gesrey

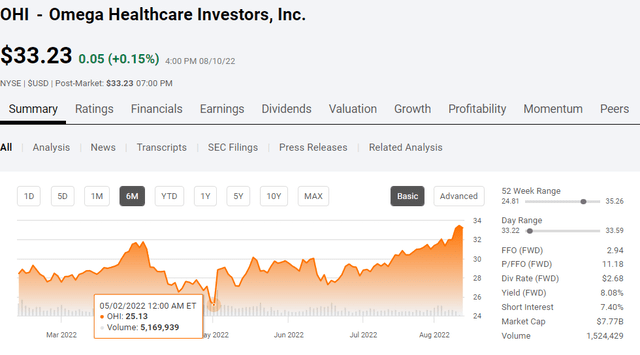

Omega Healthcare Investors (NYSE:OHI) experienced elevated levels of difficulty through the height of the pandemic, and more than 2-years later, there are still lingering effects. Some had written OHI off as select operators were unable to meet their contractual obligations, and the level of adversity seemed overwhelming. I have stayed bullish on OHI because I believe in the big picture, and a reduction to the dividend never occurred. OHI’s portfolio consists of Skilled Nursing Facilities (SNFs) and Senior Housing Facilities (SHFs), which is an area I want to be invested in due to an aging population. Shares of OHI immediately declined after the Q1 release to $25.13, then rebounded after the market realized it wasn’t a doom and gloom situation. Since the Q1 drop on 5/2/22, OHI has rebounded 32.23%, and over the past month, shares have appreciated by 12.61%. I have indicated that OHI was trading at depressed levels due to their peers, and after their Q2 release, I still feel shares are undervalued. The fears of a dividend cut should be well in the past as OHI is set to pay its next $0.67 quarterly dividend per share on 8/15/22. I think OHI will continue to rally into 2023, and maybe at some point, OHI will make another run on the $40 mark. Regardless of what occurs, I will continue collecting and reinvesting this high-yielding dividend and increasing the income that my investment in OHI generates.

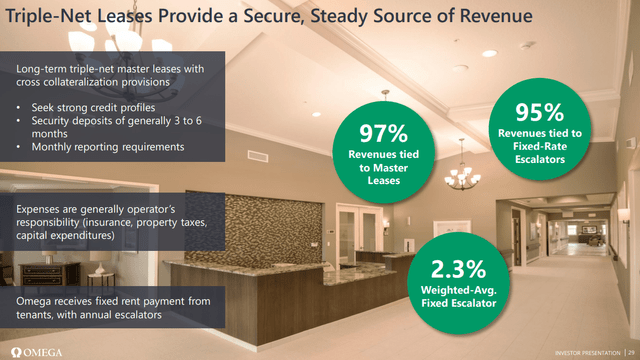

OHI is my favorite type of equity REIT as it specializes in triple net leases

I have a love-hate relationship with real estate. I am not interested in rental properties, but I am thrilled to invest in well-run REITs. I don’t have the time or the temperament to deal with tenants or the responsibilities that come with being a landlord. Real estate has always been looked at as a good investment, and I agree, it is, but physical real estate outside of my home just isn’t for me. I would rather invest in a basket of REITs and collect large dividends without having the responsibility of managing rental properties. My favorite REITs are ones that specialize in triple net leases.

OHI is a triple-net lease equity REIT (Real Estate Investment Trust) that supports Skilled Nursing Facilities and Assisted Living Facility operators with financing and capital. OHI has a portfolio of long-term healthcare facilities and mortgages on healthcare facilities throughout the U.S. and the U.K. Triple Net Leases, otherwise known as NNNs are a lease agreement on a property where the tenant or lessee assumes the responsibility of paying all the expenses for the property. Unlike paying rent under the parameters of an NNN, the tenant agrees to pay all the expenses for the leased space, which includes real estate taxes, insurance, and maintenance on top of the regular payments such as rent, utilities, and all other payments that are usually the responsibility of the landlord. On the landlord side, NNNs can become a reliable source of income with minimal overhead costs as most of them are passed on to the tenant.

How great does that sound? An entity leases space from a REIT and is responsible for basically everything pertaining to the property. When I think about a match made in heaven this is very close. NNNs are favorable to the landlord and I am able to invest in them without expending an ounce of energy. In addition to the Targets (TGT), Home Depots (HD), and Walmarts (WMT) of the world, SNFs, and SHFs play a critical role in society and I don’t see them going away. 87% of OHI’s revenue is tied to NNN master leases, with 95% of its revenue tied to fixed-rate escalators. OHI has a 2.3% weighted average fixed escalator built into their leases. 98% of their portfolio leases expire after 2024, with an average lease term of 9.4 years. 14.3% of OHI’s leases expire in 2027, 15.8% in 2031, and 36.5% in 2032 and beyond. From an operational standpoint, this is favorable to additional revenue generation out of OHI’s existing portfolio.

OHI’s management provided us with additional updates throughout their portfolio and continues to keep the ship above water.

Operationally, OHI delivered in Q2 beating on both the top and bottom line. OHI generated $244.65 million of revenue in Q2, which was a $24.59 million beat, while producing $0.76 of funds from operations (FFO), a $0.02 beat compared to the consensus. From the $0.76 of FFO, $0.71 per share were funds available for distribution (FAD), allowing OHI to generate a nice coverage ratio from its $0.67 quarterly dividend. OHI’s dividend payout ratio is currently 88% of their adjusted FFO and 94% of their FAD. OHI reiterated that, as they discussed last quarter, their ability to put restructuring portfolios back to work improved the FAD payout ratio by 7%, and as they continue this process, management sees their FAD ratio and liquidity continuing to improve. Occupancy in the SNFs has trended upward, and staffing availability has slightly improved. OHI believes there is a permanent shift in wage increases for full-time staff, which has been met with significant increases in Medicaid rates from a number of states. The strength of OHI’s assets base has allowed them to work through restructuring with struggling operators causing limited impacts on their long-term cash flow.

Agemo and Guardian were the two struggling providers that seemed to catch the market’s eye. Agemo hasn’t resumed its contractual agreement for rent or interest payments. No payments were made in July, and the $16 million of rent and interest will only be recognized if Agemo is able to fulfill its obligations. OHI is in talks with Agemo on a restructuring agreement where a sale of a significant portion of Agemo’s existing portfolio within OHI’s portfolio could be likely.

OHI had placed Guardian on a cash basis and didn’t receive payments in Q1. In Q2 Guardian resumed its contractual rent and interest payments which were a reflection of the new terms with OHI. In Q2 OHI recorded $5.2 million in income related to Guardian, consisting of $3.8 million of contractual rent payments received and $1.4 million in interest payments received. At the start of Q3 Guardian’s rent and interest were reset to an aggregate of $24 million per year. As part of Guardian’s agreement with OHI, OHI sold 12 facilities and released 8 facilities.

There were 2 operators that OHI didn’t mention by name, so I will call them operators 1 and 2. Operator 1, which is the equivalent of 3.4% of OHI’s annualized contractual rent and mortgage interest revenue, did not make its payments in Q1. During Q2, this operator paid its full Q2 rent and interest obligations of $8.8 million and borrowed the remaining $4 million on its $20 million credit facility with OHI. July’s rent and interest of $2.9 million have been paid in full. Operator 2, which represents 2.4% of OHI’s rent and mortgage interest, wasn’t able to pay its March obligations to OHI. In April, the lease with operator 2 was amended and allowed the $2 million security deposit to be applied to its March rent payment. Operator 2 was granted a deferral for April, regular payments were required to resume in May, and OHI did not indicate that Operator 2 defaulted on this obligation.

Many investors have been worried about OHI’s ability to maintain its financial obligations due to the hardships that its operators faced. Due to management expertise and the strength of OHI’s balance sheet, OHI has continuously met all of its obligations. Throughout all of the adversity, OHI has continued to make new investments to strengthen its future, and 2 investments were announced on the Q2 call. OHI completed a $20 million preferred equity investment in a joint venture which acquired an acute care hospital located in New York City. This will generate a cash yield of 12% and is structured to be redeemed within a 5-year term. OHI is also closing on a $36 million mezz loan investment and a $90 million working capital loan commitment, both to an existing operator. The mezz loan bears a cash yield of 12% and has a 3-year term, and the working capital loan bears a blended cash yield of 11% and has a 1-year term. In Q2 OHI’s investments totaled $73 million, and as of 6/30/22, OHI has made $214 million worth of new investments and capital expenditures.

OHI still looks attractive compared to its peers, even after its recent rally

Even though OHI has rallied significantly off its May lows, and over the past month, it still looks attractive compared to its peers. Based on the three metrics I utilized to compare REITs within the same sector, OHI has the largest dividend yield, trades at a lower than average price to FFO, and has a low EBITDA to total debt ratio.

I will be using the following companies to compare OHI against:

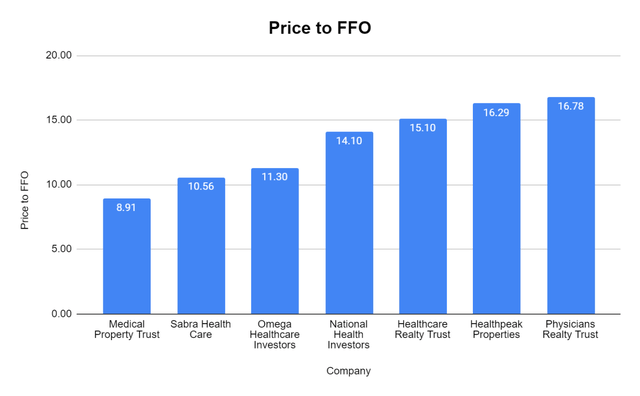

The peer group has a price to FFO range of 8.52 to 16.03. OHI currently sits at the lower end of the range with a 11.3x price to FFO. The average price to FFO of the group is 13.29x. Even though OHI’s price to FFO has increased from 10.99x to 11.3x since the last time I looked at this metric, it still seems to be a good buy at its current level.

Steven Fiorillo, Seeking Alpha

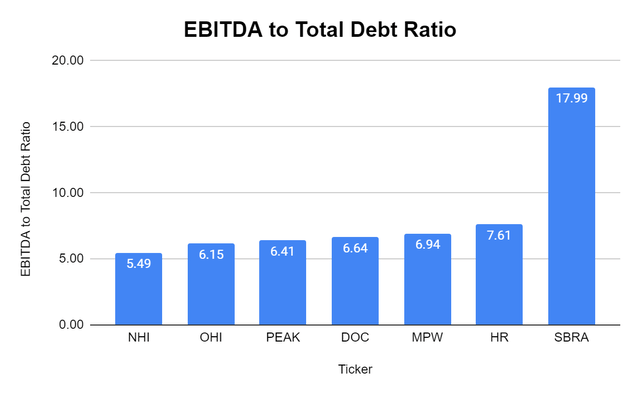

OHI is trading at a 6.15x EBITDA to total debt ratio, which indicates that OHI could eliminate its total debt over 6.15 years based on how much EBITDA they generate. This is often a metric that is utilized to assess a REIT’s debt load. The peer group has an average EBITDA to total debt at 8.18x, with SBRA having a 17.99x level. OHI seems to be positioned well as its EBITDA to total debt level falls on the lower end of the spectrum.

Steven Fiorillo, Seeking Alpha

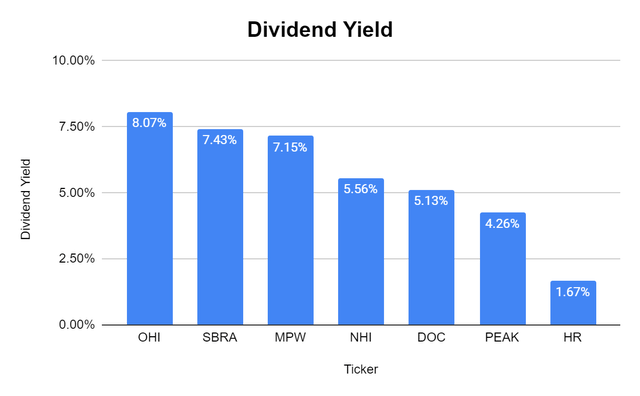

When it comes to the dividend, OHI is still the largest yield at 8.07%. The group’s average is 5.61%, and OHI continues to pay its large dividend. Every quarter that passes with the dividend intact is another quarter that instills further confidence in OHI’s ability to pay its dividend.

Steven Fiorillo, Seeking Alpha

Conclusion

Could things be better, sure, but I am very happy with my investment in OHI. I have been an investor since the end of 2017 and reinvested every dividend along the way. Prior to next week’s dividend, the 19 dividends that have been collected have generated 49.73% of my initial investment through dividend income, and my share count has increased by 45.78%. I believe that management has proven they can navigate the current situation without reducing the dividend and ultimately get OHI back to a position where the dividend can grow. I did sell covered calls at a $37 strike price on the Jan 20th, 2023, chain on some of my shares to generate additional income. The only way I plan on reducing my position is if the shares tied to the covered calls get called away. I believe that shares of OHI can continue to appreciate, especially if management releases positive news about its operators that are still having trouble.

Be the first to comment