LaylaBird/E+ via Getty Images

OptiNose (NASDAQ:OPTN) is one of the leading pharmaceutical companies in the treatment of nasal polyps. In 2022, the company announced positive results from two phase 3 clinical trials evaluating the efficacy and safety of OPN-375 (Xhance) in the treatment of chronic sinusitis for which there are no FDA-approved drugs. As a result, OptiNose became the first pharmaceutical company to validate the use of nasal treatment to improve both symptoms and reduce inflammation within the nasal cavity, opening the door to expanding Xhance to 10 million patients in the US alone. Since writing my last article in March 2022, the company’s stock has risen by 56%, which significantly exceeded the return of the S&P 500.

Seeking Alpha

Despite this, I believe that due to the growth in revenue, the continued high gross margin and the ability of OptiNose’s management to achieve the stated goals in the development of the pipeline, maintains significant upside potential for the company’s shares in the next two years.

OptiNose’s Financial Position

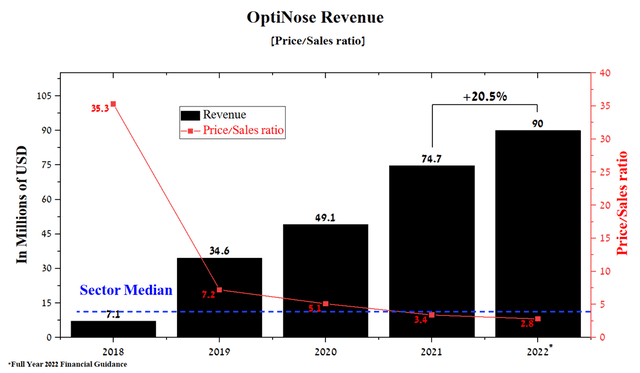

Under the leadership of Peter Miller, the company’s business continues to grow. At the latest quarterly report, OptiNose management confirmed expectations that Xhance sales will be at least $90 million in 2022, up 20.5% from 2021.

Source: Author’s elaboration, based on Seeking Alpha

Although OptiNose is a small pharmaceutical company, the Price/Sales ratio continues to decline and is lower than the average value for the pharmaceutical industry, which indicates that the company is undervalued by Wall Street. It should be noted that the increase in revenue is associated with some factors, and the key one is the high efficiency of Xhance, which, as mentioned in previous articles, is used to treat nasal polyps. The relatively low price and positive experience of using OptiNose’s medicine by patients favorably affect the increase in the number of physicians who prescribe Xhance.

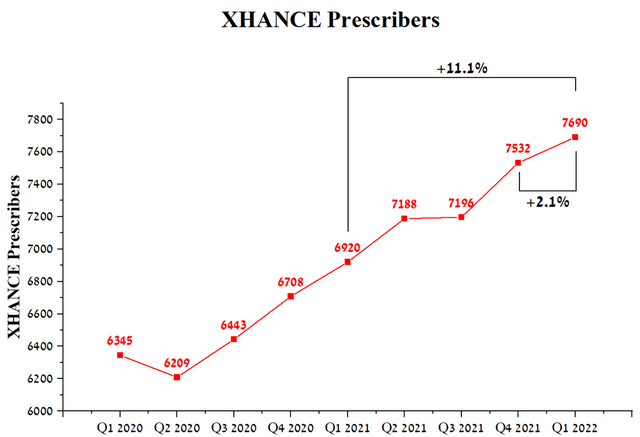

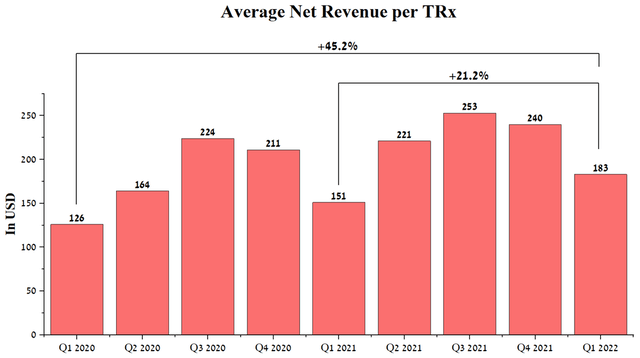

Source: Author’s elaboration, based on quarterly securities reports

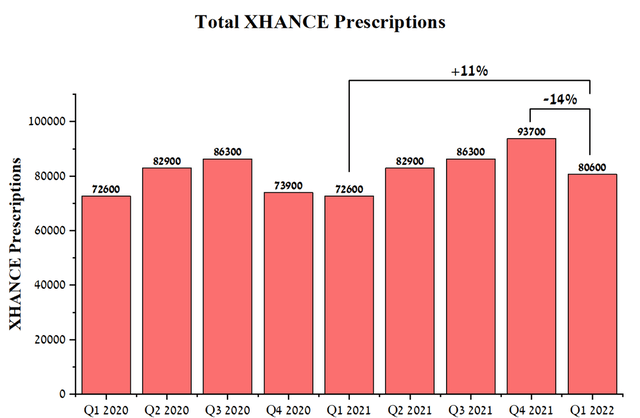

The total number of Xhance prescriptions was 80,600 in Q1 2022, up 11% from Q1 2021. However, there is a 14% decline year-on-year, which is mainly due to the decision of OptiNose’s management to increase net revenue per recipe to improve the margin of the business. As a consequence, this led to a decrease in the number of prescriptions filled by patients under insurance coverage, which required co-payments above a certain threshold.

Source: Author’s elaboration, based on quarterly securities reports

In my opinion, the company’s management made the right decision to increase net sales per prescription, as this will accelerate OptiNose’s approach to the start of positive cash flow needed to grow the business and reduce the risk of diluting investors. In Q1, Xhance’s average net revenue was $183 per prescription, up 21.2% year-over-year.

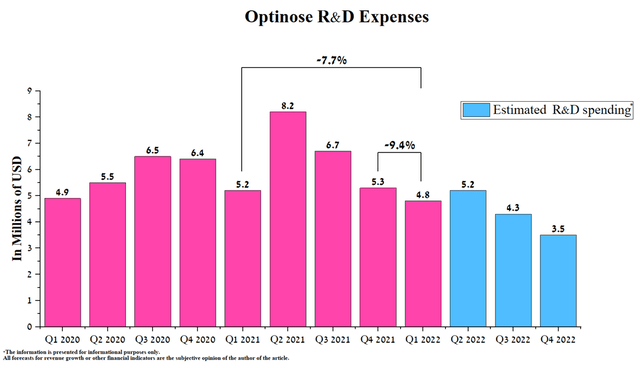

Source: Author’s elaboration, based on quarterly securities reports

The company continues to reduce spending on research and development, namely, it amounted to $4.8 million for the 1st quarter of 2022, a decrease of 9.4% compared to the previous year.

Source: Author’s elaboration, based on Seeking Alpha

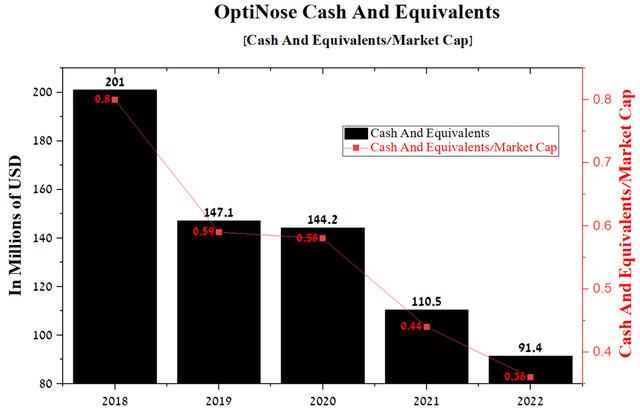

I expect the downward trend in R&D spending to continue in the coming quarters as the company completed two large phase 3 clinical trials in 2022 and is currently conducting a small clinical trial to determine the efficacy and safety of OPN-375 in treating adolescents with bilateral nasal polyps. The reduction in spending will slow down cash spending, which amounted to $91.4 million at the end of Q1 2021, or 36% of the company’s total capitalization.

Source: Author’s elaboration, based on Seeking Alpha

In small pharmaceutical companies, it is critical to keep track of cash levels to mitigate the risks associated with additional share issuance. As discussed later in the article, OptiNose’s product candidate showed positive data in a clinical study, which significantly increases the likelihood of FDA approval and also favorably increases interest from pharmaceutical companies that can partner with OptiNose, which will improve the company’s financial position.

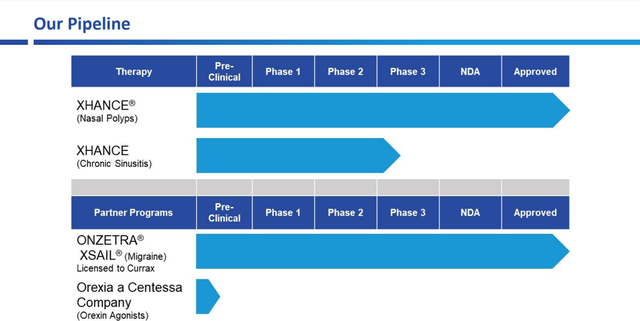

Product Pipeline OptiNose

OptiNose is developing a patented medicine targeted at the treatment of chronic sinusitis. In addition, the company has partnered with Currax Pharmaceuticals to provide certain intellectual property used in FDA-approved ONZETRA XSAIL for the treatment of migraine. OptiNose’s drug delivery system (EDS) is also being used in Centessa Pharmaceuticals’ product candidate, which is being developed for the treatment of type 1 narcolepsy.

Source: Corporate Presentation

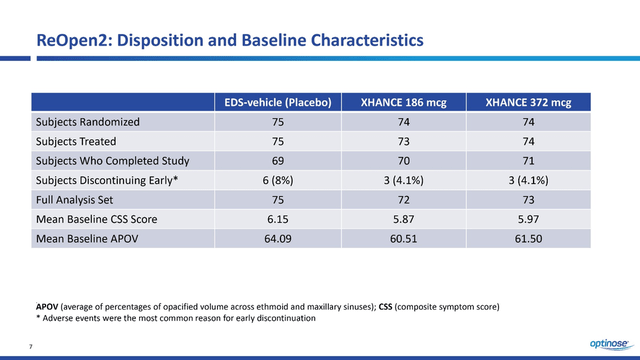

In a previous article, we discussed the results of the first Phase 3 ReOpen1 clinical trial evaluating the efficacy and safety of Xhance in the treatment of chronic sinusitis. On June 13, 2022, the company announced the positive results of the second phase 3 clinical trial of ReOpen2, which confirmed the efficacy and favorable safety profile in the treatment of this inflammatory disease of the nasal cavity. This study included 222 patients, which is less than in ReOpen1. The baseline characteristics of ReOpen2 patients were slightly different from those of ReOpen1 and thus this article will discuss the results separately from the first study. I believe the company made the right decision to recruit patients with slightly different average baseline CSS and APOV scores, as this would allow for more clinical data to be collected for regulatory agencies and thus reduce the risk of requesting more data. In addition, 8% of patients who took placebo discontinued participation before ReOpen2 was completed, which is significantly more than in the groups of patients who took Xhance at various dosages. According to the conference call, the main reason for this was adverse events and thus is a favorable factor for OptiNose’s product candidate during the future review of the sNDA application by the FDA.

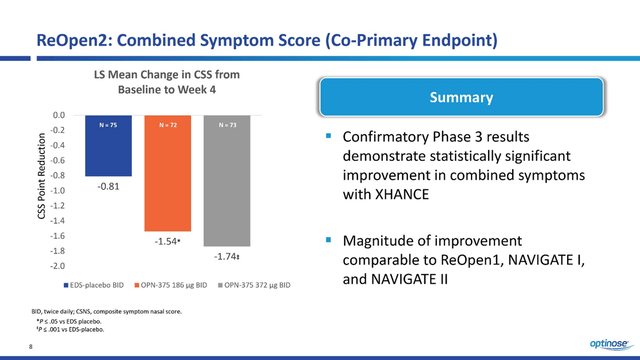

In ReOpen2, Xhance’s ability to reduce combined symptom score, which includes pressure sensations, nasal congestion and discharge, and facial pain, was confirmed in the fourth week of treatment.

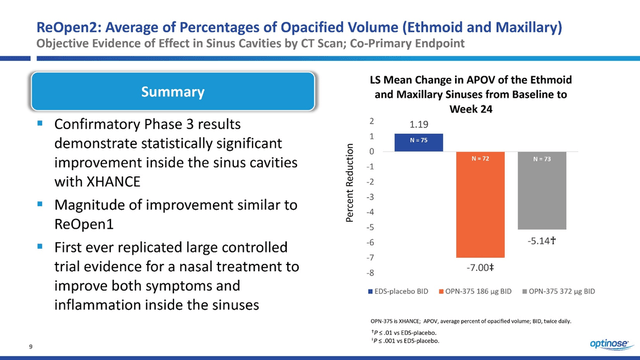

In contrast to ReOpen1, in this clinical study, there is a strong correlation between symptom improvement with increasing drug doses. In my estimation, this substantially increases the likelihood of OPN-375 being approved by the FDA. In addition, the 186mg and 372mg Xhance patient groups not only showed a statistically significant reduction in sinus inflammation as measured by APOV but also showed greater efficacy relative to the first phase 3 clinical trial.

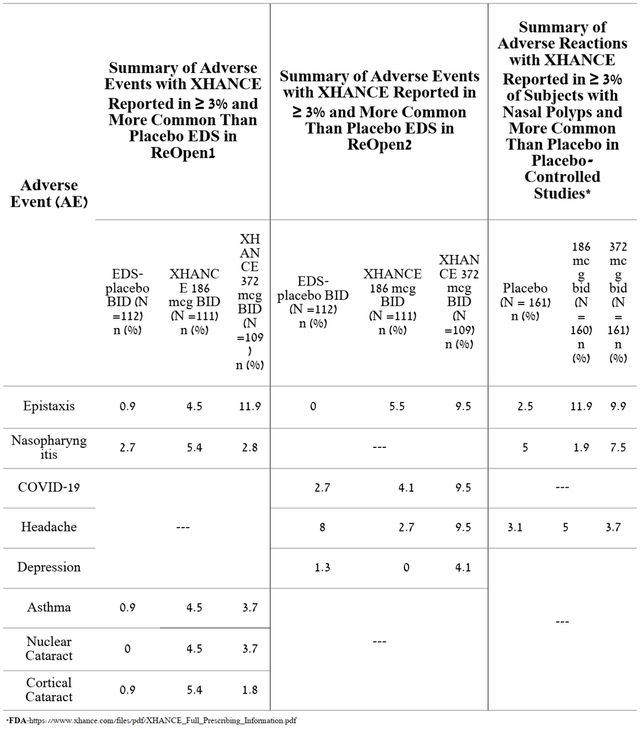

Thus, OptiNose is the first company to develop a therapy that has achieved primary and secondary endpoints in two large randomized clinical trials in the treatment of patients with chronic sinusitis with or without nasal polyps. It should be noted that the favorable safety profile of OPN-375 was confirmed in ReOpen2 and somewhat better than in the previous ReOpen1 clinical trial. Overall, the adverse events in the two clinical studies and those that contributed to Xhance’s FDA approval in 2017 were as follows.

I believe that the efficacy and safety data shown in ReOpen1 and ReOpen2 offers a high chance of expanding the indication for Xhance. OptiNose management expects to file an application with the FDA in the second half of 2022 and, as a result, the FDA decision should take place at the end of 2023. This is especially important as there are currently no approved drugs for the treatment of chronic sinusitis and thus opens up huge commercial opportunities for the company. In addition, on June 13, the CEO of the company announced that the company is working on finding partners that would accelerate the implementation of Xhance for doctors.

“But first, I will highlight the immediate XHANCE opportunity for a potential partner with a primary care infrastructure with the addition of a CS indication. In addition to the 3 million patients in specialty physician target audience, there are an estimated 7 million candidate patients currently diagnosed and being treated by roughly 50 to 60 thousand additional physicians in primary care, representing an additional market opportunity of approximately $7 billion. As we have said previously, we do not plan to build direct-selling infrastructure to optimize reach into this primary care opportunity. Instead, we intend to secure a partner with an existing, leverageable, primary care deployment to efficiently broaden adoption to prescribers outside our called-on universe. We have been assessing the space and are optimistic there are multiple partners with potential to jointly benefit from helping us realize this additional value.”

Risks

In my estimation, there are two main risks for OptiNose.

Macroeconomic risks

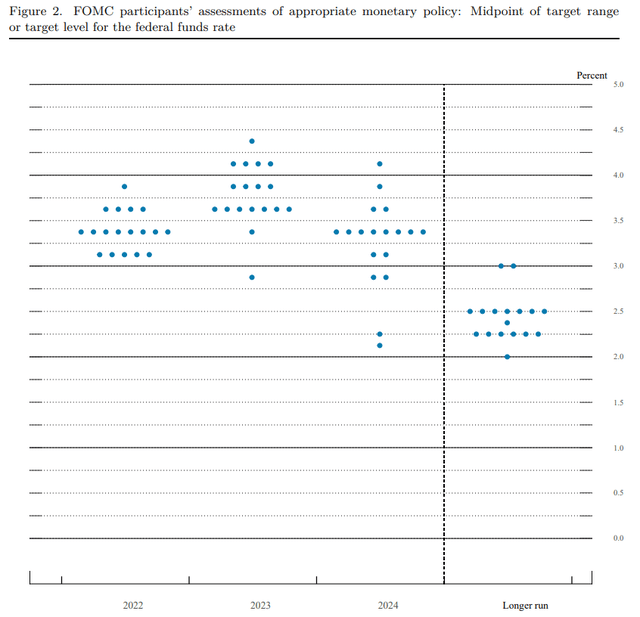

At yesterday’s Fed meeting, members of the Federal Open Market Committee expect rate hikes to 3-3.25% by 2023.

As a result, it should be taken into account that a rate increase may adversely affect the attractiveness of the stock market and lead to an increase in volatility, which may contribute to a temporary decrease in the company’s share prices.

The risk associated with the company’s debt

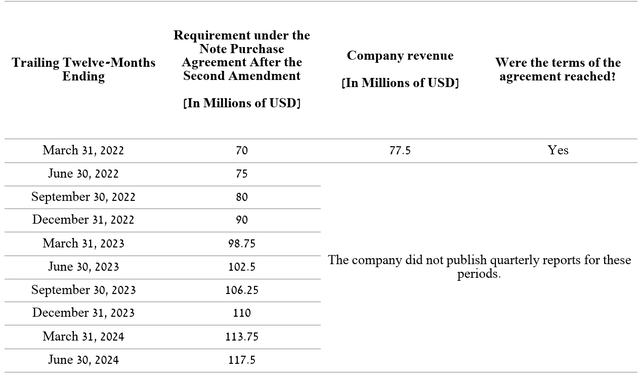

As discussed in the “OptiNose: Underappreciated Potential” article, OptiNose has a risk associated with Pharmakon Advisors’s senior bonds.

Author’s elaboration, based on Form 10-K

At the moment, there are no significant prerequisites that could lead to a violation of the terms of the agreement. However, OptiNose investors need to be very careful to ensure that the company’s revenue exceeds the established requirements, as otherwise, this may lead to negative results.

Conclusion

OptiNose is one of the leading pharmaceutical companies in the treatment of nasal polyps. In 2022, the company announced positive results from two phase 3 clinical trials evaluating the efficacy and safety of Xhance in the treatment of chronic sinusitis. As a result, OptiNose became the first pharmaceutical company to validate the use of nasal treatment to improve both symptoms and reduce inflammation within the nasal cavity, opening the door to expanding Xhance to 10 million patients in the US alone. Due to the increasing macroeconomic risks associated with rising inflation and hostilities in Eastern Europe, I reduced my ownership of OptiNose to 4% of my portfolio. However, with the company’s revenue growth, improved margins, and potential FDA approval of Xhance for a new indication in 2023, I believe in the company’s huge potential and as a result, continue to be a long-term investor in OptiNose.

Be the first to comment