Having had little to celebrate over the last few quarters, Oracle’s (ORCL) 3Q20 results proved to be a relatively bright spot as the company posted an above-consensus EPS guide. More broadly, I think ORCL’s defensive qualities could allow the stock to shine amid the current market drawdown – in particular, the company’s broad product portfolio and diverse customer base should help to insulate against category or industry-specific risks. Meanwhile, vendors concentrated around a single vertical (e.g., manufacturing or financial services) could suffer disproportionately as the outbreak weighs on IT budgets.

More positively, I see ORCL’s strong balance sheet, established market footprint, and the stickiness of its deployed software as key positives that should protect its earnings power in the coming quarters. Thus, I believe management’s guidance for double-digit EPS growth looks credible, with room for upside on accelerated cost control and share repurchases. On balance, I think ORCL’s ability to sustain EPS growth in the high-single-digit range through the cycles makes shares very attractive at ~11x FY21 earnings.

Steady Headline Growth Focused on the Recurring Revenue Base

Oracle’s 3Q revenue came in at $9.8B (+2% YoY; 3% YoY in constant currency terms), which was slightly above consensus, while headline EPS of $0.97 exceeded consensus by ~1c. However, I think it is important to note that the 3Q EPS beat was largely attributable to a favorable tax rate (the 19.1% tax rate came in 90bps lower than the guidance of 20%) and a lower share count. Excluding the >1c impact from these items, EPS would have been slightly below consensus.

4Q revenue guidance stands at -2% to +2% YoY growth in USD; in constant currency terms, this implies a $10.9B to $11.4B range. 4Q EPS guidance stands at $1.20 to $1.28. Chairman & CTO Larry Ellison sees the macro outlook stabilizing by June, with accelerating revenue growth in FY21, primarily due to its accelerating cloud portfolio mix (very much in-line with the sentiment echoed at the 2019 Analyst Day).

“Now, in June, assuming the global economic situation has stabilized, I will share with you the basis for my optimism around our revenue growth acceleration for the fiscal year 2021. It will be based on the ever-growing portion of our revenue attributable to our faster-growing subscription business.”

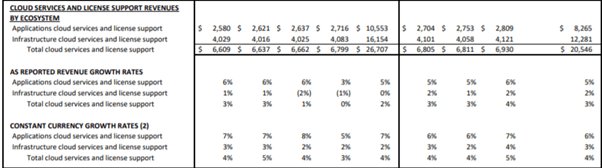

Cloud: While the Cloud and on-premise license business declined by 2% in reported terms (flat on a constant currency basis), Cloud services and license support grew 4% YoY on a reported basis and +5% in constant FX, representing a sequential acceleration from the +3% YoY in F2Q20 and outpacing consensus expectations.

Source: 3Q20 Press Release

Applications Ecosystem: Application cloud services and license support came in at $2.8bn for the quarter, which equates to a growth of 7% in constant currency terms (6% reported), extending the 6% growth in the prior period.

Source: 3Q20 Press Release

Two key things to note going forward- 1) Oracle will no longer report aggregate Application revenue, and 2) this updated metric excludes Application license sales. For the quarter, Fusion applications revenues grew 32% YoY as Fusion ERP rose 38% YoY, and Fusion HCM rose 27% YoY, while NetSuite ERP increased by 26% YoY.

Infrastructure Ecosystem: Infrastructure cloud services and license support was $4.1bn in the quarter, representing growth of 4% on a constant currency basis (2% reported) and acceleration relative to the 2% growth in the prior period. As noted with Applications Ecosystem, Oracle will also no longer report aggregate Infrastructure revenue; additionally, this updated metric excludes Infrastructure license sales.

On aggregate, ORCL has successfully re-balanced its business toward a higher recurring revenue base (comprising Cloud, Software License Updates and Product Support, as well as a portion of Hardware revenue), which now makes up ~75% of revenue, by my estimates.

|

4Q19 |

1Q20 |

2Q20 |

3Q20 |

|

|

Recurring Revenue |

7,299 |

7,215 |

7,248 |

7,360 |

|

Recurring revenue % |

66% |

78% |

75% |

75% |

Source: Company Data

Guidance Likely Implies a Fairly Conservative Outlook

While management sees minimal impact from the COVID-19 crisis, it did acknowledge some softness toward the final weeks of the quarter. As a result, the Q4 guidance range has been widened to -2% to +2% revenue growth, with the assumption that the macro outlook stabilizes in June. I would note the near-term risk to 4Q (traditionally, the company’s biggest quarter for license revenue), which relies heavily on transactional hardware and license revenue, both of which are at risk due to an uncertain macro and supply disruptions. Subscription revenues have been guided to grow at a 3% to 5% YoY pace on both a reported and constant currency basis.

However, if we were to assume that Oracle’s 4Q20 outlook for the recurring subscription and support business remains unchanged, then the revised guidance would imply a substantial change in outlook for the transactional license and hardware business. This would point toward a fairly material “macro” impact being embedded into the guide, which is attributable to either conservatism on the part of Oracle or the presence of other factors (company-specific or otherwise) that could have weighed on the growth guidance revision. I would note that Oracle’s cautious macro commentary is in-line with the likes of Adobe (NASDAQ:ADBE), which expects delayed bookings.

Recent Job Cuts Signal Challenges in the Cloud

Though ORCL has been notably bullish on the Cloud, the scope of its 3Q headcount reductions (~1,300 job cuts) in Europe suggests the shift to the Cloud is proving to be a challenge. According to the recent EWC memo, the 1,300 European jobs eliminated range from 8% to 30% of key sales groups.

While ORCL has been cutting costs for some time now, the latest move raises the risk around ORCL’s longer-term cloud outlook. While I do think the move to the Cloud is the right long-term decision for Oracle’s infrastructure business, the near-term risks and complexity are likely proving to be a greater challenge than what Oracle navigated with the move to SaaS. Nonetheless, my base case remains that the benefits of the shift to Cloud will accrue gradually over time, though ORCL’s progress will be worth keeping an eye on.

Getting Aggressive on Capital Return

Following the recent market selloff, it was perhaps unsurprising that Oracle’s board authorized a $15 billion share buyback, after all, the business generated free cash flow of over $10 billion in fiscal 2020. However, the net debt position bears watching, in my view, as it will likely expand further from the current $25.8 billion level, assuming management executes on the buyback. The move should nonetheless come as a positive surprise for shareholders as the sheer scale of the repurchase program provides meaningful support to EPS growth. For instance, the ~$4 billion of buybacks drove a ~7% YoY decline in diluted share count in the latest quarter.

|

4Q19 |

1Q20 |

2Q20 |

3Q20 |

|

|

Diluted shares outstanding |

3,495 |

3,732 |

3,410 |

3,331 |

|

Payments for repurchases of common stock |

-6,253 |

-5,519 |

-5,036 |

-4,004 |

Source: Company Data

ORCL’s ability to generate cash through the cycles also presents a compelling opportunity to drive growth via M&A amid multi-year low tech valuations and at a time when the company’s cloud portfolio could use some beefing up. In fact, I would not be surprised to see M&A-driven consolidation within the cloud and software space, which should put a floor on software valuations down the line.

ORCL is Worth a Look at Current Valuations

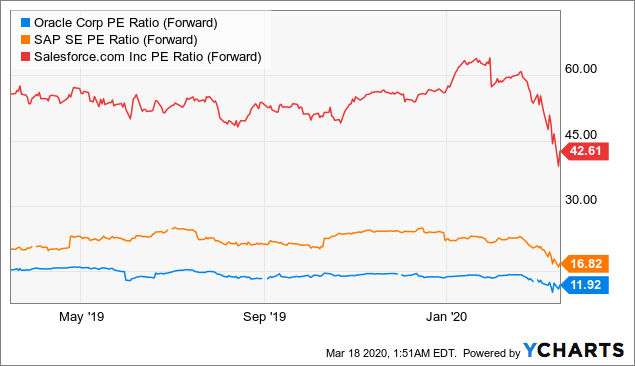

With ORCL shares trading at ~11x FY21 EPS of ~$4.40, and an implied PEG ratio of ~1.3 based on long-term EPS growth of ~8%, I think valuations are reasonable. On a relative basis, ORCL’s P/E has moved well below its software peers, despite its proven ability to generate cash flow through the cycles.

Data by YCharts

Data by YCharts

While I do acknowledge ORCL’s below-average growth prospects amid concerns over the timing of a cloud-driven inflection, I think the stability of ORCL’s top-line and margin profile more than compensates for the high-single-digit growth prospects.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment