path toward profitability make its stock a “Buy”.

Be the first to comment