koto_feja

Shares of ORIC Pharmaceuticals (NASDAQ:ORIC) have fallen by over 80% since upsized IPO was priced at $16 in April of 2020. So far in 2022, share price has also experienced a dismal 80% decline.

Back in March I sold my remaining shares for a 68% loss at $4.50 (still 50% higher than where they currently trade). However, I did highlight conviction-sized insider buying and reminded readers that I planned to revisit in a couple quarters when 2023 readouts were closer.

As time has passed, I decided to check back in on the story and found the valuation to be incredibly pessimistic ($120M market capitalization versus estimated Q3 cash position of just over $200M). In other words, Mr. Market is stating that ORIC, with 3 clinical-stage programs in early phase 1b studies, is worth NEGATIVE $80M. These are not merely “me-too” assets, as their EGFR/HER2 exon-20 program is brain penetrant (can address CNS-metastases where approved agents lack activity). Likewise, the PRC2 program is targeting the EED subunit whereas predecessors have opted for the EZH2 subunit (plagued by tolerability issues) and management noted that certain subpopulations in prostate cancer could allow for accelerated approval should data warrant.

The above to say, with the usual caveats, that I think we should dig deeper as the company would seem to be worth more than NEGATIVE $80M.

Chart

Finviz

Figure 1: ORIC weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, the decline from highs above $40 to current $3 share price is quite sickening (appears as if the company has “flat-lined” and is a shell of its former self). Despite looking like a shell company, there is still a lot going on under the hood (three phase 1 studies with readouts coming 1H 23) and so my initial suggestion for risk-tolerant investors would be to accumulate a small to modestly sized position at current levels ahead of these events. Given the current macro environment and headwinds to both risk assets as well as biotech sector, purchases could be spaced out over a period of months (or even quarters) instead of all at once.

Overview

Founded in 2014 with headquarters in San Francisco (78 employees), ORIC Pharma currently sports enterprise value of ~NEGATIVE $80M and estimated Q3 cash position of $200M providing them operational runway into 2H 2024.

Here are my notes from September’s Wainwright webcast which provides an excellent overview of current operations:

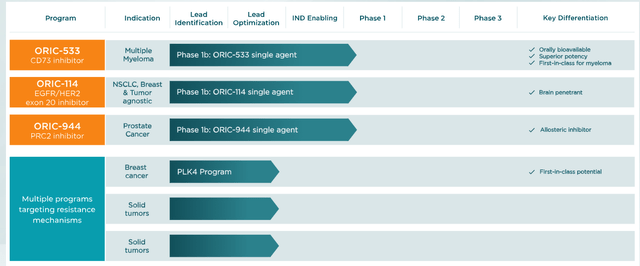

- ORIC= Overcoming Resistance in Cancer and encompasses their mission statement. Pipeline is broad and consists of potential first-in-class drug candidates and they have 3 ongoing phase 1b single-agent studies focused on validated targets followed by a pipeline of preclinical programs (both internally sourced as well as via external business development). They ended Q2 with $238M in cash with expected operational runway into 2H 24 (over a year after 3 data readouts expected in the first half of 2023).

Corporate website

Figure 2: Pipeline (Source: corporate website)

- Leadership team is highly experienced, starting with preclinical research discovery capabilities led by CSO and team that previously worked together at Genentech. They also possess full development, clinical and regulatory capabilities led by CMO and team that worked together previously at Ignyta and Aragon. Finally, they have extensive business development and strategic inlicensing capabilities via a team that worked together previously at Medivation and Ignyta.

- Successful oncology business models of the past several years tended to focus on building pipeline via internal discovery efforts or via business development. However, ORIC has been able to take a “source agnostic” approach to building the pipeline where the best molecule wins (whether internally developed or externally sourced).

- ORIC-533 is an oral bioavailable CD73 inhibitor discovered internally, whereas ORIC-114 was sourced from South Korean company Voronoi in October of 2020 and ORIC-944 from Mirati Therapeutics in July of 2020. They have 3 ongoing phase 1b studies. Bar is set high for differentiation versus competitors. Lastly, newest program is first-in-class PLK4 inhibitor in lead optimization stage.

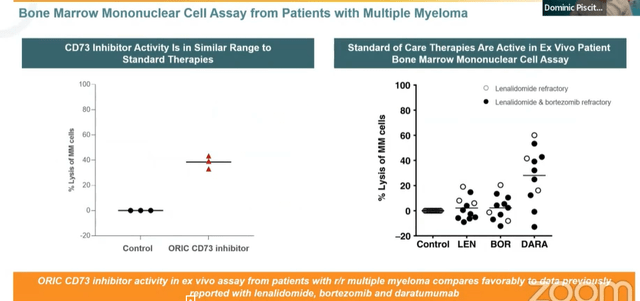

- Starting with ORIC-533, they believe the molecule is differentiated on two fronts (both preclinically as well as via clinical development plan as a single agent in multiple myeloma). Preclinically versus other small and large molecule inhibitors of CD73 (as well as A2A receptor programs), ORIC-533 showed higher potency in multiple models. Also, 533 differentiates in a high adenosine or high AMP environment as well (important given high levels of adenosine typically seen in tumor microenvironment). For multiple myeloma, last year they showed a variety of preclinical results supporting potential as a single agent followed by combination trials pending single agent activity. Key takeaway from data presented last year (ex vivo autologous patient level) was that ORIC-533 achieved 40% lysis in these models (compared favorably to other approved agents in same models like lenalidomide and bortezomib). In the current phase 1 study they are enrolling late-line MM patients (triple and quad-refractory) starting as single agent. If there is even modest activity (sounds like the bar is not being set high), they’d move into multiple combination cohorts. As far as they know, ORIC-533 is the only CD73 inhibitor being tested as a single agent in multiple myeloma.

Wainwright webcast

Figure 3: Activity of ORIC-533 in MM comparable to standard of care therapies (Source: Wainwright presentation)

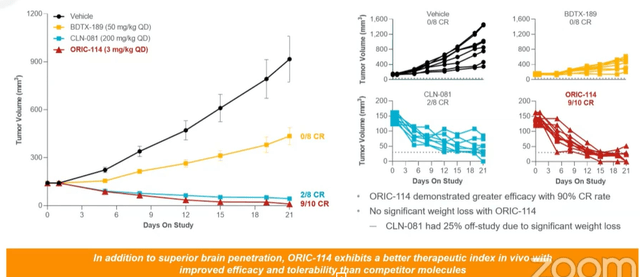

- Moving on to ORIC-114, this is a brain-penetrant EGFR/HER2 exon-20 program. Management prioritized finding a molecule selective for exon-20 insertion mutations over wild type (been a challenge for other players in the field). Second, they wanted to see CNS activity given prevalence of CNS metastases in this population. This molecule was specifically optimized across selectivity and brain penetration (exquisitely clean). Two currently approved agents for exon-20 have tolerability issues as well as lack of CNS activity. For ORIC-144, potent tumor regression has been observed in multiple non small cell lung cancer EGFR insertion models without significant weight loss. Head-to-head preclinical studies were also performed and 144 compared favorably in terms of efficacy and selectivity/signs of potential toxicities.

Wainwright webcast

Figure 4: In vivo efficacy for ORIC-144 compares favorably to competitors (Source: Wainwright presentation)

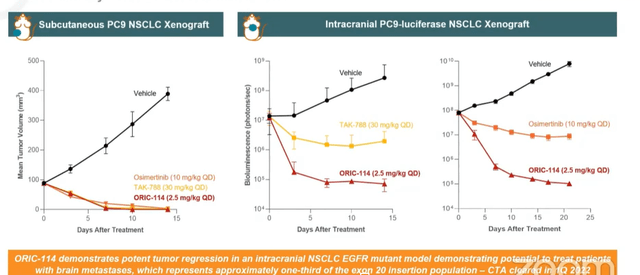

- The most important thing to highlight is CNS activity, as leading agents don’t address CNS mets (35% to 40% of these patients develop CNS mets). In vivo data versus TAK-788 and osimertinib (clinically active CNS compound) showed superiority for ORIC-144. HER2 is another indication of interest for ORIC-144, and benchmark data versus Seagen’s (SGEN) HER2 inhibitor tucatinib demonstrated antitumor activity in intracranial HER2+ breast cancer model (outperforming tucatinib). This is important as 50% of HER2+ breast cancer patients develop brain metastases. Phase 1b study is enrolling patients with advanced solid tumors who have either EGFR or HER2 exon-20 alterations or HER2 amplification or overexpression. Unlike competitor phase 1 studies, they are allowing patients with active CNS mets (treated or untreated but asymptomatic). CEO notes that amivantamab from JNJ is a great drug, but the big difference is again they are a large molecule and excluding patients with CNS mets.

Wainwright webcast

Figure 5: Superior efficacy for ORIC-144 in intracranial EGFR mutant models (Source: Wainwright presentation)

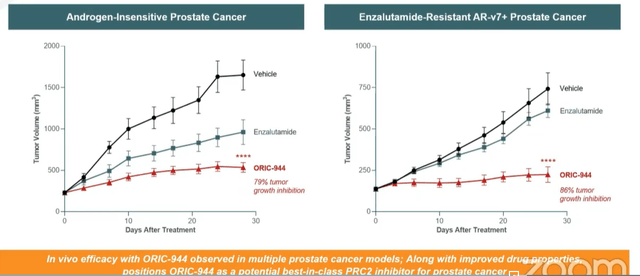

- Lastly, for allosteric PRC2 inhibitor ORIC-944, CEO notes that the PRC2 complex is a validated target with approved agents for epithelial sarcoma and follicular lymphoma. There are two druggable subunits for this complex, with most companies approaching it via EZH2 (associated with poor tolerability or PK limitations). There is only one other EED inhibitor in oncology (MAK683 from Novartis). Work done by Mirati comparing ORIC-944 to tazmetostat in DLBCL shows the former outperforming the latter by a wide margin. In androgen-resistant prostate cancer models, ORIC-944 showed good tumor growth inhibition (79% to 86% whereas competitors have seen 40% to 45% TGI). Per CEO, phase 1 study is progressing well (enrolling metastatic prostate cancer patients that have failed one or more AR modulators and up to 2 bouts of chemotherapy). These are later line patients lacking great options available, and goal is looking at safety, PK and selection of recommended phase 2 dose (sounds like they are expecting less in terms of early activity). Interestingly, they aim to see subsets of patients or potential biomarkers that would allow for accelerated approval in certain (smaller but still sizeable) populations.

Wainwright webcast

Figure 6: Strong single agent activity observed for ORIC-944, significantly better than blockbuster drug enzalutamide (Source: Wainwright presentation)

- PLK4 inhibitor program is in lead optimization, with the rationale being that cells with TRIM37 amplification require PLK4 function for growth and survival. TRIM37 amplification occurs in 20% of breast cancer and 50% of neuroblastoma and has been associated with early relapse and poor prognosis. This represents a synthetic lethality approach.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $237.8M contrasting favorably to R&D expenses of $13.8M and G&A expenses of $6.9M. Management is guiding for operational runway into 2H 2024, which seems reasonable to my eyes. Accumulated deficit to date per 10-K filing is around $245M, a reasonable figure for a company founded in 2014.

As for competition, I do think it’s important to keep an eye on Novartis’ PRC2 inhibitor MAK683. Per clinical trials gov website, DLBCL seems to be the lead indication on deck for them. However, the study design allows for evaluation in other advanced malignancies such as nasopharyngeal carcinoma (NPC), gastric cancer, prostate cancer or other advanced solid tumors for whom no further effective standard treatment is available. Thus, any positive data reported here would likely spark a sympathy move in shares of ORIC as well. ORIC’s PRC2 inhibitor to my eyes could be its crown jewel asset out of the 3 drug candidates currently in human studies. As mentioned above, there are certain populations they could potentially pursue accelerated approval via use of biomarkers such as H3K27 trimethylation.

In EGFR exon 20, I am most familiar with Cullinan Oncology’s (CGEM) CLN-081, which was the recipient of co-develop deal with Taiho Oncology for $275M upfront (allows for 50/50 US share of profits). Contrast the size of the upfront payment alone to ORIC’s negative EV. Core Biotech holding Blueprint Medicines (BPMC) also scooped up LNG-451 in 2021 for $250M upfront payment (this drug candidate is highly brain penetrant as well). I imagine that ORIC will have a hard time going up against such larger players including Takeda, but again showing early monotherapy activity in patients with brain metastases would still positively impact share price and sentiment which are at all-time lows.

As for ORIC-533, I remain highly skeptical of the inroads they can make in the highly crowded field of multiple myeloma given the impressive efficacy of approved CAR-T treatments not to mention next-generation cell therapy pioneers behind them (see my previous piece on Arcellx).

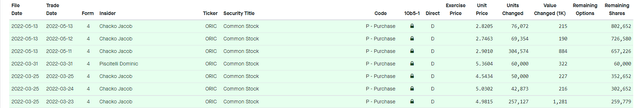

As for institutional investors of note, EcoR1 Capital owns an 8.8% stake and has been adding to its position. String of insider purchases back in Q2 of this year was also encouraging, with CEO Jacob Chacko buying over $2.6M worth of shares.

Fintel

Figure 7: Q2 insider purchases (Source: Fintel)

As for relevant leadership experience, President and CEO Chacko served prior as CFO of Ignyta (acquired by Roche for $1.7 billion). Chief Scientific Officer Lori Friedman served prior as head of translational oncology for Genentech Research and Early Development. Chief Medical Officer Pratik Multani served prior as Chief Medical Officer of Ignyta. Chief Business Officer Matthew Panuwat served prior as Head of Business Development at Medivation (acquired for $14B by Pfizer). SVP Clinical Development Edna Chow Maneval served prior as SVP Clinical Development at Ignyta and before that VP Clinical Development at Aragon (acquired by JNJ in 2013).

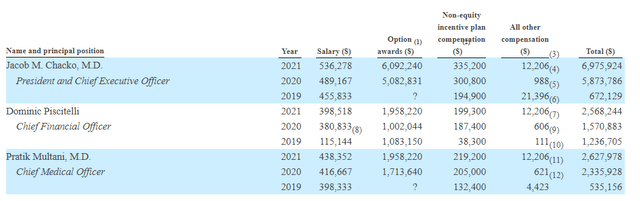

Moving on to executive compensation, cash portion of salary is higher than I’d like but still reasonable in the $400k to $536k range. Options awards for CEO at over $6M seems on the high side, but overall this coupled with non-equity compensation raises no red flags to my eyes.

Proxy Filing

Figure 8: Q2 insider purchases (Source: Proxy Filing)

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

As for IP, patent portfolio consists of 5 issued US patents, 22 pending US patent applications, 3 pending international patent applications under PCT, 2 issued patents in various markets outside of US and over 50 pending patent applications in markets outside the US. For ORIC-533, composition of matter patents are expected to expire in 2040. For ORIC-114, patents arising from pending applications are expected to expire between 2040 to 2042. For ORIC-944, issued US patents cover composition of matter and related methods of use (expected to expire in 2039, while those arising from pending applications are expected to expire between 2039 and 2042).

As for other useful nuggets from the 10-K filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), it’s interesting that in connection with licensing deals Mirati was issued 588,235 shares of common stock and Voronoi was issued 283,259 shares of common stock in ORIC. In CD73, ORIC highlights competitors developing antibodies against the target including AstraZeneca, Bristol-Myers Squibb, Novartis in collaboration with Surface Oncology, Incyte Corporation, Corvus Pharmaceuticals, Innate Pharma, Tracon Pharmaceuticals in collaboration with I-Mab Biopharma, Akeso, Symphogen, Innovent, Henlius Biotech and Jacobio Pharmaceuticals (target seems VERY crowded). Other companies, such as Arcus Biosciences, Antengene and Merck through its acquisition of Peloton Therapeutics, have small-molecule programs against this target. For ORIC-944, they are aware of several companies developing inhibitors against PRC2 via EZH2 inhibition that are currently in clinical trials, including Epizyme, Constellation Pharmaceuticals (now Morphosys), Daiichi Sankyo, Pfizer, Shanghai HaiHe Pharmaceutical and Jiangsu Hengrui Medicine Co. As mentioned above, only Novartis has an allosteric PRC2 inhibitor in a clinical study for patients with cancer. As for ORIC-114 in EGFR exon 20, they highlight competition in the form of Spectrum Pharmaceuticals, Jiangsu Hengrui Medicine Co., Daiichi Sankyo, Dizal Pharmaceuticals, Cullinan Oncology, Black Diamond Therapeutics, Bayer, Allist Pharmaceuticals and Blueprint Medicines. Additionally, Seattle Genetics has FDA approved Tukysa for the treatment of patients with HER2-positive breast cancer, including patients with brain metastases. Dizal Pharmaceuticals is also developing a brain penetrant inhibitor currently in a clinical trial for patients with HER2-positive breast cancer.

Final Thoughts

To conclude, at negative $80M enterprise value with highly experienced leadership team and multiple shots on goal in the oncology space, I would argue that the pessimistic valuation for ORIC is offering investors an opportunity ahead of possible inflection points in 2023. A potential caveat here is the increasingly crowded spaces (multiple myeloma) or targets (EGFR/HER2 exon 20) the company is pursuing, but as noted above there are clear signs of potential differentiation versus approved drugs or even programs from certain big pharma or big biotech players. If EV were at $300M or more, I’d be more hesitant to suggest a position here until after the clinical results provided additional derisking. However, negative EV to my eyes warrants at the least a small position for investors with higher risk tolerance.

It was difficult for me to revisit this company given the loss I took on my position in early 2022 when they discontinued glucocorticoid receptor antagonist ORIC-101 after disappointing phase 1b data. However, it was a worthwhile exercise and good reminder on the importance of objectively evaluating current snapshot of the company in question and whether it offers asymmetric risk/reward. I also appreciated how management handled the situation at the time, being forthright with the data and high bar they set for moving forward in the clinic (followed by conviction-sized insider buying after the data fail).

For readers who are interested in the story and have done their due diligence, ORIC is a Speculative Buy and I suggest initiating a pilot position in dips in Q4. An alternative approach would be to wait for Q1 and a confirmation from management on data sets to be presented (along with clarity on the timeline for said presentations). As this is a speculative name, it should be relegated to a smaller weighting within a diversified portfolio and not overweighted (until/if further confirmation of thesis arrives via clinical data).

From an ROTY perspective (focus on next 12 months), I will remain on the sidelines for the present. However, I will continue to monitor this name for potential entry as clinical data catalysts loom closer.

While dilution in the near term does not appear to be a cause for concern, key risks include disappointing data across three ongoing phase 1 studies as well as other setbacks in the clinic (especially delay of timelines should enrollment prove slow). I still would not be surprised if ORIC-533 is discontinued given the increasingly competitive nature of the multiple myeloma space. Likewise in EGFR/HER2 exon 20, this could be a situation where the company achieves success in the clinic but the commercial landscape would be tough for a company this size to tackle (better to establish a partnership with larger player). For PRC2 inhibitor, should initial activity signal be observed in prostate cancer, I would keep a close eye on Novartis with MAK683 given the company’s advantage in resources and infrastructure allowing them to power forward in the clinic and potentially get in the lead.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Be the first to comment