Matveev_Aleksandr/iStock via Getty Images

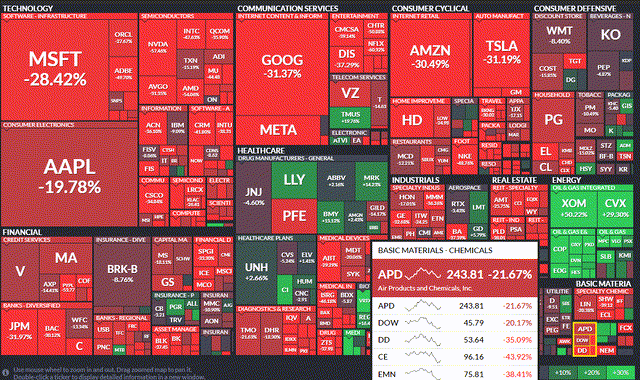

Chemical companies have gotten crushed so far this year. Some of the major U.S.-based players in the industry are down more than 35% in 2022. One small-cap plastics name, though, is simply rangebound and features a positive risk/reward setup along with a solid growth outlook.

S&P 500 Year-to-Date Performance Heat Map: Chemical Stocks Sharply Lower

According to Bank of America Global Research, Origin Materials (NASDAQ:ORGN) is a novel materials company developing cellulose-based solutions for the plastics industry. Its CMF and HTC products can be used to produce PET, paraxylene, and carbon black and activated carbon substitutes. The company expects to generate meaningful revenue starting in 2023 from its Origin 1 plant and substantial revenue and earnings from its Origin 2+ plants.

The California-based $754 billion market cap Chemicals industry stock within the Materials sector does not have earnings over the past 12 months and does not pay a dividend, according to Fidelity Investments.

It might take years for Origin to turn consistent annual profits, but there appear to be ample growth opportunities in the plastics space for this firm with some Canadian operations. A key partnership with Kolon Industries should help support a positive long-term thesis. But a risk is that higher financing costs could lead to higher expenses in the years ahead.

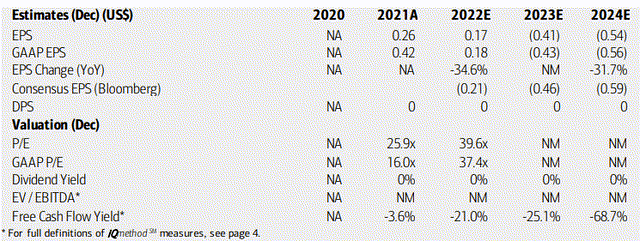

On valuation, analysts at BofA see earnings popping positive this year, but then reverting to the red in 2023 and 2024. The Bloomberg consensus forecast calls for the same cadence. As such, there is no reliable P/E, and its free cash flow yield is negative. On the bright side, Seeking Alpha has a solid B growth rating for Origin and even better B+ ratings on the firm’s profitability and momentum rankings.

Origin Earnings, Valuation, And Free Cash Flow Forecasts

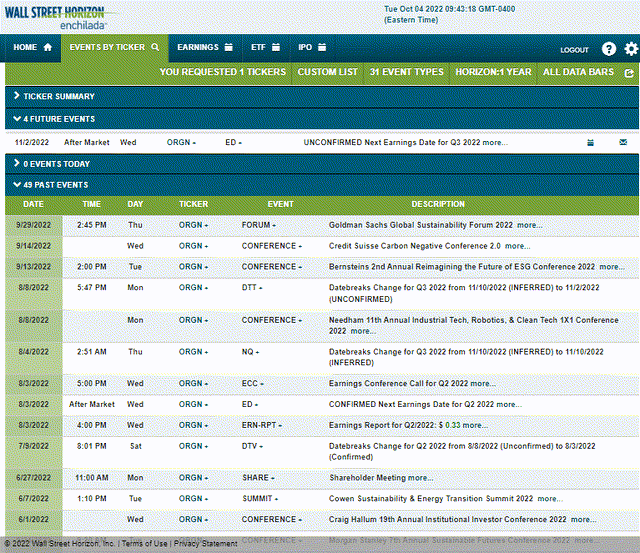

Looking ahead, ORGN’s corporate event calendar shows an unconfirmed Q3 2022 earnings date of Wednesday, November 2 after market close according to Wall Street Horizon. The calendar is light until then, though the company’s management team spoke at three industry conferences over the last few weeks on the topics of ESG and sustainability.

Corporate Event Calendar

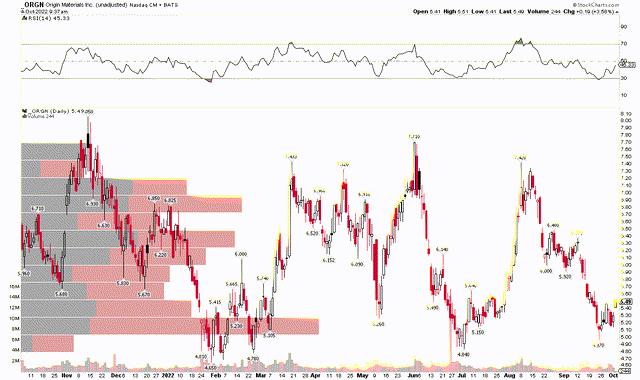

The Technical Take

ORGN has been simply rangebound for the better part of the last year. Shares have oscillated between about $4.50 and $9, which is not all that bad considering the broader market’s downtrend during that time. Still, the stock is not far from the lower end of the trading range. Logic would tell most traders that it is a buy on an approach of $5 and a sell near $8. Is it that simple? Let’s inspect the chart further.

Notice how not only is there apparent support in the $4 to $5 zone, but there is also a large volume of shares traded near $5 – that tells me there is recurring demand (volume by price indicator on the left-hand side of the chart). And we saw that play out just recently at its September low. On the upside, there is less of a definitive volume area of importance, so if the stock can climb above $9, particularly on a weekly closing basis, that would help support a bullish technical thesis. It would also portend a measured move price objective to near $14.50.

Overall, the risk/reward is solid here. Being long with a stop under $4.50 makes sense.

ORGN Shares Rangebound, But Solid Support Persists

The Bottom Line

Origin Materials is a negative earner using forward earnings estimates, but there’s growth potential with this Chemicals name. The technical chart also suggests risks are skewed bullish. Being long here looks good for both swing traders and long-term investors.

Be the first to comment