Bet_Noire/iStock via Getty Images

A guest post by D Coyne

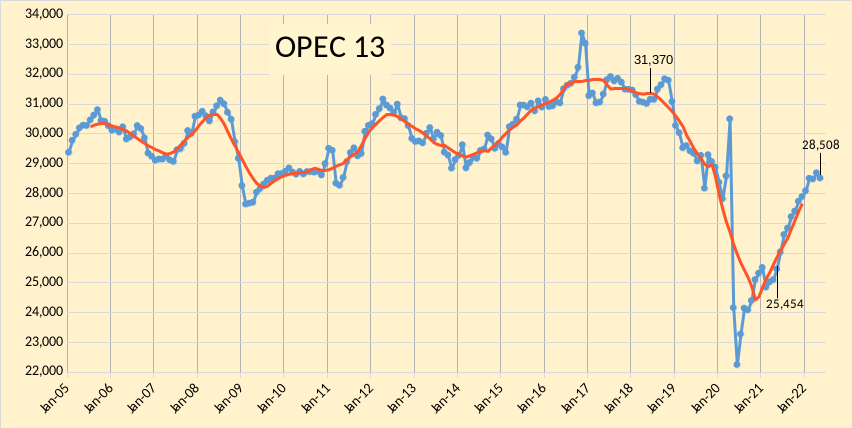

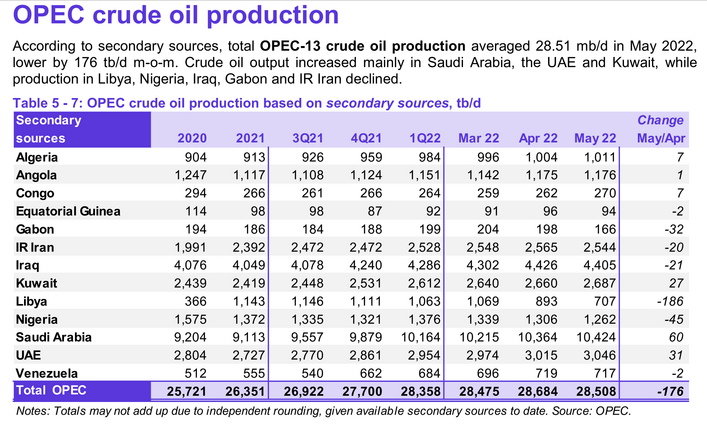

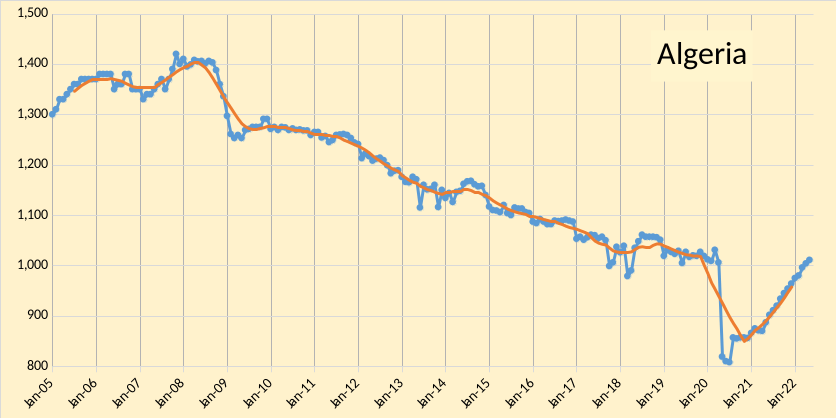

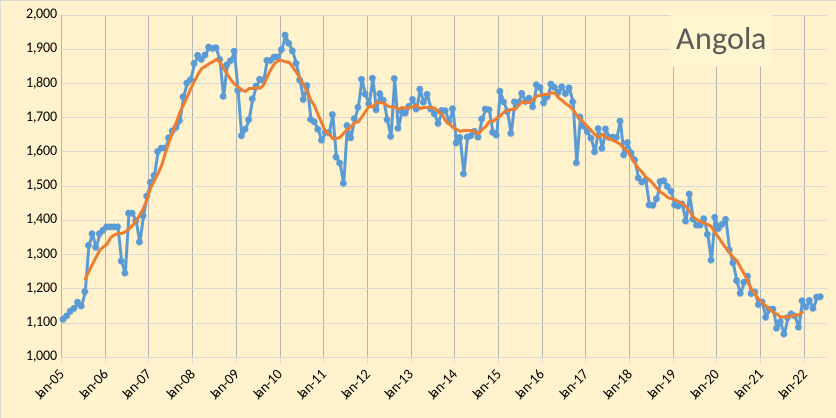

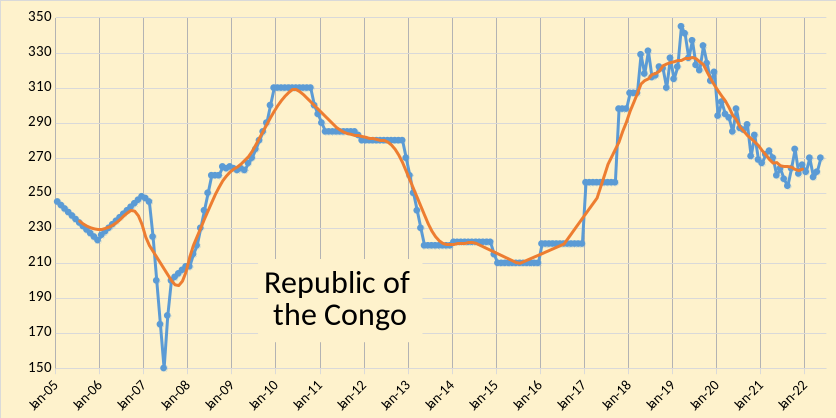

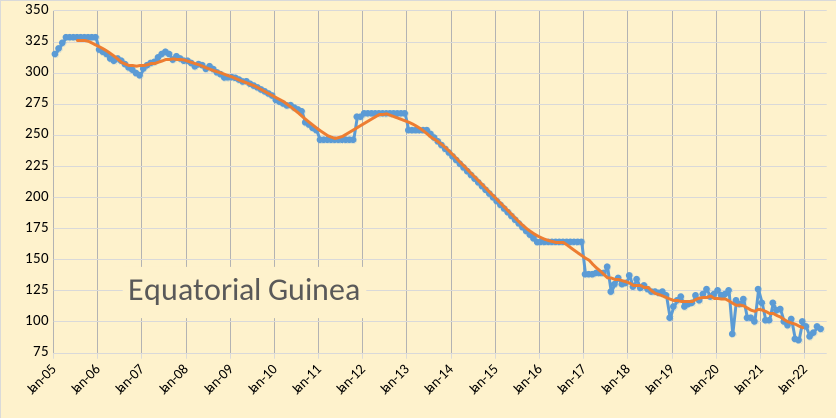

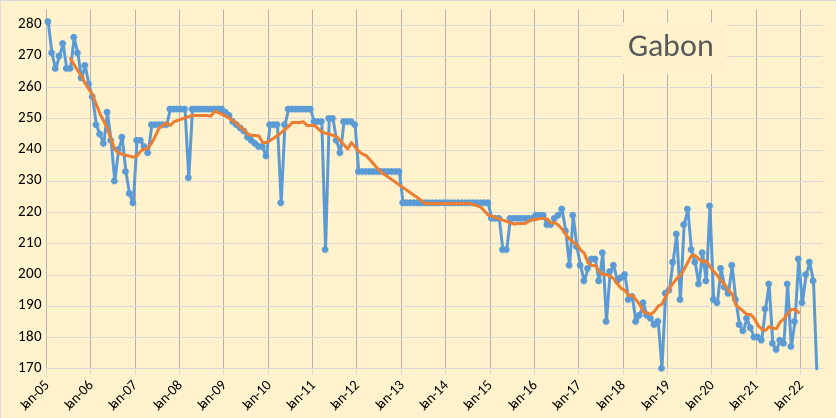

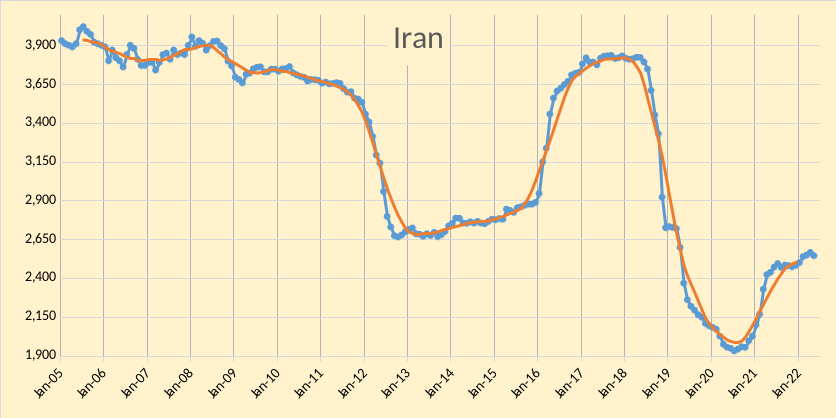

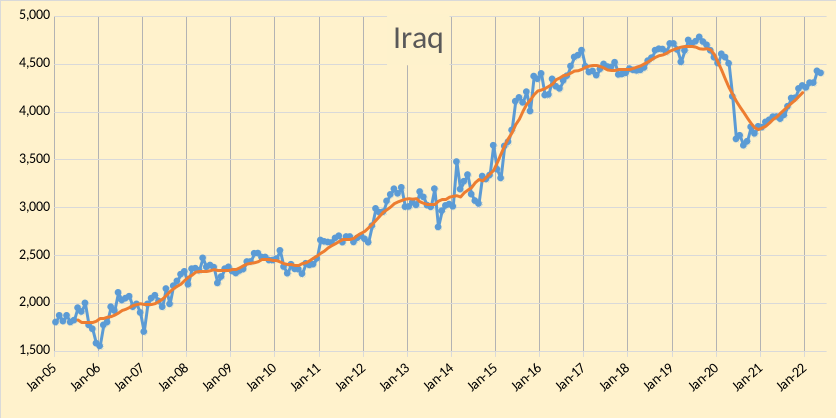

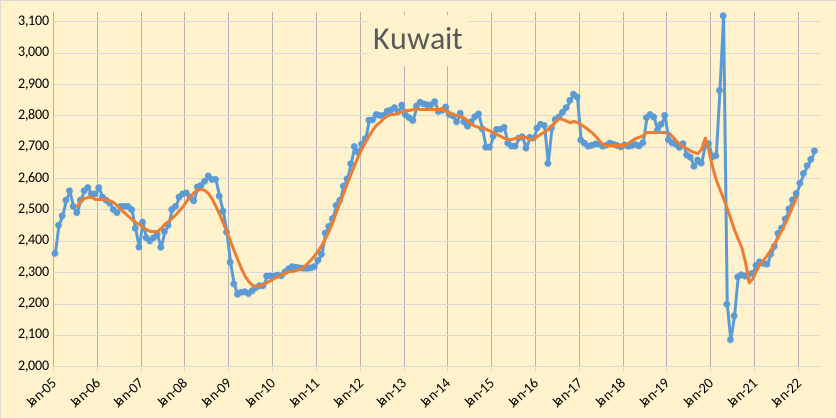

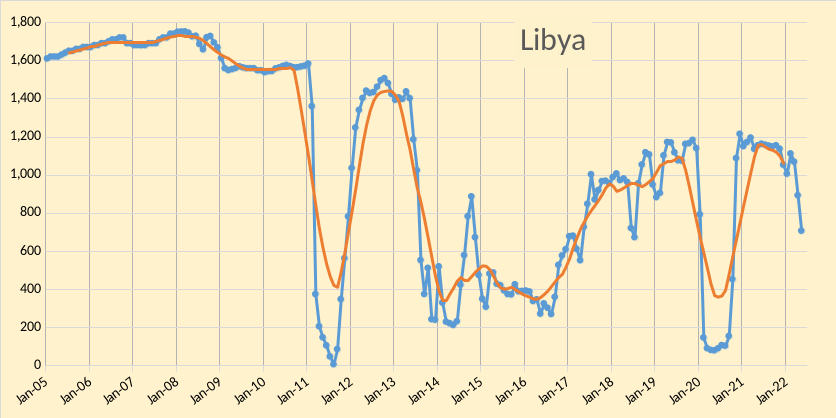

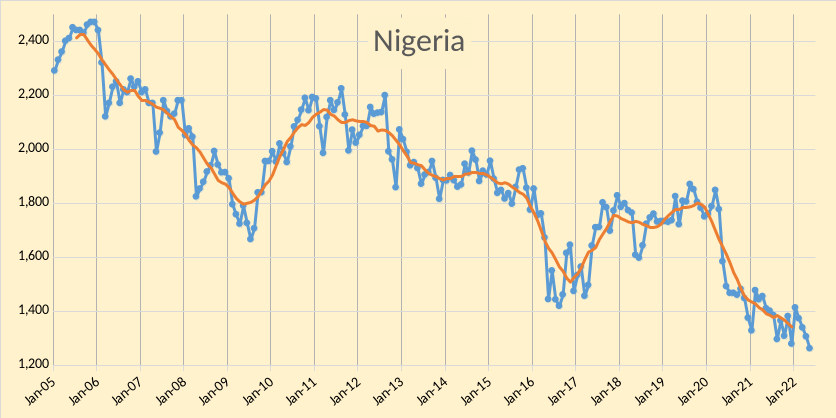

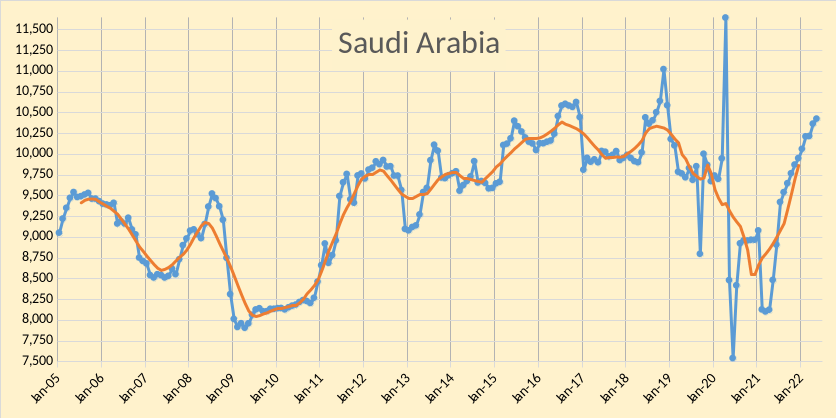

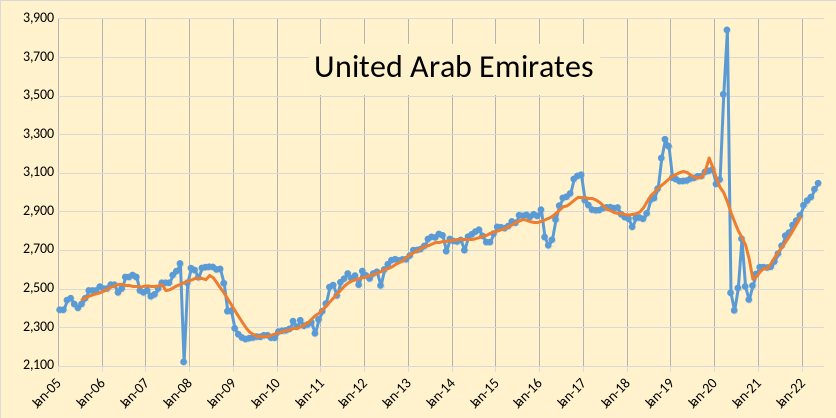

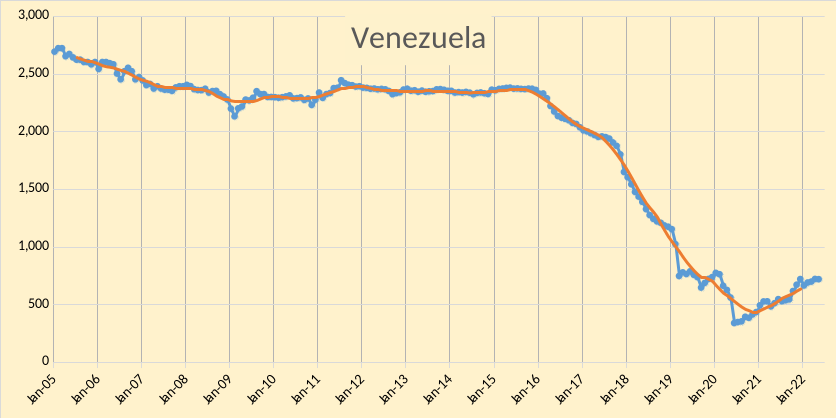

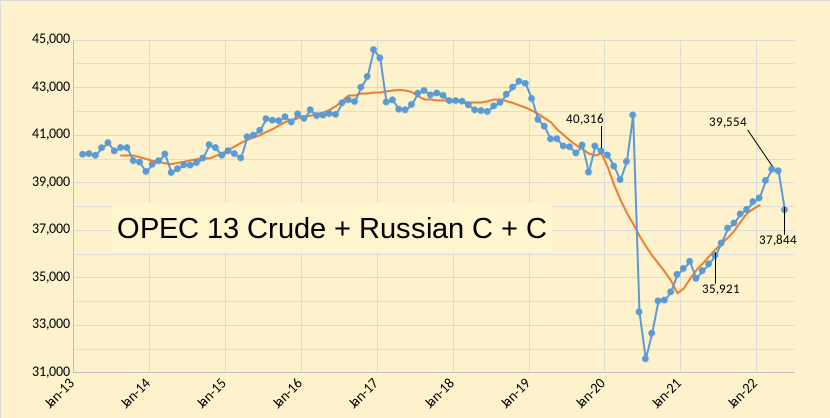

The OPEC Monthly Oil Market Report (MOMR) for June 2022 was published last week. The last month reported in most of the charts that follow is May 2022 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In most of the charts that follow, the blue line is monthly output and the red line is the centered twelve-month average (CTMA) output.

OPEC output decreased by 176 kb/d according to secondary sources in May 2022. March 2022 output was revised down by 20 kb/d from what was reported last month, and April 2022 output was revised higher by 36 kb/d compared to the May 2022 MOMR. All of the decrease in OPEC output was from Libya (-186 kb/d) and for the other OPEC nations increases more than offset decreases by 10 kb/d. Six OPEC nations had higher output and 7 had lower output, with Libya’s decrease about four times the next biggest decrease (Nigeria at -45 kb/d).

In the chart below, we have Russian C + C and OPEC crude oil output. It is doubtful that any OPEC increase in the future (mostly from Libya if they recover from the recent decrease in output plus a small increase from Iraq and UAE of perhaps 200 kb/d combined, with most of this from Iraq) will offset future decline from Russia. I expect OPEC plus Russian output to continue to decrease by as much as 750 kb/d from the May 2022 level over the near term (next 18 months) or to approximately 37,090 kb/d. It is doubtful that this 2500 kb/d decrease in World output can be replaced by increases in the US, Canada, Brazil, China, Norway, and Guyana over the near term which suggests high oil prices unless the coming World recession is severe (1% annual real World GDP growth rates or less.)

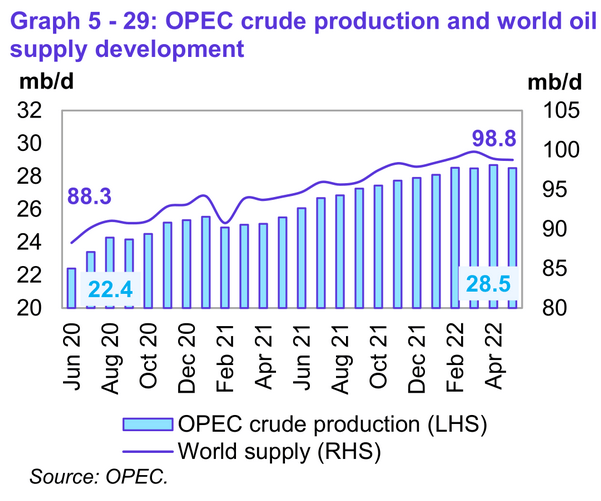

Global liquids output decreased about 150 kb/d in May, note that Libyan output decreased by 186 kb/d in May.

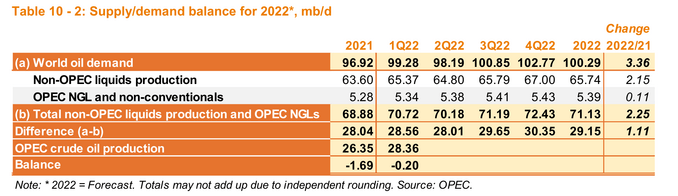

Based on OPEC’s estimate for the balance of World supply and demand, World oil stocks would have decreased by 617 million barrels in 2021 (1.69 Mb/d times 365 days). The forecast in Figure 5 above for non-OPEC liquids output looks very optimistic, and it is doubtful that the demand forecast is correct (high oil prices and a World recession are likely to lead to lower oil demand than this forecast.) If the forecast were correct, it is highly unlikely that OPEC would be able to meet the call on OPEC crude for 3Q22 and 4Q22, and we could see World oil stocks fall by another 300 million barrels in the second half of 2022. For 2021 and 2022 we would see a decrease in World oil stocks of about 900 million barrels (this includes non-OECD oil stocks).

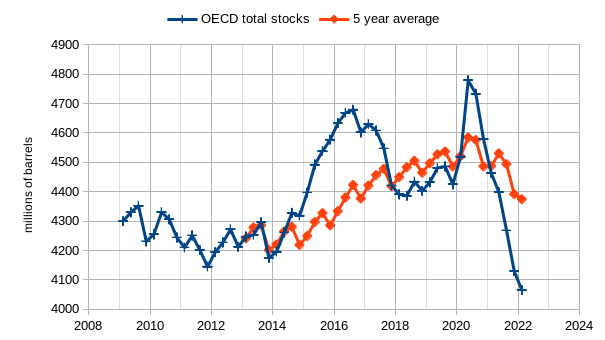

The chart above shows quarterly OECD total oil stocks (both commercial and SPR) from 1Q2009 to 1Q2022, and also the trailing 5-year average for OECD total oil stocks. The low point for the 5-year average was 4Q2013 at 4201 million barrels, 1Q2022 OECD total stocks were 4065 million barrels, about 136 million barrels lower than the lowest 5-year average of the last 9 years. Also note that OECD total oil stocks fell by 449 Mb in 2021 out of an OPEC World estimate of 617 Mb, about 73% of the total stock decrease. Unfortunately, we do not have very good data for non-OECD oil stocks. Typically, the low level of OECD stocks that we currently see, results in very high oil prices in the absence of an economic crisis (similar to 2008/2009 or worse). Based on what I see now, I would expect oil prices in the range of $100 to $150/bo for Brent Crude over the next 12 months, but the odds are very low that this guess is correct.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment