NanoStockk

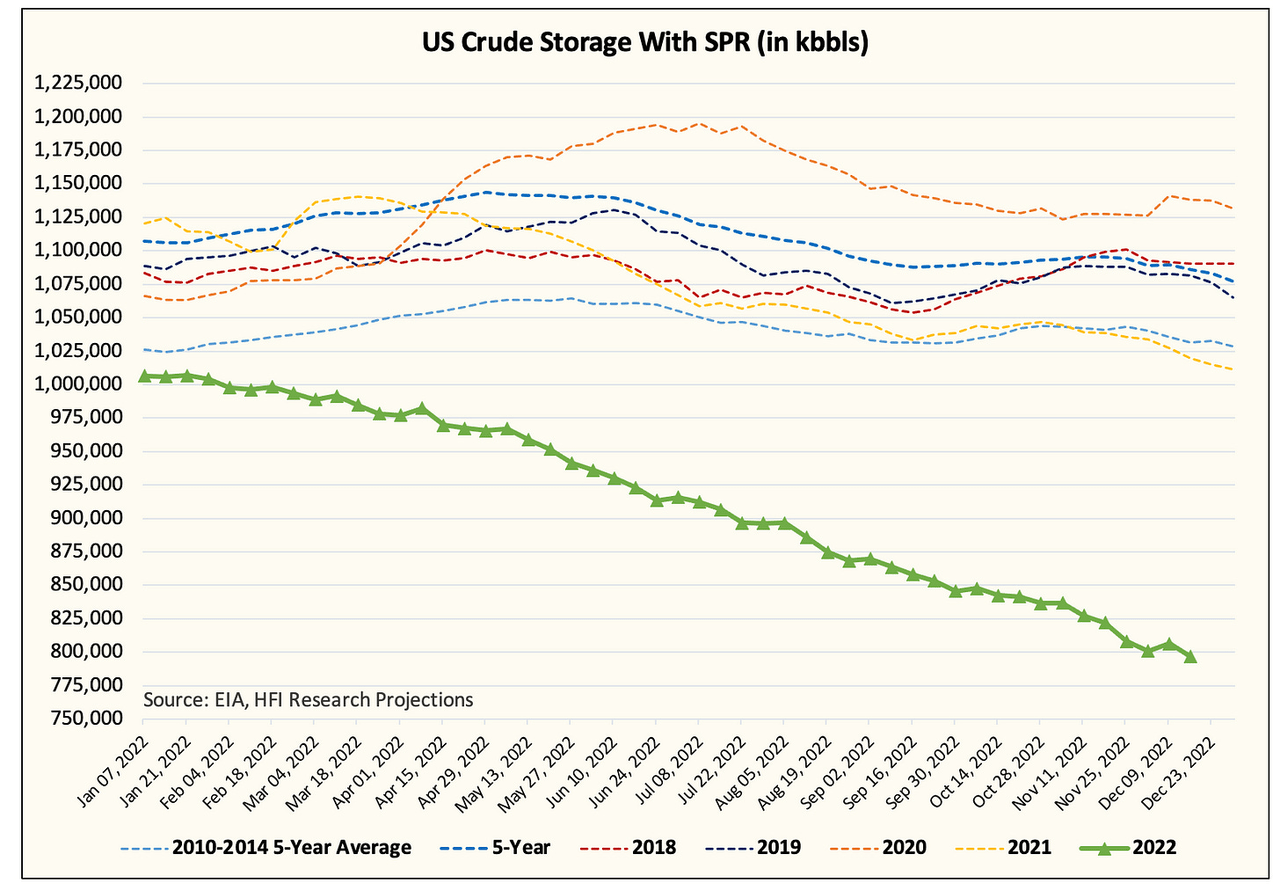

EIA reported a “bearish” report today. But we suspect traders can easily see through this data. In our weekly U.S. crude storage outlook report, we notified subscribers that this week’s crude figure will be heavily impacted by a material drop in U.S. crude exports. This figure is expected to reverse next week, which would push U.S. crude storage lower once again.

Our preliminary estimate indicates that U.S. crude with SPR should fall below ~800 million bbls in next week’s report.

EIA, HFIR

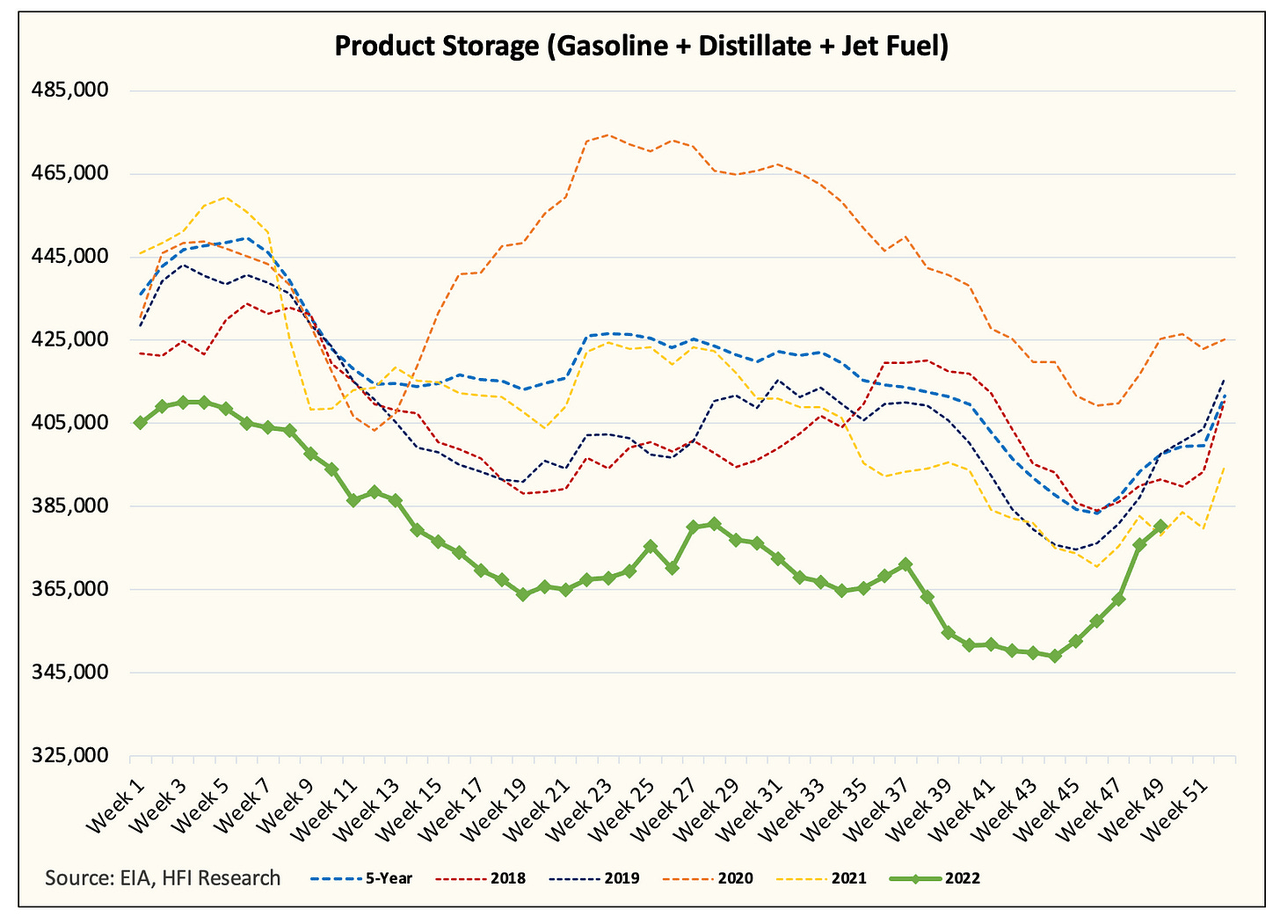

As for product storage, we seasonally build into year-end because of tax purposes. While the pace of build has accelerated, total product storage is still tight in relation to historical averages.

EIA, HFIR

In essence, we think the market is overlooking this one-time bearish report. With U.S. crude exports expected to remain elevated into year-end, readers should expect crude storage to keep drawing, while product storage should continue to build.

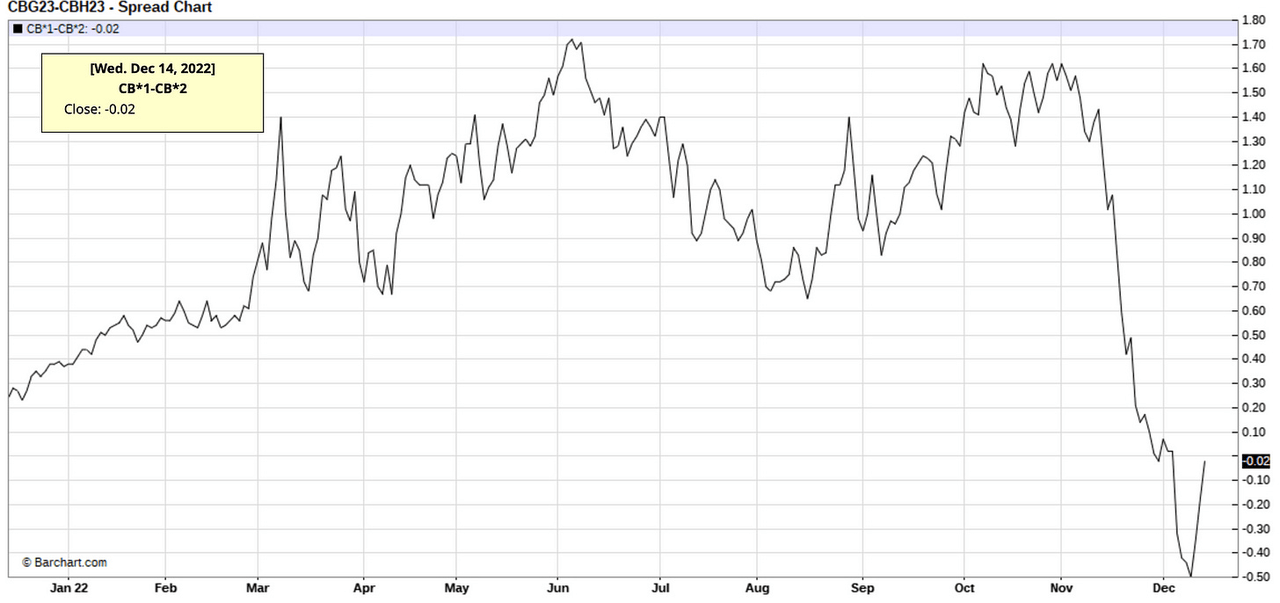

More importantly for the oil market is the return of China to the physical oil market scene. Looking at the Brent time spreads, we are starting to see the contango disappear.

Barchart.com

And as Oil Bandit reported on Twitter, Unipec has just picked up 5 VLCCs. China’s reopening has far more importance to the balance of the oil market than any other variable. The reopening also comes at a time when Russian crude exports are finally starting to fall.

As we detailed in our two reports this week on how the oil speculators are screwing the pooch, we think the timing of everything is just too perfect.

What’s next?

The oil market will need to see continued demand from China and the current decline in Russian crude exports materializing. If so, backwardation should return, which should signal to the market that Q1 balances aren’t as bad as we had previously expected. We will also need to see crack spreads improve going forward, which would signal that end-user demand is doing fine.

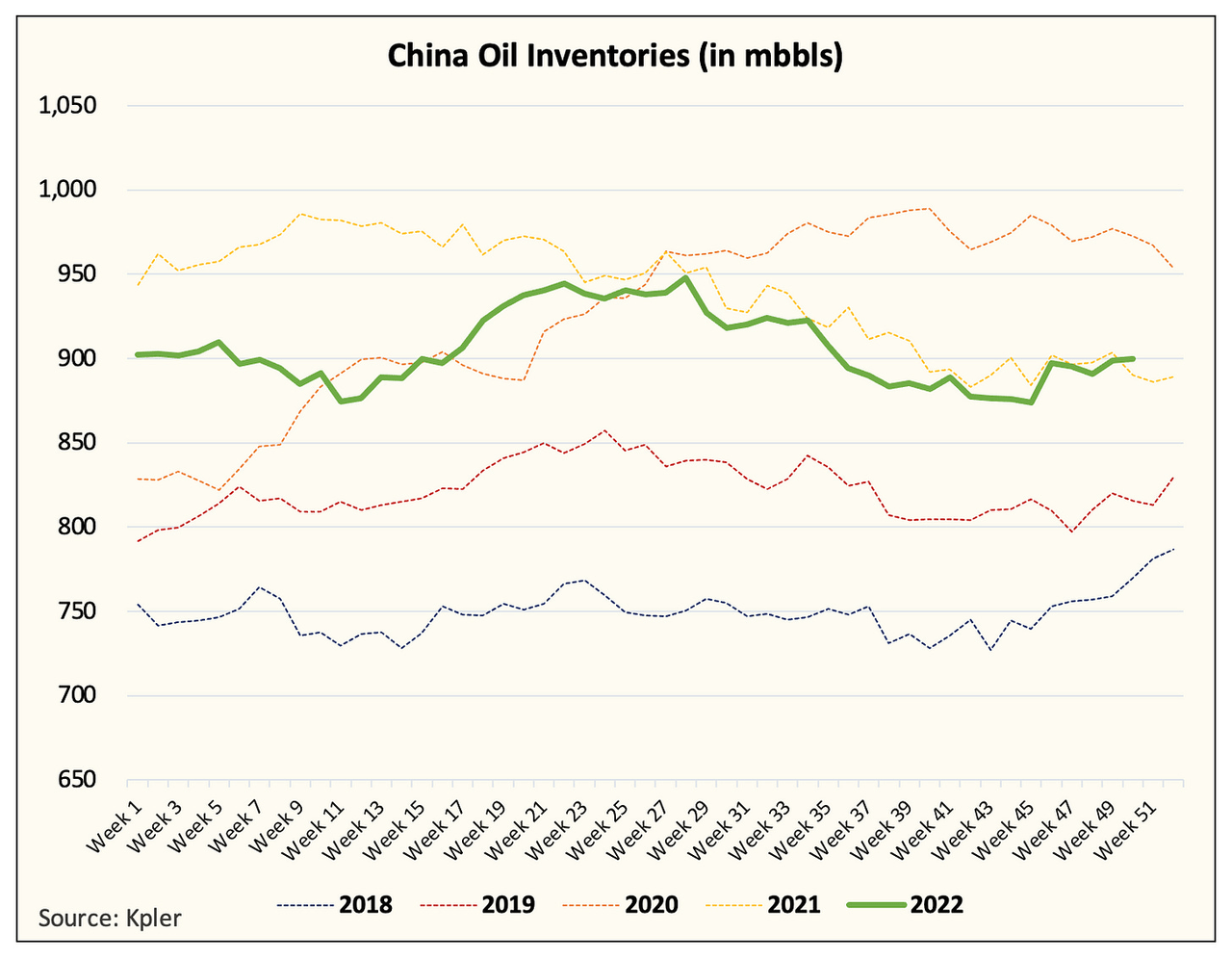

One caveat in all this will be the pace of China’s return to the oil market. Given where oil prices are today (sub $95 Brent), we think China is more likely to purchase crude on the open market than to use what’s in storage. But as oil starts to increase again, China will use its ample crude inventory to “control” prices. Similar to what the U.S. did this year with SPR, we suspect China will do the same later on.

Kpler

Given all the COVID restrictions being lifted in China, oil demand is likely to surprise to the upside, which would materially reduce its product overhang in a rapid fashion. This will be first reflected in the Singapore cracks, and when it does, that’s when you know China is back in full force.

In the meantime, there is a big technical resistance level for WTI around $82 to $84. For a lot of momentum funds, that’s the level WTI needs to surpass before the bullish liquidity flows return. Given the level of short interest in WTI and Brent, we think any signs of physical market tightening (either from China or Russia) should send prices higher.

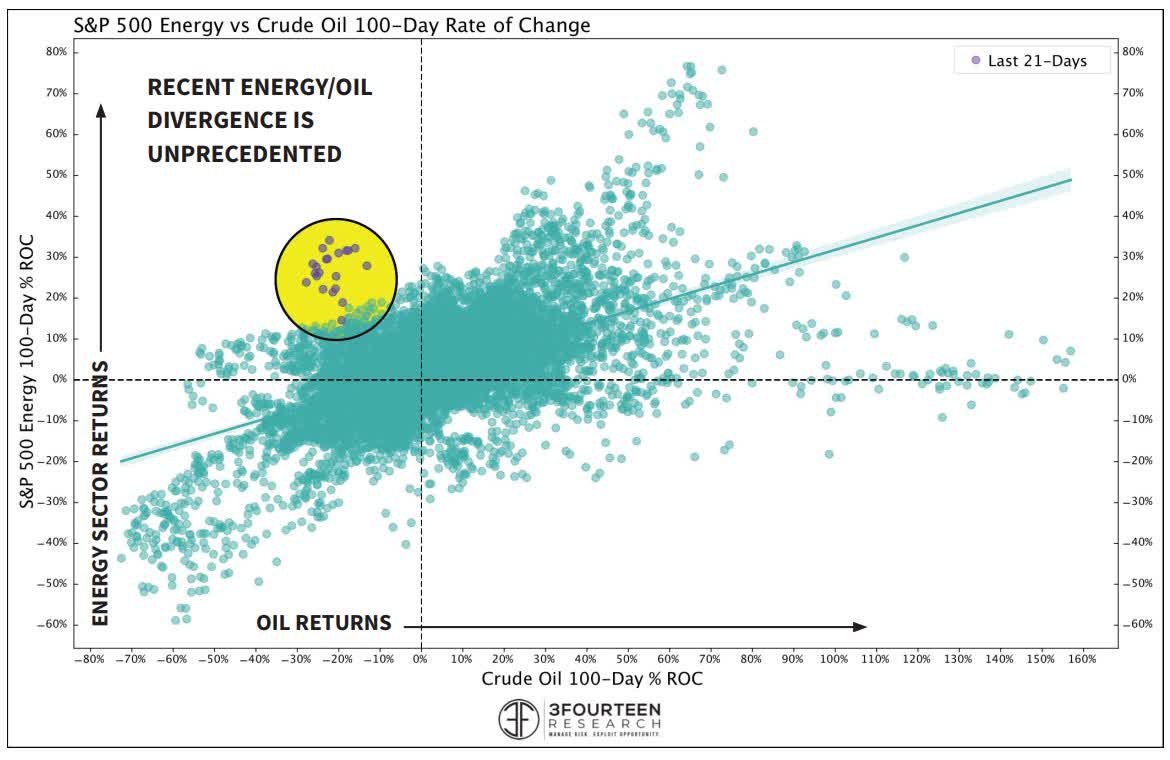

As for energy stocks, they have weathered the sell-off in oil far better than we expected. Warren Pies best illustrated this relationship in the chart below:

Warren Pies

Warren noted that this divergence has historically been resolved with oil rallying. We think readers should expect energy stocks to hold steady/trend slowly upward, while oil corrects much of the divergence.

Overall, the physical oil market red flags we noted last week turned out to be a false alarm. With China returning and Russia losing crude exports, the contango we are seeing in the market should disappear allowing for backwardation to return. Once WTI surpasses that resistance level, momentum funds, and CTAs should return to the bull trade.

Be the first to comment