imaginima

OPEC+ stunned the market last week reducing official quotas by 2 million barrels of oil per day. This move was beyond symbolic and will result in real barrels coming off the market, though far less than the headline number. WTI crude oil and products that mirror it, like the United States Oil ETF (NYSEARCA:USO), as well as Brent Crude and products that track it like the United States Brent Oil Fund (BNO) should continue to outperform in an otherwise tough market. I believe we’ve hit the point where a tight physical market starts to push prices above $100 a barrel.

OPEC+ is low on spare capacity, and just wants the oil price higher

OPEC+ wants oil prices higher. Last month’s symbolic 100k barrel/day cut didn’t do the job, nor has the numerous warnings that crude prices do not reflect the supply/demand balance in the market. OPEC+ specifically stated that “Extreme volatility and lack of liquidity in the futures market are moving prices in ways that do not conform to normal supply and demand factors” and warned they would take action. They finally did.

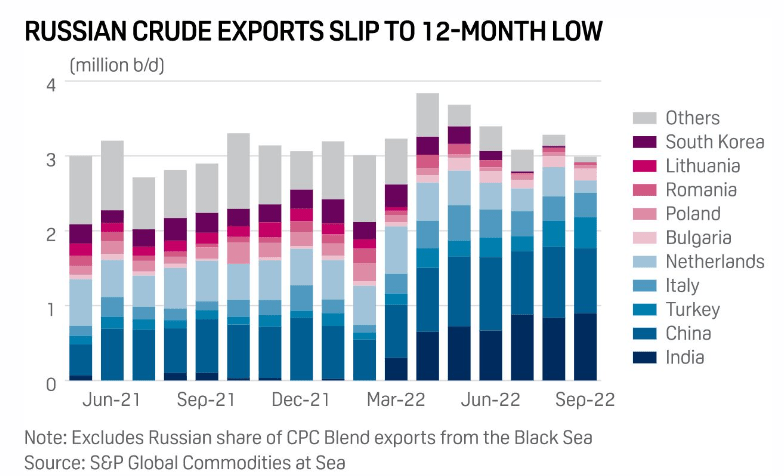

Oil spiked to over $120/bbl earlier this year on fears that Russian oil exports would be curtailed. These predictions were early – in fact, Russia increased exports early in the Ukraine conflict. But lately, exports have started to drop.

S&P Global Commodities

This is happening before EU sanctions are set to begin at the end of this year. Even without sanctions, a major risk to Russian production is from the lack of western parts and expertise, as most global partners have withdrawn. It is possible that is what we’re seeing happen.

I believe OPEC+ is simply running low on spare capacity. It’s smarter to announce a cut now rather than have output fall even further behind quotas. Especially if demand is set to grow.

Saudi Aramco’s (ARMCO) Chief Executive Officer Amin Nasser said recently at a conference in London:

The world should be worried, this is where we are heading. If China opens up a little bit you will find out that spare capacity will be eroded completely.

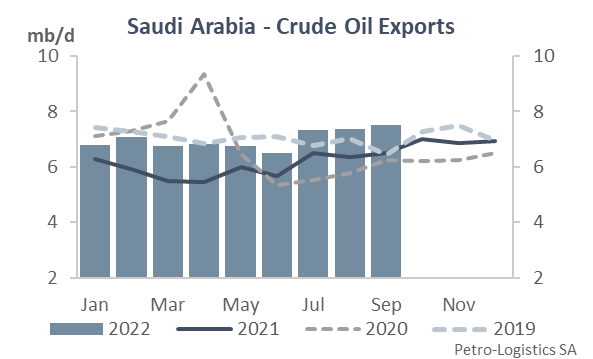

Saudi crude exports have increased since early in the year, but the growth is slowing and I think it is likely that they are nearly tapped out.

Petro-Logistics SA

With the oil market already tight, the major demand driver of China moving away from its zero COVID policy is coming closer.

There has been plenty of rumors on when this will happen. Some believe we will see this after the major party Congress happens in the next week. Others believe it will happen in the middle of next year, after China produces its own mRNA vaccines and vaccinates a majority of its population.

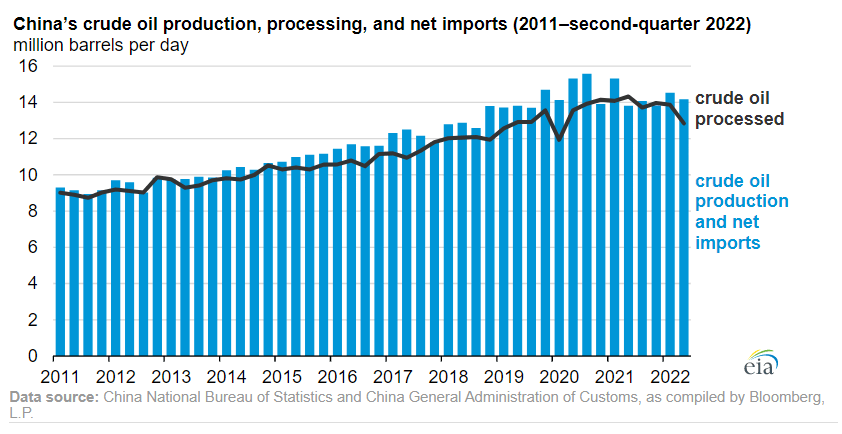

China National Bureau of Statistics

As time moves on and the rest of the world moves further away from COVID, this will happen. When it does, it could result in an extreme spike in crude demand.

It may happen sooner than most think. China recently released its 2023 import quotas 3 months earlier than normal in an attempt to encourage refiners to boost production. Is China just responding to a strong refined product export market, or is this a sign China plans to curtail its zero COVID policy?

Aside from China, worldwide demand still looks healthy as economies continue to reopen and workers return back to offices. In the US, last week saw a massive 16.2 million barrel draw (including SPR.) Many employers are still pushing workers to return to offices, which may be far more successful if the labor market weakens.

I believe crude demand will continue to be resilient, even if the expected economic weakness happens.

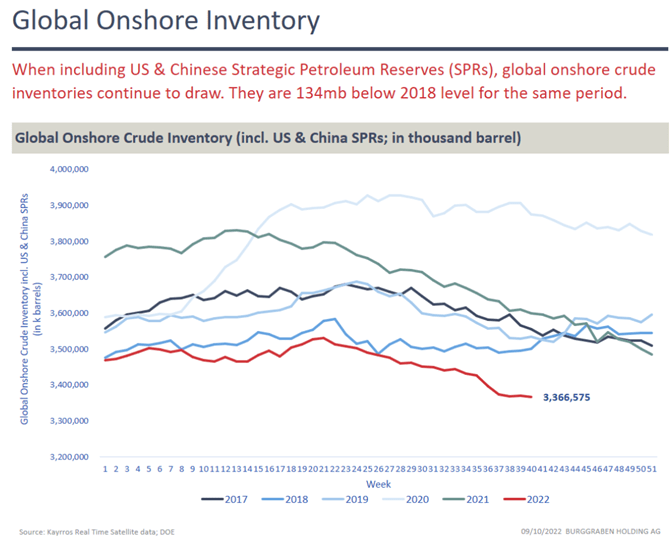

Worldwide inventories continue to draw down

Despite all the fears of global recession, global onshore inventories continue to draw. It’s worth noting how fast we’ve drawn down from the 2020 glut.

Kayrros, DOE

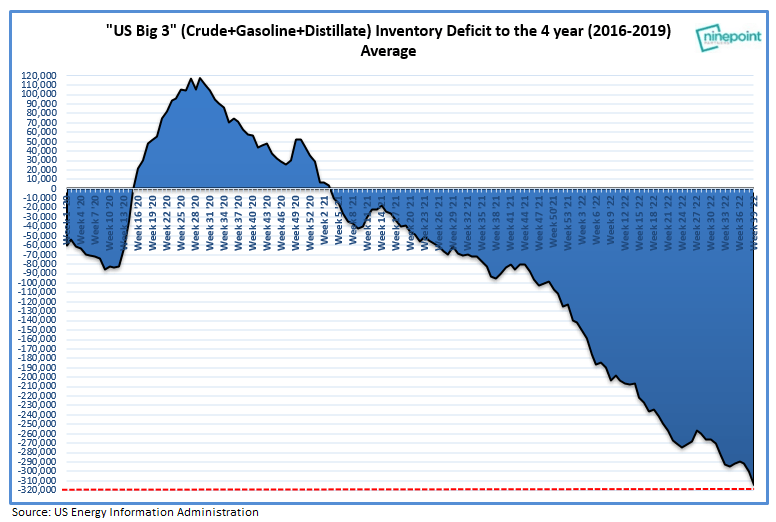

In the US, we’ve seen this as well, especially when you consider the SPR releases along with commercial crude stocks.

Ninepoint/EIA

As of now, the market is still in a deficit, and I believe many 2023 production forecasts are optimistic. I think the official 2023 US production estimate from the EIA that the US will grow from 11.8 mbpd currently to 12.6 mbpd in particular is a pipe dream.

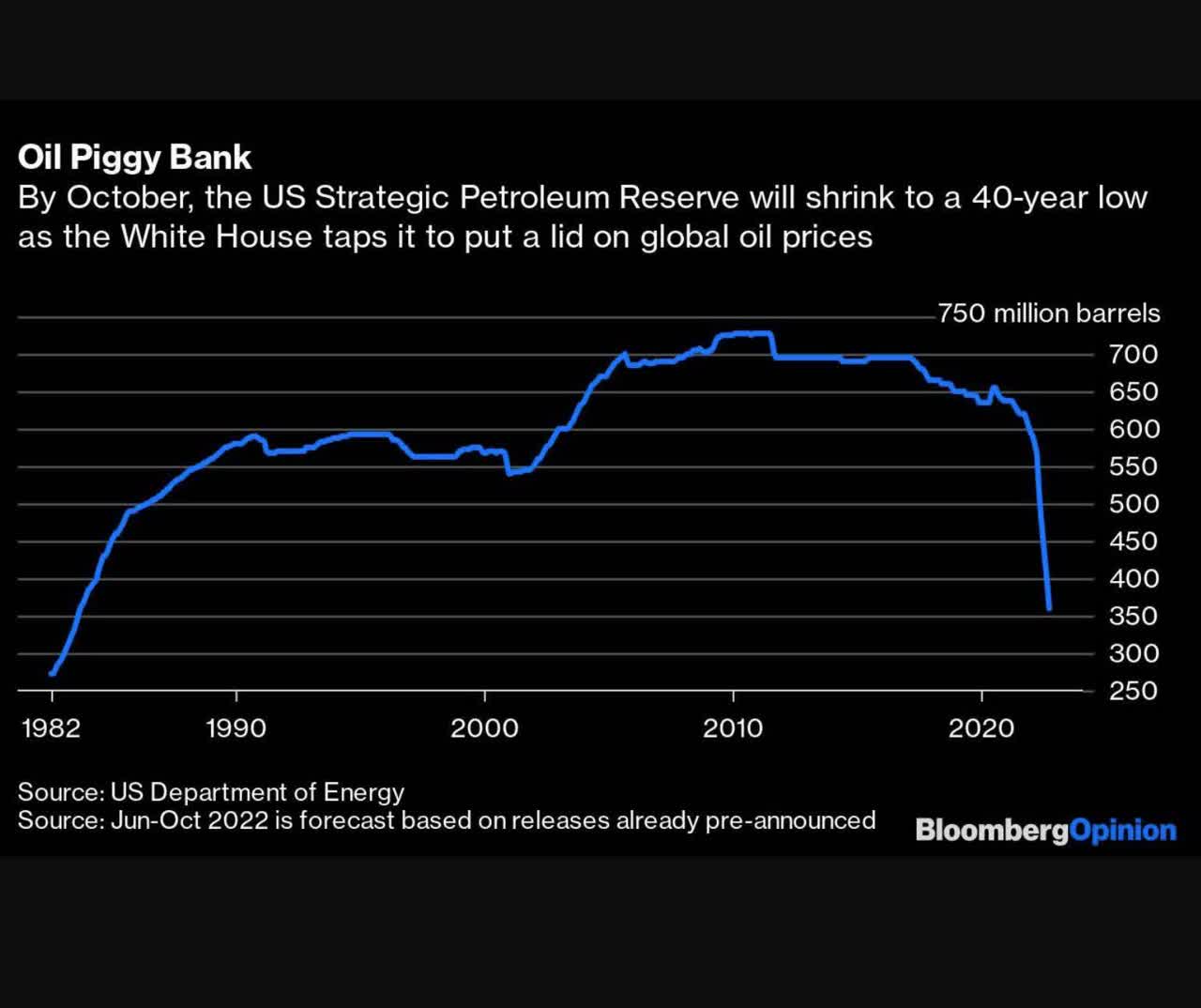

US SPR releases will be ending in late 2022 or 2023, one way or another

The US has drawn down the Strategic Petroleum Reserve from 656 million barrels to 416 million. While we could argue that this made sense when crude spiked to over $120, it makes less sense now around $90.

Bloomberg

Since the start of the year, we’ve released 177.3 million barrels; roughly 650 thousand bpd. At its current pace, the SPR will be completely empty by November 2023, which assumes we can get to exactly zero in the SPR, which likely isn’t technically feasible. Just finishing the announced sales will bring us back to levels not seen since the early 1980s.

My guess is that we stop withdrawing from the SPR around the 2nd week in November. Call it a hunch!

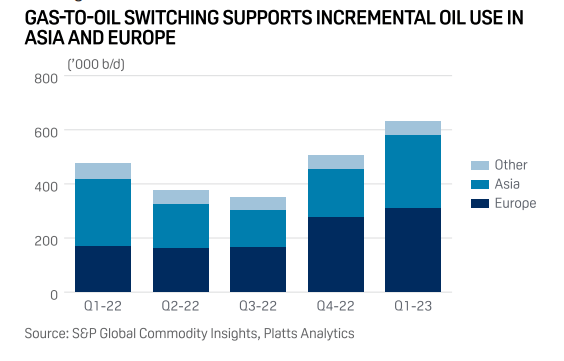

Gas to oil switching this winter will add to incremental demand

A consequence of the high price and limited availability of natural gas in Europe and Asia, gas to oil switching will be another significant demand factor this winter, especially with Nord Stream out of the picture.

S&P Global Commodity Insights

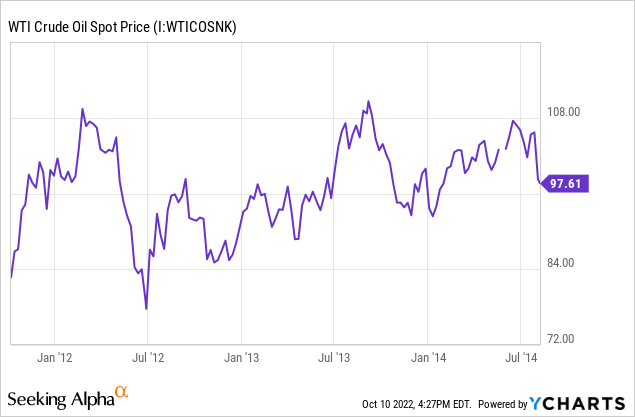

Just how high a price is oil, anyhow? Will a high price crater the economy?

WTI Crude oil averaged a bit below $100 a barrel between 2012-2014, before the shale boom ushered in another era of cheap oil. Why didn’t this crater the economy back then?

Keep in mind, $100/barrel in 2012 is equivalent to $129/barrel today just with inflation, and 10 years of technology improvements have made most things more fuel efficient. (Offsetting this, most fuel taxes are higher now, and this example becomes less dramatic for consumers outside the US.)

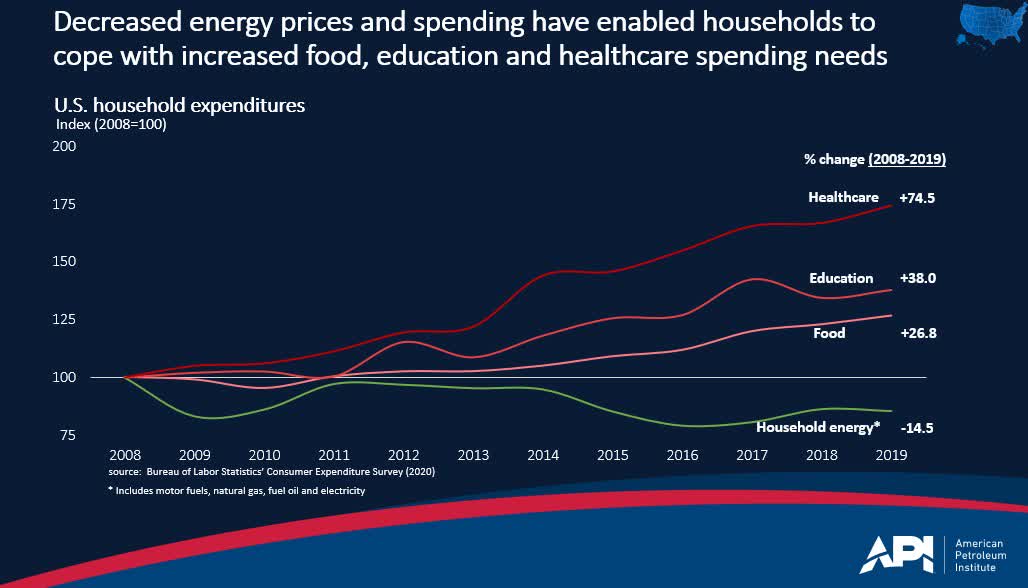

API

The truth is, at least until very recently, household energy is one of the few things that has shrunk as a percentage of the household budgets over the last decade.

The idea that economies cannot withstand $100 oil for any appreciable length of time I believe is rooted more in superstition than fact.

Conclusion

Worldwide crude demand is estimated at 99.4 mbpd.

Over the next few months, we may see a supply reduction of around 1.5mbpd from a combination of OPEC reductions 0.8-0.9mbpd and an end to SPR releases of 0.6-0.7 barrels per day.

At the same time, we could see demand accelerate further from gas to oil switching and any reopening of the Chinese economy.

I believe the normal supply response we’d expect in situations like this will be muted as politicians across the globe make a bad situation worse by threatening windfall profit taxes on producers, while the ESG crowd fights against any major new projects.

USO and BNO are clever ways to benefit from higher oil prices while avoiding much of the risk from any new taxation or regulatory burdens that may be imposed by governments on energy companies, like the proposed Big Oil Windfall Profits Tax Act in the US or the windfall profits taxes that are moving forward in the EU. As anyone who’s passed basic economics knows, policies that increase taxes on producers while rebating consumers will only serve to encourage higher prices. As long as markets remain in backwardation, these funds benefit when monthly futures contracts are rolled forward, providing a tailwind for returns.

2022’s crude oil spike was short lived because of Chinese lockdowns, SPR releases, and resilient Russian output. I don’t think any of these will persist very far into 2023.

The OPEC+ cut may have just marked the bottom for crude prices.

Be the first to comment