Antonio Bordunovi/iStock Editorial via Getty Images

Thesis

Both Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD) are high-quality companies that have been great investments and could make great investments in the future. I believe that Nvidia’s current market position and future growth potential are slightly better than AMD’s, and that these differences are likely greater than their current valuation gap. However, it’s a close call considering that AMD currently seems to have more momentum, and I believe that both companies can be good long-term investments.

Background

Nvidia primarily makes GPUs, which are highly parallel processing chips that are optimized for tasks like gaming, AI, data centers, and cryptocurrency mining. AMD makes some GPUs but is more focused on CPUs, which are the traditional chip for generic computation. Although CPUs and GPUs are generally used together, one could consider GPUs a disruptive technology; their highly parallel nature is strictly speaking not an advantage or disadvantage relative to CPUs, but GPUs have nevertheless taken “market share” of parallelized computational tasks from CPUs over the years.

Nvidia, AMD, and Intel (INTC) are often considered the big three chip designers when it comes to CPUs and GPUs. It’s worth mentioning that some big tech companies like Amazon (AMZN), Apple (AAPL), and Qualcomm (QCOM) have their own offerings and could be considered competitors, but in this article, I won’t focus very much on them.

For more background about these companies and why semiconductors can be a good investment, I recommend my deep dive into the semiconductor industry.

Market Position

Nvidia was the first mover in discrete GPUs and currently has over 80% market share, with the rest going to AMD. It’s important to distinguish discrete GPUs – which have separate memory from the CPU, yielding better performance with more power consumption – from integrated GPUs where Intel is the leader mostly thanks to its larger share of the CPU market.

Nvidia also has significant intellectual property relating to GPUs. It licenses some of this IP to other players including Intel. And as one of the largest semiconductor companies, Nvidia has a large R&D budget that will keep them on the cutting edge of future designs and IP. For example, they’re currently working on a new chip called a DPU that’s optimized for data center tasks.

These factors give Nvidia a very strong market position and a wide moat. Intel recently entered the discrete GPU market as well, but considering Nvidia’s advantages it’s difficult to imagine Intel having much more success here than AMD.

On the other hand, AMD’s position is more complicated. Obviously, with Nvidia consistently commanding the lion’s share of the GPU market, AMD has found it more difficult to compete there. But GPUs aren’t the main story with AMD anyway; CPUs are.

The company is theoretically in a similar position with CPUs as well. Intel is the market leader, has substantially more revenue than AMD, and licenses its IP for x86 processors to AMD. AMD and Intel are the only two companies with the IP to make x86 processors. In theory, all of these factors should give Intel a wide moat, and along these lines, AMD notes that “Intel is able to drive de facto standards and specifications for x86 microprocessors that could cause us and other companies to have delayed access to such standards.”

While Intel did in fact dominate AMD for over a decade, the story changed in recent years. I attribute this primarily to AMD’s decision to spin off its manufacturing unit in 2009, ultimately selling its stake in 2012. This move looked questionable at the time as AMD continued to lose market share for years, but through some combination of extraordinary foresight and sheer luck it paid off in the end.

Starting in 2016 with the move to the 10 nm node, Intel began to struggle with manufacturing delays and production errors. While Intel, AMD, and Nvidia form the triopoly of chip design, TSMC (TSM) is the manufacturing giant with over 50% market share. AMD, Nvidia, and pretty much everybody else including Apple outsource their manufacturing to TSMC, which did not share Intel’s struggles at the 10 nm node.

As with design, there are clear scale advantages in manufacturing, and that has allowed TSMC to continue to create better and smaller chips in recent years. TSMC already has 5 nm chips in mass production while Intel continues to struggle with 7 nm chips and is even outsourcing some manufacturing to TSMC.

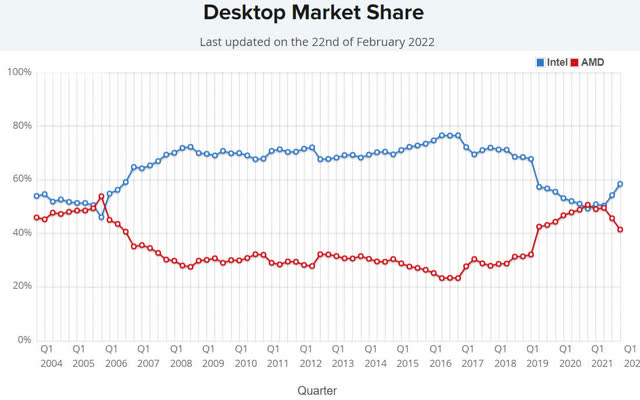

It’s no coincidence that AMD’s fortunes began to turn in 2016 when Intel was struggling with production. But while the above graph makes it look like AMD is about to pass Intel, it only considers desktop market share. For overall CPU market share, AMD only has a 27.7% share, which is admittedly still an impressive all-time high.

Despite AMD’s recent success, it’s still too early to count Intel out. Intel still has the most market share and IP, and they recently brought a new CEO in to try and turn things around. Their new strategy of using TSMC to manufacture chips may not be great for their overall business performance, but it could allow them to gain some market share back.

I would assign both AMD and Intel wide moats given their duopoly on x86 architecture. But I’m not ready to call either company the winner yet, and I think that market share for CPUs could continue to be more competitive and volatile in the coming years than many investors seem to expect.

Based on these dynamics, I view Nvidia as having a wider moat and better market position than AMD, and thus it wins in this category.

Financials

| Metric | NVDA | AMD |

| Rev. Growth (qtr) | 46% | 71%* |

| Rev. Growth (5 yr) | 31% | 31% |

| Profit Margin | 32% | 18% |

| ROI | 26% | 40% |

| ROE | 39% | 18% |

| Current Ratio | 5.3 | 2.4 |

Source: Compiled By Author

*55% organic

Turning now to the quantitative side, both Nvidia and AMD have strong financials, with clean balance sheets, stellar growth, shareholder-friendly policies, and high margins. Despite my perception that Nvidia has better market position than AMD, that’s not easy to see in the metrics above; AMD is actually seeing higher growth than Nvidia right now, albeit with a notably lower profit margin. Both companies look very high quality.

However, it’s important to consider that the market is forward-looking. According to Statista, the GPU market is expected to grow at a stellar 33% CAGR through 2028 thanks to a strong fit in fast-growing areas like AI, AR/VR, and high-performance computing.

On the other hand, the growth trajectory of the CPU looks more convoluted, as the desktop computing market is relatively saturated but future growth could come from new areas like data center. Some reports expect a single-digit CAGR in the coming years, but there are a variety of forecasts.

Moreover, while I don’t expect the threat to be anywhere near imminent, I have to note the success of ARM processors used in Apple’s new MacBooks, in some parts of Amazon’s AWS, and in virtually all mobile phones. The continued success of ARM could moderately lower the growth trajectory of both AMD and Intel.

Although the exact future growth rates are impossible to predict, I do think it’s likely that we’ll see more growth for Nvidia’s GPUs than for x86 CPUs in the coming years. That’s been the case in the past as well. Both Nvidia and AMD had 31% revenue CAGR over the last five years, but during that time Nvidia’s discrete GPU market share remained relatively stable while AMD’s CPU market share nearly doubled. Thus, it’s safe to say that AMD was only able to keep up with Nvidia’s growth by gaining market share at a rate that will almost certainly be unsustainable going forward.

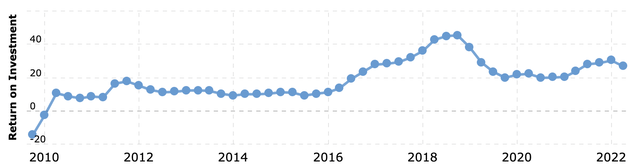

As further evidence of this, consider Nvidia’s positive and relatively stable ROI over the last decade:

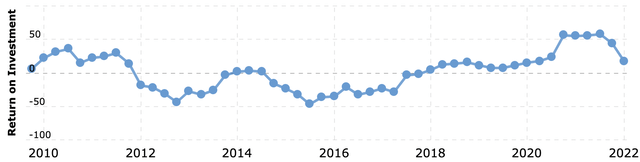

On the other hand, AMD had consistently negative ROI before it began to take share from Intel in 2016:

This is further evidence that AMD’s financial profile has been elevated by its recent success against Intel, which almost certainly won’t continue at the same rate and possibly won’t continue at all.

Despite these considerations, according to Seeking Alpha, analysts expect about 14% revenue CAGR for both Nvidia and AMD in the next few years. Morningstar expects a five-year CAGR of 16% for Nvidia and 19% for AMD. To me, these are head-scratching numbers, since based on the growth rates and other statistics outlined above I would expect Nvidia to grow faster than AMD over the long term.

Granted, AMD currently seems to have more momentum than Nvidia as they’re growing faster. In their most recent earnings, Nvidia missed on forward guidance and announced that they were slowing hiring to account for weakening demand. Meanwhile, AMD crushed earnings and didn’t show any signs of weakness. It remains to be seen whether this will become a trend or was just an off quarter for Nvidia and I lean more towards the latter, but this could at least explain why analysts currently have the projections they do.

Valuation

| Metric | NVDA | AMD |

| P/E | 48 | 37 |

| Forward P/E | 28 | 20 |

| PEG | 1.0 | 0.7 |

| P/FCF | 63 | 49 |

| Avg Price Target | +56% | +45% |

Source: Compiled By Author

While Nvidia has been the winner up to this point, now it’s AMD’s time to shine, as it’s notably cheaper than Nvidia based on multiple valuation metrics.

To me, this is evidence that the narrative I’ve presented so far is what the market believes as well. That is, I believe that Nvidia warrants a higher multiple due to a wider moat and a better growth trajectory. In fact, despite projecting AMD for similar or higher growth than Nvidia, analysts have an average price target that implies more upside for Nvidia than for AMD, even from its current higher valuation. That’s another head-scratcher that makes me wonder what these analysts are thinking.

Regardless, from the lower price, it’s fair to argue that investors are adequately compensated for AMD’s worse market position and potentially slower growth trajectory. After all, starting valuation matters for total returns in addition to growth, especially over shorter time horizons.

On that note, are either of these starting valuations appealing? I would say yes, as long as you believe that the companies can continue growing at mid-double digits or faster. The PEG ratios shown above look very good but may reflect unsustainable growth rates. Instead, here are some potential returns using my valuation model with various revenue growth rates, assuming slight margin expansion, no substantial share buybacks or dilution, terminal P/E of 20, and a 10-year time horizon:

| CAGR | 10% | 15% | 20% | 30% |

| NVDA Total Return | 1.3x | 1.9x | 3.0x | 6.7x |

| AMD Total Return | 1.4x | 2.2x | 3.3x | 7.5x |

Source: Tech Investing Edge

AMD has a higher total return for each CAGR because of its lower starting valuation. Both companies probably won’t deliver their market-crushing 10x+ returns of the last decade, since in the coming decade they have higher starting valuations and larger revenue bases. But that doesn’t mean they can’t be decent investments that beat the market.

Conclusion

Although I like Nvidia’s story better than AMD’s as it relates to market position and future demand, it’s worth restating that both companies are very high quality and are some of the most appealing semiconductor companies to invest in. Personally, I don’t have much interest in stressing over the Intel vs AMD war, so at the current valuations, I’d be willing to pay a bit of a premium to own Nvidia instead. However, AMD could be the better pick for investors who have high conviction in its disruptive story and/or want a stock with a cheaper valuation. Of course, there are many great options to choose from in the semiconductor industry, so it’s also fine to look at cheaper options like TSMC or, as I’ve previously argued, Micron.

Be the first to comment