New Zealand Dollar, S&P 500, Treasury Yields, RBA -Talking Points

- Wall Street starts week with risk-on flows, S&P 500 pushes into fresh record close

- Upbeat economic data prints continue to encourage investors into riskier assets

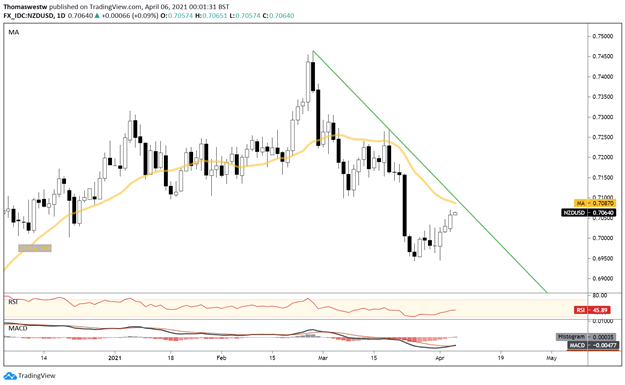

- New Zealand Dollar receives bullish technical signal versus US Dollar

Discover what kind of forex trader you are

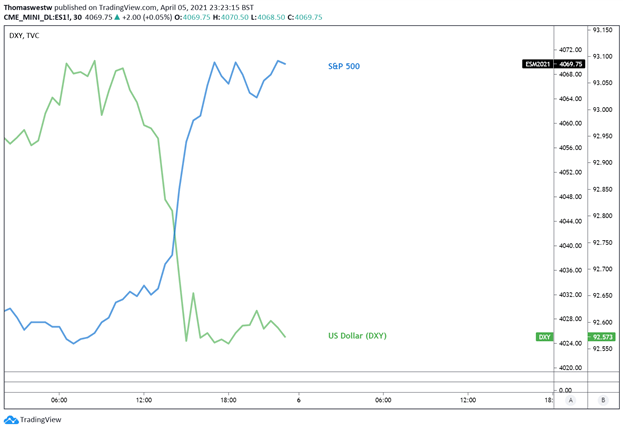

US traders returned from a long Easter holiday weekend, reinvigorated and ready to take on additional risk. The S&P 500 rose to a fresh record high extending gains from last week. Technology stocks saw heavy inflows, with the Nasdaq 100 Index climbing over 2% on the day. Small-cap stocks lagged, but the Russell 2000 index managed to climb 0.49%

Elsewhere, traders moved out of the Treasury market. Yields across the curve rose, reflecting the risk-on move in the New York trading session. The benchmark 10-year yield climbed 2.03% through the Wall Street closing bell. The safe-haven US Dollar saw selling against its major G10 peers. Despite the weaker USD, gold and silver failed to catch a bid, with traders favoring US equities.

The upbeat Wall Street session comes after a blow-out US jobs report, released last Friday when US markets were closed. 916k jobs were added in March in the United States versus expectations of 647k, according to the DailyFX Economic Calendar. Moreover, the March ISM services PMI for the US released Monday morning printed its strongest figure since the Covid pandemic began, registering at 63.7 versus an estimated 59.0.

S&P 500, US Dollar (DXY) – 30-Min Chart

Chart created with TradingView

Tuesday’s Asia-Pacific Outlook

Asia-Pacific markets moved higher on Monday and may continue to see buying across the major APAC equity indexes in Tuesday’s session. Hong Kong’s Hang Seng Index (HSI) rose nearly 2% on Monday, while mainland China’s CSI 300 pushed 0.99% higher. Elsewhere, South Korea’s KOSPI managed to climb 0.26% after turning negative early in the session. Japan’s Nikkei 225 rose 0.79%.

The Reserve Bank of Australia (RBA) will release its interest rate decision today. Analysts expect Australia’s central bank to hold rates steady at 0.1%. In fact, the meeting isn’t likely to be a major mover, with no major policy changes likely to be announced. Nonetheless, traders will be keeping a close eye on the event, as prudent investors should.

Later this week, China will release inflation data, as well as new yuan loans for March. In the US, the Federal Reserve will release its minutes for the latest Federal Open Market Committee meeting. Loretta Mester, President of the Cleveland Federal Reserve, spoke Monday, urging the markets to remain cautious despite the blowout jobs report.

NZD/USD Technical Outlook

The New Zealand Dollar has recovered a portion of sharp losses against the US Dollar in March when some risk-aversion spurred USD buying. NZD/USD is now approaching its 20-day Simple Moving Average. A trendline from the February swing high may also impose some resistance. However, a bullish signal from the MACD was generated, with a cross above its signal line this week, which may help ignite more upside in the pair.

NZD/USD Daily Chart

Chart created with TradingView

New Zealand Dollar TRADING RESOURCES

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwateron Twitter

Be the first to comment