Justin Sullivan

Oracle (NYSE:ORCL) has just reported yet another strong quarter that seems to have come as a surprise even as expectations were already running high.

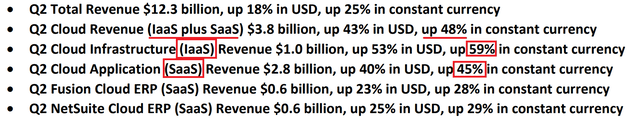

As it was largely expected, topline growth remained strong across all major business units, with revenue from cloud infrastructure and cloud applications increasing nearly 50% in constant currency.

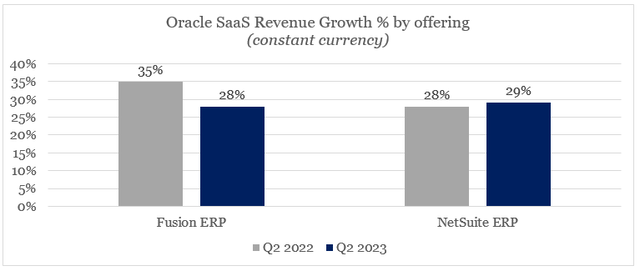

Growth in Enterprise resource planning (ERP) segments remained elevated and management’s optimism is at odds with the negative sentiment expressed by some of Oracle’s major peers.

prepared by the author, using data from Earnings Releases

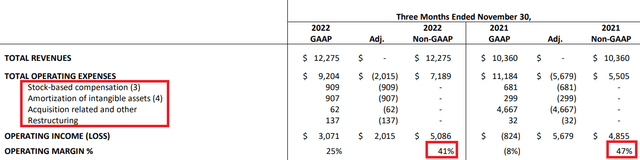

Adjusted operating margin stood at 41% during the quarter, however, everyone following my work would know that I generally disapprove of the practice of including stock-based compensation and amortization of intangible assets as a means to show recurring profitability.

However, even when comparing the Non-GAAP profitability of Oracle to that of Salesforce (CRM) for example, the superior competitive positioning of the former becomes apparent.

We’re raising our fiscal year 2023 non-GAAP operating margin guidance from 20.4% to 20.7%, an expansion of 200 basis points year-over-year

By adjusting Oracle’s operating profit for restructuring and acquisition related expenses only, we arrive at an operating margin for the first half of the fiscal year of 26%, compared to 37% a year ago.

The reason for this sharp decline is mostly related to Cerner’s acquisition, which is currently being integrated within Oracle’s portfolio of services. More importantly, however, Oracle’s management does not seem to use Cerner as a means to increase short-term topline growth and thus inflate its valuation.

Instead, Cerner is being used as a major stepping-stone for establishing Oracle’s expertise in the healthcare space. As I showed before, healthcare and banking are two strategic sectors for ORCL where it could establish itself as a global leader.

During the call yesterday, Larry Ellison reinstated the huge opportunity in building and deploying a global early warning system for emerging pathogens, automating hospitals, clinics and doctors’ offices and integrating all that with national public health systems.

Safra just gone back from visiting some prospective customers that are countries that we will be signing contracts with a number of countries to build these national systems. And these contracts are enormous, I mean, absolutely enormous. And there will be several of them. So, as I said in my note in the press release, the scale of this healthcare opportunity is unprecedented but so are the responsibilities that go along with it.

Source: Oracle Q2 2023 Earnings Transcript

In The Spotlight – Cloud Infrastructure

Although results from the Software-as-a-Service (SaaS) segment were impressive as usual, it is the infrastructure side of the business that will likely be in the spotlight over the coming years.

Growth of infrastructure subscription revenues is accelerating and stood at 9% during the quarter, compared to 5% a year ago.

Infrastructure subscription revenues, which also include support, were $4.5 billion, up 9% in constant currency.

Source: Oracle Q2 2023 Earnings Transcript

GAAP infrastructure subscription revenues were $4.4 billion, up 5% and excluding legacy hosting services, infrastructure cloud services grew more than 50%.

Source: Oracle Q2 2023 Earnings Transcript

Infrastructure cloud services also noted a massive increase, which remains consistent with the overall strong positioning of the company.

As mentioned already, infrastructure cloud services revenue was up 59% in constant currency. Now excluding legacy hosting services, infrastructure cloud services revenue grew 69% with an annualized revenue of $3.8 billion, including OCI consumption revenue, which was up 88% and cloud and customer consumption revenue, up 83% and autonomous database up 50%.

Source: Oracle Q2 2023 Earnings Transcript

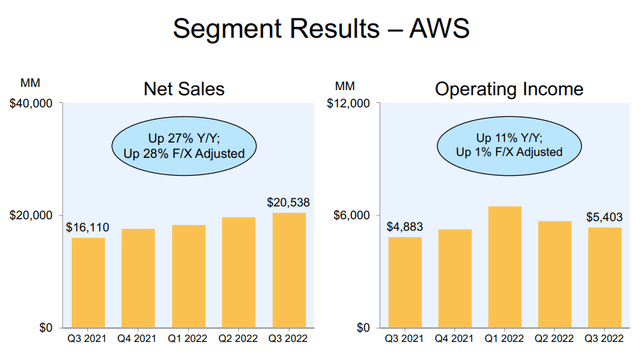

Although it is not fully comparable, we are already seeing growth slowing down at some of Oracle’s major peers in the infrastructure space. AWS, for example, recently reported quarterly net sales of $20.5bn, which were just slightly above the $19.7bn reported in the previous quarter.

What is even more important is that AWS profitability is already flat to declining from a year ago, while Oracle’s IaaS gross margin is accelerating.

Additionally, I would note that IaaS gross margins improved again this quarter, and I expect IaaS gross margins will continue to improve in response to accelerating demand we have continued to build data center capacity.

Source: Oracle Q2 2023 Earnings Transcript

Once again, we should remember that this is not comparing apples to apples, however, it gives a strong indication of how Oracle is quickly catching up with the current leaders in the space – Amazon (AMZN), Microsoft (MSFT), and Google (GOOGL).

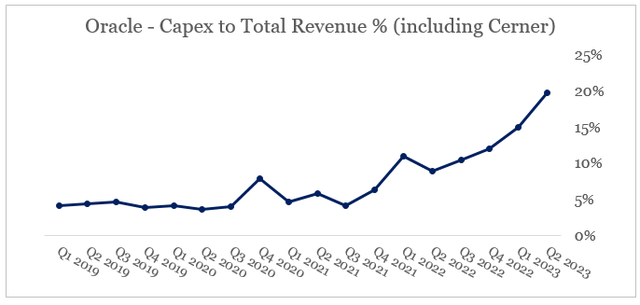

Capital expenditure, which is largely related to Oracle’s data centers, continues to increase at an exponential rate even when scaled to the company’s already growing topline. During yesterday’s reported quarter, Capex stood at roughly 20% of revenue.

prepared by the author, using data from SEC Filings

Although this should not be surprising given the early signs of accelerating growth I showed all the way back in the summer of 2021, the market does not seem to fully price the massive opportunity ahead.

CapEx this quarter was $2.4 billion as we continued to invest in our cloud to meet this accelerating demand. With triple-digit IaaS bookings growth the last couple of quarters we now expect to spend about this amount per quarter for the next few quarters as we build capacity for our customers’ needs.

Source: Oracle Q2 2023 Earnings Transcript

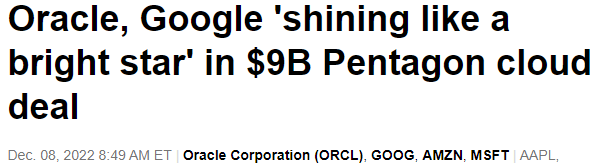

Not only that but Oracle’s strong positioning in the cloud is already being recognized by the U.S. government, given the security and reliability of its cloud.

Seeking Alpha

I also recently emphasized the importance of the large international footprint of Oracle’s cloud and the importance of its partnership with Microsoft in the multi-cloud era.

In addition, we now have 40 public cloud regions around the world with another 9 being built. In addition, 12 of these public regions interconnect with Azure, giving customers true multi-cloud capabilities.

Source: Oracle Q2 2023 Earnings Transcript

Conclusion

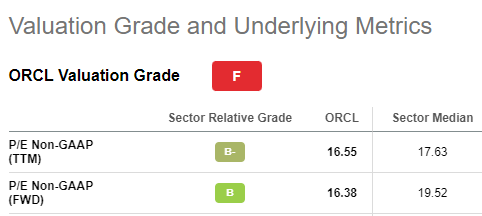

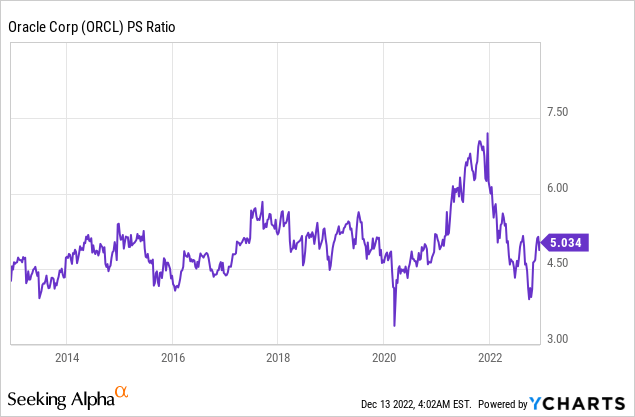

As Oracle’s strong long-term strategy is now bearing fruit, the company still trades at only 16 times forward earnings and its price-to-sales multiple is not materially different from the average for the past decade.

Seeking Alpha

While challenges for the global economy and equity markets remain, Oracle’s conservative valuation multiples in combination with the company’s superior competitive positioning still present an attractive opportunity from a risk-reward point of view.

With a total return of above 50% since I first covered the company more than two years ago, my long-term investment thesis of the company remains intact. That is why the company has made its way to The Roundabout Portfolio, which consists of my highest conviction ideas, where the market fails to appreciate the long-term potential of businesses that are not managed on a quarter-by-quarter basis.

Be the first to comment