Petmal

Investment thesis

I have previously written on Origin Materials (NASDAQ:ORGN) that can be found here. I continue to think that Origin is well positioned to be a leader in its field and management’s targets remain well within target, positioning the company for a large growth runway. I reiterate my investment case for Origin below:

- Origin has a superior proprietary platform technology that enables its customers to meet their net zero ambitions while maintaining their performance and cost of the products.

- Origin is expected to have strong barriers to entry with its well-developed patent portfolio ensuring competitors are unable to compete with Origin and remain far behind it.

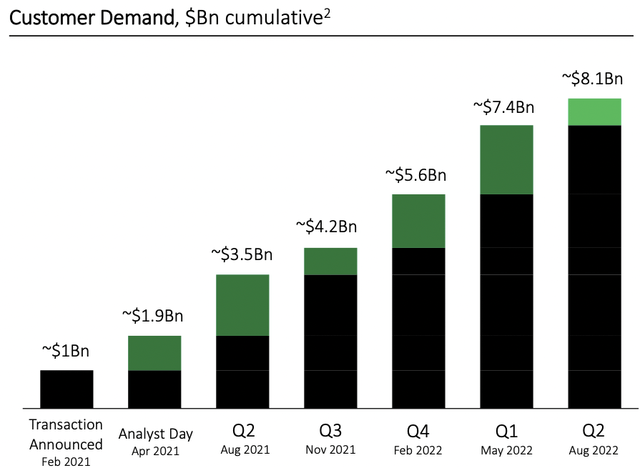

- Origin continues to see strong demand for its products as the total cumulative customer demand continues to grow, with new and existing customers expanding partnerships with Origin.

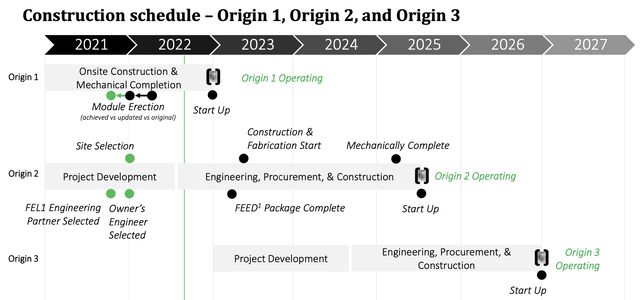

- Origin 1 seems likely to begin operations in 2023 while Origin 2 remains on track to start operations in 2025.

Strong customer demand and well-capitalized balance sheet

Origin continues to see strong customer demand in 2Q22, as the total cumulative customer demand achieved a new milestone of $8.1 billion. This resulted in a 131% year on year increase from 2Q21, and a sequential increase of 9% over the prior quarter.

Origin customer demand (Origin 2Q22 Slides)

New customers in the second quarter includes ATC Plastics, Revlon (REV) and Kuraray. Revlon is working with Origin to develop packaging materials for cosmetics and reserved commercial volumes for Origin PET, while Kuraray (OTCPK:KURRF) is partnering with Origin to commercialize carbon negative polymer materials. Also, Origin announced that they have expanded that existing relationship with Danone.

Lastly, while the specifics were not disclosed, Origin entered a strategic relationship with a large United States supermarket chain. This, in my view, will add to number of applications that Origin’s products can be used for and presents a huge opportunity for Origin given the wide variety of products sold in a supermarket chain.

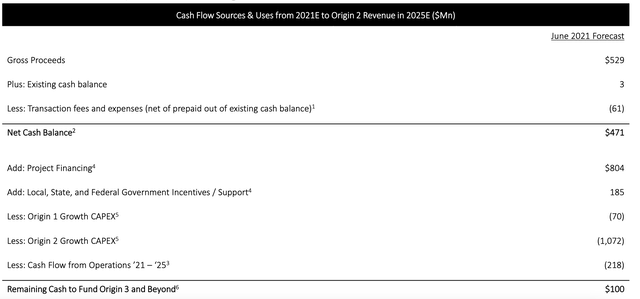

Origin remains to be well capitalized and has the necessary funding needed for Origin 1 and 2, with about $407 million in cash available as of 2Q22. As shown below, based on management’s estimates, they will still have $100 million in cash remaining to fund Origin 3 and beyond, after taking into account the funds needed for Origin 1 and 2.

Cash flow forecast (Origin Investor Slides)

Favorable regulatory policies

There is without a doubt an improvement in policies that support the work that Origin is doing as countries, companies and governments are increasingly taking action to achieve their net zero carbon targets.

First, one of the favorable policies to be passed was the California Senate Bill 54. This new bill is positive for Origin because it will bring additional demand to the company as its existing and potential customers will seek to lower their costs by using certain renewable materials, like that of Origin’s renewable and bio-based materials. As a result, to save on fees that they would have to pay, existing and potential customers of Origin will look to move towards items derived from renewable materials. This new bill also requires that all single use packaging in the state of California be either recyclable or compostable by 2032, and it also requires a reduction of 25% of plastic by weight, and lastly, it requires that at least 65% of single use packaging to be recycled.

As a result of Origin’s bio-based PET’s desirable characteristics like it having recyclability properties and light weight, I am of the opinion that this new bill could drive further growth in demand for Origin’s products.

The second positive regulatory policy was from Canada, which prohibits single use plastic sales. This is positive for Origin as PET was listed as one of the items not prohibited due to its recyclability characteristics. This is an encouraging policy from Canada that could drive further demand for Origin’s products if other countries start to follow the lead from Canada.

Construction timeline remains intact

Management gave an update on both Origin 1 and 2 in the 2Q22 earnings call, both of which are progressing well. In the call, management continued to reiterate that Origin 1 and 2 are on schedule and going as planned.

Timeline for construction (Origin 2Q22 Slides)

Origin 1 is the company’s first plant which continues to be on track to begin operating in 2023 despite the difficult supply chain environment the company is facing. In addition, the capital budget for Origin 1 remains at $125 million to $130 million, showing that management is able to execute well despite an inflationary environment. The personnel needed for Origin 1 has been employed ahead of 2023. All in all, I think that it’s definitely a positive that the first plant is going online as per schedule despite the tough operating and supply chain environment today.

For Origin 2, this is expected to be operating in 2025, and management states that the timeline, budget and financing that they have previously announced remains intact. I think that management is taking a prudent approach as they have not yet procured any equipment for Origin 2 as they are expecting that inflation and the supply chain environment will work in their favor in a few years’ time. I think that this could provide some upside to the capital budget for Origin 2 if they eventually spend less than expected due to improved supply chain conditions and lower inflation.

For Origin 2, the company has selected a site in Louisiana, which is pending finalization. The site is said to have good access to feedstock, have a good source of labor and access to the necessary infrastructure.

In conclusion, I think that Origin 1 looks set to be commissioned and start operations in 2023, while Origin 2 is on track to be operational 2 years later in 2025. In terms of timeline, the management is coping well in meeting their expectations and being on schedule, while at the same time, costs have been managed well and in a prudent manner to ensure that the capital budget is adhered to.

Strong secular tailwinds for the business

First, with geopolitical tensions rising, countries around the world realize the need to move towards green energy and reduce reliance on fossil fuels. As the invasion of Ukraine by Russia led to elevated energy prices all over the world, it emphasizes the importance of having solutions that are less volatile and increasingly more sustainable. With Origin’s bioplastics not being made by fossil fuels like most of the plastics around the world, companies are starting to see the benefit of bioplastics made from renewable sources as pressure mounts on both the economical front and the environmental front.

Second, companies are increasingly finding ways to achieve their net zero targets and one of the ways to achieve this is to incorporate negative carbon materials into their supply chains and ecosystems and to transform the way that their products are made. As a result, this brings both large and small companies to Origin as many companies increasingly see the value add in Origin’s offerings.

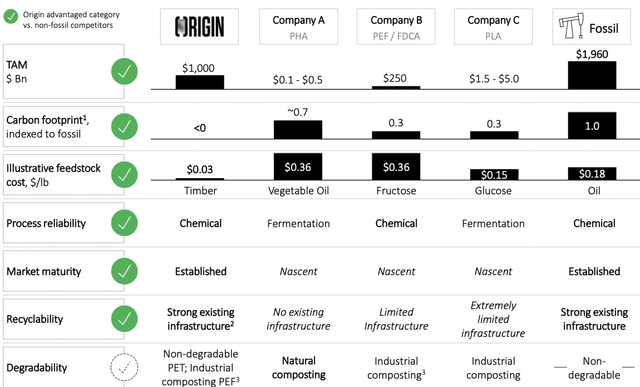

Competitors

I think that it’s interesting to put Origin next to its competitors to see how management thinks it compares to other bioplastic companies. For one, Origin does see that it has a larger total addressable market than its other peers in the industry, with more than $1 trillion in market opportunity available for Origin, while it sees a lower market opportunity for its other companies.

In addition, another striking difference is the carbon footprint when indexed to plastics made from fossil fuels, as Origin has less than zero carbon footprint while the carbon footprint of peers range from 0.3 to 0.7. Other differences between Origin and its competitors are that Origin is in a business that is relatively less risky as it operates in a more established market, with strong existing infrastructure, and also with lower costs as the feedstock costs are also expected to be lower.

Comparison with competitors (Origin Investor Presentation)

Valuation

I maintain my 1-year target price of $12.33 for Origin. Based on the recent 2Q22 update, I find that management’s commentary and the relevant disclosures in the quarter show that Origin continues to be on track and will likely meet my financial forecasts for the company. As before, I continue to incorporate in my model projections up to Origin 3 and will go beyond 2025. My forecasts for 2025F revenue is $440 million, implying an EV/Sales ratio of 0.92x.

I assume an EV/Sales multiple of 3x, which I think is justified given that revenues are expected to grow at a CAGR of 80% from 2025 to 2030. I will continue to monitor this and adjust this multiple if Origin is able to achieve better or worse ramp up for Origin 1 and 2.

Given my target price for Origin is $12.33, implying an upside of 142% from current levels.

Risks

Execution risks

As the company has yet to officially start operations in Origin 1, there are risks that the company is unable to execute and ramp up operations in Origin 1 well. Given that Origin 1 will set the precedence for Origin 2 and beyond, if there are any problems with execution, this could lead to a de-rating in its multiple. As such, management needs to prove that they are able to operate and execute well for Origin 1 in order for investors to have confidence in Origin 2 and beyond.

Risk of delays

While there are no delays announced yet and everything is going according to plan, if the company is unable to meet its targeted timeline, this could lead to a slower ramping up of revenues and thus, would require me to adjust my financial forecasts downwards. It will also need to meet these operational deadlines to ensure that customers see it as a reliable partner that is able to meet their stated timeline.

Risks from concentration

As a result of being dependent on a small number of large customers, their business may be dependent on a concentrated number of customers in the near-term. However, in the long-term I think that we will see diversification in revenues as more customers sign with Origin. If any one of these large customers terminate their agreements, this could lead to downward revisions for the company.

Competitive pressures

While Origin’s products are innovative, it is competing against large chemical companies that have balance sheets that enable them to spend large amounts on research and development. If any of these large chemical companies or even new startup companies are able to bring to the market products that can compete with Origin, this will result in downward revisions to my estimates for Origin.

Conclusion

I think that the investment thesis for Origin remains intact after its 2Q22 update. The demand for Origin’s products continue to grow despite a weakening macroeconomic environment. Furthermore, its timeline and capital budgets for Origin 1 and 2 remains on track even with all the supply chain disruptions and inflationary environment. With improved regulatory policies for Origin in both California and Canada, the demand for Origin is set to rise as more potential and existing customers are incentivized to accelerate their net zero plans. Lastly, Origin continues to have strong industry tailwinds support demand for its carbon negative bio-based products. I reiterate my buy rating for Origin and with my target price being at $12.33, this implies an upside of 142% from current levels.

Be the first to comment