VioletaStoimenova/E+ via Getty Images

Investment Summary

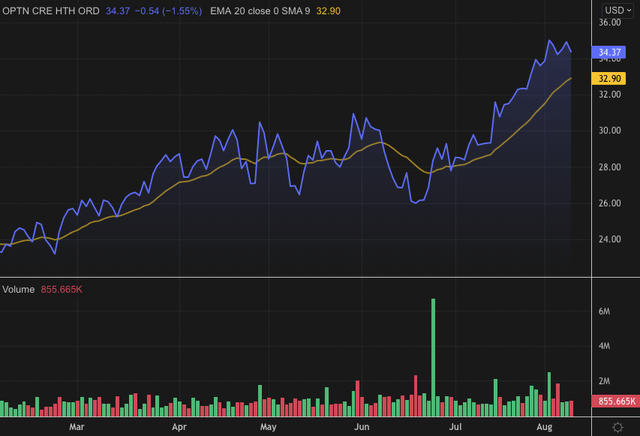

Sifting through the healthcare universe, one will find there are numerous selective opportunities with large upside capture within the space. With the latest sector rotation favouring healthcare, plus the sector’s historical performance in economic downturns are each supportive as well. Here we turn to Option Care Health, Inc. (NASDAQ:OPCH), a name that exhibits numerous equity premia that investors are rewarding so far this year. The stock has caught a bid in H2 FY22 and has outstripped the majority of its peers. Here, we price OPCH at $41 and rate the stock a buy.

Exhibit 1. OPCH 6-month price action

Data: Refinitiv Eikon

Q2 earnings extend longer-term trends

Second quarter earnings came in strong for the company with upsides at the top-line versus consensus estimates. Strength was observed across the therapy portfolio, with balanced growth between its acute care (“acute”) and chronic care (“chronic”) offerings. Total revenue printed a 14% YoY growth to $980 million, with the chronic segment underpinning the bolus of contribution. Acquisitions were accretive for ~200bps of net revenue and ~300bps of gross profit. However, this caused gross margin to narrow by 100bps YoY to 22.1%, as the chronic division is a lower margin offering. Inflationary pressures to cost inputs were also a factor, namely the logistical cost of delivering care. Still, gross profit totaled $216 million, up from $198 million YoY.

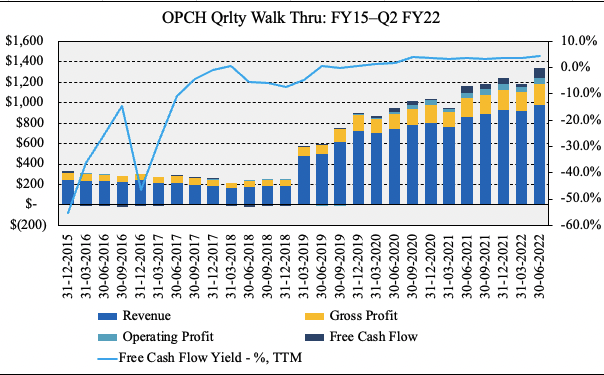

As seen in Exhibit 2, quarterly operating trends are a key standout for OPCH. Aside from ongoing upshift in revenue volumes, both operating income and FCF have each ticked up nicely over the past few years as well. The result has been a gradual lift in FCF yield such that investors presently realize a 4.5% TTM FCF yield. Hence, with $100 million in FCF conversion this quarter – a 42% YoY gain – investors also lay claim to ~$1 in FCF per share.

Exhibit 2. Quarterly operating metrics continue to stretch up particularly at & below the bottom line

Data: HB Insights Estimates; OPCH SEC Filings

Moving down the P&L, OPCH printed operating income of $59 million, a 22% YoY gain from OPEX of $157.8 million. It reported non-GAAP EBITDA of $85 million on a ~8.5% margin. It therefore stands to reason that, whilst the revenue and gross profit mix has tilted towards the lower margin chronic segment, vertically down the P&L profitability has actually improved. On CFFO of $104 million it has a cash conversion ratio of 2.7x with a distribution of $38.5 million to net income.

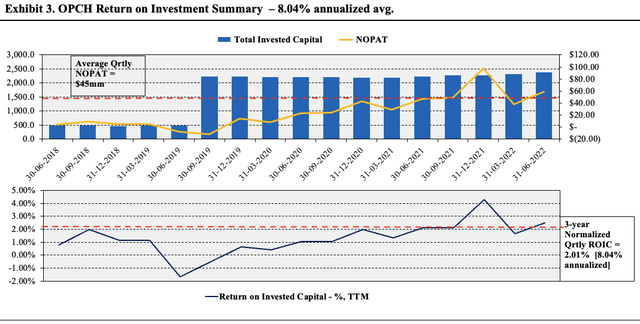

It is these kind of features that standout for OPCH in the investment debate. As seen in Exhibit 3, the company continues to grow post-tax profitability on a sequential basis. Here we investigated how much NOPAT the company generated from the previous year’s invested capital. Results are pleasing. We demonstrate that (annualized) return on investment has normalized to 8.04% over since FY18–date, after averaging a $45 million NOPAT conversion per quarter ($180 million annualized).

Exhibit 3.

Data: HB Insights, OPCH SEC Filings

Guidance upgrade in line with sector trends

With the upside achieved vertically down the P&L last quarter management has increased FY22 full-year guidance. We’ve seen numerous exemplars of this in the back end of 2022, pointing to a strong period of growth for the sector. OPCH now forecasts $3.85–$3.95 billion, calling for ~15% growth at the top at the upper end of guidance. It forecasts non-GAAP EBITDA of $342 at the upper range and foresees CFFO of $250 million.

Moreover, it opened another six new infusion centres last quarter, and forecasts to open >25 centres by the end of FY22. It now has 140 infusion centres across the country treating more than 225,000 patients per year, and it expects continued investment in this segment looking ahead.

Valuation

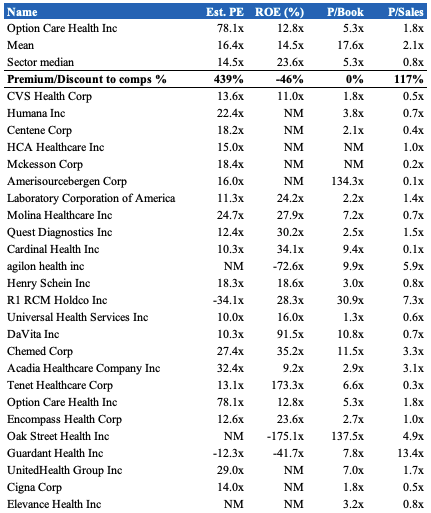

Shares are trading at 1.8x sales and generated 12.8% in ROE for the quarter, and a 7.8% FCF ROE. As seen below, shares are priced at more than 78x forward P/E – a ~440% premium to GICS Industry peers – suggesting the market is expecting an above-sector growth at the bottom-line for OPCH next year. This is integral to the investment debate seeing as investors have moved to rewarding bottom-line fundamentals in FY22, and hence OPCH looks attractive on this front.

Exhibit 4. Multiples and comps

Data: HB Insights

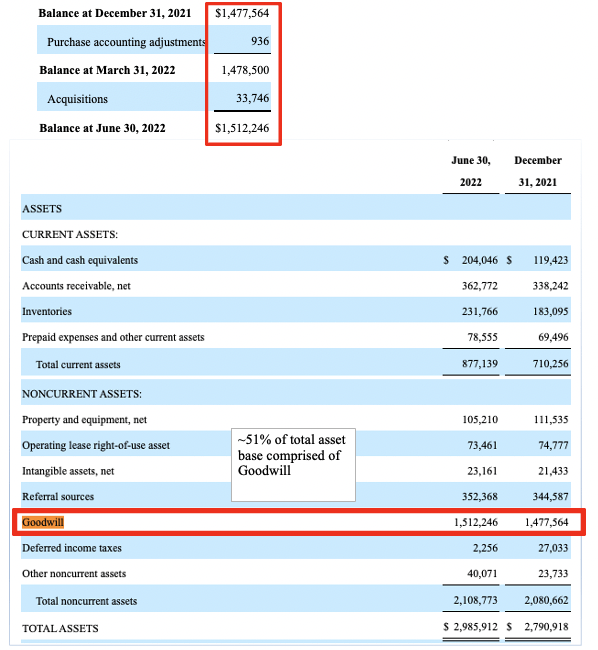

However, on deeper examination, the valuation case begins to weaken. OPCH has ~51% or $1.51 billion ($8.30/share) of its asset base booked up as goodwill. Anyone familiar with the accounting treatment of goodwill will know that it is a form of intangible after acquisition of another company. It is the premium paid over the fair market value of the acquired company. There is no cash tied to this, it is simply a capitalized expense. This suggests OPCH “overpaid” by more than $1.5 billion for its recent acquisitions, although there’s the case for brand value and technology in some of the acquired names.

However, this creates a dilemma when looking to value the company and its stock. Ideally, we use tangible book value as an identifier of corporate value in various calculations. However, after adjusting for goodwill and other intangibles on the balance sheet, OPCH actually has a negative tangible book value of $602 million. Therefore, in terms of “tangible” value, other than FCF and forward earnings estimates, we aren’t left with much to work with here. This is a key risk that we must bake into the valuation thesis for OPCH.

Exhibit 5. Goodwill makes up for the bolus of asset base and therefore tangible book value is in the red

Data: HB Insights, OPCH 10-Q, Q2 FY22

As such, at 78x FY22 EPS estimates of $0.77 values the stock at $60.06 per share. However, this is overly generous by estimate given the data outlined above. As such, reflecting a 51% adjustment to forward earnings to remove the goodwill, re-prices the stock at $41 per share. There is still ~20% upside capture on this valuation.

In short

OPCH has hit a turning point and looks to continue unlocking long-term value in the future investment landscape. With the latest sector rotation favouring healthcare, the company is well positioned to compound returns achieved this year. Operating metrics, in particular normalized return on investment, are key standouts for the company. However, we’d ideally like to see more of an even split between tangible value and goodwill in terms of corporate and stock valuation. As such, whilst forward earnings multiples are supportive of extensive valuation upside, after adjusting for this, we price the stock at $41 per share and seek a return objective of 20% to that mark before re-evaluating. Rate buy.

Be the first to comment