Brandon Bell

Occidental Petroleum (NYSE:OXY) reported its 2Q 2022 earnings and it’s clear that the company is far away from the days of needing to pay preferred equity dividends with stock. The company’s stock price seems to hover around our $60/share estimate, similar to where Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) is interested; however, we see the potential to drive substantial returns overall.

Occidental Petroleum Strong Quarterly Results

Occidental Petroleum generated incredibly strong quarterly results taking advantage of strong pricing in the markets. The company is receiving the financial payoff of the Anadarko Petroleum acquisition finally.

Occidental Petroleum Investor Presentation

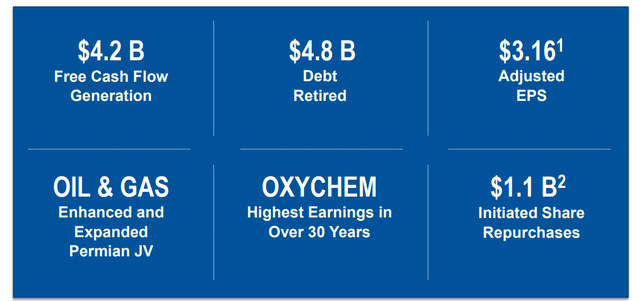

Occidental Petroleum generated a massive more than $4 billion in FCF in the quarter and managed to retire almost $5 billion in debt. The company’s integrated assets performed across each level, with OxyChem hitting their highest earnings in 30-years. The company’s debt retirements pushed its net debts to below its targets of $20 billion.

The company is continuing to pay a modest dividend of less than 1%. The company also recently initiated $1.1 billion in share repurchases, a 2% annualized yield from those repurchases alone. This was a small part of the company’s FCF and putting all this together, the company has the cash flow to generate substantial returns.

Occidental Petroleum Continued Developments

Occidental Petroleum is working to continue developing its impressive portfolio of assets.

Occidental Petroleum Investor Presentation

The company has expanded its Ecopetrol partnership, which exists on 20,000 high quality acres of assets. The company is bringing the Horn Mountain West field online and received 25-year Algeria contract extension. At the same time, the company is achieving record production rates from other assets. These continuing developments will support continued production.

The company is working to expand integrated production and OxyChem is a good example of this. The company’s battleground membrane conversion is expected to cost $1.1 billion and add $275 million in incremental EBITDA conversion. The continued capital and exploration expenses will support additional returns.

Occidental Petroleum Financials

The company’s financials after all this are remaining incredibly strong which will support rewards.

Occidental Petroleum Investor Presentation

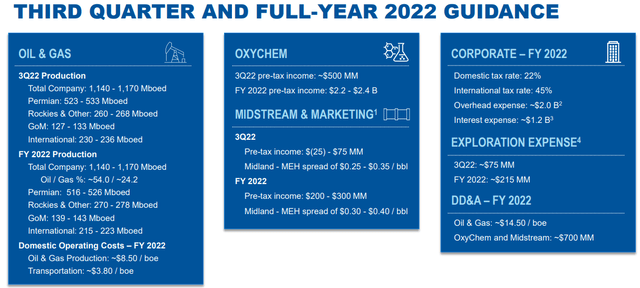

Occidental Petroleum’s guidance for the remainder of the year remains strong. The company expects roughly 1.155 million barrels/day of production at around 54% oil. Operating costs production and transportation costs are expected to be low at $12.3/barrel. That’s substantially lower than current prices.

The company’s pre-tax OxyChem income for the year is expected at $2.3 billion, where 3Q 2022 is expected to be quieter. In the midland the company expects modest income with the 3Q 2022 also weaker. Corporate, overhead, and interest expenses are all expected to be modest and we expect debt to decrease substantially.

The company’s strong financials will support continued earning strength for the rest of the year.

Occidental Petroleum Shareholder Returns

The company’s substantial returns are significant.

Occidental Petroleum Investor Presentation

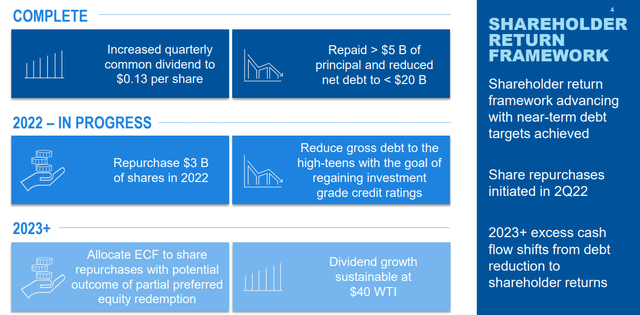

The company increased its quarterly dividend to $0.13/share, still a modest dividend yield. The company managed to repay more than $5 billion in principal, massive debt savings to reduce net debt to <$20 billion. The company is planning to repurchase $3 billion in shares in 2022, or almost 6% of outstanding shares, with ~7% total shareholder yield.

The company is planning to go into 2023 with dividend growth sustainable at $40 WTI or <50% of current prices. At the same time, the company is also looking for share repurchases and additional growth. The company’s FCF will comfortably support additional returns and its debt is down to just over 1 year of FCF.

Another potential source of shareholder returns in the meantime is an acquisition by Berkshire Hathaway. The company owns almost 20% of Occidental Petroleum, not counting preferred equity, and it has the cash to comfortably acquire the company. What happens remains to be seen, but it could lead to quick shareholder rewards.

Thesis Risk

The largest risk to the thesis is two-fold in our view. First is oil prices. Of course the company is heavily profitable with Brent at almost $100/barrel, however, the story changes at lower prices. The company suffers at negative prices. The second risk is that Berkshire Hathaway now has an almost 20% stake. The company is known for regularly changing its mind on oil market bets, which could put strong selling pressure on the stock should that happen.

Conclusion

Occidental Petroleum has a unique and incredibly strong portfolio of assets and the company’s FCF has been incredibly strong with its low breakeven. The company has a dividend of almost 1% and is committed to repurchasing more than 5% of shares in 2022 alone. That’s a mid-to-high single digit shareholder return rate.

The company’s debt is now down to less than $20 billion. The company is still targeting an investment grade credit rating, which we expect it can get to soon. Occidental Petroleum also has the ability to deliver stronger short-term returns with an acquisition by Berkshire Hathaway. Regardless, the company is a valuable investment.

Be the first to comment