LeviaZ/iStock via Getty Images

Investment Thesis

We initiated Olaplex (NASDAQ:OLPX) coverage in mid-October, on the eve of the infamous guidance correction and dramatic drop in stocks. This was an example of bad timing, the stock lost about half of its market value three days after.

The company’s updated guidance was like a bolt from the blue not only for analysts but also for Olaplex’s management, which previously set a goal of maintaining ~18% revenue growth in the long term.

Management believes that the sharp slowdown in growth is due to macroeconomic turbulence. However, there is a possibility that Olaplex has run into fundamental problems. Arguments in favor of both positions are presented in the research.

While investors should avoid this kind of dichotomy, we remain cautiously bullish because:

- Olaplex can afford to significantly increase its marketing costs because the company has abnormally high margins. A doubling of marketing spend would reduce net margin by about one percentage point. One percentage point is a reasonable price to pay if Olaplex returns to its growth trajectory.

- Today, the company’s portfolio includes only 14 products, and management plans to release several new products annually, as well as plans to expand into related markets. In terms of sales channels, there is also room for growth.

- It seems that the market has already reflected all the worst in the stock price. Olaplex trades at a significant discount to its peers, although the company has a higher growth rate and higher margins even after adjusting expectations.

Macro Headwinds Or Fundamental Problems?

In mid-October, Olaplex management updated its full-year forecast for revenue, adjusted EBITDA and net income. The updated data assumed a significant decrease in indicators, relative to the previous guidance:

- Net sales: $704M-$711M vs. $796-$826M previously (+17.6%-18.8% year-over-year);

- Adjusted EBITDA: $425-$431M vs. $504-$526M (+4.0%-5.4% year-over-year);

- Adjusted net income: $303-$307M vs. $363M-$379M (+9.9%-11.4% year-over-year).

It seems that the updated forecast was a bolt from the blue not only for investors and analysts of the Street but also for the company’s management – this is evidenced by the size of the adjustment and its urgency (less than a month before the release of quarterly results).

It is worth noting that the company exceeded adjusted quarterly expectations. However, the shares did not react – investors still had questions about the long-term potential of Olaplex.

Management believes that the sharp slowdown in growth is due to macroeconomic turbulence. High inflation, tighter monetary policy and contraction in consumer demand led to a decrease in demand for Olaplex products. Why this might be true:

- At the end of the last reporting period, EPS estimates decreased by 7% since July for S&P 500 companies. According to Bank of America, analysts cut forecasts in nine of the index’s 11 sectors. In other words, the difficult macroeconomic environment has indeed affected many companies, one of which could very well be Olaplex.

- Since the IPO, Olaplex has shown impressive revenue growth, keeping marketing spend in the low single-digit range. In 2021, for every dollar spent on sales and marketing, the company earned $112 in revenue vs. $99 in 2020. This shows that the company’s success is based on a quality product, not marketing hype.

- With extremely low marketing spend, Olaplex is one of the most mentioned brands on Instagram. After studying the reviews on the Internet, you can conclude that the company has its own audience. It is unlikely that consumer habits have changed so quickly.

Obviously, the macroeconomics argument has left many blank spots for analysts. Evercore’s Rob Ottenstein tried to attribute the slowdown to the July price increase, while Goldman’s Jason English suggested that the company’s past successes came from one-time buyers now moving on to another product. Indeed, there are several factors that demonstrate that Olaplex may have faced a bigger challenge:

- In the previous article, we talked about the sustainability of the beauty industry. We referred to specific studies, but this is understandable even on an intuitive level – people continue to use shampoo even in deep crises. Based on the results of the last quarter, we know that companies focused on the premium price segment proved to be more resistant to inflation. Therefore, prestige beauty must also be sustainable.

- The latest financial results of industry neighbors were successful and showed no signs of slowing down. Beauty’s (ELF) results exceeded all expectations (+33.2% in sales), and the company raised its full-year outlook. L’Oreal (OTCPK:LRLCY, OTCPK:LRLCF) reported strong growth of +20.5%, management stressed that beauty product demand remains robust. Coty (COTY), which has gone through a transformation not so long ago, also reported well.

- According to Q3 2022 results, Professional revenue decreased by 16% year-on-year. We have previously argued that high exposure to beauty professionals highlights the high quality of the product. The decrease in professional sales may indicate a deterioration in brand positioning and the fact that more competitive offers have appeared on the shelves of beauty salons. Recall that, according to the company, 61% of customers make product purchase decisions based on recommendations from a stylist.

The company has clearly encountered a headwind, but the nature of this headwind is not yet clear. Moreover, it seems that it is not clear even for the leadership of Olaplex. However, decisions have already been made to overcome them, which boils down to an increase in marketing costs. However, we do not yet know how suitable the drug will be. Slower growth coupled with shrinking margins could hold Olaplex’s share price higher.

Management’s Strategic Initiatives

As part of the latest conference call, management announced a number of strategic initiatives that the company can implement to return to a growth trajectory. First, as noted above, the growth of marketing spend. The financial strength of Olaplex lies in its margins. If a firm doubles its marketing spend, its net margin drops by only one percentage point. This is a strong argument to keep the bullish position.

To date, the Olaplex portfolio includes a total of 14 products. The company plans to launch two to three retail SKUs and one pro back bar treatment product annually. In addition, the company plans to enter adjacent markets that are not related to hair care.

In terms of sales channels, there is also room for growth. As the market leader in prestige beauty, Olaplex is only present in 15% of US salons in 2021 per client. In 2023, it is planned to concentrate on premium and prestigious salons. Olaplex holds 12% of Sephora’s shopping carts and only 5% of Ulta’s, which also provides additional room for growth.

OLPX Stock Valuation

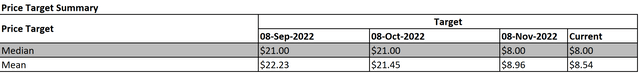

After a bad quarter, all analysts covering OLPX lowered their price targets. The minimum price target from investment banks set by Barclays is $5 per share (-12.4% downside potential). In turn, Raymond James estimates OLPX at $20 (251% upside potential). According to the Wall Street consensus, the company’s fair market value is $8.5, which implies 53.7% upside potential.

Olaplex trades at the industry average on EV/Sales multiple, but is heavily discounted on P/E, EV/EBITDA, P/Cash flow and P/E multiples, driven by the company’s high margins.

| Company | Ticker | EV/Sales | EV/EBITDA | P/Cash flow | P/E GAAP | FWD P/E |

| Olaplex | OLPX | 5.41x | 8.64x | 14.27x | 13.83x | 15.08x |

| Estee Lauder | EL | 5.29x | 22.88x | 34.72x | 39.95x | 46.28x |

| L’Oreal | OTCPK:LRLCY | 5.53x | 26.45x | 31.62x | 35.83x | 35.83x |

| e.l.f. Beauty | ELF | 6.42x | 43.02x | 46.11x | 85.13x | 76.28x |

| Coty | COTY | 2.17x | 13.10x | 11.10x | 84.85x | 41.12x |

Source: Seeking Alpha

Conclusion

Olaplex has faced a significant challenge, the nature of which remains unknown. Management believes that the reason for the slowdown lies in the difficult macroeconomic environment. However, there is a possibility that Olaplex may have run into more fundamental problems. While investors should avoid this kind of dichotomy, we remain cautiously bullish. It seems that the current value of the shares more than includes all the risks. Olaplex trades at a discount to peers, although the company significantly outperforms its industry neighbors in terms of growth and margins. In addition, the company retains a number of growth drivers, which will be driven by management’s strategic initiatives.

Be the first to comment