ijeab

Thesis

OFS Capital (NASDAQ:OFS) is a small-cap financial services company that can provide high yield in an uncertain macroeconomic environment. The company has a diversified investment portfolio in all areas of the capital structure, with substantial yield and low credit losses. In addition, management has a proven track record of shareholder value creation in the form of increasing its investment value and through distributions. We believe that OFS Capital can continue to enrich shareholders with high distributions and capital preservation.

Company Overview

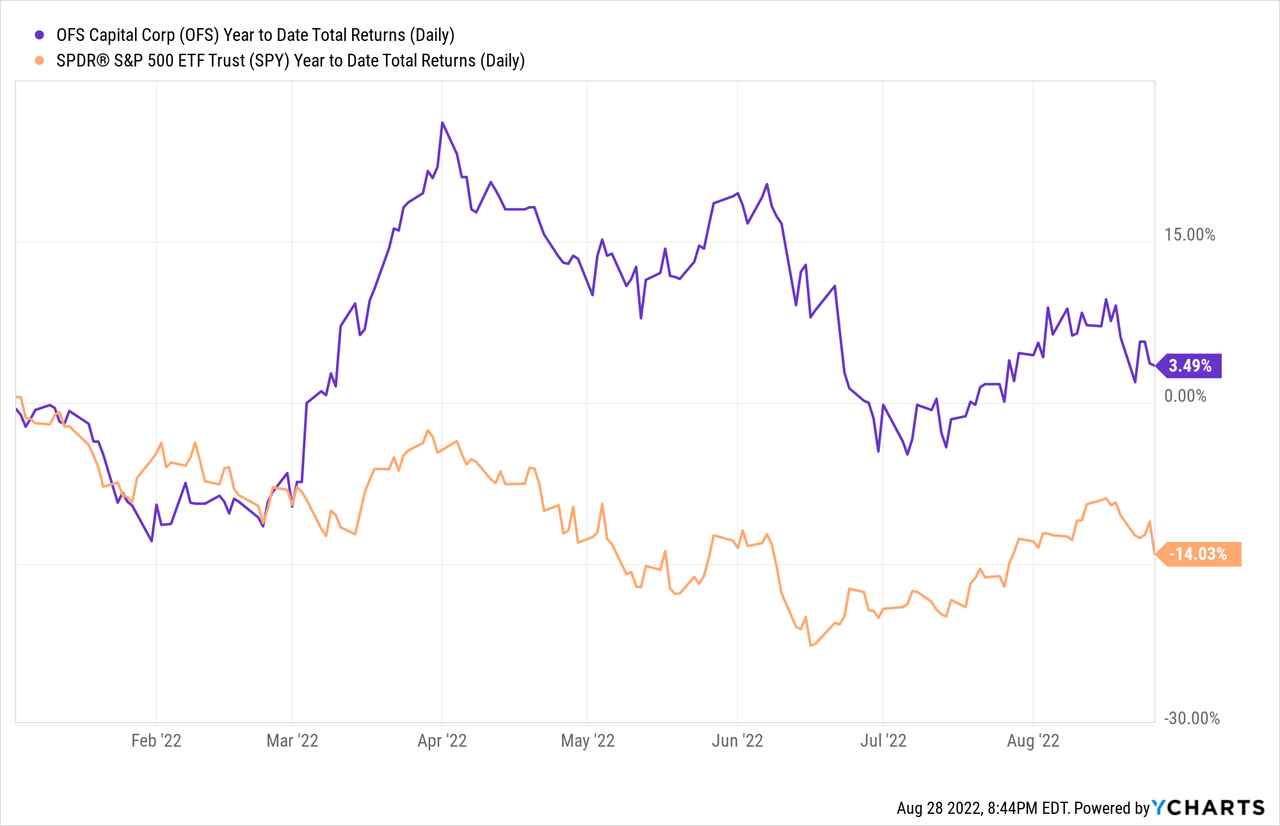

OFS Capital is a financial services company that provides financial solutions for middle market companies. The company focuses primarily on debt financing though the company also engages in equity financing across a variety of industries. The firm makes investments of $5 to $35 million for each transaction, and the company engages in transactions such as recapitalization, acquisition financings, growth capital investments, leverage buyouts, and more. Even with the recent volatility after Federal Reserve Chair Jerome Powell’s Jackson Hole speech, OFS Capital is positive year-to-date, returning 3.49% compared to S&P 500’s return of -14.03% in the same time frame. The company has a market capitalization of $144.37 million as of the time of this writing.

Small But Mighty

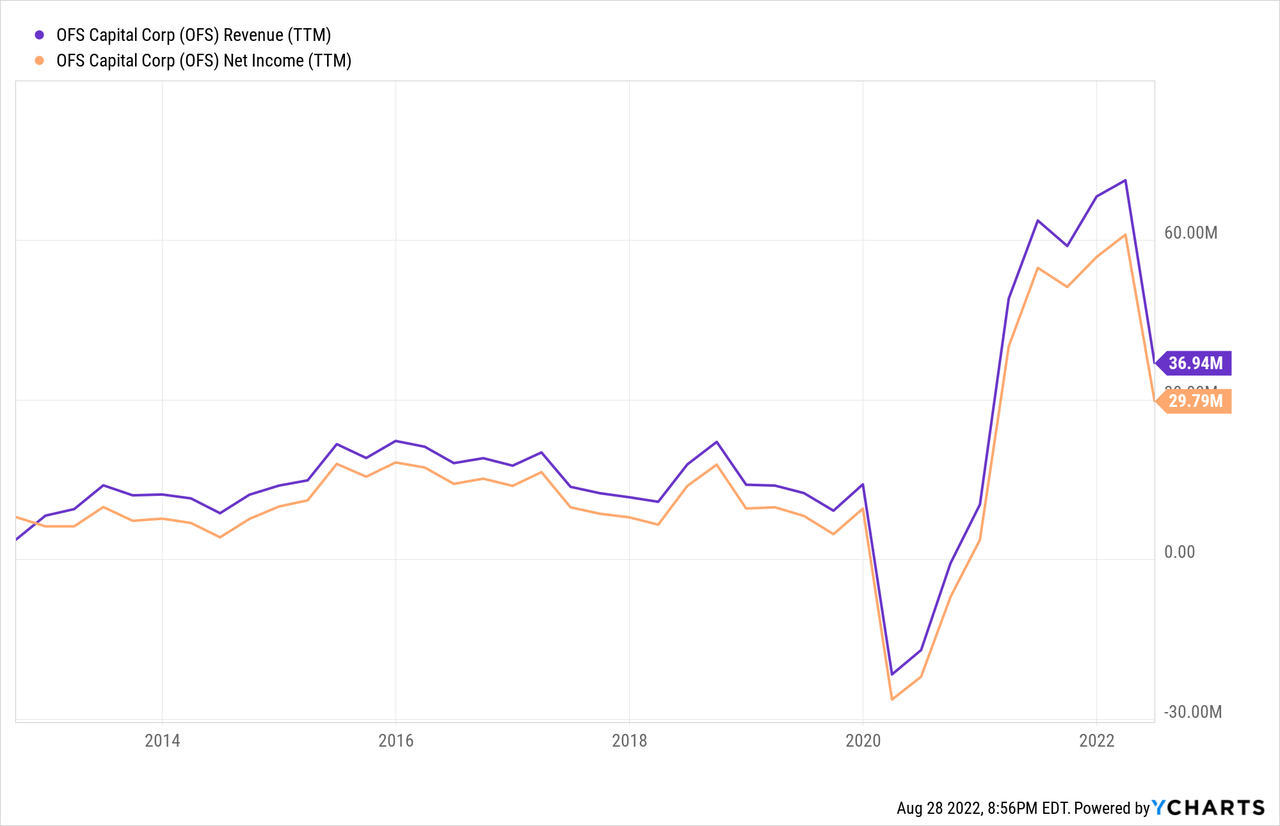

OFS Capital is a small cap financial services company based in Chicago that makes investments on companies with an annual EBITDA between $3 million and $50 million. We believe that the company’s focus on middle market companies is beneficial for investors. Since the pandemic, middle market companies have been doing particularly well as a result of strong U.S. consumer base and the impact of re-shoring. Though the company is fairly small with regard to market capitalization and the type of financial services that the company provides, the management has been able to deliver solid financial results for shareholders. Though there was a minor quarter-over-quarter decline in the company’s quarterly revenue, the company continues to be profitable and results are in line with its historical performance.

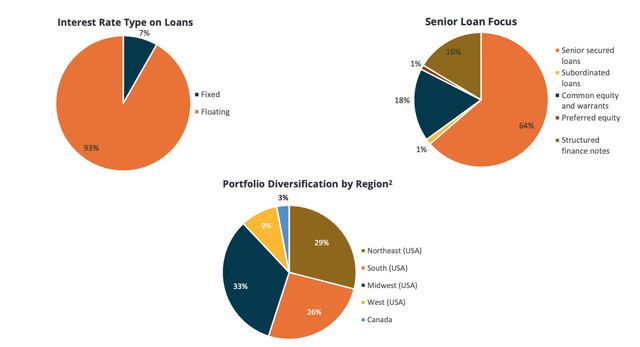

The company also has a diversified investment portfolio of $547.7 million, with debt investments making up $356.0 million and equity investments making up $101.8 million of that portfolio. The remainder of the portfolio is divided in structured finance note investments and unfunded commitments to portfolio companies. Debt investments make up more than half of the investment portfolio, and we are pleased to see that 93% of the loan portfolio has a floating rate, which protects investments from a high interest rate environment, and that 98% of the loan portfolio is senior secured loans, which should provide some equity cushion to investors. We believe that the portfolio is well protected against asset price decline from higher interest rates as portfolio yields will rise with underlying interest rates. In addition, the fact that 98% of loans are senior secured loans means that 98% of the debt portfolio is senior in the capital structure, and so the investment will only suffer realized losses if the invested companies were to decline significantly in value, and wipe out equity holders and subordinated debt holders.

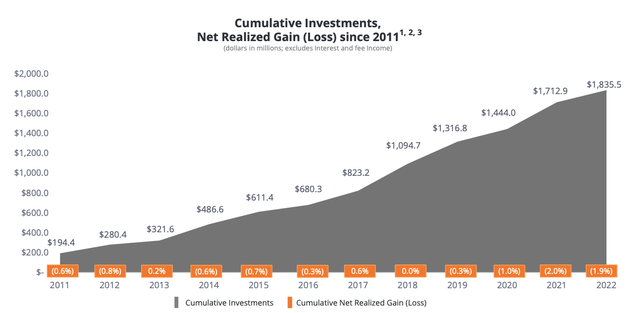

Furthermore, the portfolio is geographically diversified and has positions in all segments of a company’s capital structure. The mix of the loans should provide a good mix of yield while providing some protections against major credit risks. The company reports that the weighted average performing income yield of its portfolio is 9.1%, which is impressive and similar to the current dividend yield. In addition, OFS Capital has historically been able to protect the value of its portfolio losses and we believe that management will be able to continue to do this moving forward. The cumulative net realized losses for the company has only been ~1.9%, and though loss rates have slightly picked up in the recent years, we believe this is due to the effects of the pandemic and an unfavorable interest rate environment.

Friendly Shareholder Policies

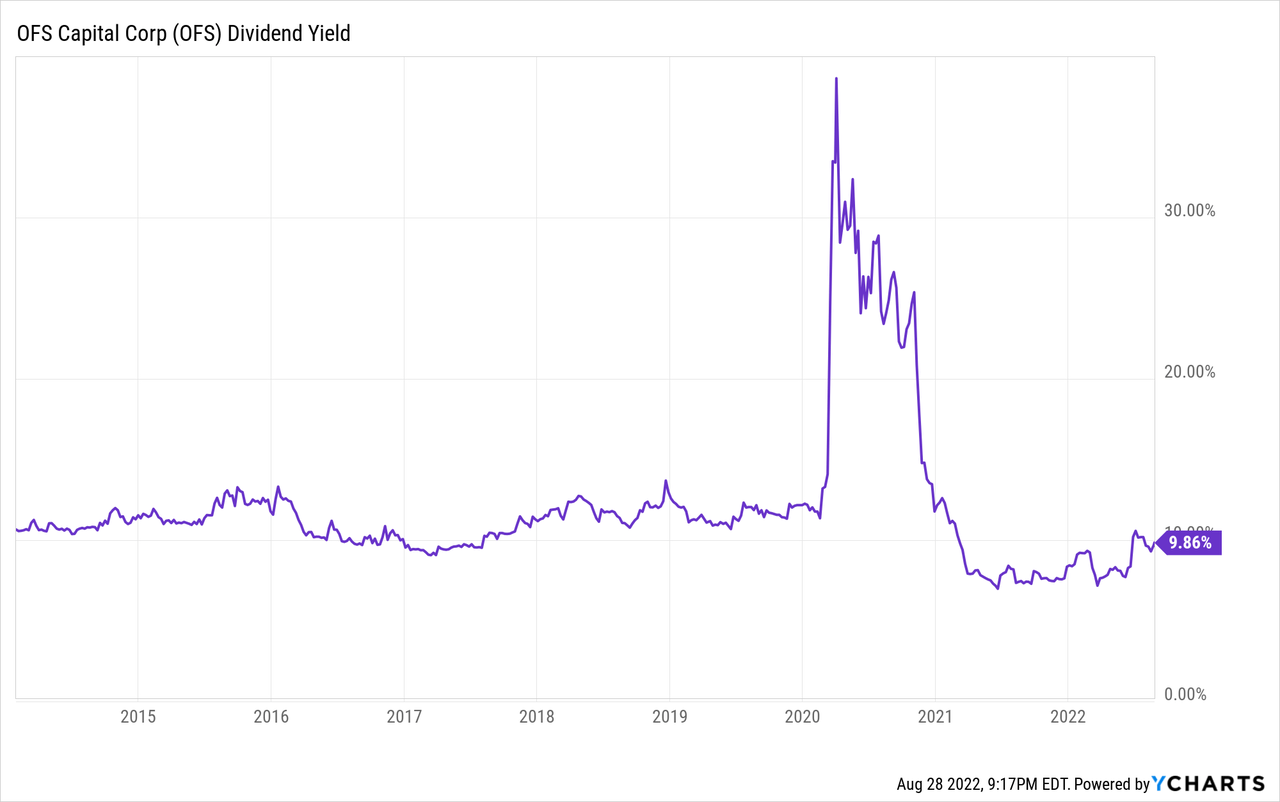

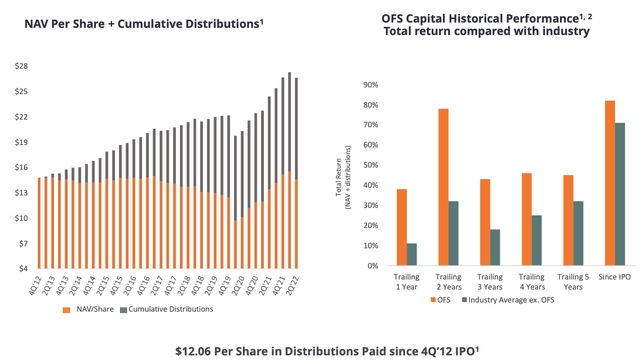

OFS Capital has a consistent dividend track record, and its current TTM annual dividend is $1.16 per share – a dividend yield of 10.77% based on current prices. Though the dividend payout has a high variance quarter-over-quarter, management’s commitment to dividend distribution is apparent, as the company maintained its dividend payout even during pandemic albeit at a lower distribution. Regardless, given the current dividend yield, we believe that the company can continue to pay out around 7% to 10% in dividend yield in the near future, similar to the historical yields below.

Furthermore, the company has had a great track record of shareholder value creation through increases in NAV per share and distributions. The graph below demonstrates the combined increase in the value per share over each quarter. With the exception of quarters following the pandemic lockdowns, the company has generally been able to post increasing NAV/Share increase and an even greater increase in the distributions. Management reports that since Fourth Quarter of 2012, the company has returned $12.06 per share in just distributions alone, which is higher than the current price per share of ~$10 per share. Whether looking at trailing 1 year total return or since IPO in 2012, the company has always returned more to shareholders than the industry average.

Macroeconomic Risk

OFS Capital is not immune to the macroeconomic risks that are faced by many financial services firms. Rising interest rates and the potential for a steeper recession would affect the company’s investment portfolio by reducing the value of the invested assets and/or portfolio companies being unable to pay interest on its loans. When analyzing such risk, we find that it’s important to assess liquidity risks and see whether the company has access to enough cash to finance any deterioration in the portfolio. We believe OFS Capital has enough liquidity to withstand major economic downturns as the company has ample cash on hand with $14.84 million in cash – which is around 10% of its market capitalization. Furthermore, the company has no debt maturities until 2025, which should provide no immediate financial pressures even if the economy were to deteriorate further and/or the company experiences a liquidity crunch. Consequently, we believe OFS Capital is well protected against major macroeconomic risks.

Conclusion

We believe that OFS Capital is a great small-cap financial stock that can provide high yield and a consistent income stream in a diversified portfolio. Management’s track record of shareholder value creation is undeniable and we believe that the company’s diversified loan portfolio along with an interest-rate sensitive deal structure makes this financial services company an attractive investment proposition.

Be the first to comment