MurzikNata/iStock via Getty Images

Thesis

Oatly (NASDAQ:NASDAQ:OTLY) is a food company burning through cash and operating in a competitive industry with weak growth prospects. Despite the company’s poor business viability, we are recommending a “HOLD” for investors as the stock is heavily shorted and could be a potential acquisition target due to the major discount to its IPO valuation. Until some of these upside risks are addressed, we recommend investors to stay on the sidelines on this stock.

Company Overview

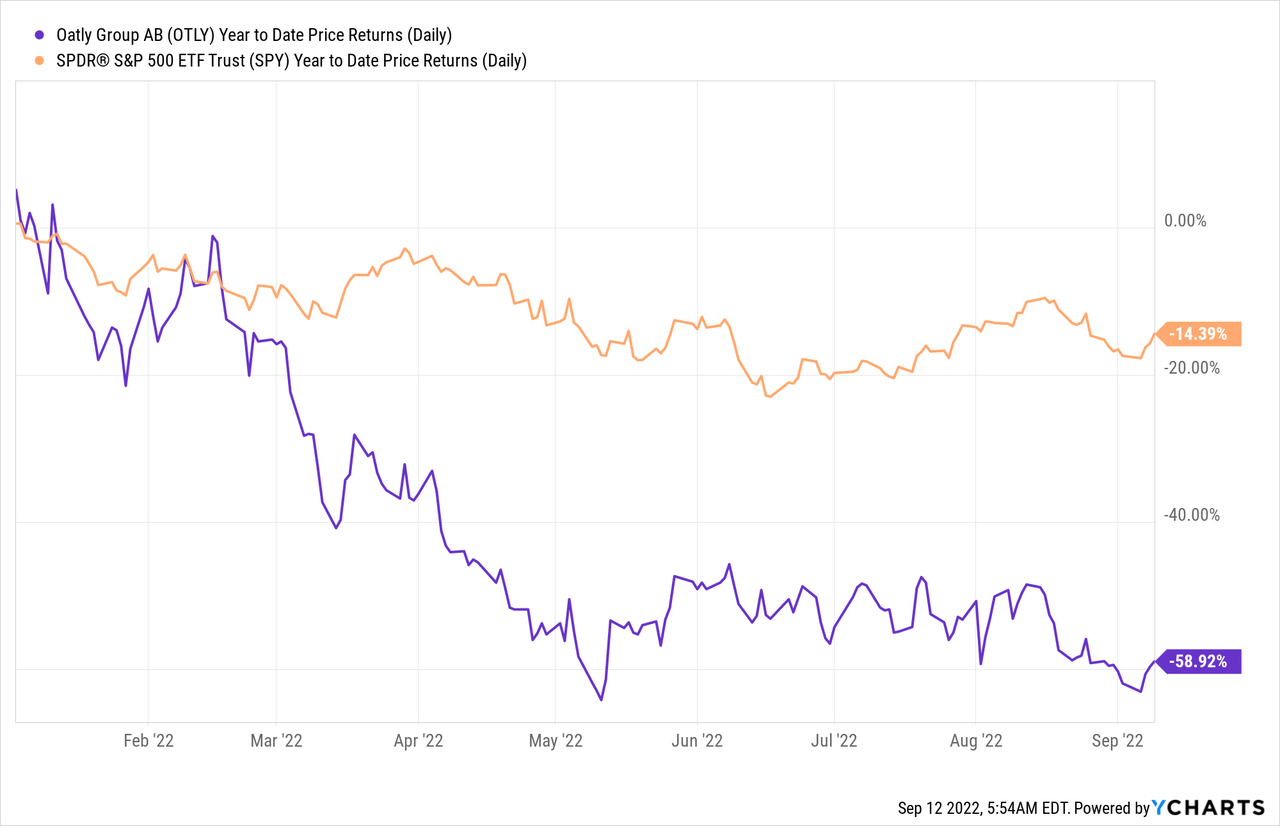

Oatly is a Swedish food company that produces alternatives to dairy products from oats. Oatly currently sells chilled oat drinks, ice creams, oat based yogurts, coffees, and more. The company completed its Initial Public Offering with a IPO price of $17 per share in 2021. In that IPO, the company raised $1.4 billion in the offering at a valuation of $10 billion. Since then, the stock price has cratered to $3.27 per share, and has declined -58.92% since the beginning of the year, compared to S&P 500’s return of -14.39%. The company has a current market capitalization of $1.94 billion.

Recent Earnings Overview

Oatly reported Q2 2022 financial results on August 2nd, 2022. The company reported top line growth across various regional segments, and combined, the YoY Q2 revenue growth amounted to 21.8%. The positives stopped there, as bottom line metrics worsened considerably. EBITDA loss expanded to $62.6 million this quarter compared to $43.5 million last year, and Net Loss attributable to shareholders expanded to $72.0 million this quarter compared to $59.1 million in the prior period. Furthermore, costs also increased meaningfully on a year-over-year basis. R&D expenses rose 14% YoY and SG&A expenses increased 16.8% YoY. We believe these costs will likely accelerate as inflation affects personnel and development costs. In our view, unlike last year when top line growth was favored due to the low interest rate environment, we believe that bottom line metrics are more important during current market conditions as investors seek safety and profitability over future sales growth prospects. Overall, we view last quarter’s results as a net negative given the worsening profitability metrics and increasing costs.

Small Market Opportunity

Oatly operates in a dairy market, which is saturated with numerous small and large dairy players. Big consumer discretionary giants like Nestle (OTCPK:NSRGY), Coca-Cola (KO), PepsiCo (PEP), Chobani, and etc. are relevant players competing against each other in the industry. Such wide array of well-capitalized competitors in an industry would be unfavorable for newcomers like Oatly. Furthermore, the global dairy market is expected to only grow at 6.39% CAGR from 2021 to 2028, which is limited growth compared to other markets like plant-based meat market which is expected to grow at 14.7% CAGR. The relatively limited market growth would also limit Oatly’s future growth potential, and will likely impact the company’s ability to compete effectively in a competitive industry. Even within the oat milk market specifically, Oatly no longer has the most market share in the U.S., as the company ceded its top market position to Planet Oat earlier this year. Overall, Oatly has limited market opportunity in the dairy market, and is not even the biggest player in the oat milk market.

Poor Financial Performance

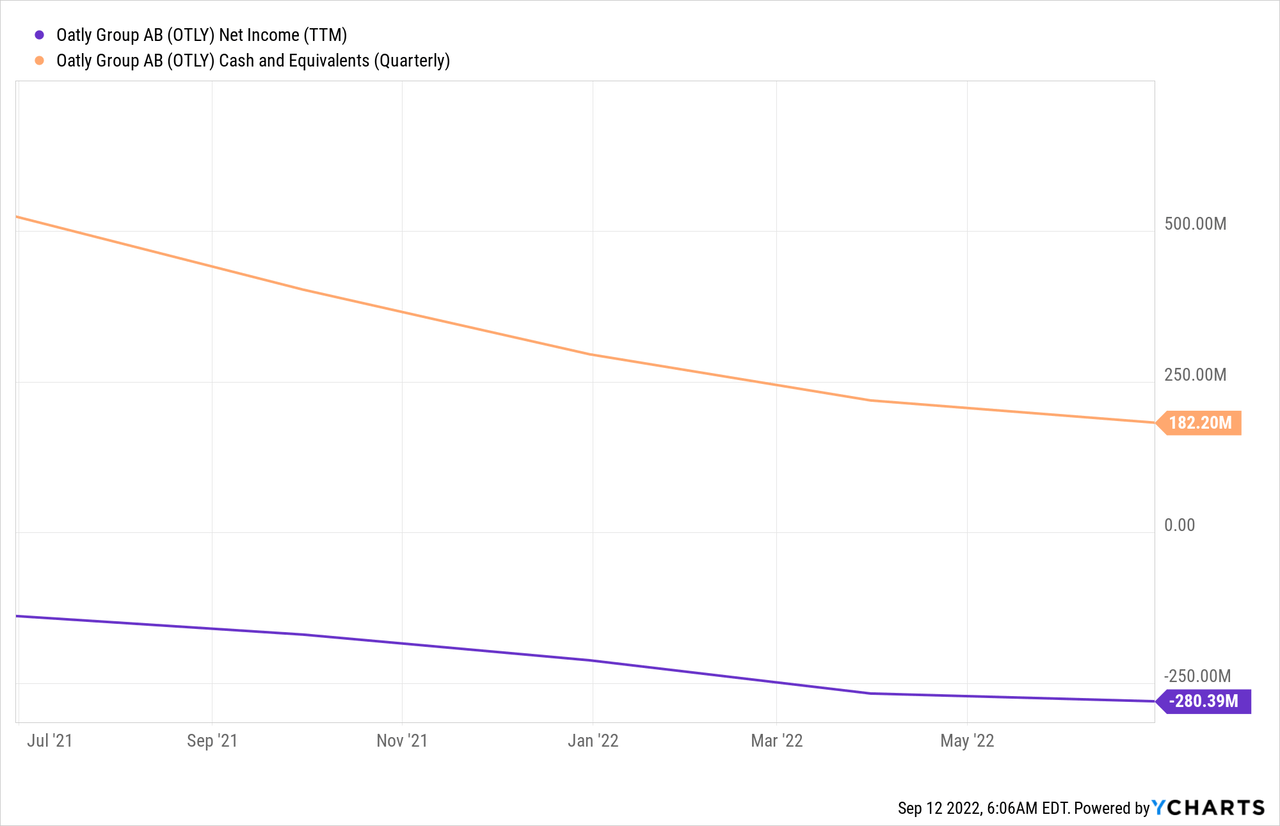

Since the IPO in 1H 2021, Oatly’s bottom line has worsened on a quarter over quarter basis with deteriorating balance sheet. For 2021, the company reported a net loss of -212.4 million, and the loss on a TTM basis now stands at -280.4 million. When compared to the net loss of -35.6 million in 2019, one can see Oatly’s trend of deteriorating financial performance over the last few years. The continued loss has heavily damaged the company’s balance sheet as now the company’s cash position declined from $295.6 million at the end of 2021 to $182.2 million as of this last quarter. In that same time frame, the company’s total liabilities increased by ~10%, from $383.6 million to $421.1 million. The steep decline in the health of the balance sheet should be alarming to investors, in addition to no visibility on how the company will be able to turn around its business anytime soon. With negative headlines like the recent recall over fears of microbial contamination of its products as well as economic slowdown as a result of high inflation and tightening monetary policy, we are not convinced that the company will be able to radically alter its financial prospects in the near future.

Risks to Upside

High Short Float

Despite the major negatives afflicting Oatly’s financial prospects, we are recommending a “HOLD” as a result of the high short float of 9.37%, which increases the risk of a “short squeeze” that can push up the stock price regardless of current fundamentals. Companies have a high probability of a “short squeeze” in the event that short float ratio nears ~10%, which is close to Oatly’s current short float ratio. Before we recommend a “Sell”, we would like to see the short float decline meaningfully.

Acquisition Target

With the company trading currently near ~80% below its IPO price, another major risk to the upside is if the company were to find a potential buyer given its market position and brand awareness. With so many players vying for market position and gain additional competitive advantage, there may be moves by bigger players to acquire the brand at a discounted price. Any official or unofficial news may be catalysts for a stock price surge, and hence makes us hesitant to recommend a “Sell” on the stock.

Conclusion

Overall, Oatly is a company with deteriorating fundamentals and burning through cash very quickly. Despite the unfavorable business prospects, we are recommending a “HOLD” for the stock as there may be upside catalysts agnostic to the company’s fundamentals. We will continue to monitor the stock and update investors based on any changes in the business or if risks to the upside are addressed.

Be the first to comment