Clicknique

As many of my followers know, I was once a shopping center developer and I owned a portfolio of properties across the southeastern US. Most of the retail centers were located in smaller tertiary markets in lower income rural markets.

In almost every center you could find a finance company, a payday lender, a dollar store, and rent to own business – and the common denominator for all of these businesses is that they thrived on the distressed consumer.

As I reflect on my decades of experience as a landlord, it’s obvious to me that there will always be a market for distressed consumers who live paycheck to paycheck.

And, whenever we enter a recession, the demand for high interest short-term loans will escalate.

Recently I was reading a Wall Street Journal article by Kristin Broughton in which she interviewed LendingClub Corp’s (LC) CEO Drew LaBenne, and he said,

“In the near-prime space (borrowers with credit scores between 620 and 659) we’ve done some pretty extensive tightening. That’s where we and everyone in the industry are seeing the most stress on consumers. We’ve tightened (those) originations about 50%.”

What LaBenne means is that most of the stress is in the near-prime space which is where LendingClub’s digital banking model has prepared for the recession.

However, most economists believe that we’re entering what I refer to as a “garden style” recession in which of Citi Global Wealth Investments explains,

“We expect for next year, employment will fall by 2 million people. That’s how we define our recession. We think there will be one, and it will be defined by that loss of jobs.”

To put that into perspective, the job loss prediction is about one quarter of the number of people unemployed in 2009. Banks are likely to tighten credit further and households are bound to cut back spending and increase savings.

I recently contacted my local credit union where I financed my fleet of family vehicles. I purchased my wife’s car a year ago (and refinanced my second car) at an interest rate of 2.5% (five-year term) and the loan officer quoted me a rate today of over 5%.

Ouch!

So, with rates soaring and the potential for a recession, why am I recommending (and buying) shares in a brick-and-mortar consumer finance company?

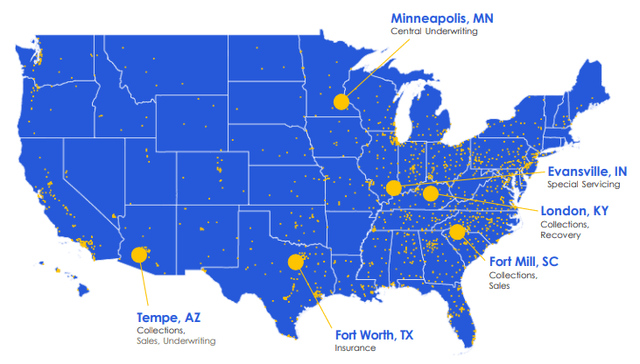

Well, first off, unlike LendingClub’s digital model, OneMain Holdings (NYSE:OMF) offers an omnichannel hybrid operating model that consists of ~1,400 branches and six central operations centers across the U.S with a deep branch network supported by digital capabilities.

OneMain Investor Presentation

OMF’s CEO, Douglas Shulman, made it clear on the latest earnings call,

“We continue to invest in customer experience, technology and data analytics. I’ve spoken at length in the past about how our digital investments have helped us maintain our competitive position in loan originations.”

Shulman’s describes his company’s competitive advantage as follows,

“We risk score our entire portfolio on a monthly basis. The scores are generated using machine learning models that leverage internal and external credit payment and behavioral data.

We then optimize who we reach out to, when to reach out and how to reach out. Based on payment patterns, responsiveness and demonstrated changes in circumstances, we will dynamically evolve our interactions with customers, whether it be through phone calls, text or e-mails.”

Call me old school, but that sounds like OMF is much more than a local finance company owned by the local Boss Hog (using the Dukes of Hazzard analogy). Shulman continues,

“Said another way, our digital tools and advanced analytics, combined with our locally-based team members, are resulting in fewer customers moving to charge-off even if they fall behind on a payment at some point in time.”

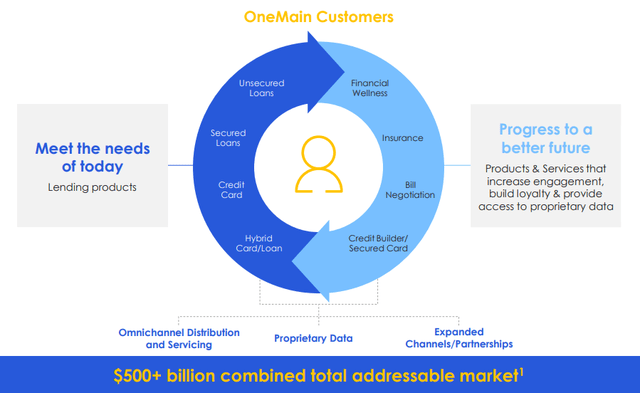

Another differentiator for the company is its Brightway credit card that rolled out this year. There are more than 100,000 cards issued that generate $79 million in receivables. The company reports that digital engagement remains strong: ~90% of payments made in app, >80% of customers enrolled in e-statements.

OMF anticipates a targeted and disciplined Brightway expansion in 2H22 as cards are expected to drive $100 – $150 million of annual capital generation by 2025, with attractive growth beyond. Shulman explains,

“We’ve taken a conservative credit card underwriting posture, similar to the very tight credit box we have in our personal loans, which gives us plenty of cushion and a high level of confidence that the cards we are booking today will be profitable regardless of the economic picture.”

OneMain Investor Presentation

A Focus on Quality

Much like LendingClub, OMF is also preparing for the recession, as Shulman explains,

“Regarding the nonprime consumer overall, while unemployment rates remain at historically low levels, it is clear that inflation has presented challenges to some consumers, especially those at the lower end of the credit spectrum. We’ve reflected this in our tighter underwriting.

We started to see inflation become a challenge for consumers across the entire industry in the second quarter. However, from the data we see, our book is performing quite well in comparison to other nonprime lenders. This is due to the competitive advantages we have developed in our business model. These include our branch-based network, which enables us to work closely with our customers.

We also have a long history of serving the nonprime consumer, during which we have developed a suite of tools and techniques to help customers stay on track. We tailor collections and assistance treatments based on sophisticated analytics. This increases the likelihood that we will be repaid even when a customer hits a rough patch. This is a result that is both good for our customers and good for our business.

And we stayed very disciplined in our underwriting and have been tightening our credit box for almost a year now. We were early to selectively cut our credit box in late 2021 and early 2022 and have followed on with very meaningful tightening this summer. Our current credit posture is conservative given the uncertainty associated with the persistent elevated inflation and the weakened macroeconomic outlook.”

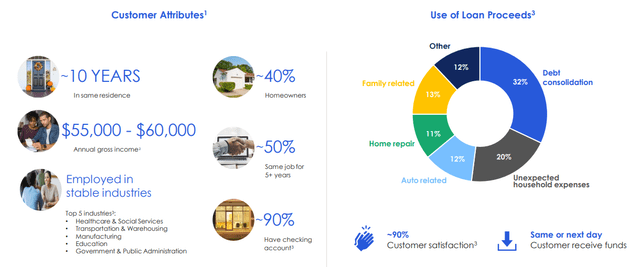

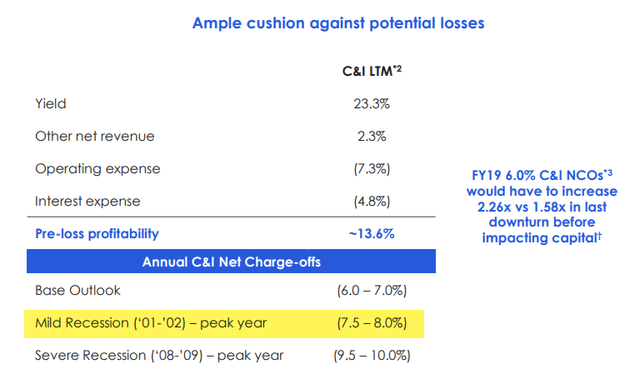

OneMain Investor Presentation

The Balance Sheet

In late August OMF initiated a $500 million ABS transaction that was received with strong demand and was upsized to $1 billion and tightened to an average coupon of 5.17%. The company saw strong support from returning investors and decided to add some new investors to the program. The CEO explained,

“I’m also really pleased that we continue to demonstrate one of our core strengths, our balance sheet and funding capabilities by raising $1 billion in a difficult funding market.”

In 2022 (in one of the most difficult funding environments) OMF issued $2.2 billion in the ABS market at an average rate of about 4.8% and an average life of just over three years (the portfolio rate is ~5%).

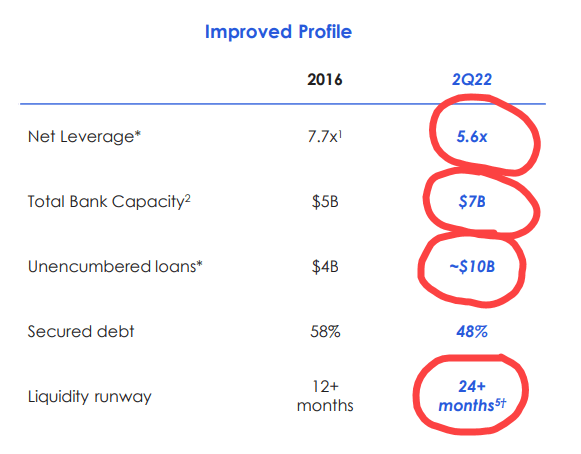

OMF’s liquidity runway (the length of time it can operate under stressed macroeconomic conditions with no access to capital markets) is more than 24 months. The currently “runway” is $7.4 billion (committed bank capacity) and net leverage at the end of the quarter was 5.6x.

OneMain Investor Presentation

Managing Risk: What Separates the Best from the Rest

OMF has an impressive 100-plus year operating history and over the decades the company has been successful at adapting to an ever-changing marketplace.

In Q3-22 the company generated $188 million on a GAAP basis or $1.52 per diluted share. Capital generation was $283 million, down $77 million from Q3-21, reflecting a $128 million increase in net charge-offs from the historic lows a year ago.

On an adjusted C&I basis OMF earned $187 million or $1.51 per diluted share, down from $2.37 per diluted share in Q3-21. Again, this difference was driven by the normalization of charge-offs as well as increases to loan loss reserves.

Managed receivables reached $20.5 billion in Q3-22, up $1.3 billion or 7% from a year ago. Net interest income was $895 million, up 2% compared to the prior year quarter, driven by higher average receivables.

Net interest margin remained strong at 18.1% in the quarter and the overall portfolio yield was 22.6%, down 55 basis points sequentially. Net charge-offs in the quarter were 5.9%.

To prepare for the recession OMF has significantly decreased unsecured loans to new customers and its top risk rates (those with the best credit quality and lowest risk customers) make up 60% of new originations today versus 37% a year ago.

Relative to 2008, OMF’s portfolio is better positioned today given its higher secured mix, central servicing capability and pro-active credit tightening capabilities.

OneMain Investor Presentation

As seen above, even in a severe recession, OMF expects to remain profitable!

Shulman adds,

“We’re seeing a lot of opportunity to write profitable new business even with our more conservative credit box. And while we are beginning to see the benefits of our tighter underwriting in recent vintages, these changes will take some time to fully materialize in our $20 billion portfolio. We expect to maintain a conservative underwriting posture until we have more clarity about how the environment will evolve.”

Decisions, Decisions…

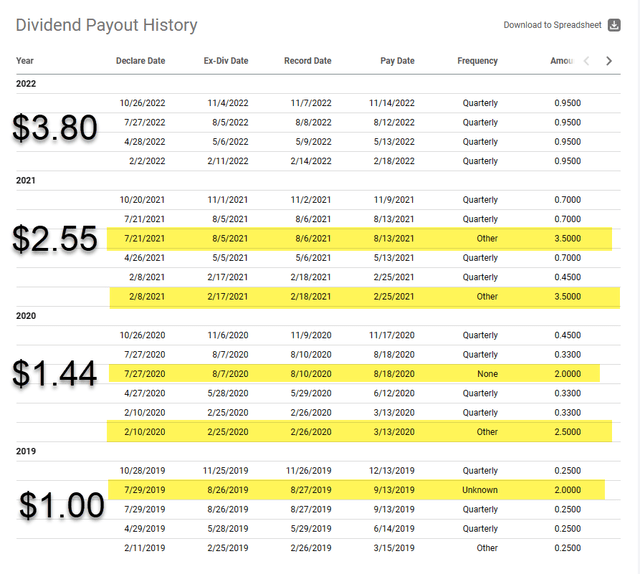

OMF’s current $3.80 annual dividend provides a very healthy yield of approximately 11.4%.

The company repurchased 1.2 million shares in Q3-22 and has repurchased approximately 5.6 million shares (or about 4.5% of shares outstanding) at the beginning of the year.

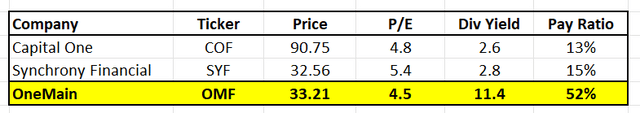

In terms of peers, I used these two:

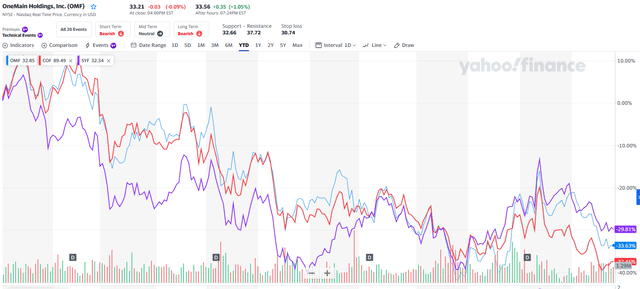

Yahoo Finance (OMF in blue, COF in red, SYF in purple)

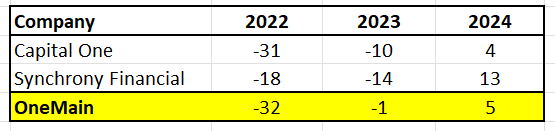

All are down roughly 30%…

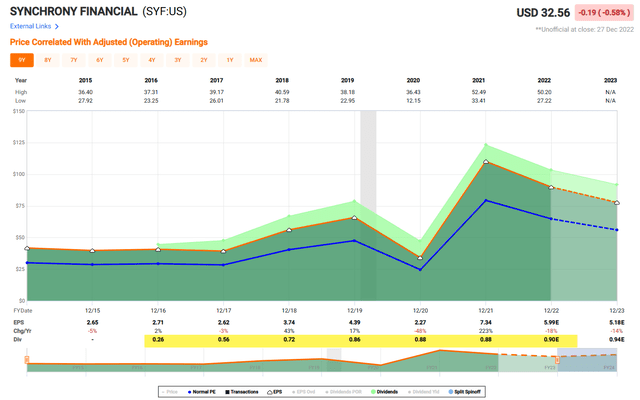

In terms of dividend performance, SYF gets the nod for never cutting the dividend (as seen below):

FAST Graphs

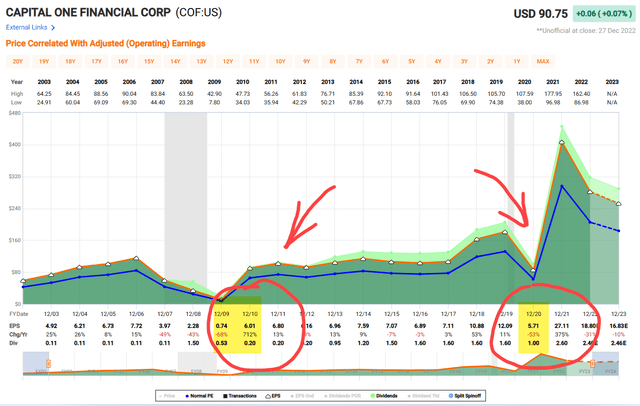

COF cut the dividend in the Great Recession and also during COVID-19:

FAST Graphs

OMF started paying dividends in 2019 and has done a good job of rewarding shareholders:

Seeking Alpha

In terms of valuation, you can see that all three finance lenders trade in the 4.5x to 5.5x and OMF is the cheapest, trading at 4.5x. Also, OMF distributes more dividends which of course makes this the most tempting pick of the three:

iREIT on Alpha

As seen below, OMF has the best analyst scorecard in terms of forecasted EPS growth:

iREIT on Alpha

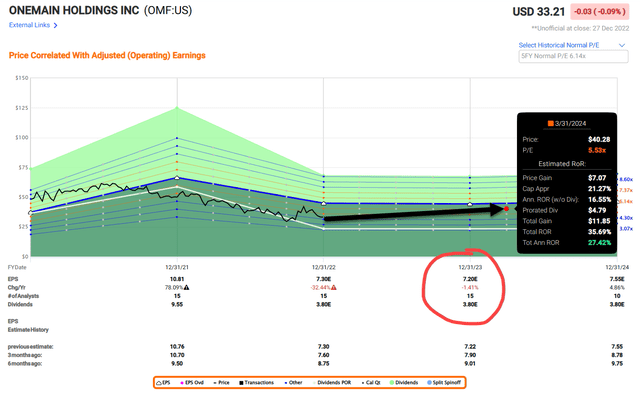

As shown below, the analyst forecast includes 15 firms, so the estimates are diverse and provide a better overall snapshot for sentiment.

While I consider most any stock that yields north of 10% a likely “sucker yield” I’m gonna be a “sucker” here and pick up a few shares.

I think OMF’s management team has prepared for the overall worst outcome (worse recession) and if my assumptions are correct (mild recession) I believe OMF could hit $40.00 by Q1-24.

FAST Graphs

That outcome puts OMF in the Strong Buy category.

Now keep in mind, you can always become a landlord and collect rent checks like I did… and of course, the rent checks are much more predictable.

Alternatively, I believe the fear is overblown and I’m planting a few seeds before this “garden style” recession begins to unfold. Hopefully I’m right, because I certainly don’t need any suckers sprouting in my income portfolio.

Happy Holidays!

Be the first to comment