MoMo Productions/DigitalVision via Getty Images

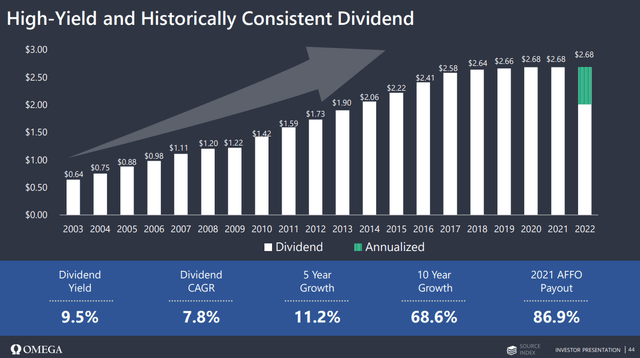

Unlike the major indices, Omega Healthcare Investors (NYSE:NYSE:OHI) is positive in 2022, up 8.64%, but it’s still down -2.74% over the past year and well off its 2020 highs. Pre-pandemic, OHI spent a considerable amount of time trading over $40 per share as it breached the $40 level in August of 2019 and didn’t fall back into the $30s until the pandemic crash in March of 2020. OHI has had its share of hardships throughout the pandemic, but its management team persevered and dealt with every challenge, from operators not being able to make rent, and staff shortages. Today, shares of OHI are below the levels they originally rebounded to in 2021, and I believe it’s one of the most attractive REITs today. I have been invested in OHI for almost 5 years now, and while the share price isn’t that much higher than my average price per share, it’s been a great dividend investment. I am going to outline why this has been one of my favorite dividend investments and why I believe OHI is still a great buy today.

The power of compounding has made Omega Healthcare Investors a great dividend investment for me

The statistics I am about to share are a great example of why I always say I am perfectly fine with high-dividend stocks trading sideways or within a range. I purchased my first block of OHI shares in late 2017 at an average price of $31.57, and dollar cost averaged in early 2018 buying additional shares at $27.38. My cost per share on OHI from the initial investments is $29.95 per share. Since then, I have collected 20 dividends which have all been reinvested. OHI has been up and down since the end of 2017, and my shares have appreciated by 9.1% based on my average cost of $29.95. Through reinvesting the dividends and compounding interest, my invested capital has grown by 62.26%, which is an additional 53.16% compared to if I had taken the dividends as cash. Not only has my original investment grown significantly, but my quarterly cash flow has also grown at an average rate of 2.12% over the last 18 dividends since my 2nd dividend was paid.

I am going to dive into the numbers to illustrate how powerful dividend investing can be. For these purposes, when I say invested capital, I am referencing my two investments into OHI, my initial investment, and when I dollar cost averaged into OHI in the beginning of 2018.

Through the 20 dividends I have collected, OHI has generated 52.99% of my invested capital which I have reinvested into OHI. In just shy of 5 years, OHI has paid me 52.99% of my invested capital, and shares are 9.1% higher than my average price per share. If this isn’t a good investment, I am not sure what is. The reinvested dividends have increased my share count by 48.72%. The first dividend I collected was only from my original block of shares, and my 2nd collected dividend reflected all my purchased shares. Since my 2nd dividend was paid, my quarterly dividend has grown by 45.83%, at an average rate of 2.12% per quarter. If my quarterly dividend continues to grow at an average rate of 2.12%, then over the next year, my quarterly dividend should grow by an additional 8.75% based on today’s share price.

Investing is a marathon, not a sprint. Volatility, bear markets, and bull markets are all part of being an investor. There were periods when the headlines were negative, and being an investor in OHI wasn’t popular, but I believed in the research I had conducted. OHI has not given me a reason to reconsider my investment. If you read the quarterly conference call transcripts, management has been transparent about OHI’s challenges, including payments from several operators. Looking at how many shares I have been able to acquire during bearish cycles in OHI, there were some quarters where I was able to add 50-100% more shares than in prior quarters. Overall, OHI has been a great investment, and the cash flow it generates continues to increase each quarter. Regardless if OHI starts to grow its dividend again in the future, I am growing my quarterly cash flow by reinvesting each and every dividend.

OHI is outperforming the major indices and VNQ 2022, while outperforming VNQ over the past 5 years

I recently wrote an article about the Vanguard Real Estate ETF (VNQ), and my premise was that I could recreate a larger yielding mini-ETF from its positions that met my criteria. When I am investing in REITs, I generally look for yields of at least 5-6%, as I am not looking at these investments from a capital appreciation standpoint. OHI was one of VNQ’s holdings that I recreated a mini-ETF with. OHI VNQ’s 48th largest position of 168 investments, as it owns 10.97 million shares.

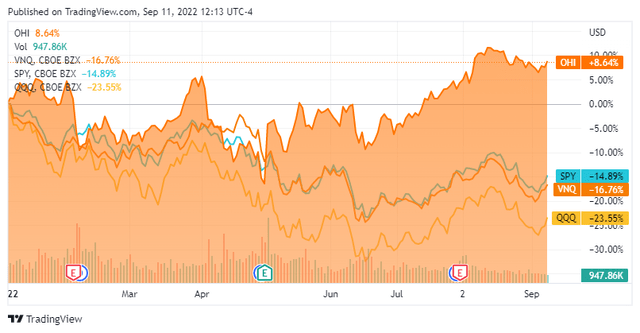

OHI has outperformed VNQ, the SPDR S&P 500 Trust (SPY), and the Invesco QQQ ETF (QQQ) YTD. QQQ is still in a bear market, while SPY and VNQ have still declined by double-digits. Looking at a YTD chart of these investments, OHI has been a better position, especially since this is not a total return chart, simply a capital appreciation chart.

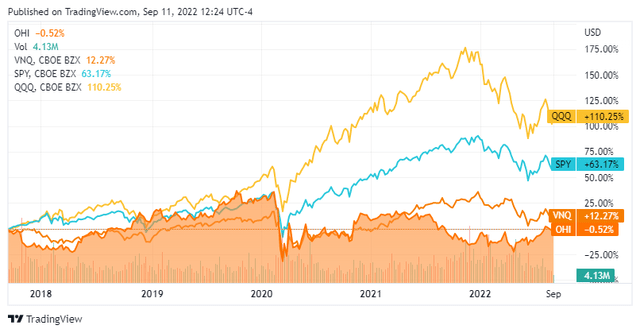

It wouldn’t be fair for me to look at just 2022, as OHI has traded sideways over the past 5 years. QQQ has appreciated by 110.25%, while the SPY appreciated by 63.17%. OHI is down -0.52%, while VNQ is up 12.27% over a 5-year period. Some would argue that OHI has not been a great investment looking at this chart, and if you disregard dividends, you would be correct. Dividends should be factored in as they are part of the investment.

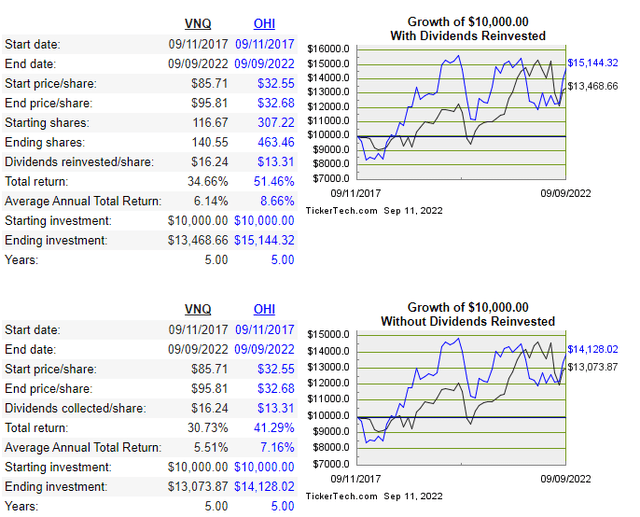

The power of reinvesting the dividends are incredible, but even without reinvesting dividends, OHI has been a better investment than VNQ over the past 5 years. Utilizing a DRIP return calculator, you can compare VNQ to OHI. From 9/11/17 to 9/9/22, the total return of OHI would have been 41.29% if you had taken the cash instead of reinvesting the dividends, compared to 30.73% for VNQ. By reinvesting the dividends, OHI’s total return increased to 51.46% compared to 34.66% for VNQ. While over a 5-year period, VNQ’s appreciation is almost 13% greater, the low dividend yield has not made it a better investment than OHI.

This is why I look at the bigger picture and consider how reinvesting the dividends will impact my investment. Since I am looking at a long-term horizon, the dividend yield absolutely matters, as the total return over the past 5 years indicates.

Omega Healthcare still looks inexpensive compared to its peer group

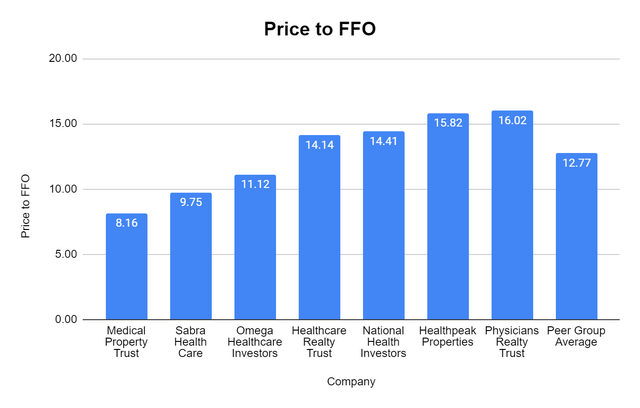

I have been tracking OHI against its peer group in its price to Funds From Operations (FFO), EBITDA to Total Debt, and Dividend Yield for some time. OHI still looks attractive to me from these metrics. I will be using the following companies to compare OHI against:

OHI’s peer group trades at an average price to FFO of 12.77x. OHI trades at 11.12x its FFO, which is well under the peer group average. This indicates that your buying shares today at a better FFO valuation than several of its peers. This is one of the valuation metrics I put a lot of emphasis on as it’s the equivalent of looking at a price to FCF valuation for traditional equities.

Steven Fiorillo, Seeking Alpha

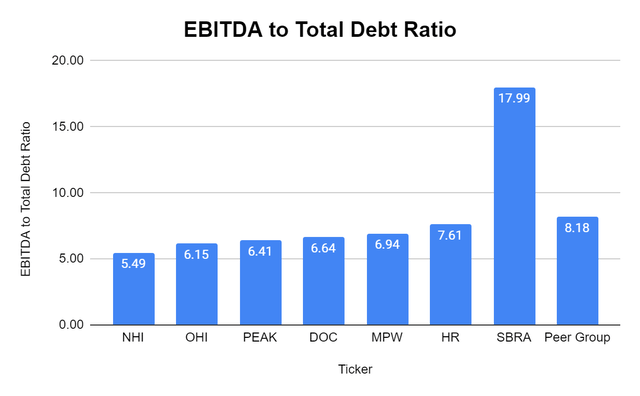

Looking at the EBITDA to Total Debt ratio, OHI looks to be in excellent condition. OHI trades at a 6.16x multiple of EBITDA to total debt which indicates that OHI can eliminate all its debt with 6.16 years of its EBITDA. The peer group average is 8.18 years, and OHI has the 2nd lowest multiple.

Steven Fiorillo, Seeking Alpha

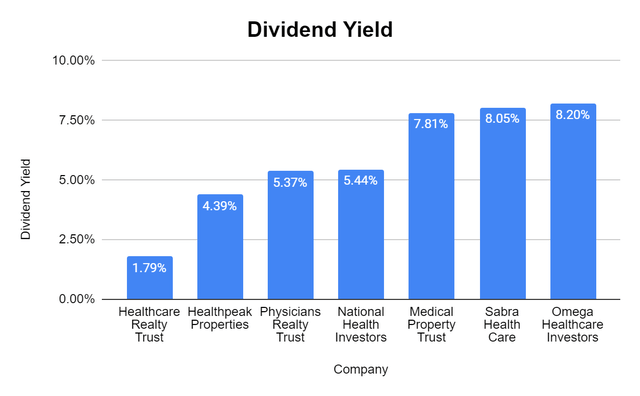

When it comes to REIT investments, I want to get at least a 5-6% dividend yield out of them. OHI is yielding 8.2%, which is the largest dividend yield from its peer group. OHI’s consistently large dividend yield has allowed me to generate a large total return over the years, as OHI’s share appreciation has been less than 10% since my original purchase.

Steven Fiorillo, Seeking Alpha

Conclusion

OHI has been volatile over the years, but it remains one of my favorite REITs. The noise has finally died down about OHI having to reduce its dividend as OHI continually beats the FFO estimates, and the situation with its operators improves. I think there is still an opportunity sub $33 for both capital appreciation and large amounts of dividend income. I have a long-term time horizon on this investment and plan on reinvesting my shares for decades to come. My price target for OHI is $37.54 as this puts OHI at a 12.77 price to FFO ratio, which is the equivalent of the current peer group average. I think management will continue to deliver improving operational news on the upcoming conference call, and shares could rally back toward $40 going into 2023.

Be the first to comment