Free art director/iStock via Getty Images

A Bear’s Argument

I have seen multiple bullish views on OneWater marine (NASDAQ:ONEW) on Seeking Alpha and elsewhere. The main argument everywhere is that it’s cheap. But I saw that there was a failure to dig deeper into its financials and understand why it could be justified. The other argument is that it is pursuing acquisitions. This may not always be the right strategy either. In our analysis we will unpack our argument in the following ways:

- Look at the company’s financial positioning and how recent acquisitions has it ill equipped for an economic downturn

- Overlooked areas that may be a cause for concern

- Valuation that looks a lot different if we consider historical lessons

Acquisitions and Growth at a Cost

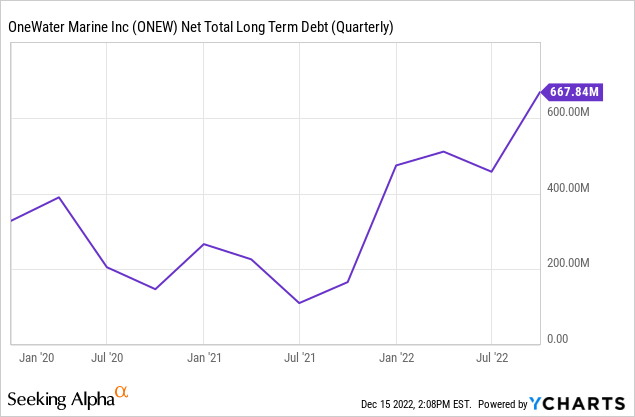

Company has been aggressive in its pursuit of growth. With 21 acquisitions under its belt since its inception, it looks like the company looks to acquisitions to show a big portion of its growth. This is acceptable as long as financial health is sound. When you dig a little deeper, we observe a few key points –

- Net long term debt has almost tripled in the last few years

- Liquidity and Solvency is inconsistent across different metrics

|

Debt to Equity Ratio |

1.8 |

Acceptable |

|

Operating Cash Flow |

$160M |

This metric has been increasing and could be good on its own but it is less than 20% of its debt indicating poor debt coverage |

|

Current Ratio |

1.2 |

Good but a big contributing factor is inventories which are at its highest levels. This ratio would dramatically drop if inventories were to be written off. This will be covered again in a further section |

|

Quick Ratio |

0.22 |

Poor. Indicates the ability of its liquid assets to meet its current liabilities. |

|

Altman-Z-Score |

2.1 |

Acceptable. A score less than 1.8 is seen as a firm with a high risk of bankruptcy |

- High return on equity (>30%) is skewed by its high use of debt. While high ROE is a good indication of the company’s ability to generate profits from shareholders investments, in OneWater Marine’s instance it looks like debt was a big contributing factor. With changing credit markets it would be beneficial for an investor to think how this would look if the company’s ability to borrow was affected.

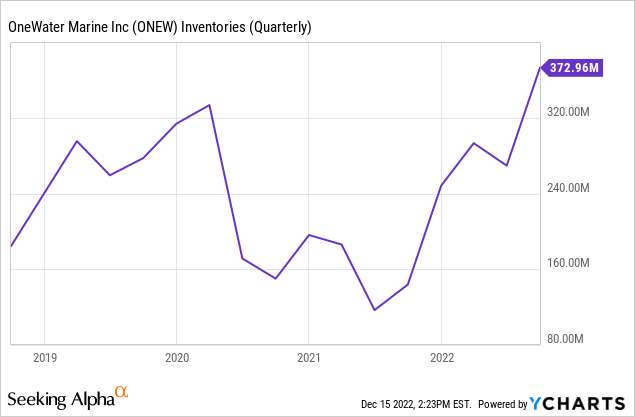

High Inventory

Currently, the company is showing high inventory levels. This looks even more dangerous when you draw parallels between now and the last time the boating industry underwent a significant downturn. To survive, most boating companies around that time wrote off their inventories and this time might be no different.

- Cost of goods sold is up 36.8% while inventories are up 159% for the same time period. For consumer companies, it is not ideal to see inventories growing twice more than cost of goods sold. This suggests that there could be cost issues that haven’t been addressed and could hit profitability

- Growing inventories could be a result of increasing tightness in credit markets. As access to credit decreases it affects a consumer’s ability to purchase big ticket items.

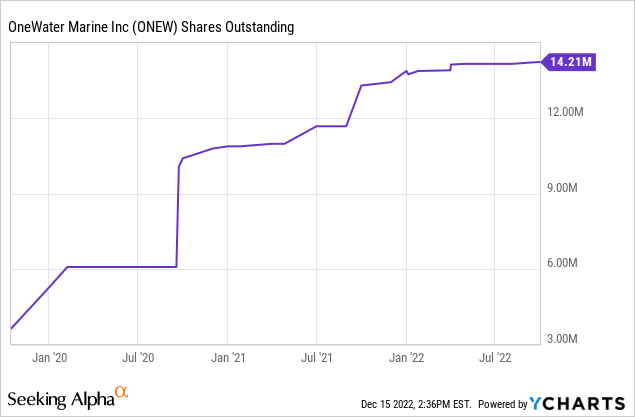

Shareholder Dilution

Debt is not the only way the company has raised cash and it has been looking at multiple public offerings of its common stock. This has resulted in the share count tripling over the last five years.

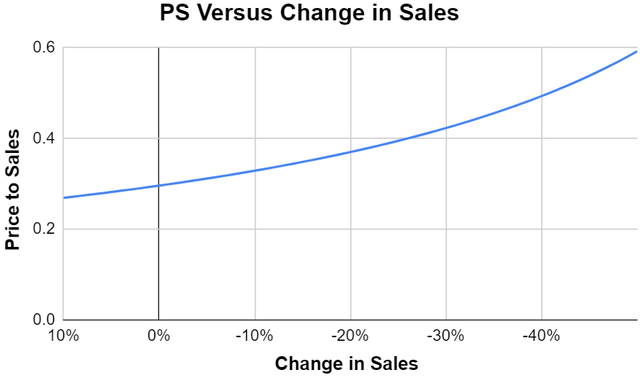

Valuation

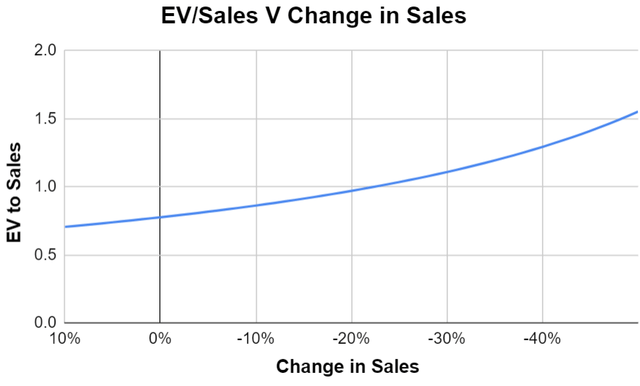

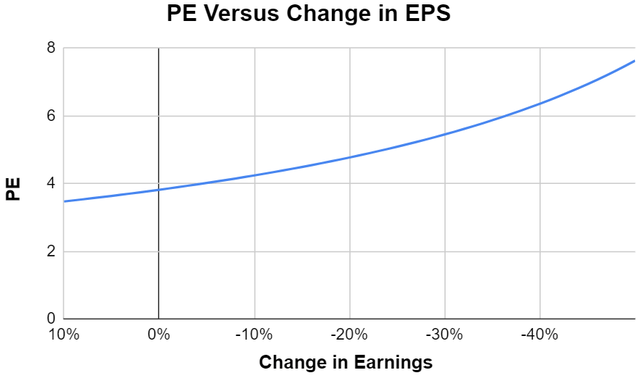

The company looks quite undervalued at the moment. Trading at a PE of 3.5, it compares well not only within its sector but also against the entire industry. But this valuation should be taken with a grain of salt especially considering that we have a good chance of heading into a recession and consumer discretionary companies are the most vulnerable in an economic downturn. By estimates there is an average earnings decline of 30% across all industries during a recession. During the last recession, MarineMax, a big boat retailer in the same space, saw its sales go down by more than 50% and saw its net income turn negative during the worst years. Since it’s impossible to know how much of an effect we would see this time around our best option is to take another look at our metrics in a range of scenarios, and then a different picture starts emerging. A picture where stock valuation starts aligning with the market. If you believe markets to be forward looking, then the “stock-is-highly-undervalued-therefore-its-a-buy” narrative starts changing.

Author Computed Author Computed Author Computed

Closing Comment

At this point I rate OneWater Marine as a sell. Even at present low valuations the company has very few paths to increase value for shareholders in my opinion. I think its go-to method of acquisitions are going to further strain its financials. Either it has to take on more debt or issue stock, both of which are bad for shareholders in the long term. In the short term, for organic growth the macro environment is too uncertain and it is not favorable to this industry. If an investor really needs exposure to this segment, I recently covered another name in the industry with better financial positioning, with a similar strategy towards growth, better valuations, and no shareholder dilution in the last five years.

Be the first to comment